TC

@TCpolevaulter

Crypto Option plays, not too bad at picking where the market won’t go!

Was dir gefallen könnte

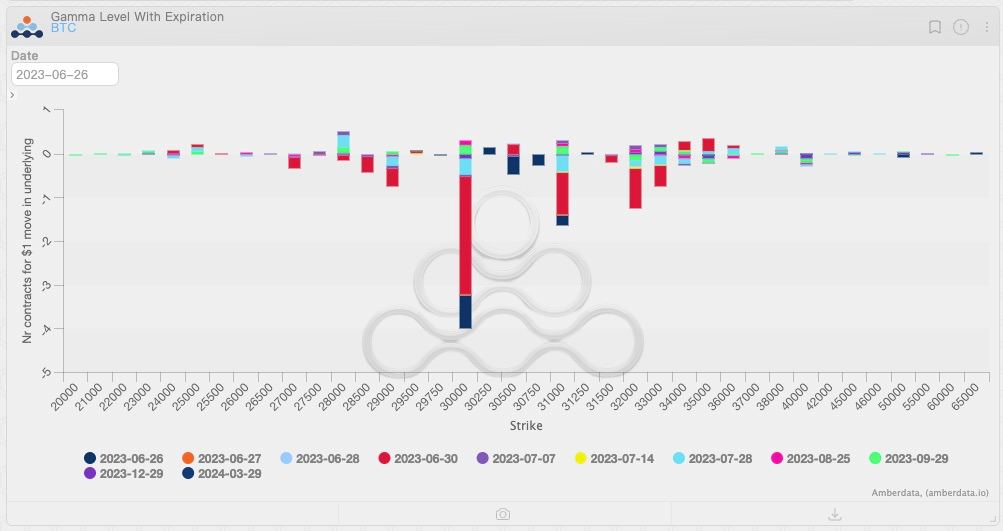

🎇 Fireworks incoming? 150,633 BTC options contracts worth $4.57 billion & $1.23 million ETH contracts valued at $2.3 billion will expire on @DeribitExchange. The bitcoin contracts due for settlement account for 43% of the total open interest. Read more: coindesk.com/markets/2023/0…

I just published Discover Your Options Trading Persona — What Type Are You? medium.com/p/discover-you…

I just published From Lego Bricks to Option Ticks: Constructing Success in Financial Markets link.medium.com/k3nBzyBUFAb

link.medium.com

From Lego Bricks to Option Ticks: Constructing Success in Financial Markets

Unleashing the Builder Within: How my childhood Lego creations led me to understand and succeed in the complex world of options…

When you think the crypto contagion won’t affect you.

Super excited to partner with @Ledger!

Ledger joins forces with @FTX_Official to bring you the best & most secure trading experience! 🔄 You can now swap 120+ crypto assets with FTX through Ledger Live. 🔐 Swap more coins, with lower fees, while retaining self-custody of your assets! 🔗 bit.ly/3yEreDT

If BTC/crypto options had been more readily available (esp in the US) going into this cycle, could we have avoided the current credit crisis? Would firms (e.g. lenders) have bought puts as insurance? Generated more stable yield through covered calls? Or just speculated more?

United States Trends

- 1. #hazbinhotelseason2 63.4K posts

- 2. Good Wednesday 21.2K posts

- 3. Peggy 20.4K posts

- 4. LeBron 88.8K posts

- 5. #hazbinhotelspoilers 4,290 posts

- 6. #InternationalMensDay 27.2K posts

- 7. #DWTS 54.9K posts

- 8. Dearborn 251K posts

- 9. Baxter 2,473 posts

- 10. Kwara 187K posts

- 11. #HazbinHotelVox 19.7K posts

- 12. Patrick Stump N/A

- 13. Whitney 16.6K posts

- 14. Grayson 7,246 posts

- 15. Tinubu 156K posts

- 16. Orioles 7,466 posts

- 17. Cory Mills 10.7K posts

- 18. Ward 27K posts

- 19. MC - 13 1,135 posts

- 20. Sewing 5,253 posts

Was dir gefallen könnte

-

Chris Willette

Chris Willette

@cj3041 -

Tao & Reishi

Tao & Reishi

@KahloCrypto -

k g

k g

@KeGemer -

Jonathan Clay

Jonathan Clay

@jonwclay88 -

BhAaD

BhAaD

@BhAaDEdGE -

Some guy

Some guy

@randombtc00 -

Rex Manning

Rex Manning

@ItsRexManning -

InquizitiveOne

InquizitiveOne

@InquizitiveOne -

rv_m

rv_m

@Veronica090922 -

Igor M.

Igor M.

@misconixxx -

0xxEthereum

0xxEthereum

@0xxEthereum -

Krish Gosai | Web3 Lawyer

Krish Gosai | Web3 Lawyer

@kcgosai -

Dasu

Dasu

@dasu4321 -

CJ

CJ

@Costness -

Ron G

Ron G

@RonGroom

Something went wrong.

Something went wrong.