AlgoAdvantage | Simon

@algo_advantage

Quant Trader & host of The Algorithmic Advantage podcast. http://www.thealgorithmicadvantage.com https://www.quantivealpha.com

Talvez você curta

This is BIG. Algo Advantage is undergoing metamorphosis. Check out the 10 min video on my back-story and how I got 10 market wizards to start helping us all! Video on the home page of the new site: algoadvantage.io Bookmark this! @Alphatative @basso_tom @DrTomStarke…

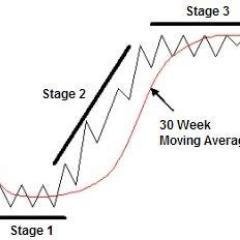

In the age of machine learning, high-frequency trading, AI, untold data options and black box models, it’s easy to believe that only the most sophisticated strategies have any edge left. Yet Brent Penfold has spent decades proving the opposite. Yes, he has the track record to…

The premier Quant Conference with @quantstrats in London October 14-15. 10% off with ALGOADVANTAGE10. Rub shoulders with all the best of the best quants in Europe this year, you may even learn something! : ) #Quant

Looking forward to chatting about this stuff with you soon mate : )

🚨BREAKING: A new Python library for algorithmic trading. Introducing TensorTrade: An open-source Python framework for trading using Reinforcement Learning (AI)

That's a wrap! If you enjoyed this thread: 1. Follow me @pyquantnews for more of these 2. RT the tweet below to share this thread with your audience

OpenAI, Google, and Anthropic just published guides on: • Prompt engineering • Building agents • AI in business • 601 AI use cases 9 of the best guides you can't miss:

Even when @laurensbensdorp & I were babies we just frothed on this trading stuff! Couldn't get enough of it. Couldn't resist this sorry... : ) Full show: youtu.be/YcsgsVXInPI

What looks like a bad strategy on its own can actually be the missing puzzle piece. Robustness comes from how strategies interact, not from making each one look perfect in isolation. I chat in depth about that on @algo_advantage with Simon. youtube.com/watch?v=YcsgsV…

youtube.com

YouTube

042 - Laurens Bensdorp II - Building Strategies with Purpose

Always good to chat @laurensbensdorp !

And here's my second podcast with @algo_advantage It is always great to talk with like-minded people who know their stuff. We covered a lot from trend following, to mean reversion, (over)optimization, when to switch off a system, and so much more! thealgorithmicadvantage.com/podcast/042-la…

youtube.com/watch?v=gKbAo7… Round II of a systematic trading masterclass with @laurensbensdorp : architect non-correlated, purpose-built portfolios—mix trend following, mean reversion, and long-volatility hedges to drive smoother, higher risk-adjusted returns. We unpack the…

When I sat down recently with @AlvarezQuant of Alvarez Quant Trading, I knew I'd be tapping into a deep reservoir of quantitative trading wisdom. Cesar’s journey into systematic trading began similarly to many of us—starting with discretionary trades, dabbling in mutual funds,…

Let's keep going with @PKycek on building supercharged but robust crypto strategies. How do you make them robust with such a limited amount of historical data? This should be your first question. Full show: youtu.be/B5v3oc-DjII

Managing crypto risk? Forget stops, use hedging strategies says @PKycek. Interested in hedging strategies for stocks? Tune in to an up-coming show with @laurensbensdorp who has a similar framework. Great minds think alike ; ) Full show: thealgorithmicadvantage.substack.com/p/040-pavel-ky…

Unlock insane returns with quant crypto trading! Discover how top quant trader @PKycek from Robuxio builds robust portfolios combining mean reversion, momentum, and hedging strategies - even with limited historical data. Learn essential techniques for managing crypto volatility,…

Psychology for Quant Traders? Really @steenbab ? The punch-line from Brett’s research is simple: systematic trading is less “set-and-forget” and more Formula 1 pit-crew—engineering precision plus real-time human performance. Code finds edges; psychology keeps you creative enough…

United States Tendências

- 1. $ZOOZ 1,961 posts

- 2. Knesset 66.4K posts

- 3. Good Monday 30.2K posts

- 4. Columbus 46.8K posts

- 5. #MondayMotivation 9,894 posts

- 6. Israeli Parliament 6,725 posts

- 7. #LingOrmTop1and2EMVDiorSS26 96.9K posts

- 8. StandX 2,322 posts

- 9. #GalxeID 8,198 posts

- 10. CONGRATS LINGORM PFW EMV 88.4K posts

- 11. #njkopw 33.2K posts

- 12. #IndigenousPeoplesDay 1,253 posts

- 13. Branch 43.3K posts

- 14. All 20 69K posts

- 15. Cryptocurrencies 4,367 posts

- 16. Rod Wave 2,234 posts

- 17. Victory Monday N/A

- 18. Red Cross 65.6K posts

- 19. God Bless President Trump 17.6K posts

- 20. Happy Thanksgiving 18.5K posts

Talvez você curta

-

Sorem 🏴🇳🇬

Sorem 🏴🇳🇬

@sorem -

Cygnet Trading

Cygnet Trading

@CygnetTrading -

akhil

akhil

@akhil4113 -

Peter154

Peter154

@PeterCheang1 -

Far far galaxy

Far far galaxy

@ellafromhell -

N A R O

N A R O

@mniNaro_ -

pyotr

pyotr

@jmnncc -

Kolbe Vandenberg

Kolbe Vandenberg

@Kolbev11 -

tommygarc

tommygarc

@ColoringsByJet -

Pipsinthehood

Pipsinthehood

@pipsinthehood -

abouu_934

abouu_934

@Ab934z -

Sgt_Black_Gold

Sgt_Black_Gold

@SgtBlackGold -

Nostracannibus

Nostracannibus

@theystolemytag2

Something went wrong.

Something went wrong.