Swarm Quant

@SwarmQuant

Systematic Trader commanding a quirky brigade of buggy scripts in their heroic pursuit of accidental alpha.

You might like

Remind me again was it a good or a bad thing, when $LTC starts moving?

What do you guys use as a simple marked hedge in crypto to run a market neutral strategy against? The problem I am talking more about an equal risk weighted market index. So BTC is not really the answer because this index looks a lot more like the Alts chart than BTC. (Same…

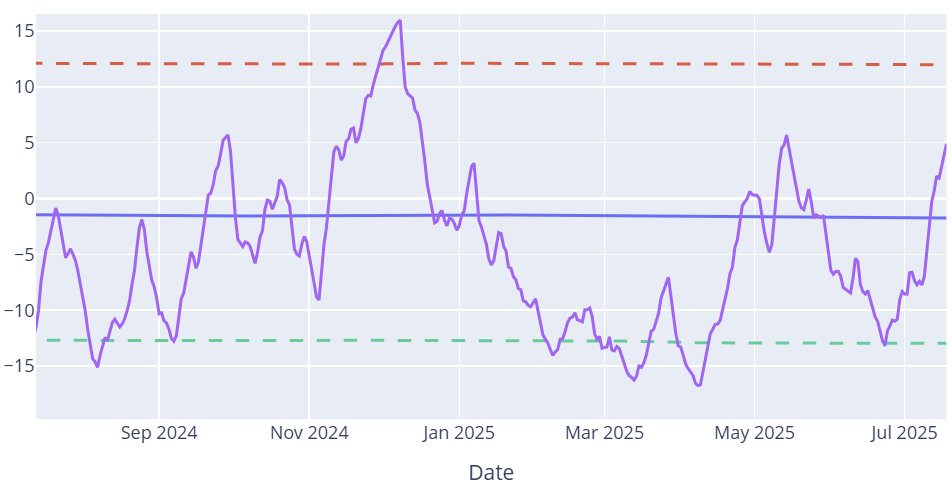

Turns out this time was not much different and we fully cooled off again.

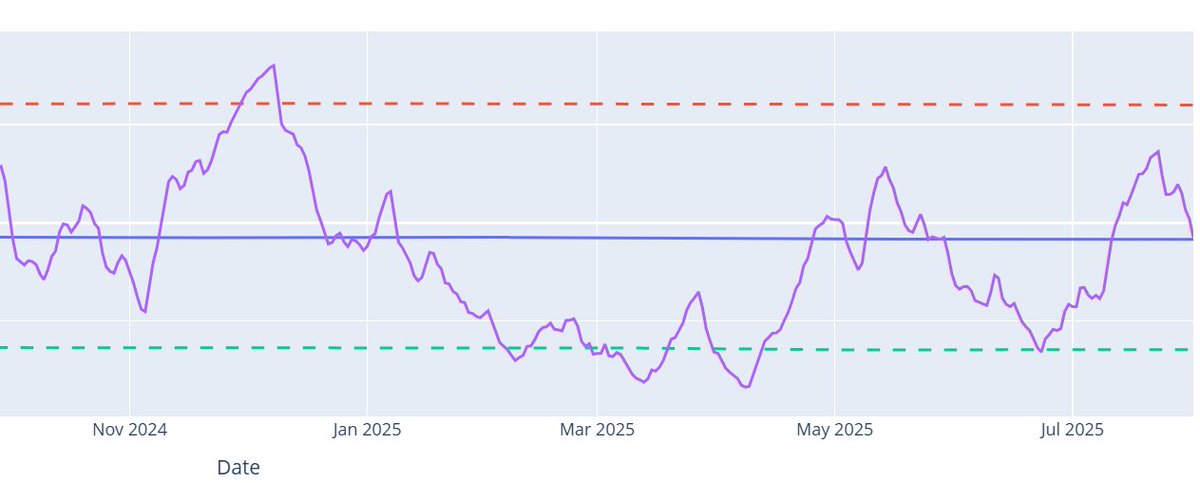

In May this was about the time we got shafted. Let's hope this time is different and we get to experience a little more fun

Yes, very true. Most directional crypto shops are still in deep DD or are just recovering. The sad part is that many investors have it even worse. Because these funds get most of their money during peak mania. Same as people buying crypto outright. Which means they buy at the…

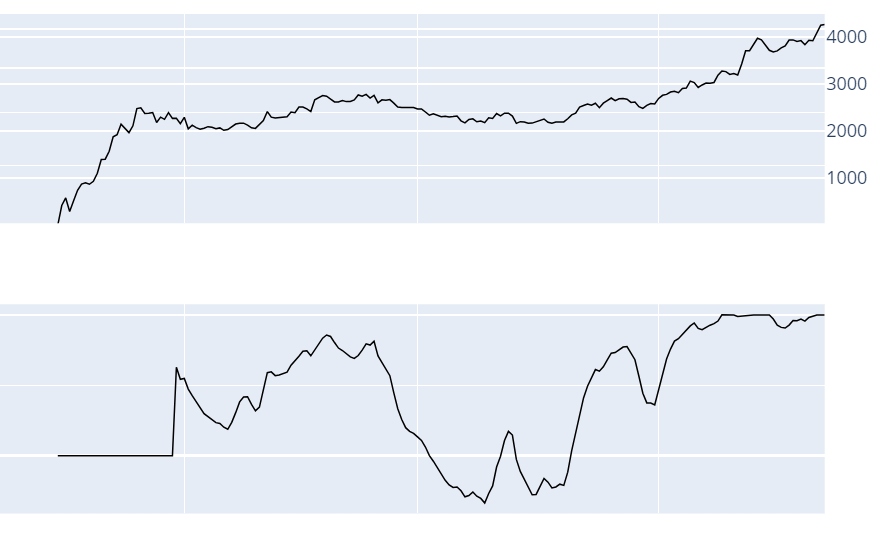

Fun fact: Everyone is making money on Crypto Twitter, right? Meanwhile: Most of professional directional trading shops in crypto are underwater or they are just getting out of multi-quarter drawdown. Source of information: Professional crypto trading allocators.

First profit-taking has started in one of my biggest positions $BNB

These #1 awards are so stupid... Funds that use them to brag should probably be avoided. They are for the "best performance" in a single month... You can be down 99% because your startegy is to buy shitcoins (which is the strategy of many funds) and for one month your shit…

In May this was about the time we got shafted. Let's hope this time is different and we get to experience a little more fun

Will it be another nothing burger for the crypto market or some sustained fun?

$HYPE relative performance against the entire market. Fairly similar to it actual performance as the overall market is not moving much.

With $HYPE I have the urge to do some manual fundamental "holding" / trading. But I think my models can handle that better than I can.

Also to find something, you should mostly just do sth others have been doing for a long time. Don't try and be novel. Very similar to the startup world. Most people think you have to do sth new, but the easiest way is to just copy sth that is already proven to work.

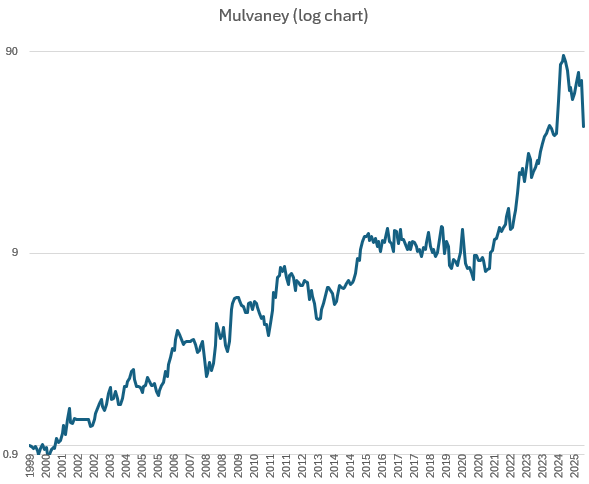

I mean he still is an absolute baller. The system makes these crazy returns BECAUSE VERY FEW PEOPLE CAN LIVE WITH THOSE RETURNS. It is actually ver hard. He seems to go at max risk for his strategy. Which makes the ride very emotional. He is good as long as he doesn't fly to…

OMG! Paul Mulvaney's fund lost 40.7% in April & is now down 55.4% from its peak (largest drawdown ever). Just a year ago, everyone was jealous of his returns. Not as much now. Still great long-term results, but who can live with 50%+ drawdowns, Sharpe of just 0.53, & MAR of 0.27?

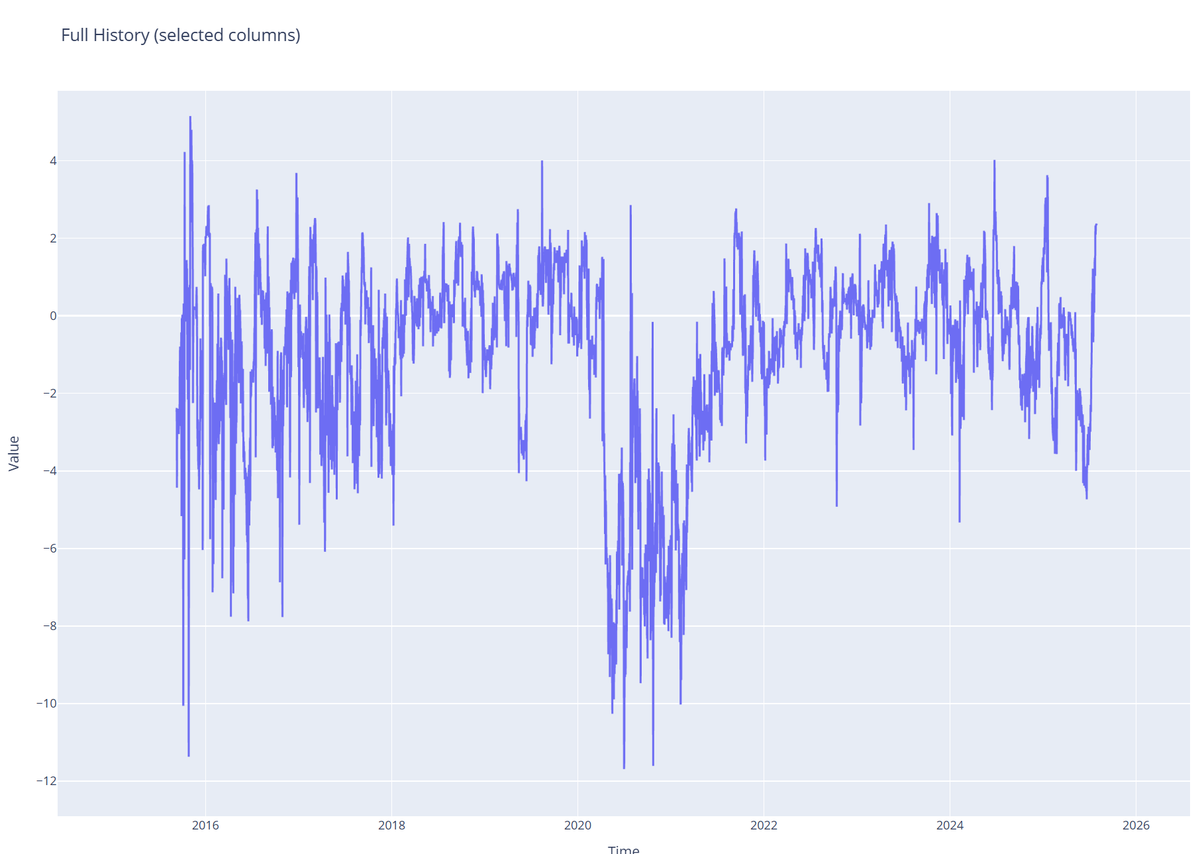

I see risk as volatility as risk, yet I also see it as a feature not a bug. Volatility is of the simpler things to predict as it clusters. Also, volatility brings opportunity. I prefer a very high vol asset over a very low vol asset. THE LOW VOL ASSET CAN BE RISKIER THAN THE…

I don’t see volatility as risk. Volatility is a feature not a bug.

Little insides from the crypto fund world

Many funds are larpers. In crypto there are many that just hold BTC. There are also many funds that just shoot from the hip all the time (most got big in one cycle. They were all in on a single token. By Survivorship bias they survived and are now still running selling the…

United States Trends

- 1. #TheTraitorsUS N/A

- 2. Colton N/A

- 3. #TNAiMPACT N/A

- 4. Cooper Flagg N/A

- 5. Warsh N/A

- 6. #thepitt N/A

- 7. #911onABC N/A

- 8. Candiace N/A

- 9. Dillon Brooks N/A

- 10. Abigail N/A

- 11. #LGRW N/A

- 12. Iron Lung N/A

- 13. Eddie N/A

- 14. langdon N/A

- 15. Yam Yam N/A

- 16. Mark Aguirre N/A

- 17. whitaker N/A

- 18. Patrick Kane N/A

- 19. Ian Cunningham N/A

- 20. Lindgren N/A

Something went wrong.

Something went wrong.