SmallCapKing - aka “Bob”

@SmallCapBob2

The self-proclaimed #SmallCapKing of small-cap stocks. I’m NOT really a KING 🤴. My friends just call me “Bob” 👨🦳

You might like

#Trump is reportedly set to announce he will be assigning a special task force to carry out a full investigation of the events that took place in 2021, whereby #RobinHood and other various trading platforms, colluded against #GameStop by turning off the buy button $HOOD $GME

“Will get back in”? He’s gotten. I GUARANTEE @michaeljburry has already accumulated $GME MOA$$ 101 1. Accumulate under the radar 2. Let it cook, until it finds support 3. Start posting on X

I think @michaeljburry will get back into $GME. It makes sense at this point. Tons of cash on hand and the business is no longer bleeding money.

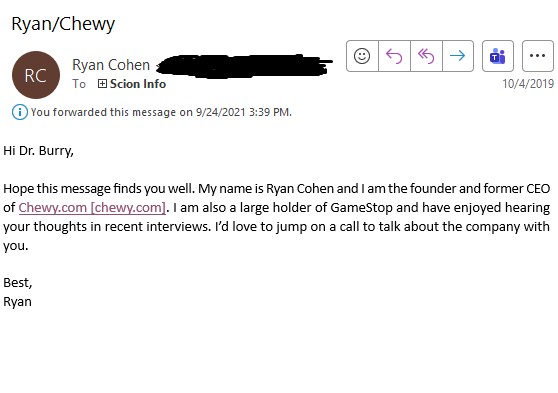

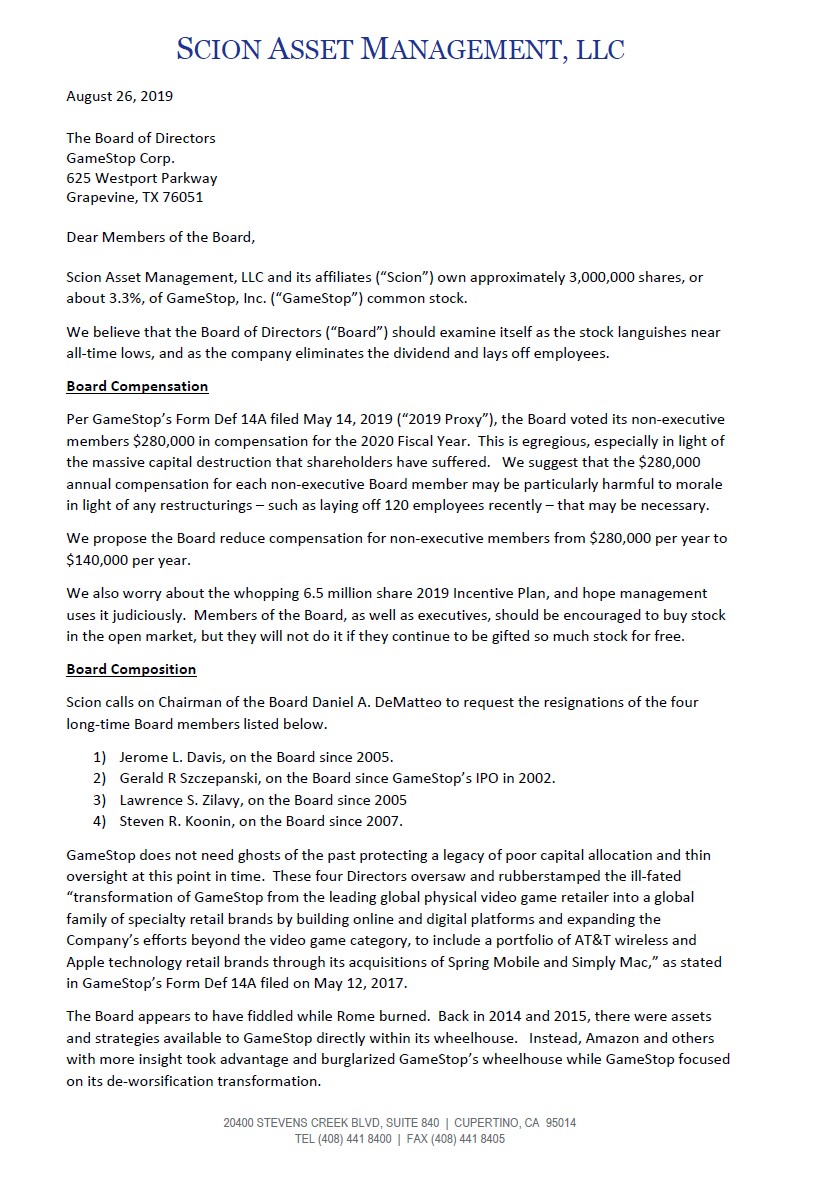

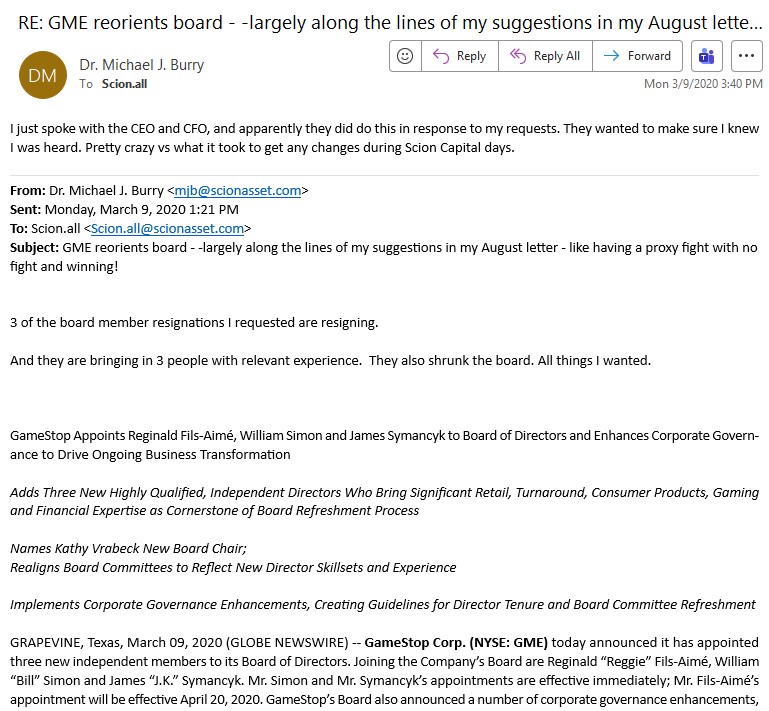

Appears the “brightest financial minds” who may have been advising @ryancohen in 2025, is in fact the same man who appears to be advising him in 2019 ➡️ @michaeljburry 🤫 What’s interesting is both Cohen & Burry are equally “eccentric” Match made in heaven #GameStop ➡️ $GME

If you don’t think @ryancohen has the brightest financial minds in the world advising him on the best strategy to trap $GME short sellers and end the manipulation of #GameStop once and for all, you’re just not paying attention Once revealed, Cohen will look like a genius!

If @ryancohen reached out to @michaeljburry in 2019, it’s safe to assume Cohen reached out to Burry in 2025 to help devise a plan to help exploit those holding toxic $GME swaps and derivatives 🤫

It was complicated with $GME. In some ways, I wasn't really done in 4Q 2019.

#GameStop How many times does $GME get halted on Friday after the post @michaeljburry made last night?

I can’t wait for @ryancohen post a picture of him with @michaeljburry It would be yet another cog in the wheel of #GameStop’s circle of life if an OG of $GME, resurfaced for round 2! 🥊

In 2019, Burry advocated for GME doing a share repurchase that could retire 80% of the TSO and obliterate the extreme short interest. GME’s market cap is at 9.69 billion. Remind me, how much cash does GME have on hand currently? 🌝

2025 TIMELINE FOR @michaeljburry >become active on X >publicly short $NVDA & $PLTR >make 20% within 3 weeks >Shut down hedge-fund Scion Capital >Start #Substack newsletter >Generate $10 million+ >Post about $GME @TheRoaringKitty @ryancohen

It’s a good thing @saylor is eating oranges now. It will prolong him from getting scurvy when $MSTR goes to zero and shareholders throw him on a life raft and push him out to sea 🤣 $BTC

Method to @michaeljburry’s madness If $NVDA drops 20-30% collateral haircuts spike forcing sales of NVDA & covering underlying shorts to meet calls Since $GME swaps mature (many 2021-vintage TRS expiring Q4 2025-Q1 2026), DTCC/LCH clearers will demand real shares not synthetics

Hedge funds and prime brokers (e.g., via Citadel or Goldman Sachs) leverage $NVDA shares as "prime collateral" in repo agreements or swap arrangements. This allows them to borrow against it—often at low rates—to fund naked shorts or TRS on $GME without immediate liquidation risk

Hedge funds and prime brokers (e.g., via Citadel or Goldman Sachs) leverage $NVDA shares as "prime collateral" in repo agreements or swap arrangements. This allows them to borrow against it—often at low rates—to fund naked shorts or TRS on $GME without immediate liquidation risk

Why did @michaeljburry first disclose he was short $NVDA before posting about $GME? NVDA's stock—prized for its liquidity and growth—is frequently used as high-quality collateral to secure borrowing for massive short positions, including GME derivatives.

🤡 $BTC

Why $50M Bitcoin Is Not Crazy — It’s Inevitable Most people hear $50,000,000 per BTC and think it’s a meme. It isn’t. It’s the logical endpoint of monetary history, nation-state game theory, and the AI century. Here’s the Rising Dynasty framework I use to see it 👇

$GME

United States Trends

- 1. Thanksgiving 1.96M posts

- 2. Packers 34.9K posts

- 3. #GoPackGo 5,518 posts

- 4. Thankful 382K posts

- 5. Wicks 3,935 posts

- 6. Jordan Love 5,166 posts

- 7. Goff 5,737 posts

- 8. #GBvsDET 2,282 posts

- 9. #OnePride 4,867 posts

- 10. Turkey 255K posts

- 11. Jameson Williams N/A

- 12. Jamo 2,538 posts

- 13. Tom Kennedy N/A

- 14. Amon Ra 1,926 posts

- 15. Brian Branch N/A

- 16. LaFleur 1,761 posts

- 17. Cece Winans N/A

- 18. Romeo Doubs N/A

- 19. David Montgomery N/A

- 20. Ray J 2,741 posts

You might like

-

LittleIronMan

LittleIronMan

@LittleIronMan12 -

Dehix

Dehix

@Dehix_Trades -

TraderZero

TraderZero

@_TraderZero_ -

Tiffiny Fawcett

Tiffiny Fawcett

@tiffinyfawcett -

JC Capital Consultants

JC Capital Consultants

@CapitalJc -

Da Stock Analyst

Da Stock Analyst

@DaStockAnalyst -

Nitro

Nitro

@Nitro95732773 -

The Bankruptcy King 👑

The Bankruptcy King 👑

@TyroneLopez_ -

Josh Stai

Josh Stai

@Josh_Stai -

Hulk Investments

Hulk Investments

@HulkInvestments -

Vaunte Capital

Vaunte Capital

@VaunteCapital -

Turtle Tee Tradez

Turtle Tee Tradez

@TurtleTeeTradez -

Arca.

Arca.

@arcabulls -

indus-capital.com

indus-capital.com

@induscapital77 -

TT Day Trading Alerts ™

TT Day Trading Alerts ™

@trooper_trading

Something went wrong.

Something went wrong.