Shell Capital Management LLC

@ShellCapital

Founded @MikeWShell in '04, Shell Capital takes investment management to the next level by actively managing risk and dynamically adapting to evolving markets.

You might like

In market downtrends, it becomes more apparent why we first emphasize survival through active risk management to limit portfolio drawdown. Invest with us at shell-capital.com

Which has the most predictive power for investment returns? Drop your answer and reasoning below 👇🏼

ASYMMETRY® focuses on adaptive, risk-managed, positively skewed strategies that align portfolio exposure with changing market regimes rather than clinging to legacy “buy-and-hope” models built for a different era.

Static allocation underestimates the impact of shifting volatility trends. Risk isn't a constant—it evolves with market psychology and positioning. ASYMMETRY® dynamically adjusts to volatility trends rather than assuming fixed exposures.

ASYMMETRY® isn’t guessing direction—it’s engineering payoffs when the odds are skewed in our favor.

ASYMMETRY® isn’t about predicting the future—it’s about structuring trades to thrive in uncertainty.

ASYMMETRY® doesn’t chase returns—it controls risk to unlock exponential upside.

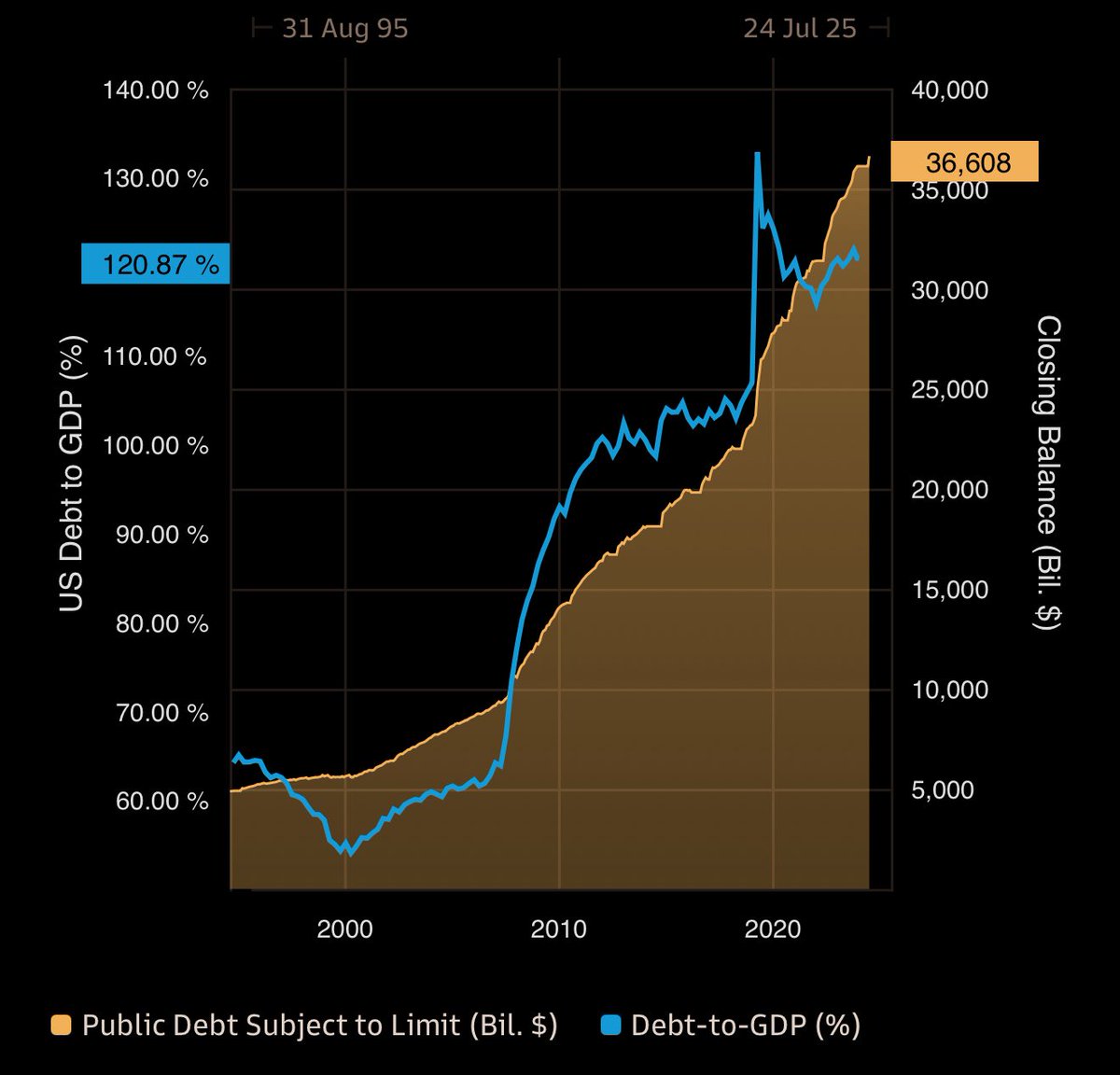

U.S. debt just hit $36.6 trillion. Debt-to-GDP is now 120.87%—we owe more than we produce. That’s not linear risk. It’s convex fragility. When debt compounds faster than GDP, policy options shrink and tail risk grows.

Trend-following strategies participate in directional moves and cut losses early—which truncates left-tail risk and allows for large right-tail wins.

Convexity is engineered, not found. It’s created by structuring strategies that react non-linearly to market moves.

Asymmetric hedging strategies can be engineered to create convex payoffs—defined as small, manageable losses with the potential for large, exponential gains.

$SPX uptrend remains intact—but with fewer stocks participating and volatility compressed, the rally is fragile. Breadth divergence + vol compression = asymmetric risk of sharp reversal.

Drawdowns matter—because they determine whether you stay invested long enough to benefit from the upside.

Convexity is engineered. It comes from designing strategies that perform non-linearly—losing small in calm markets and gaining big in shocks.

Today's -1.7% decline in the $SPX is outside the normal noise of the market, and volatility expansion is likely.

The VIX indicates a volatility expansion is in play for the S&P 500 and stock market as we enter August.

Where others see risk tolerance as a box to check— ASYMMETRY® sees it as a spectrum to engineer around.

The beauty of volatility lies in its duality: a harbinger of chaos, yet a canvas for convexity. Short it blindly, and you’re chasing ghosts; harness it wisely, and it reveals the market’s hidden rhythms. As Einstein said, “In the middle of difficulty lies opportunity.”

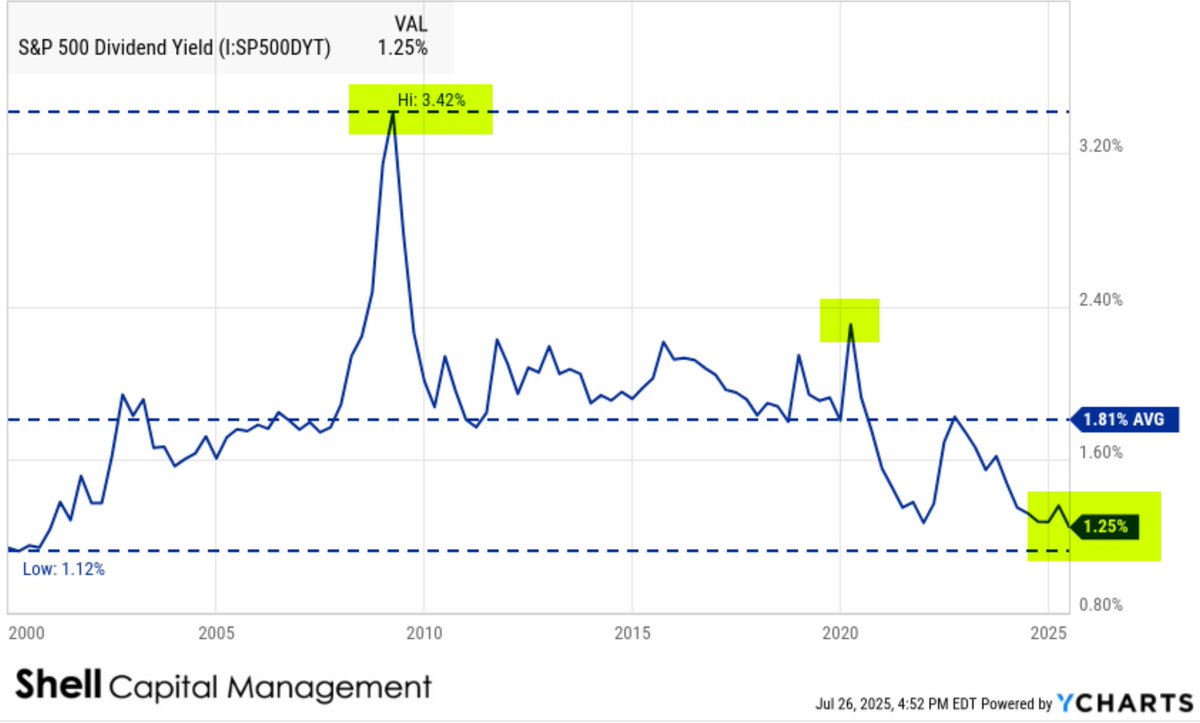

Historical Context: Yield Spiked in Crises The yield surged during the 2008–09 Global Financial Crisis when prices collapsed and dividends were sticky or only slightly cut. We see similar spikes in 2020 during the pandemic crash. Today’s low yield signals no margin of…

United States Trends

- 1. Eagles 121K posts

- 2. Eagles 121K posts

- 3. Jalen 26K posts

- 4. Ben Johnson 15.4K posts

- 5. Caleb 45.9K posts

- 6. AJ Brown 5,245 posts

- 7. #BearDown 2,234 posts

- 8. Philly 25K posts

- 9. Patullo 11.6K posts

- 10. Sirianni 6,891 posts

- 11. Black Friday 513K posts

- 12. Lane 53.5K posts

- 13. Georgia Tech 4,624 posts

- 14. Swift 56.1K posts

- 15. #CHIvsPHI 2,450 posts

- 16. #GoDawgs 4,953 posts

- 17. NFC East 1,763 posts

- 18. Saquon 7,780 posts

- 19. Gunner 5,254 posts

- 20. Monangai 6,292 posts

You might like

-

RealActivity - Mission Critical Healthcare Systems

RealActivity - Mission Critical Healthcare Systems

@realactivityusa -

IBN (InvestorBrandNetwork)

IBN (InvestorBrandNetwork)

@IBNMediaNetwork -

Mike Shell

Mike Shell

@MikeWShell -

Lance L. Black

Lance L. Black

@lancelblack -

NaosAssetManagement

NaosAssetManagement

@NaosAssetMgmt -

www.AISmartPicks.com

www.AISmartPicks.com

@FreePicks_today -

CannabisNewsWire

CannabisNewsWire

@CNWMediaOnline -

Crypto Rookies

Crypto Rookies

@CryptoRookies -

thevybe

thevybe

@the_vyb3e -

QMCQuantumMinerals

QMCQuantumMinerals

@QuantumMinerals -

Point Broadband

Point Broadband

@PointBroadband -

Mina Bashta

Mina Bashta

@Bashtanol -

NetworkNewsWire

NetworkNewsWire

@NNWMedia

Something went wrong.

Something went wrong.