Preston Pysh

@PrestonPysh

Bitcoin & Books. Cofounder of TIP. GP @egodeathcapital. Advisor at @primal_app and @debificom. I buy Bitcoin at @River. Nostr: http://primal.net/preston

You might like

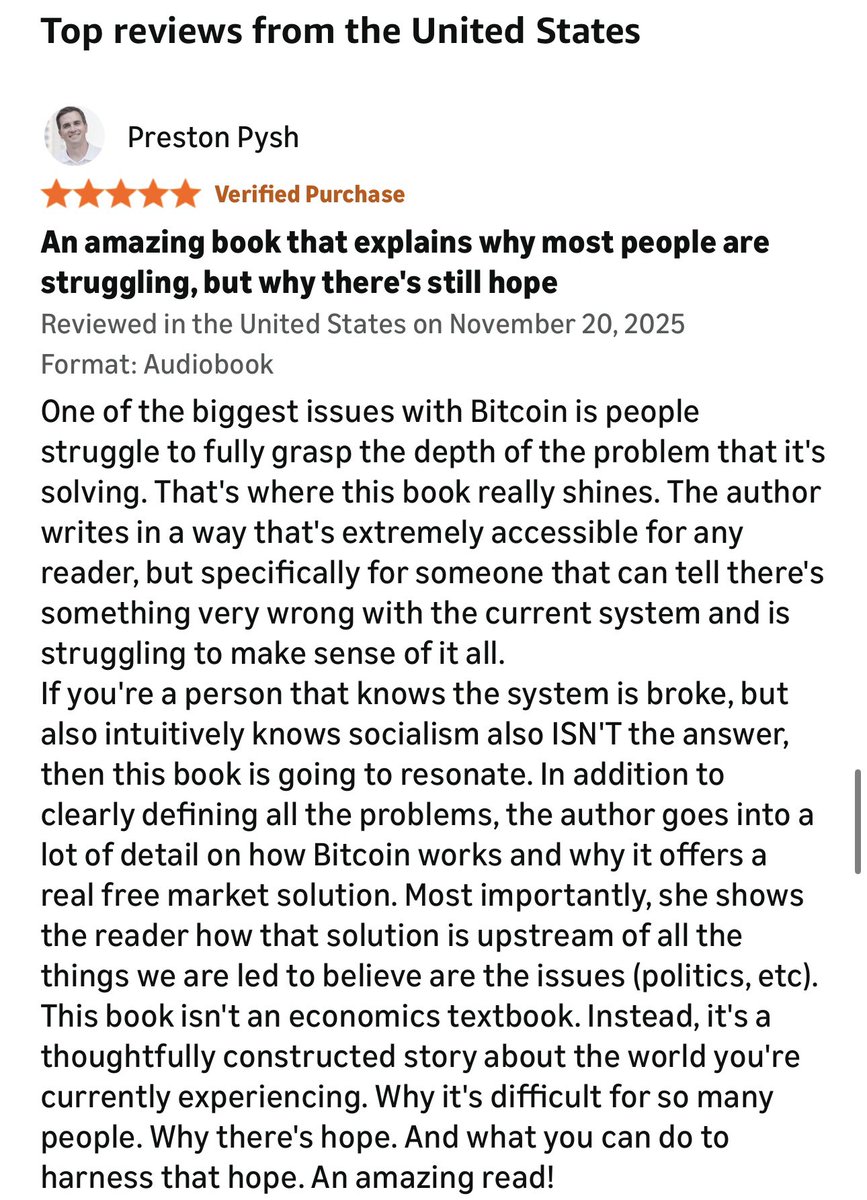

Today, @PrestonPysh and @natbrunell discuss her book Bitcoin is for Everyone, a concise, accessible guide to Bitcoin’s relevance in today’s world. They explore Natalie’s personal immigrant story, the financial wake-up call of 2008, and how Bitcoin offers hope amid systemic…

youtube.com

YouTube

Bitcoin is for Everyone w/ Natalie Brunell (BTC255)

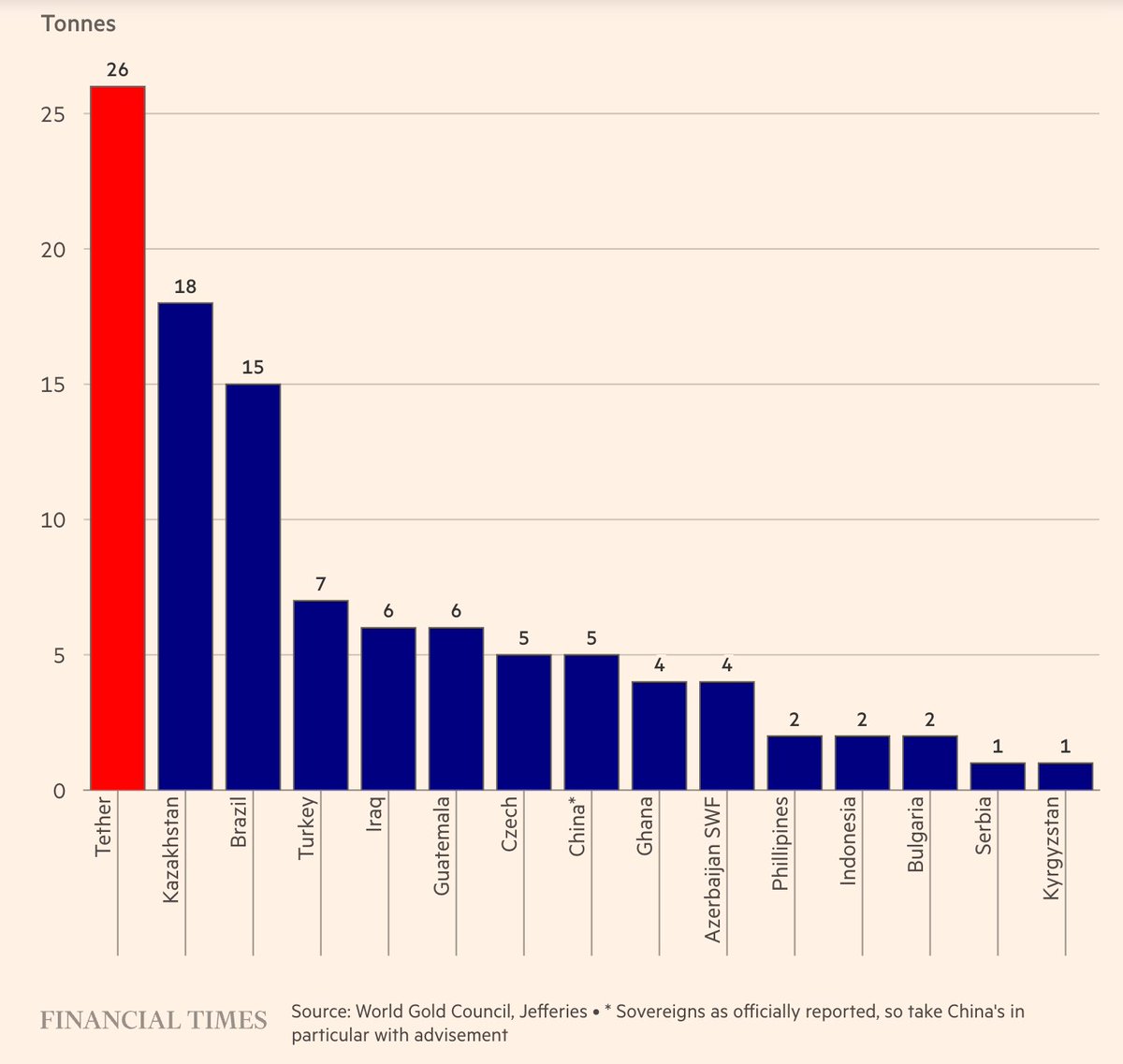

Tether bought more gold last quarter than every central bank.

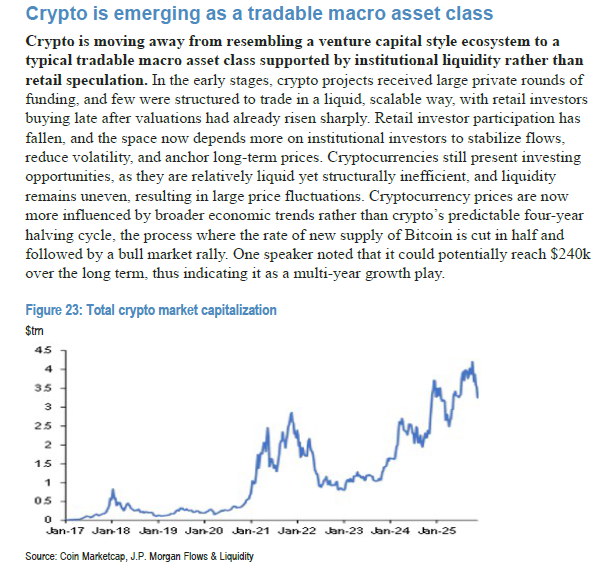

JPM: "Crypto is moving away from resembling a venture capital style ecosystem to a typical tradable macro asset class supported by institutional liquidity rather than retail speculation... One speaker noted that it could potentially reach $240k over the long term, thus indicating…

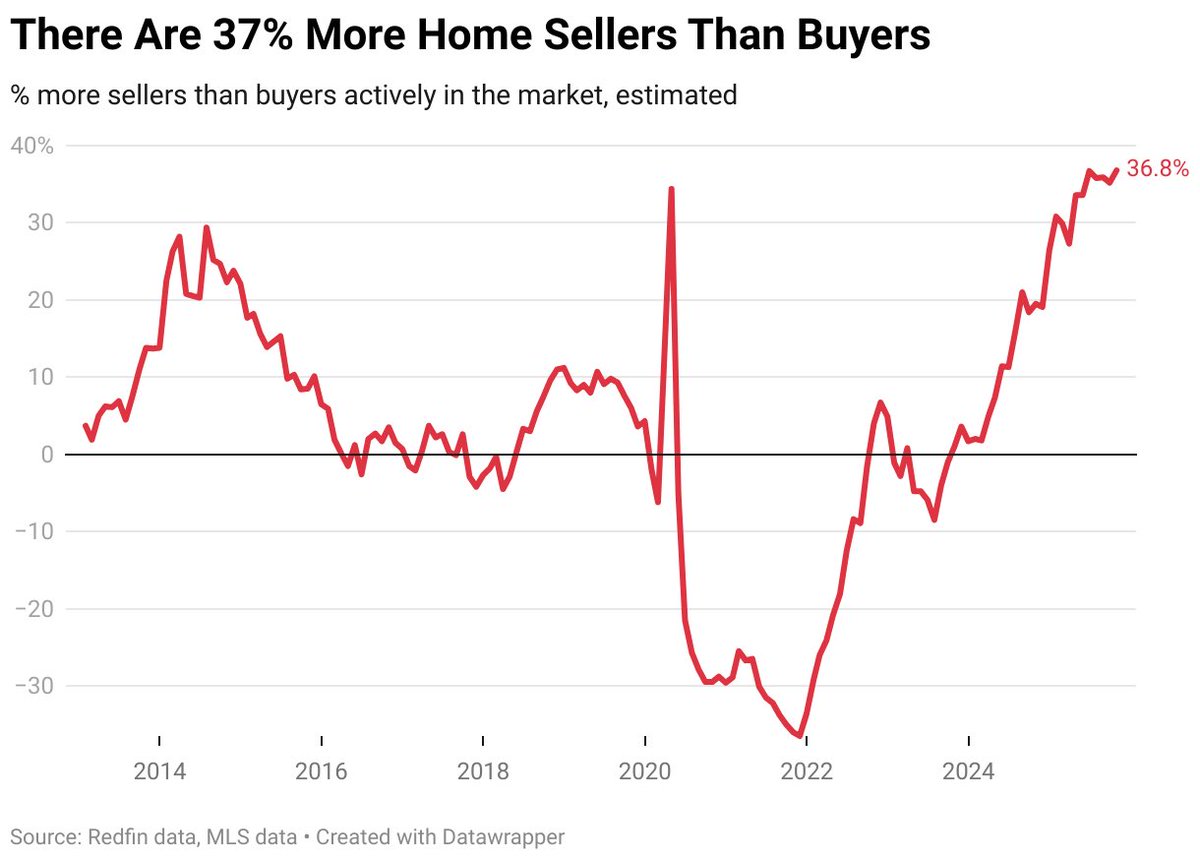

Per @Redfin, October saw an estimated 36.8% more home sellers than buyers, biggest gap in records dating back to 2013

The Baltic Honeybadger 2025 recap is here 🦡 🇱🇻 Eight years ago today — November 25 — we kicked off Baltic Honeybadger 2017, a Bitcoin-only gathering that sparked its own kind of fire 🔥 Since then? It’s been a wild journey, shaped by everyone who showed up, spoke up, and kept…

Tom Lee: Insufficient Crypto Liquidity Forces Institutional Hedging Flows Into Strategy In a CNBC interview on November 21, the host highlighted Strategy's 50% decline over the past three months and its 65% drop from the July peak, questioning how closely its selloff is tied to…

It’s like the opening to Spaceballs

ELON MUSK: IF YOUR JOB INVOLVES MOVING ATOMS, YOU’RE SAFE. IF IT INVOLVES MOVING DIGITS, AI IS TAKING OVER LIKE LIGHTNING "AI is really still digital. Ultimately, AI can improve the productivity of humans who do things with their hands Literally welding, electrical work,…

Operation Chokepoint 2.0 regrettably lives on. Policies like JP Morgan’s undermine confidence in traditional banks and send the digital asset industry overseas. It’s past time we put Operation Chokepoint 2.0 to rest to make America the digital asset capital of the world.

What an honor to read this review of Bitcoin is for Everyone from @PrestonPysh 🧡 Thank you so much! 🥹

Absolute insanity: Nvidia, $NVDA, has gained $450 billion AND lost -$600 billion over the last 54 hours. That's a swing of over $1 trillion of market cap, or $19 billion PER HOUR for the last 54 hours straight. These are not "fundamental" price moves. This is sentiment based.

First, let's put $550 billion/week in perspective. In 2013, we rolled $100 billion per week. That's a 450% increase in just over a decade. Why? Because foreign central banks stopped buying our long-term debt after 2022.

Loved this interview with @LukeGromen, hosted by @PrestonPysh. youtu.be/RA2cvfdwy0I?si…

youtube.com

YouTube

Bitcoin & Macro Overview Q4 2025 w/ Luke Gromen (BTC254)

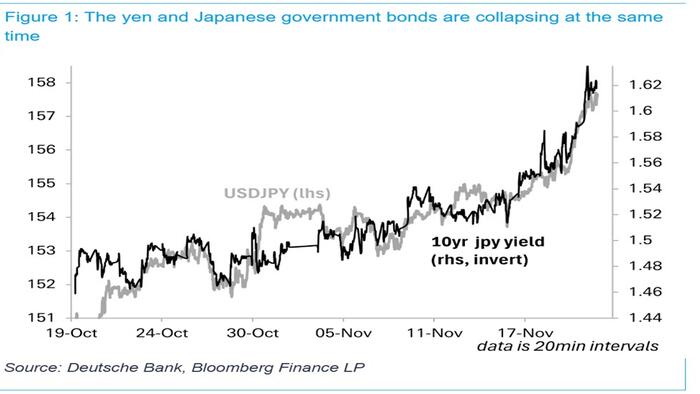

All Hell Breaks Loose In Japan As Yen, Bonds Crash Ahead Of Gigantic, Debt-Busting Stimulus zerohedge.com/markets/all-he…

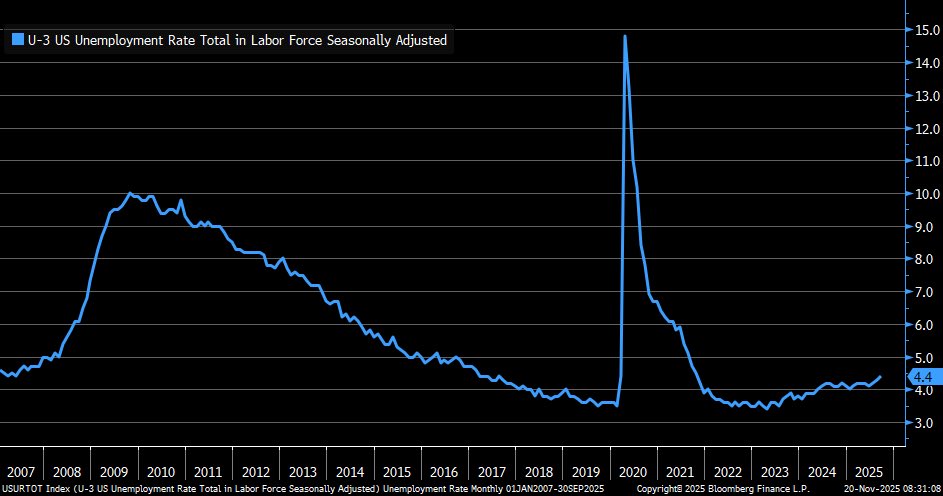

September unemployment rate at +4.4% vs. +4.3% est. & +4.3% in prior month

GAAP useful life is an estimate but the market is giving us the real number in practice A100s are 6 years old and still running at full utilization with rising var margins. If an asset keeps printing cash & demand is supply-gated, its “useful life” isn’t shrinking it’s extending

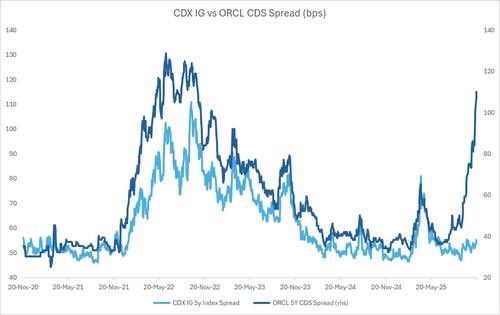

Credit traders are far less optimistic than stock analysts when it comes to Nvidia's figures. The price of hedging against an Oracle default (CDS price) has risen even further.

BREAKING: The odds of the Fed NOT cutting rates in December surge to 68% after the US Labor Department cancels the October jobs report, per Polymarket.

BREAKING: The US Labor Department announces that it is CANCELLING the October jobs report. For the first time since 2013, we will not be receiving a monthly jobs report.

Thanks for having me back on @TIP_Network, @PrestonPysh! Enjoyed another lively discussion.

Today, @LukeGromen and @PrestonPysh delve into America’s financial fragility, exploring Treasury funding risks, shifting global power dynamics, and challenges for Fed policy. They discuss the rising relevance of Bitcoin and gold amid liquidity constraints, and how economic…

United States Trends

- 1. #lip_bomb_RESCENE N/A

- 2. #River 3,731 posts

- 3. Ravens 58.7K posts

- 4. #heatedrivalry 16.1K posts

- 5. Lamar 46.5K posts

- 6. ilya 17.5K posts

- 7. Shane 20.9K posts

- 8. Joe Burrow 21.2K posts

- 9. Hudson 11.9K posts

- 10. Connor 15.2K posts

- 11. #WhoDey 4,218 posts

- 12. BNB Chain 8,067 posts

- 13. Zay Flowers 4,209 posts

- 14. #hrspoilers 3,624 posts

- 15. Sarah Beckstrom 225K posts

- 16. scott hunter N/A

- 17. Third World Countries 28.4K posts

- 18. Derrick Henry 4,491 posts

- 19. AFC North 2,368 posts

- 20. Harbaugh 3,215 posts

You might like

-

Jack Mallers

Jack Mallers

@jackmallers -

Willy Woo

Willy Woo

@woonomic -

Robert ₿reedlove

Robert ₿reedlove

@Breedlove22 -

PlanB

PlanB

@100trillionUSD -

Dan Held

Dan Held

@danheld -

Peter McCormack 🏴☠️🇬🇧🇮🇪

Peter McCormack 🏴☠️🇬🇧🇮🇪

@PeterMcCormack -

Documenting ₿itcoin 📄

Documenting ₿itcoin 📄

@DocumentingBTC -

Raoul Pal

Raoul Pal

@RaoulGMI -

Lyn Alden

Lyn Alden

@LynAldenContact -

Marty Bent

Marty Bent

@MartyBent -

Adam Back

Adam Back

@adam3us -

Bitcoin Archive

Bitcoin Archive

@BitcoinArchive -

Saifedean Ammous

Saifedean Ammous

@saifedean -

Michael Saylor

Michael Saylor

@saylor -

Bitcoin is Saving

Bitcoin is Saving

@BitcoinIsSaving

Something went wrong.

Something went wrong.