SystematicEdge

@SystematicEdge1

AI Specialist | Systematic Prop Trader Democratizing systematic trading strategies. Sharing the journey and testing out different data-driven strategies

I haven't been posting my prop-firm related content. To be honest, I don't want to just be posting payouts/passes etc like other traders on X ( no disrespect to those though, its certainly inspirational ). I've only started using X as of about half a year ago, and genuinely it…

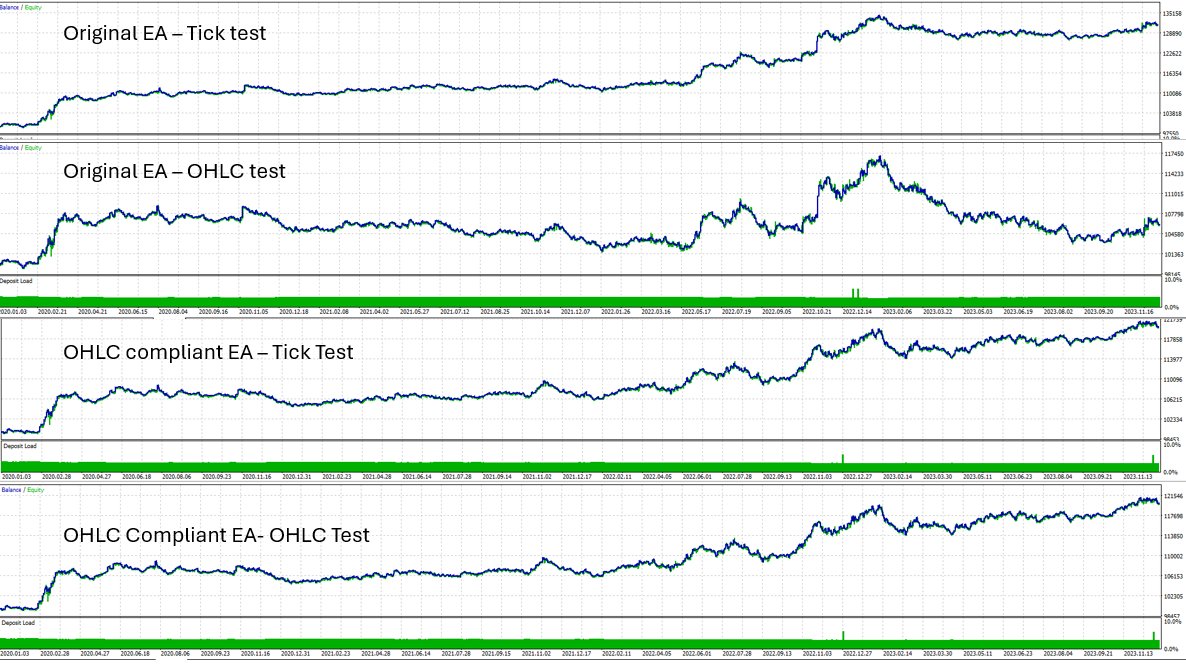

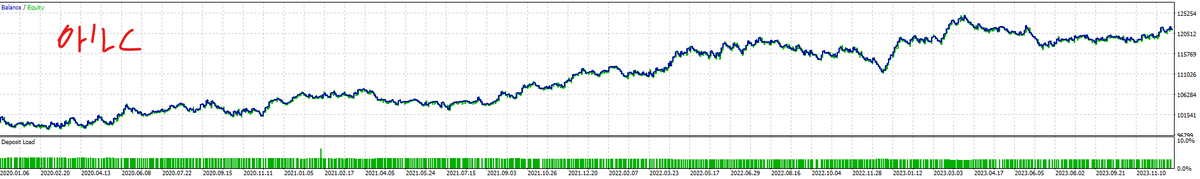

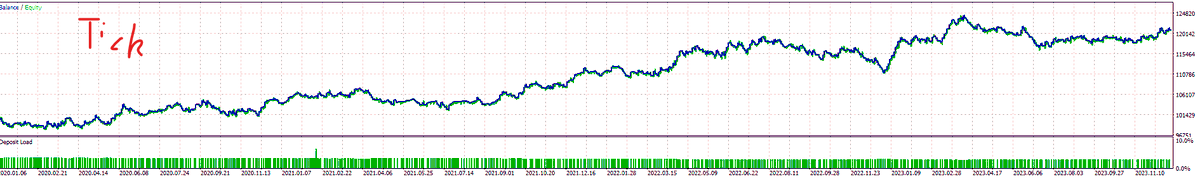

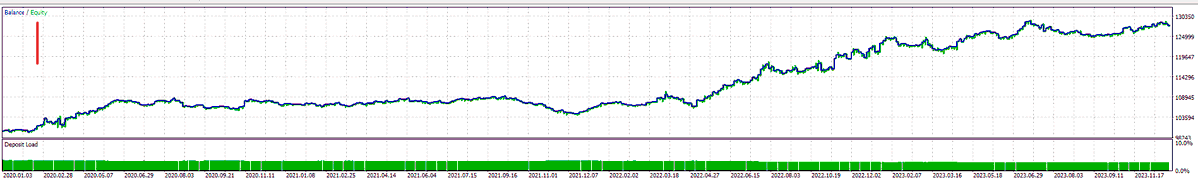

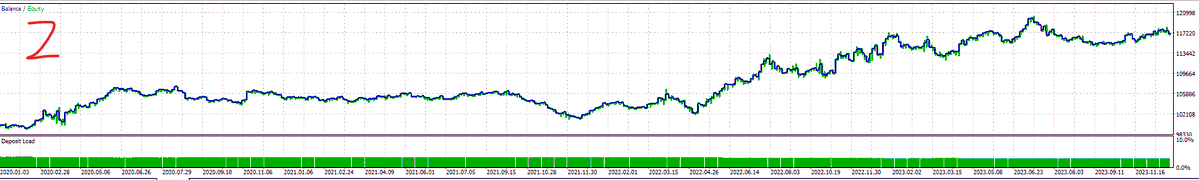

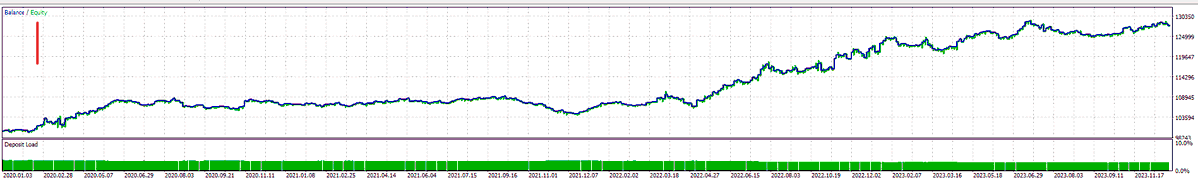

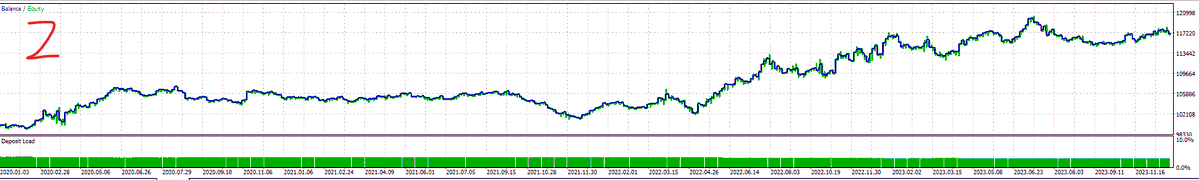

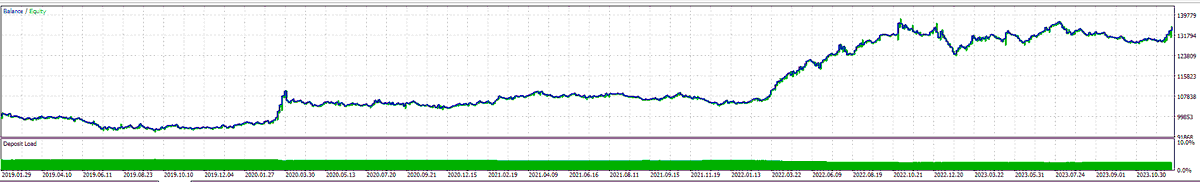

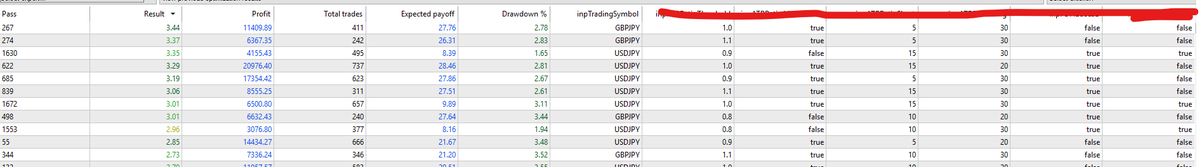

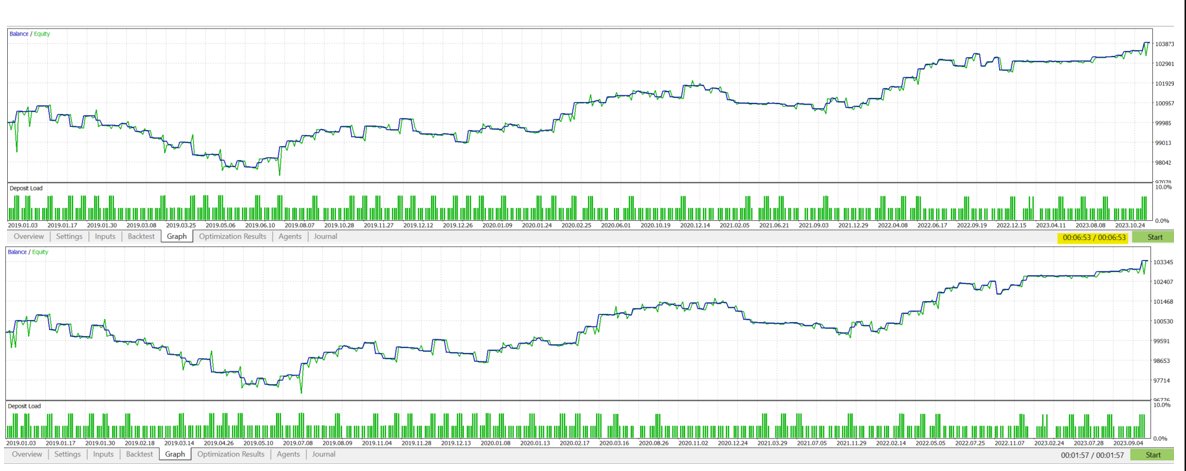

Promise will be my last post about this 😂. Again - just showing how OHLC can really skew the results of MT5 backtests. OHLC versions of backtests typically run 5-20x faster than the tick version, but can be inaccurate based on execution etc. I've just gone ahead and updated…

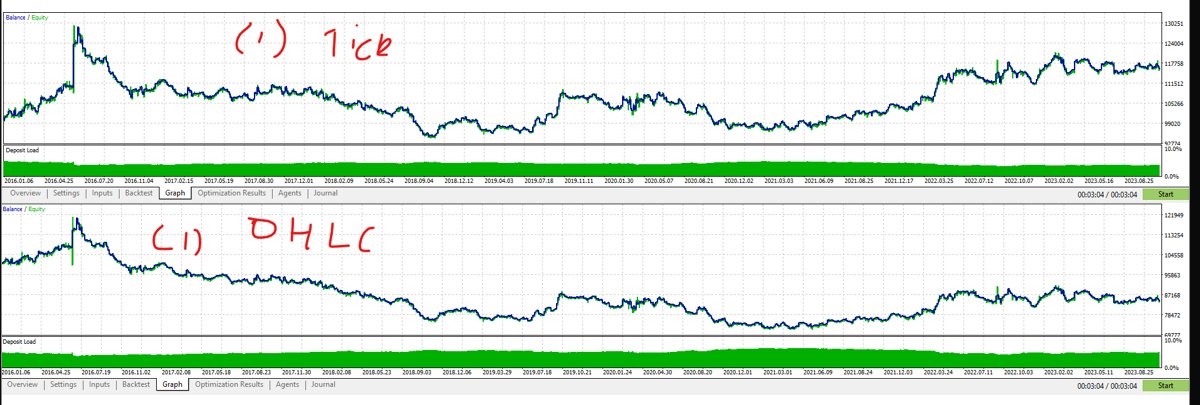

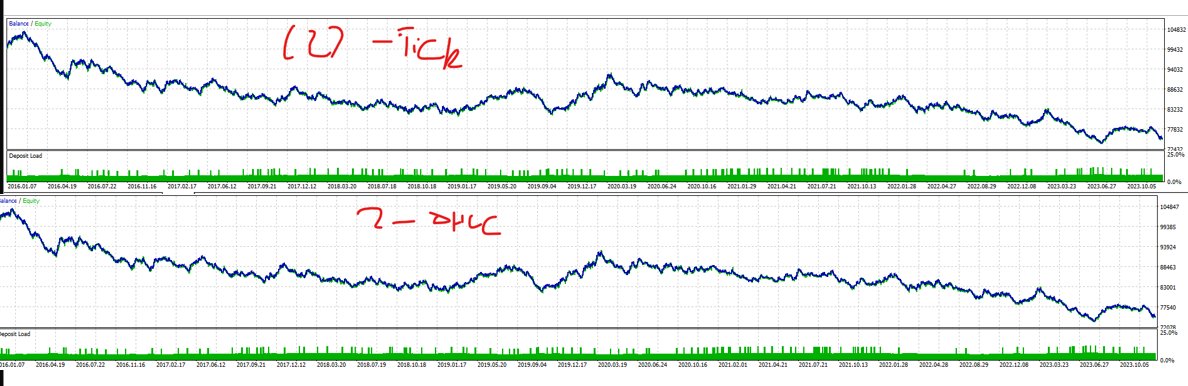

Just for reference, I've attached: 1. Tick vs 1m OHLC backtest for an EA NOT optimized around 1min executions 2. The above, but the EA is optimized to execute on 1min timeframes. Much smaller disparity between (2) than (1). Yes I know that these backtests don't look great (…

Just a bit more analysis between backtests of every tick and 1min OHLC 👇. Time 1min OHLC takes about 1/15 of the time of every tick ( this depends on EA logic though ) Trade count Both modes had the same trade count ( recall, I've re-programmed EA logic to make it M1 OHLC…

Just a bit more analysis between backtests of every tick and 1min OHLC 👇. Time 1min OHLC takes about 1/15 of the time of every tick ( this depends on EA logic though ) Trade count Both modes had the same trade count ( recall, I've re-programmed EA logic to make it M1 OHLC…

I digress - there's actually ways to make the 1 min OHLC COMPARABLE ( but not the same of course ) as the back test every tick. Overall, it probably bumps up my optimization speeds > 30-50x. The main idea is to change the EA logic to not check every tick / bid /ask, but instead…

Anyone got any tips on how else to make MQL5 backtests run faster? ( Especially for optimizations ) Using 1 min OHLC vs Every tick during the backtest gives such different results, even though the 1 min OHLC takes only 1/15 of the time. Equity curve looks similar, but the…

Agreed - in my experience though, trying to "predict" the bottoms/tops can get nasty. Better to just assume that price will be moving how its moved previously: 1. if its trending -> it will continue trending 2. if its ranging -> it will continue ranging And then structuring…

Every trading model ever created fits into two categories: Continuation or Reversal That's it The industry sells you 69 different "setups" so you keep buying courses But price only does two things: keep going or turn around Stop collecting strategies and start mastering…

Anyone got any tips on how else to make MQL5 backtests run faster? ( Especially for optimizations ) Using 1 min OHLC vs Every tick during the backtest gives such different results, even though the 1 min OHLC takes only 1/15 of the time. Equity curve looks similar, but the…

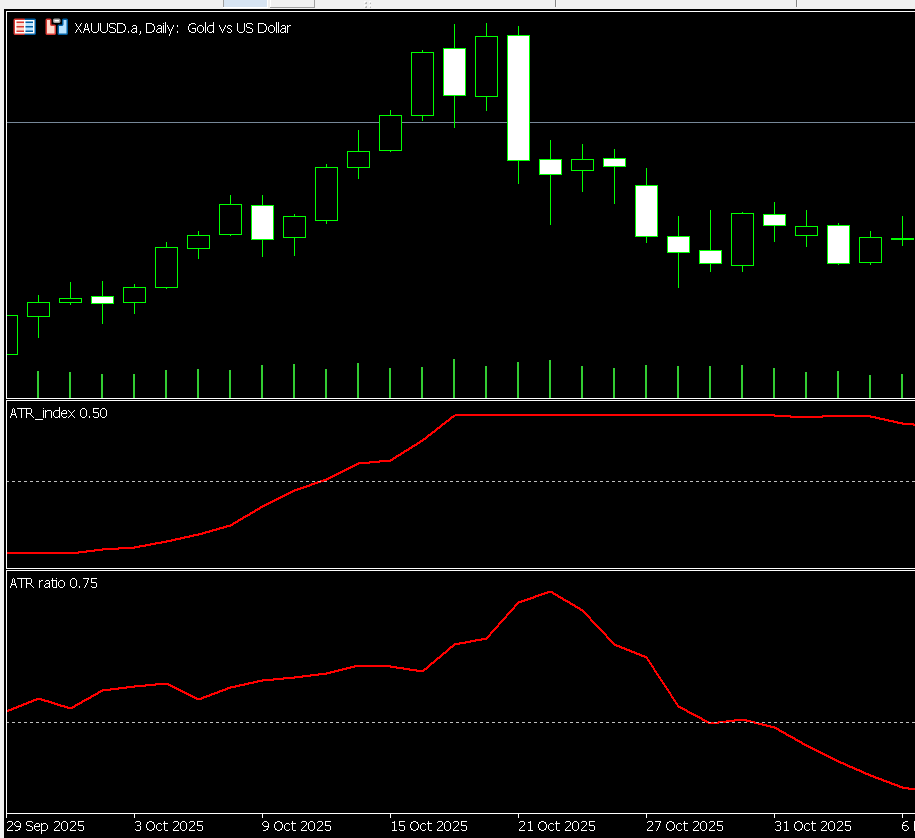

Starting to become a much bigger fan of comparing values at [1] to values at [2] - and using that as a filter for my trades. If ATR of Wednesday > ATR of Tuesday implies : Volatility was higher👆 yesterday compared to the day before = good conditions for a breakout trade. The…

![SystematicEdge1's tweet image. Starting to become a much bigger fan of comparing values at [1] to values at [2] - and using that as a filter for my trades.

If ATR of Wednesday > ATR of Tuesday implies :

Volatility was higher👆 yesterday compared to the day before = good conditions for a breakout trade.

The…](https://pbs.twimg.com/media/G-i9afRaoAAErbn.png)

![SystematicEdge1's tweet image. Starting to become a much bigger fan of comparing values at [1] to values at [2] - and using that as a filter for my trades.

If ATR of Wednesday > ATR of Tuesday implies :

Volatility was higher👆 yesterday compared to the day before = good conditions for a breakout trade.

The…](https://pbs.twimg.com/media/G-i9uBiakAAHs-a.png)

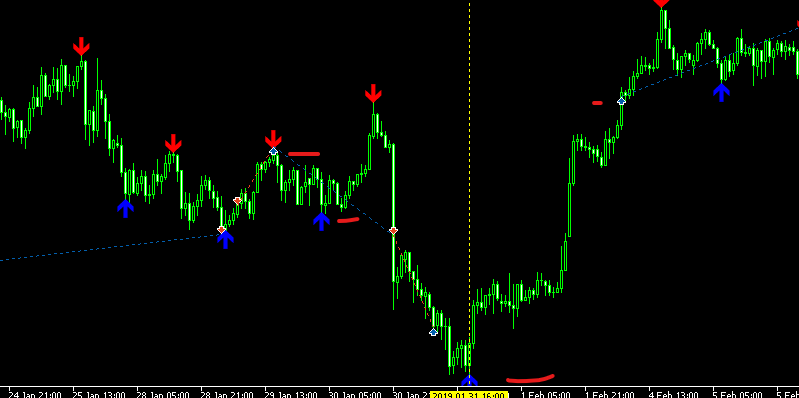

Here's a small entry model I'll be testing a bit more this week ( could work for manual traders too ). **Backtest on USDJPY. Trust me, it does not have this exact performance on every single pair 1.Identify most recent swing highs and swing lows ( however you want, you can use…

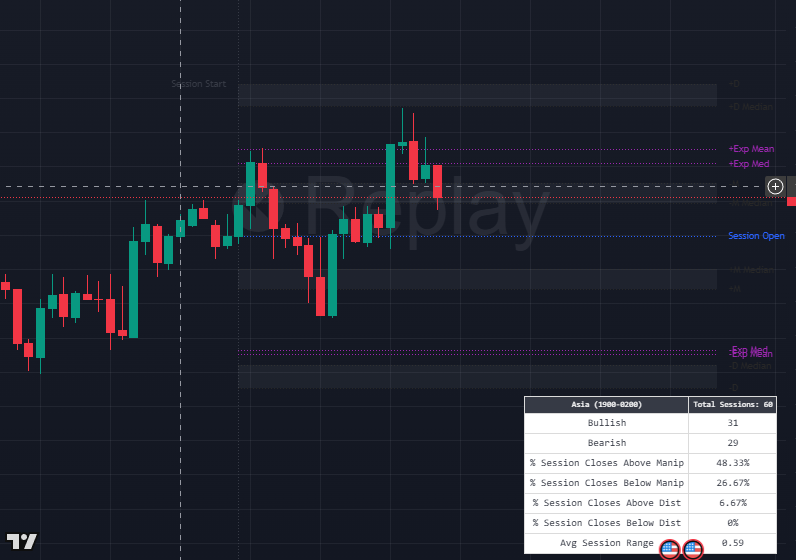

Lots of my recent research inspiration has been coming from X and especially trading view nowadays. One in particular I've been exploring is @notprofgreen Session Map Indicator on TV ( not a plug lol ). Just genuinely an interesting statistical based indicator ( it shows an…

Now that coding has become 10x easier, one thing I've been actively focusing is increasing speed of optimizations / reducing work of optims. An easy way to go about this is have the actual trading symbol itself as an input optimizable in MQL5. Sure you can run optimizations on…

How to improve backtest speeds in MQL5 by atleast 2x? 👇👇👇 ( Literally just ask claude code lol ) Wasn't too keen on using AI tools on developing code/EA , but honestly they have been an absolute game changer to my development process. 1. Can test/re-iterate much quicker ->…

November was a pretty awesome month from a payouts perspective - around 16k USD in payouts. Dec has been much much slower though, haven't had as much time to actually trade these accounts because I'm actually travelling too lmao. Trading and travelling is actually a pretty…

Lesson of the day : MT5 does not include commission costs automatically into custom loaded symbols ( e.g. data from Dukascopy or otherwise ). You gotta add it in yourself, and I gotta say it really exposed how much commissions ate into my algo performances. Needless to say will…

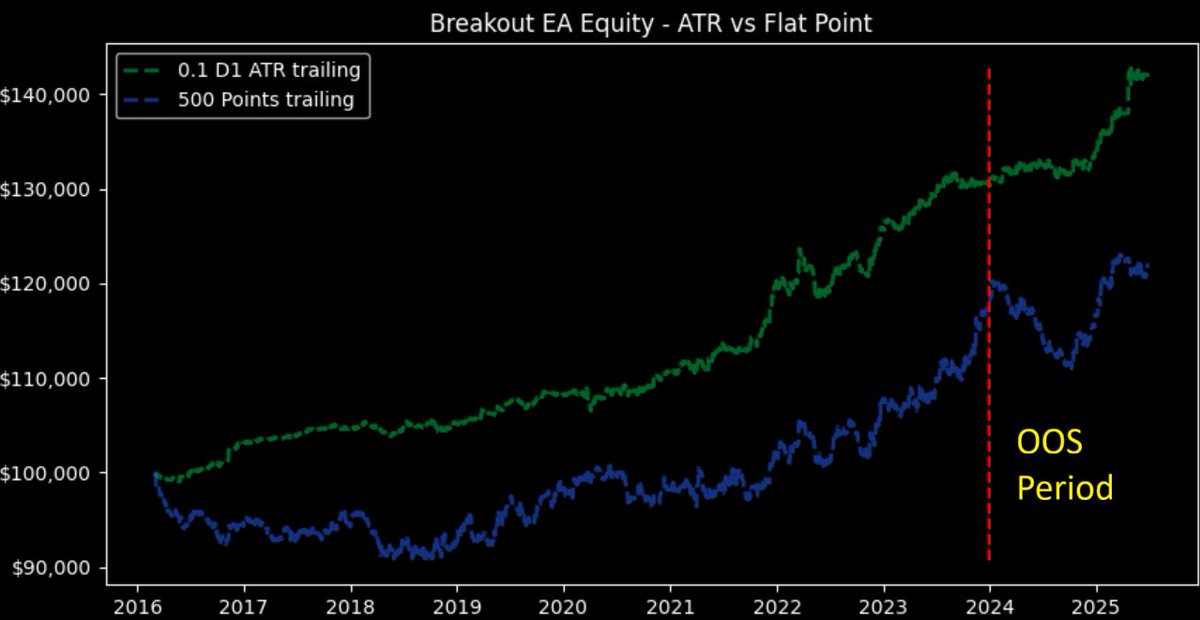

Been working on two separate filters to try and better identify good breakout trades. Main idea being tested is -> increasing ATR = price more likely to break out. To make it asset-agnostic, two ways I'll be testing this is : 1. If shorter period ATR > longer period ATR, then…

Backtesting ideas manually is exhausting, and seeing failed idea after failed idea is very demotivating. Algo-trading though? Lets you iterate faster Easier to understand how much you expect to lose ( or gain) Really a no brainer imo.

Think in Distributions, Not Trades A system is not a single trade. It’s a distribution of outcomes stretched over time. If one loss can break your belief, you didn’t understand the distribution.

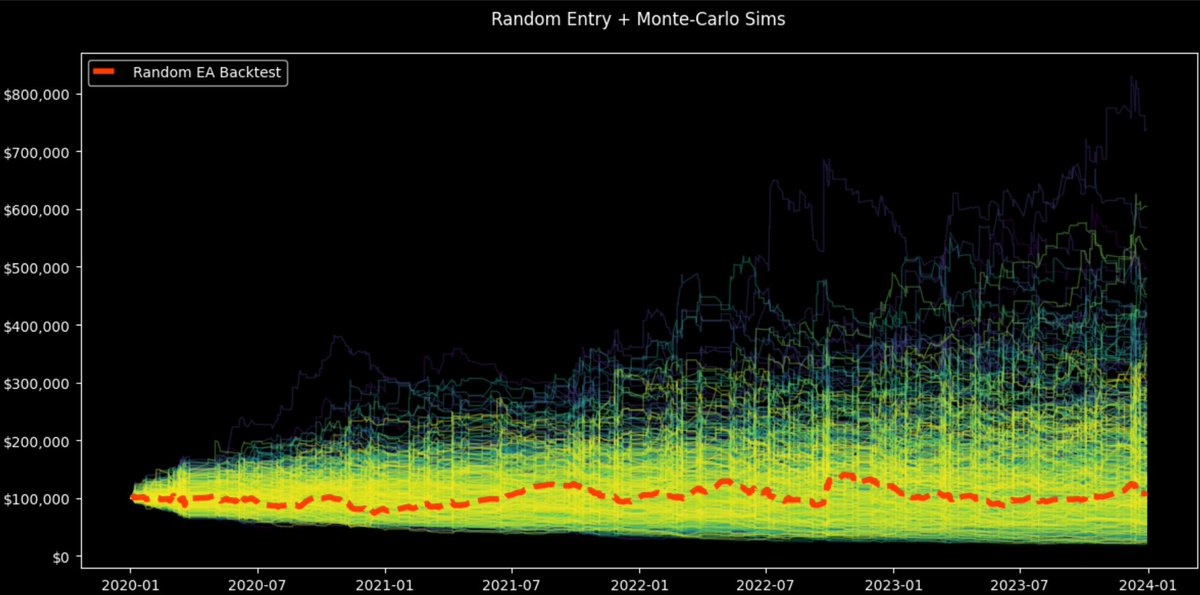

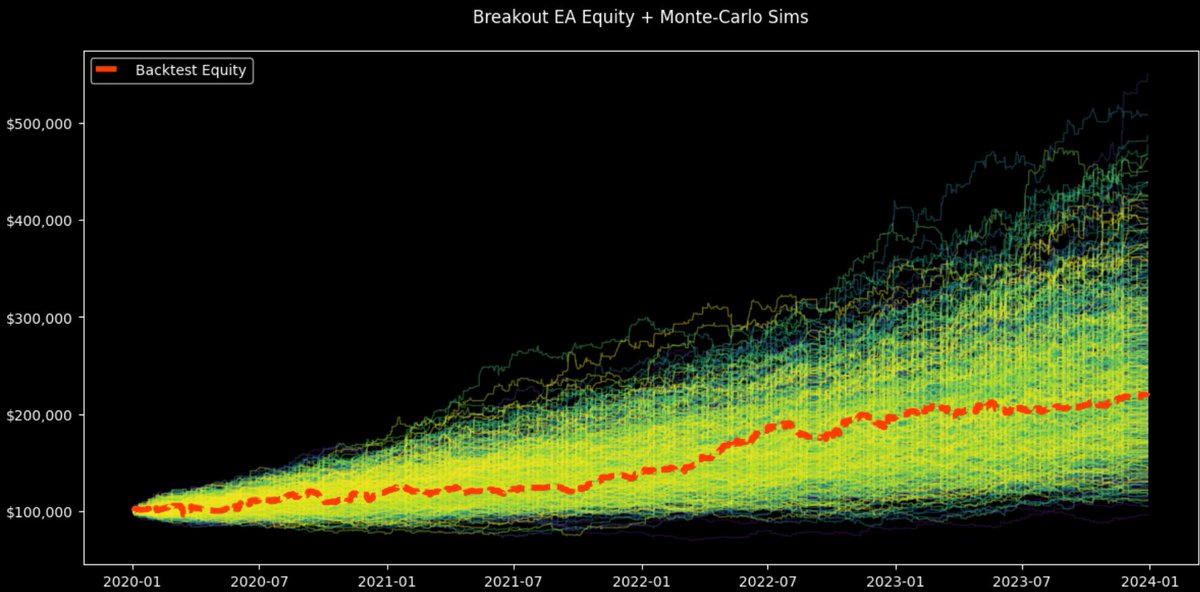

One back-test doesn't tell us nearly enough information about whether a strategy is consistently profitable. Thousands of back tests? Now that gives a bit more confidence. Been playing with Monte Carlo simulations of algo returns and I think I was able understand more about:…

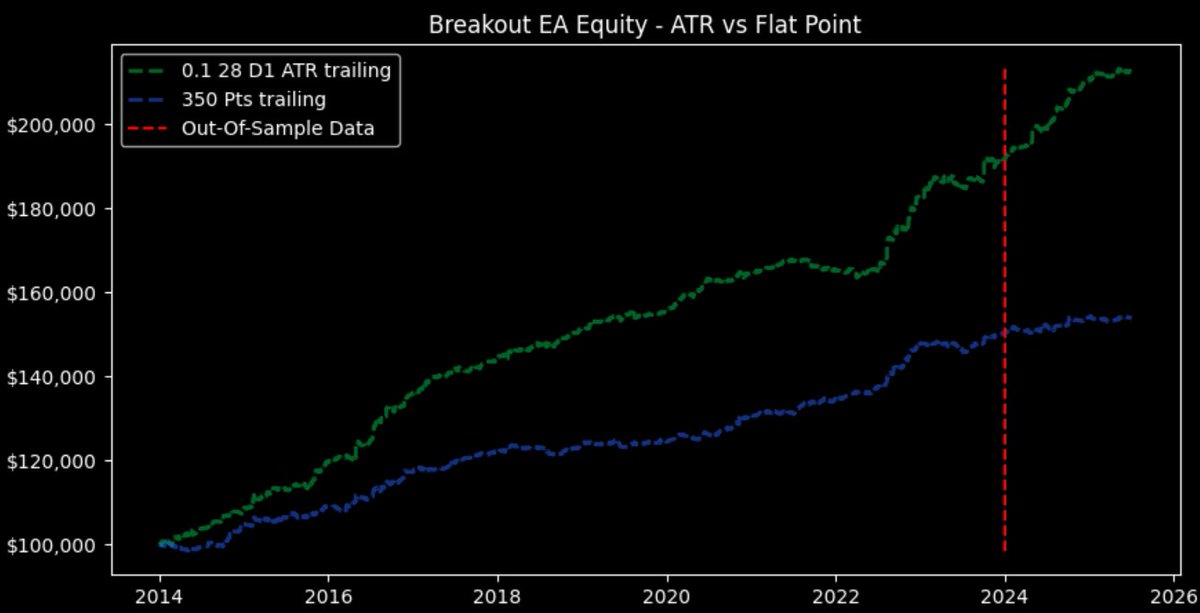

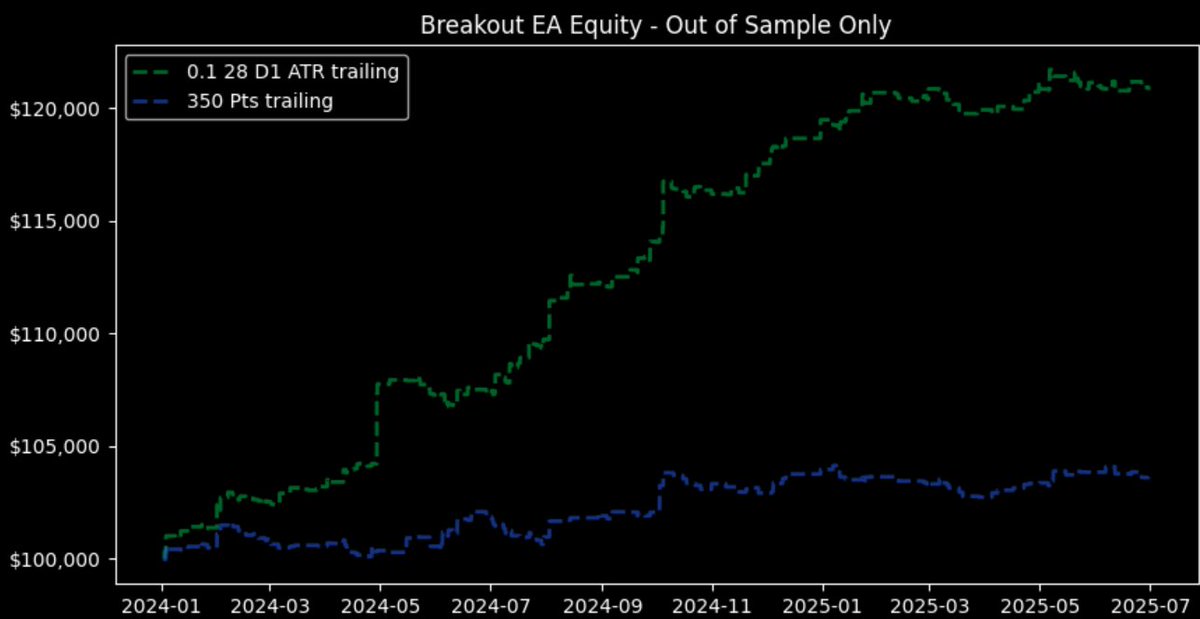

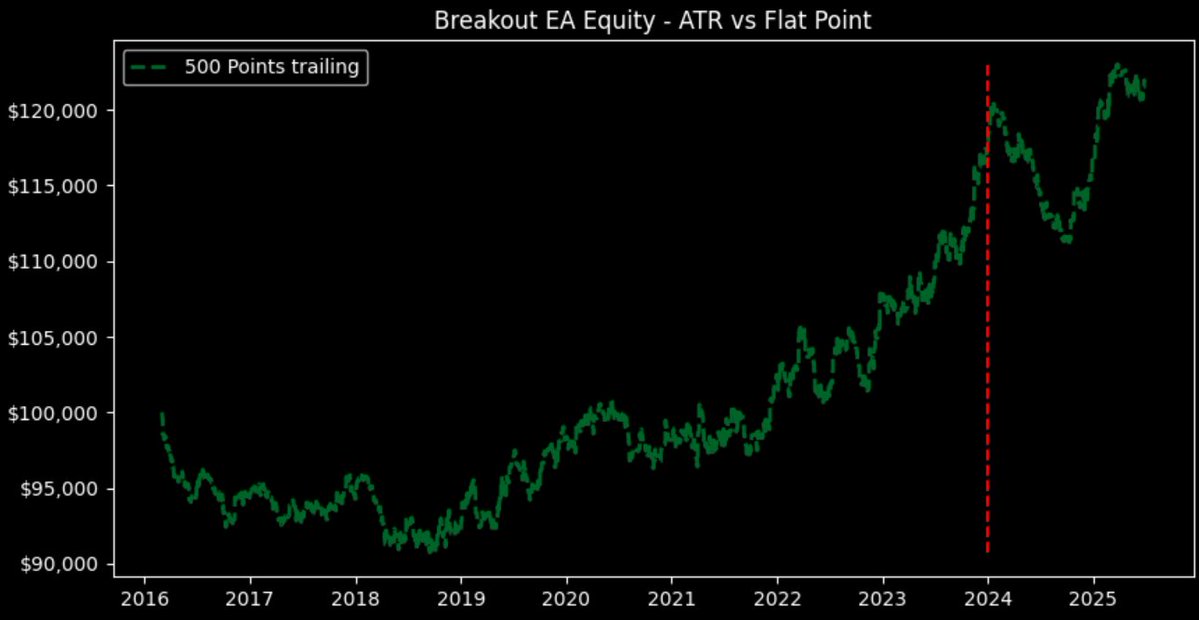

How I increased my algo RR by 30% in Out-Of-Sample data by one update to the exit condition 👇 My current algos use a flat point trailing SL which I thought was ideal ( since it was also easier to code lol ). However, I've recently been optimizing my algos with a trailing SL…

Reasons like this are why I share my work on X. It's easy to forgot common ideas/ or things that seem obvious when you work alone. Been smashed with work recently but wanted to make an update. I've actually been performing optimizations on my EA using US100 and kept wondering…

Very interesting, great analysis. Can clearly see that the trail outperforms. Now have you done comparisons of the different types of trails? As an example ATR trail vs EMA trail vs Heiken Ashi candle trail. Those are the most common im quite sure.

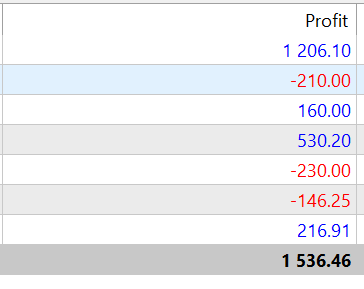

Some wins for this week :)). 1. 2nd payout of this month coming from @QtFunded . Cheers to the team @AlexQuantTekel for processing this so quick, just waiting for the funds to hit and it will be happy days! 2. I've been running my system on an FTMO 100k eval. Only up 1.5% this…

United States Trends

- 1. Joe Brady N/A

- 2. Daboll N/A

- 3. Babich N/A

- 4. Holocaust N/A

- 5. Custom N/A

- 6. Cam Ward N/A

- 7. #DaredevilBornAgain N/A

- 8. Aaron Judge N/A

- 9. Doomsday Clock N/A

- 10. Philip Glass N/A

- 11. Jessica Jones N/A

- 12. Jimmy Kimmel N/A

- 13. Jarritos N/A

- 14. Taxation N/A

- 15. Megyn N/A

- 16. $UNH N/A

- 17. Juan Crow N/A

- 18. MLB The Show 26 N/A

- 19. #ValentinoSpeculaMundi N/A

- 20. Raiders HC N/A

Something went wrong.

Something went wrong.