Superalgos

@Superalgos

Open-source trading bots platform with a social trading network crowdsourcing superpowers for retail traders. Decentralized, permissionless, incentivized.

You might like

This bull cycle is structured in roughly 8-month impulses. The last two marked significant higher highs (+20%) after three bullish months, followed by 5 months of consolidation. Should the pattern repeat, we will likely see the local low in Dec, and the next local top in March.

Can we have a monthly version of these @_Checkmatey_ ?

Here you go mate. BTC charts.checkonchain.com/btconchain/sup… USD charts.checkonchain.com/btconchain/sup…

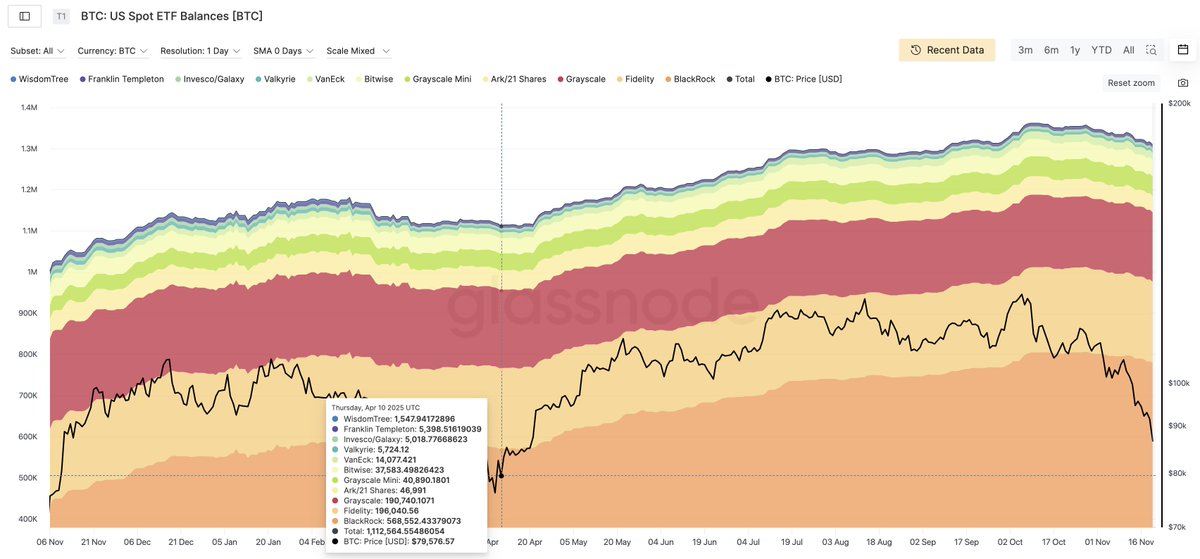

Capital is not leaving bitcoin

Semi-shock: Bitcoin ETFs saw net *inflows* on Friday, as a group (the others picked up slack for IBIT, teamwork in effect). Cant deny Boomers showing serious mettle. Still over 95% of aum hanging tough despite, as their hero Billy Joel says, they didn't start the fire.

Capital is not leaving the market and price doesn't tell the whole story: The ATH balance in US Bitcoin ETFs on 12 Oct was 1,361,938 BTC, with price in the 115K level. The balance as of today is 1,309,239 BTC, with price sliding to the 80.5K level. Only 52,699 BTC in ETFs have…

This bull cycle is structured in roughly 8-month impulses. The last two marked significant higher highs (+20%) after three bullish months, followed by 5 months of consolidation. Should the pattern repeat, we will likely see the local low in Dec, and the next local top in March.

Capital is not leaving Bitcoin: The last time bitcoin price touched the 80K level on 10 Apr 2025, US ETFs had 1,112,564 BTC in their balance. Today, the balance is 1,309,239 BTC, up 196,675 BTC.

This bull cycle is structured in roughly 8-month impulses. The last two marked significant higher highs (+20%) after three bullish months, followed by 5 months of consolidation. Should the pattern repeat, we will likely see the local low in Dec, and the next local top in March.

Today's bitcoin slide to the 80.5K level sets the drawdown at 36.17%, significantly larger than in previous corrections in the bull run, this time, in the context of major tickers with similar numbers: Oracle: -44% Palantir: -30% Meta: -27% AMD: -27% Tesla: -22% Nvidia: -19%…

This bull cycle is structured in roughly 8-month impulses. The last two marked significant higher highs (+20%) after three bullish months, followed by 5 months of consolidation. Should the pattern repeat, we will likely see the local low in Dec, and the next local top in March.

Bitcoin is currently at 29.6% drawdown from ATH, still within range on the bull run

Bull run drawdown numbers so far: AUG 24: 33.46% APR 25: 31.94% CURRENT: 26.32% Perspective.

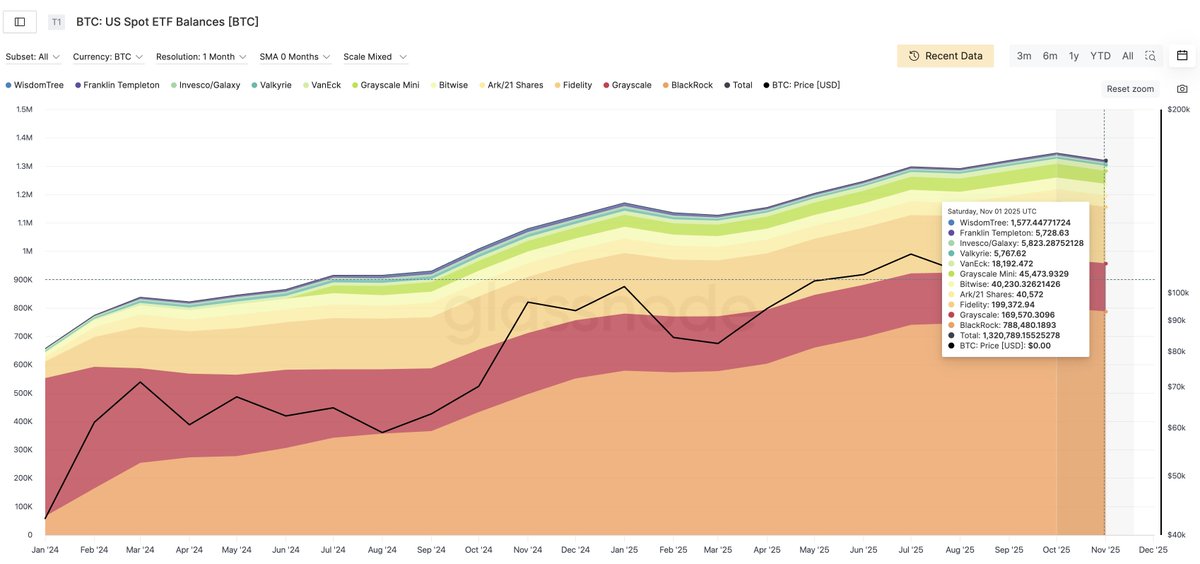

More nuance on current bitcoin sentiment: 1.32M BTC are still in the hands of Bitcoin ETF holders. November's outflows don't even make a dent in the balance. This capital is here for the long run. Price action and X do not reflect market sentiment. Source: @glassnode

This bull cycle is structured in roughly 8-month impulses. The last two marked significant higher highs (+20%) after three bullish months, followed by 5 months of consolidation. Should the pattern repeat, we will likely see the local low in Dec, and the next local top in March.

A bit of perspective on bitcoin sentiment: Bitcoin ETFs outflows in Nov amount to 25K BTC so far. Sep and Oct saw inflows of 56K BTC. The previous correction of Feb / Mar 2025 saw outflows of 45K BTC. Current flows seem ordinary bull market flows. Source: @glassnode

This bull cycle is structured in roughly 8-month impulses. The last two marked significant higher highs (+20%) after three bullish months, followed by 5 months of consolidation. Should the pattern repeat, we will likely see the local low in Dec, and the next local top in March.

Talk about buying the dip

My statement of intent 👇 After years of teaching Bitcoin on the ground — with the real plebes, unbanked communities, Indigenous groups, and low-income neighborhoods — I’ve seen firsthand that most native-language speakers are oral users, not readers. And the same is true for…

Bull run drawdown numbers so far: AUG 24: 33.46% APR 25: 31.94% CURRENT: 26.32% Perspective.

This bull cycle is structured in roughly 8-month impulses. The last two marked significant higher highs (+20%) after three bullish months, followed by 5 months of consolidation. Should the pattern repeat, we will likely see the local low in Dec, and the next local top in March.

We've reached the max pain point in the context of this 3/8 time signature bull run, deeping to the level of the previous impulse. Still within bull territory judging by previous experience.

This bull cycle is structured in roughly 8-month impulses. The last two marked significant higher highs (+20%) after three bullish months, followed by 5 months of consolidation. Should the pattern repeat, we will likely see the local low in Dec, and the next local top in March.

Elon fantasises about bitcoin in 2025... who's gonna tell him?

“Maybe there won't even be money in the future but might be measured in terms of wattage, like how much power can you bring from electrical standpoint?” maybe you should hold on to your bitcoin... in case it catches on...

The Samurai Wallet sentencing is terrible. I am working on it. I am working on a LOT of these cases. I need Bitcoiners to flex their influence right now. You need to make calls to the admin. We will not win this in woke courts. We can win in the Whitehouse.

We live in a political theatre where the actors pretend to fight while sharing the same backstage. The bankers write the script, the economists narrate it, and the politicians dance for the cameras like puppets. It’s entertaining, yes… but it’s quietly killing your money. They…

United States Trends

- 1. Klay 20.5K posts

- 2. #AEWFullGear 70.3K posts

- 3. McLaren 47.7K posts

- 4. Lando 100K posts

- 5. #LasVegasGP 188K posts

- 6. Ja Morant 9,060 posts

- 7. gambino 2,478 posts

- 8. Hangman 9,957 posts

- 9. Samoa Joe 4,826 posts

- 10. Swerve 6,405 posts

- 11. LAFC 15.5K posts

- 12. #Toonami 2,831 posts

- 13. Bryson Barnes N/A

- 14. Verstappen 81.4K posts

- 15. Utah 24K posts

- 16. Kimi 39.1K posts

- 17. Benavidez 16K posts

- 18. Terry Crews 7,902 posts

- 19. Fresno State 1,010 posts

- 20. LJ Martin 1,301 posts

You might like

-

Greg Valancius

Greg Valancius

@gvalan -

Mustafa Ugras

Mustafa Ugras

@mugras -

AdmiralOdawg

AdmiralOdawg

@AdmiralOdawg -

DaedalusEG

DaedalusEG

@DaedalusEG -

kadir sainkaplan

kadir sainkaplan

@kadirsainkaplan -

🇺🇸I Am Not Your Negro (👑🦂)

🇺🇸I Am Not Your Negro (👑🦂)

@Amazon_Queenn -

akelmazulkuf

akelmazulkuf

@zakel21 -

Charles Pilger

Charles Pilger

@pilgerowski -

Der Brettermacher Ferienwohnung

Der Brettermacher Ferienwohnung

@brettermacher -

@KINGORI JOHN

@KINGORI JOHN

@5_kingori -

pearl

pearl

@S_defse -

Cryptocolic.base.eth

Cryptocolic.base.eth

@Crypto_colic -

MehmetBurhan&Tuba🇹🇷 🇵🇸 🇦🇿🇵🇰

MehmetBurhan&Tuba🇹🇷 🇵🇸 🇦🇿🇵🇰

@MehmetBurhanGn1 -

PiN 🦋

PiN 🦋

@kriptopnr -

🇸🇪 Carl J | ⚙💫

🇸🇪 Carl J | ⚙💫

@signalyticCarl

Something went wrong.

Something went wrong.