Mike Shell

@MikeWShell

Investment manager of ASYMMETRY® Managed Portfolios for asymmetric risk/reward. Edge, trend, momentum, convexity, optionality, flows, sentiment, volatility.

你可能會喜歡

Having tactically traded through the 1998 Russian crisis and LTCM collapse, the dot-com bubble and crash, the 2007–09 financial crisis, the COVID shock, and everything since—I can’t stress this enough: The best countertrend setups don’t come from just buying dips. They come…

Tops are processes. Not events. You don’t identify them by prediction. You identify them by behavioral deterioration. It’s diagnostics— not clairvoyance.

Which has the most predictive power for investment returns? Drop your answer and reasoning below 👇🏼

“The big money in booms is always made first by the public – on paper. And it remains on paper.” — Edwin Lefèvre Open profits are the markets money— until you take them.

Valuation is a headwind. Multiple independent models are elevated. Historically, rich starting points have reduced forward return potential versus average; they don’t predict short-term direction. We frame it as return asymmetry risk—less upside-to-downside skew from here.

It’s never “different this time.” Technology evolves, liquidity cycles change, and new participants emerge, but the underlying laws of asymmetry — how gains and losses compound — remain constant. What varies is how investors collectively express the same recurring emotions of…

Breadth is thinning as the S&P 500 grinds higher inside its trend channel, with momentum and participation not confirming fresh highs—classic late-leg signals—but without distribution on the major leadership charts yet.

Trend risk expands with valuation. As a stock’s valuation multiple (price-to-earnings, price-to-sales) rises, the risk of trend reversal increases, even if the price trend remains technically strong.

To have earned the S&P 500’s long-term annualized return of ~10% since 1928, investors had to tolerate drawdowns as deep as -50% or more, sometimes lasting years. That’s the price of admission.

asymmetric optimism: your upside lies ahead— not behind.

Gold has reached a speculative extreme — record short-gamma imbalance in GLD options (about 10 times normal), implied volatility at the 100th percentile, and demand for upside calls that is similar to May 2006, when gold rose 60% before falling 30%, which means the market is in a…

With all this intelligence— Can we get a cure for tinnitus?

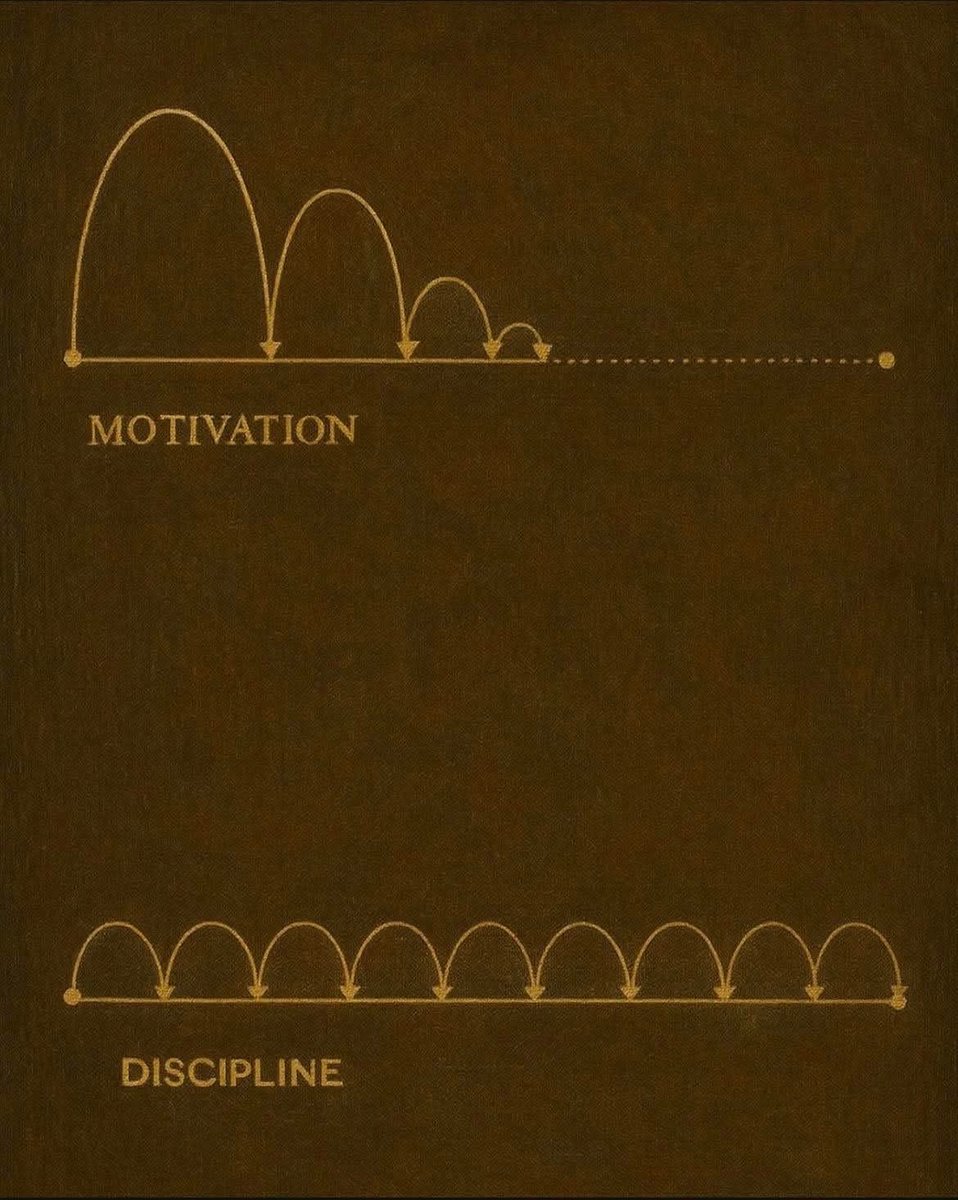

Motivation is like volatility — it spikes and fades. Discipline is like trend — persistent and directional.

You can’t preach unity while you’re throwing gasoline on the same fire. Real unity starts when leaders take responsibility for their own words instead of blaming others for the division they help create. And in Walz’s case, it rings even more hollow because he’s been guilty of…

In football betting and tactical trading, the edge isn’t about predicting — it’s about positioning. You win not by being right every time, but by risking a little when wrong and making a lot when right.

You have to rescue yourself

Asymmetry arises from behavioral inefficiency. Fear and euphoria move prices farther than fundamentals justify, creating positive skew for disciplined contrarians. shell-capital.com/asymmetric-ins…

Achieving asymmetric returns isn’t easy. It requires significant skill in identifying opportunities, managing risk, and handling behavioral biases like losing losses too long and selling winning positions too early.

A 3–6% pullback can reset short-term momentum indicators (RSI, ATR%, volatility ratio), potentially re-creating asymmetric entry points— if the longer-term trend remains intact.

United States 趨勢

- 1. Thanksgiving 2.01M posts

- 2. Jack White 5,012 posts

- 3. Packers 38.4K posts

- 4. Thankful 408K posts

- 5. #GBvsDET 3,023 posts

- 6. #GoPackGo 5,894 posts

- 7. Wicks 4,227 posts

- 8. Jordan Love 5,583 posts

- 9. Goff 6,073 posts

- 10. #OnePride 5,688 posts

- 11. Jameson Williams 1,703 posts

- 12. Jamo 3,307 posts

- 13. Turkey 266K posts

- 14. Tom Kennedy N/A

- 15. Seven Nation Army N/A

- 16. Amon Ra 2,384 posts

- 17. LaFleur 2,191 posts

- 18. Brian Branch N/A

- 19. Ray J 3,050 posts

- 20. Carrington Valentine N/A

你可能會喜歡

-

IBN (InvestorBrandNetwork)

IBN (InvestorBrandNetwork)

@IBNMediaNetwork -

Lance L. Black

Lance L. Black

@lancelblack -

Shell Capital Management LLC

Shell Capital Management LLC

@ShellCapital -

Stockhouse Publishing

Stockhouse Publishing

@stockhouse -

CannabisNewsWire

CannabisNewsWire

@CNWMediaOnline -

@TarragonCapital

@TarragonCapital

@KyleKelly111 -

The O'Dell Group of Seven Gables Real Estate

The O'Dell Group of Seven Gables Real Estate

@theodellgroup -

Ken Borkan

Ken Borkan

@KBMIA -

DrThought

DrThought

@iamdavidrhough -

NetworkNewsWire

NetworkNewsWire

@NNWMedia -

STAND League

STAND League

@standleague -

NorCal Mortgage

NorCal Mortgage

@norcalmortgage -

Mina Bashta

Mina Bashta

@Bashtanol -

Bright Vessel

Bright Vessel

@brightvessel -

EdgarFamilyLaw

EdgarFamilyLaw

@EdgarFamilyLaw

Something went wrong.

Something went wrong.