Timber Point Capital Management

@TPCM17

TPCM is a boutique New York based investment firm providing outsourced investment services, alternative and multi-asset solutions for our clients.

你可能会喜欢

A holiday shortened week but more than a few technology companies set to report with importance for the tech/AI trade including A, DELL, HPE and NTAP - in addition to ADI, WDAY and ZS. Hoping for more Friday follow through as opposed to Thursday selloff. Labor market concerns…

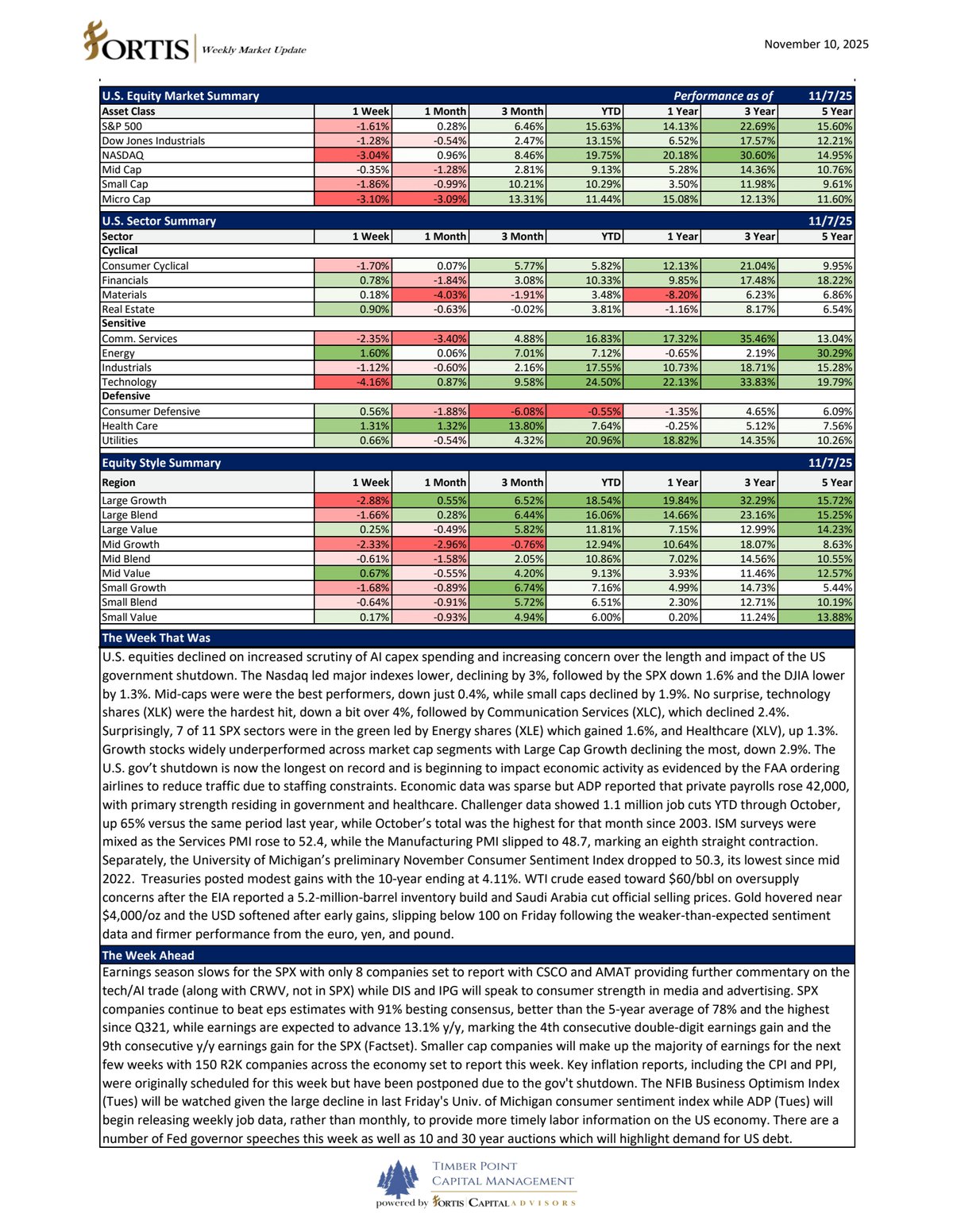

It's all good, the government shutdown is behind and the market is poised to rally into December on seasonals and a reduction in AI-spending fears. We think odds of an additional 25bps rate cut are better than the coin toss currently embedded due to a weak labor market. We remain…

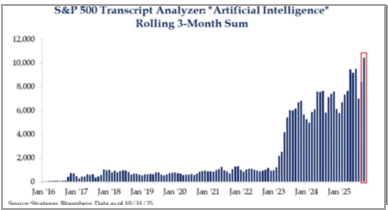

An end to the gov't shutdown is good news after a difficult last week for the Nasdaq, down a bit more than 4%, on concerns over extended valuation and capex spending for AI-related names. Interestingly, 7 of 11 SPX were positive last week reflecting investors desire to broaden…

Private data out this week - including ISM PMI's for manufacturing and services, ADP employment and Challenger Job Cuts - that will shed light on the state of the economy beyond the positive commentary (mostly) coming from EPS releases. We look forward to parsing these reports as…

Fed rate cuts have failed to lower longer term yields or spark a turn in the housing market despite the Administration's ardent wishes. Meantime, regional Fed activity is less than encouraging with downbeat reports out of Dallas, Philly and New York. None of this matters for SPX…

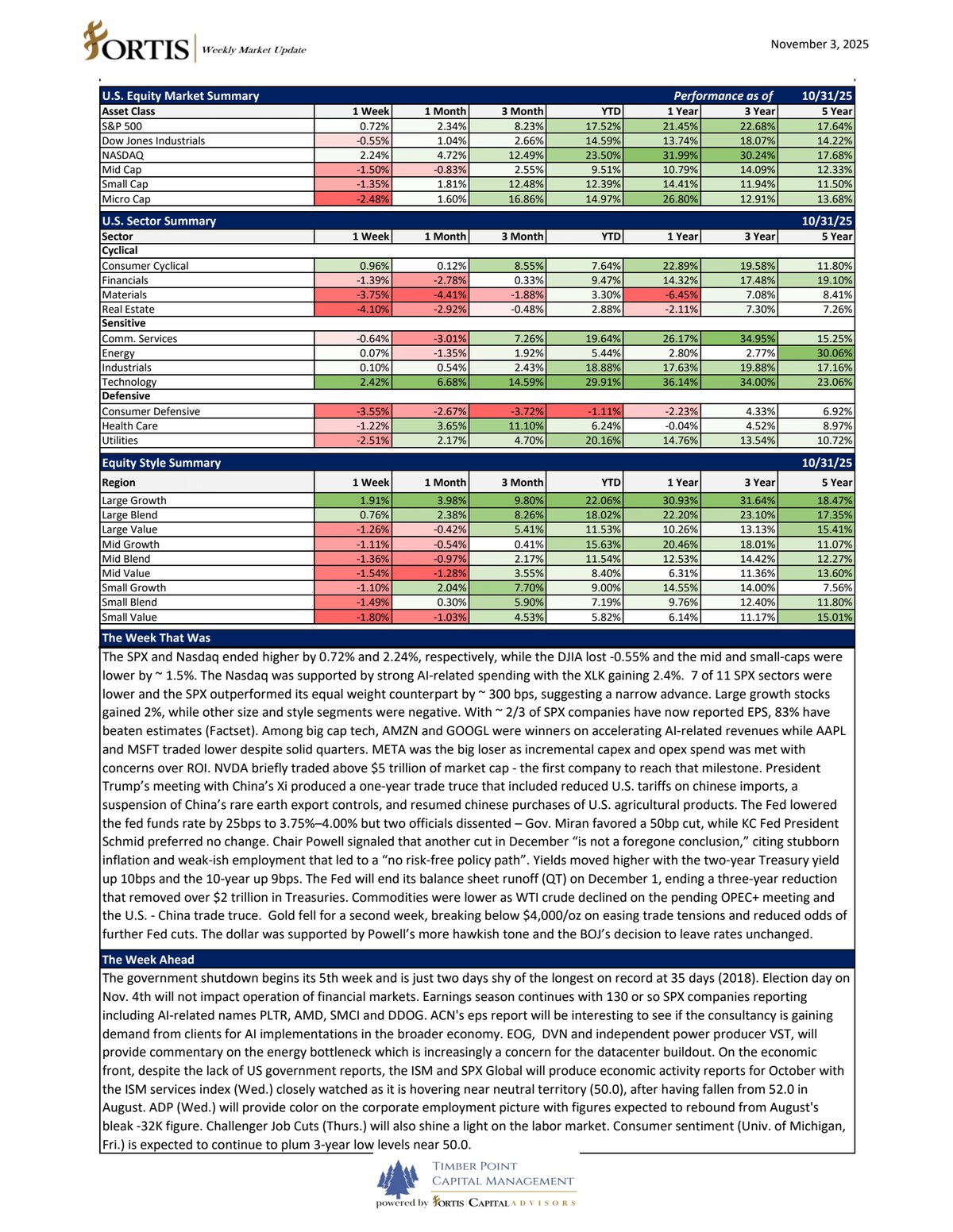

Chair Powell will be front and center on Wed. providing his assessment of the economy that continues to be hampered by a lack of economic data. Nonetheless, investors are expecting a further 25bps fed funds rate cut. Mag 7 companies (META, MSFT and AMZN) report EPS this week…

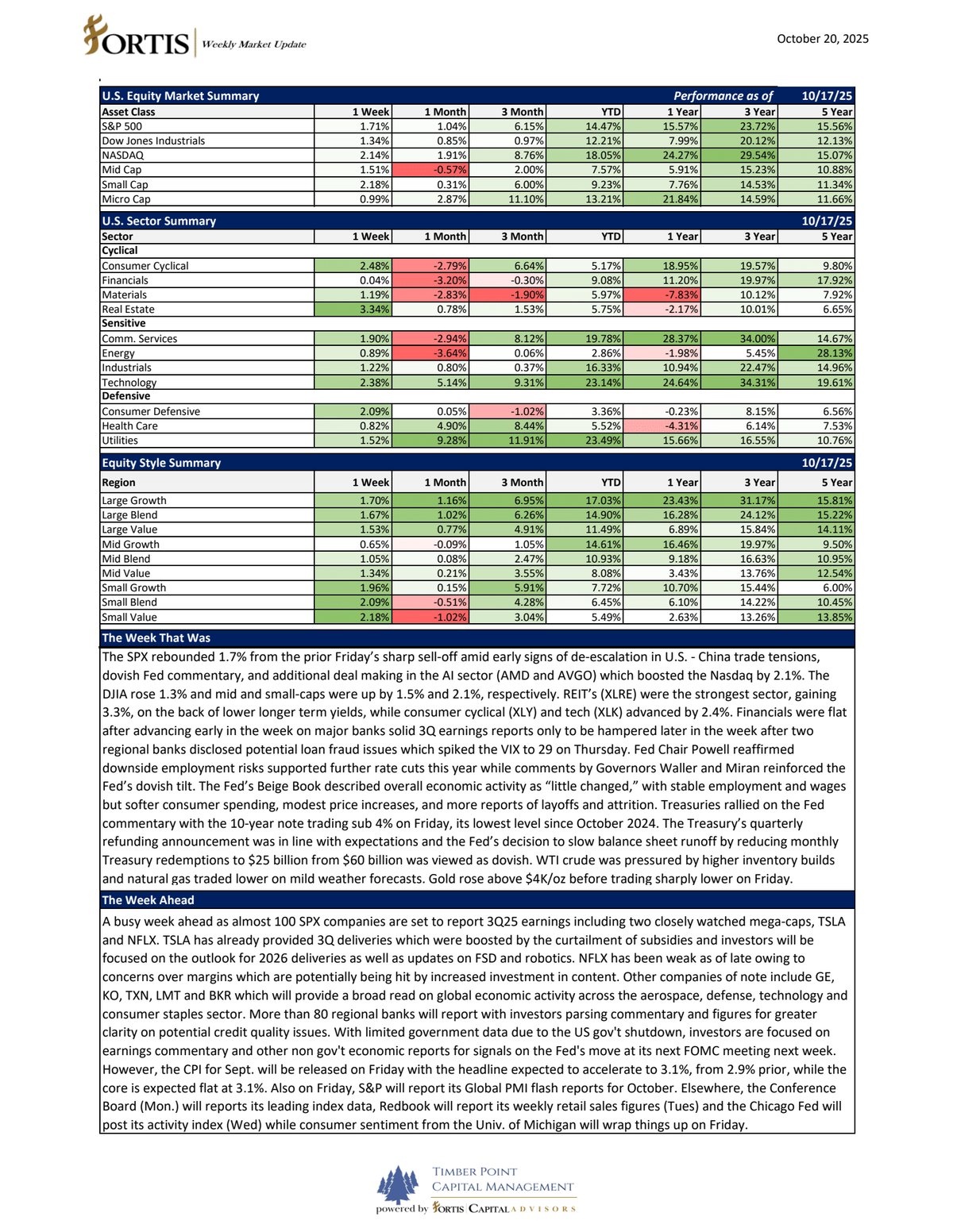

More than 80 regional banks report this week which should provide all the commentary the market needs to decide whether credit quality issues that have surfaced over the past few weeks are "one-off's" or the start of something systemic. We vote for the former given what we heard…

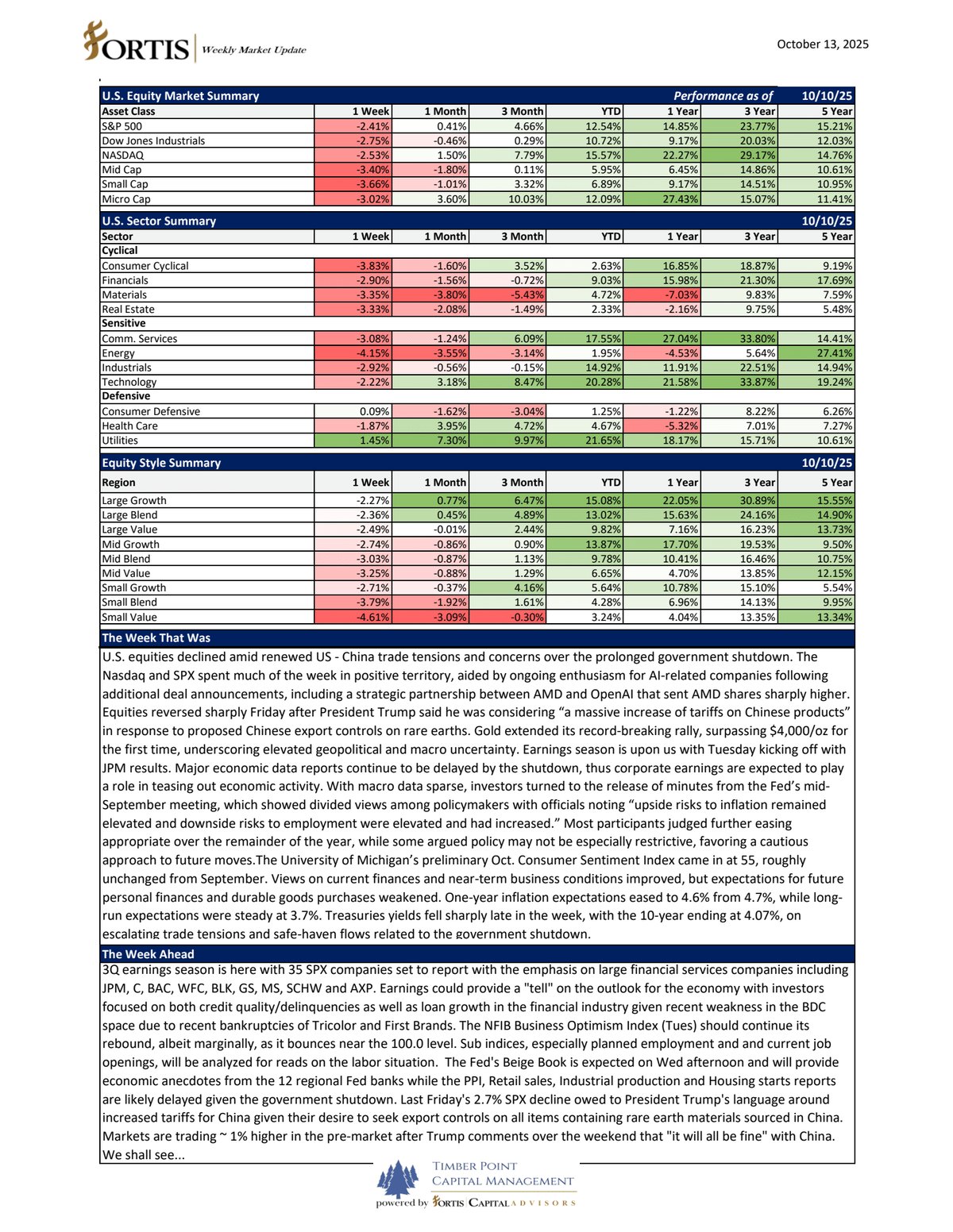

Earnings season is in full swing this week with 35 SPX companies reporting, many being the largest financial services companies, that will comment on credit quality and loan growth as "tells" on the economic outlook given the lack of government data. The Fed's Beige Book on…

Our 4Q25 market outlook opines on the technology trade..."Today’s market is dominated by technology and communication services companies with stronger balance sheets, higher margins, and faster growth profiles. In addition, forward P/E ratios, when measured two years out, look…

Light week for economic data, with or without the government shutdown, so focus turns to Fed-speak and FOMC minutes from last meeting. The Weekly takes a quick look at the rebound in ONTO that looks promising for more upside as well as some interesting price action from NVTS,…

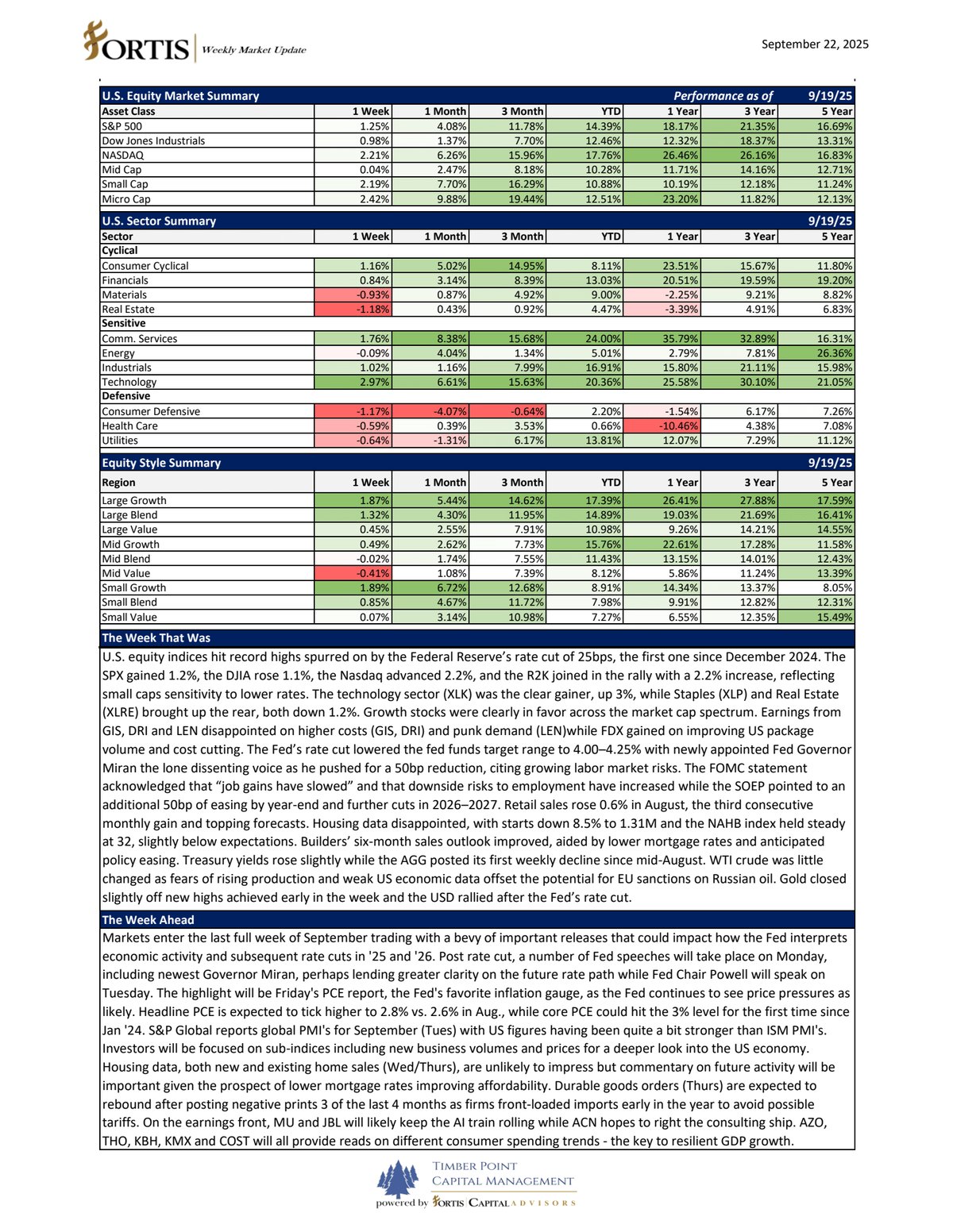

Busy week ahead as lots of "Fed-speak", with eyes, and ears, on new Governor Miran today and Chair Powell tomorrow. PCE report on Friday is highlight of the week, with the core print expected to return to the 3% level for the first time since late '24. The Fed characterizes…

International stocks continue to lead the way but Europe has been lagging since starting 2025 strong. We think the same structural challenges exist and question the durability. Financial conditions are loose as the Fed begins a rate cutting campaign with equity markets at their…

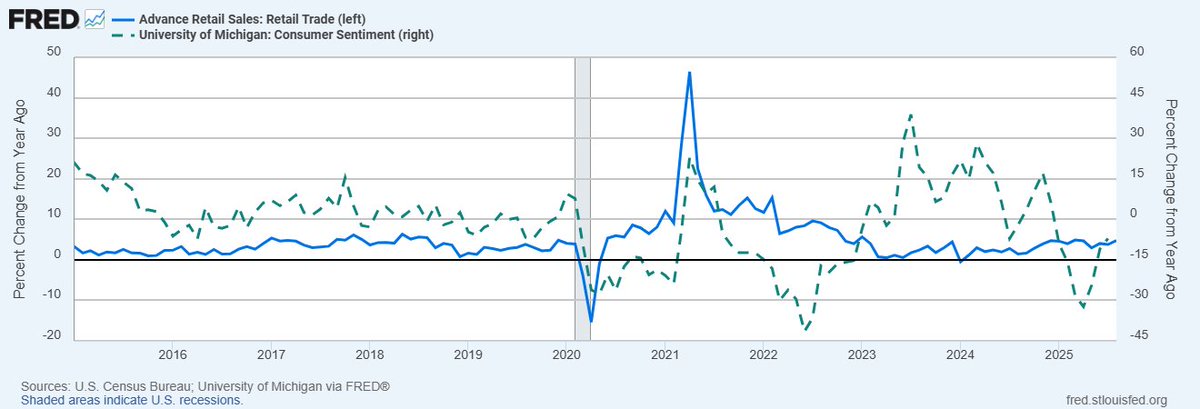

Retail sales surprise to upside and remain surprisingly resilient despite all the cross currents impacting the economy (tariffs, weaker labor market). Univ. of Michigan survey appears to be useless in terms of indicator of consumer purchasing patterns. Watch what consumers are…

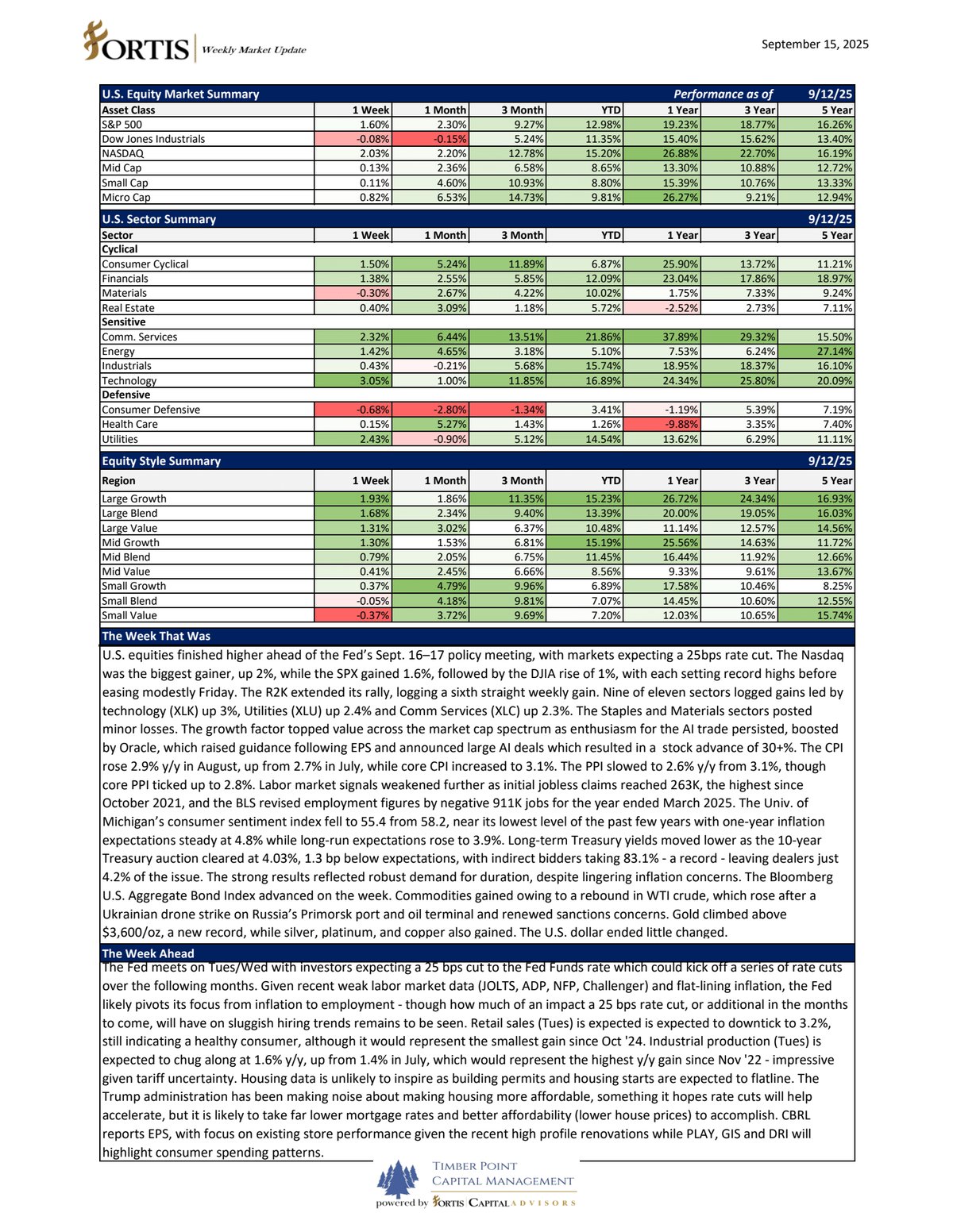

"Don't disappoint us" is the message from investors to FOMC as they meet on Tues/Wed with 94% of investors per CME FedWatch expecting a 25bps rate cut while the balance expect a 50bps cut. Commentary post the meeting will perhaps be most important as investors gauge how many…

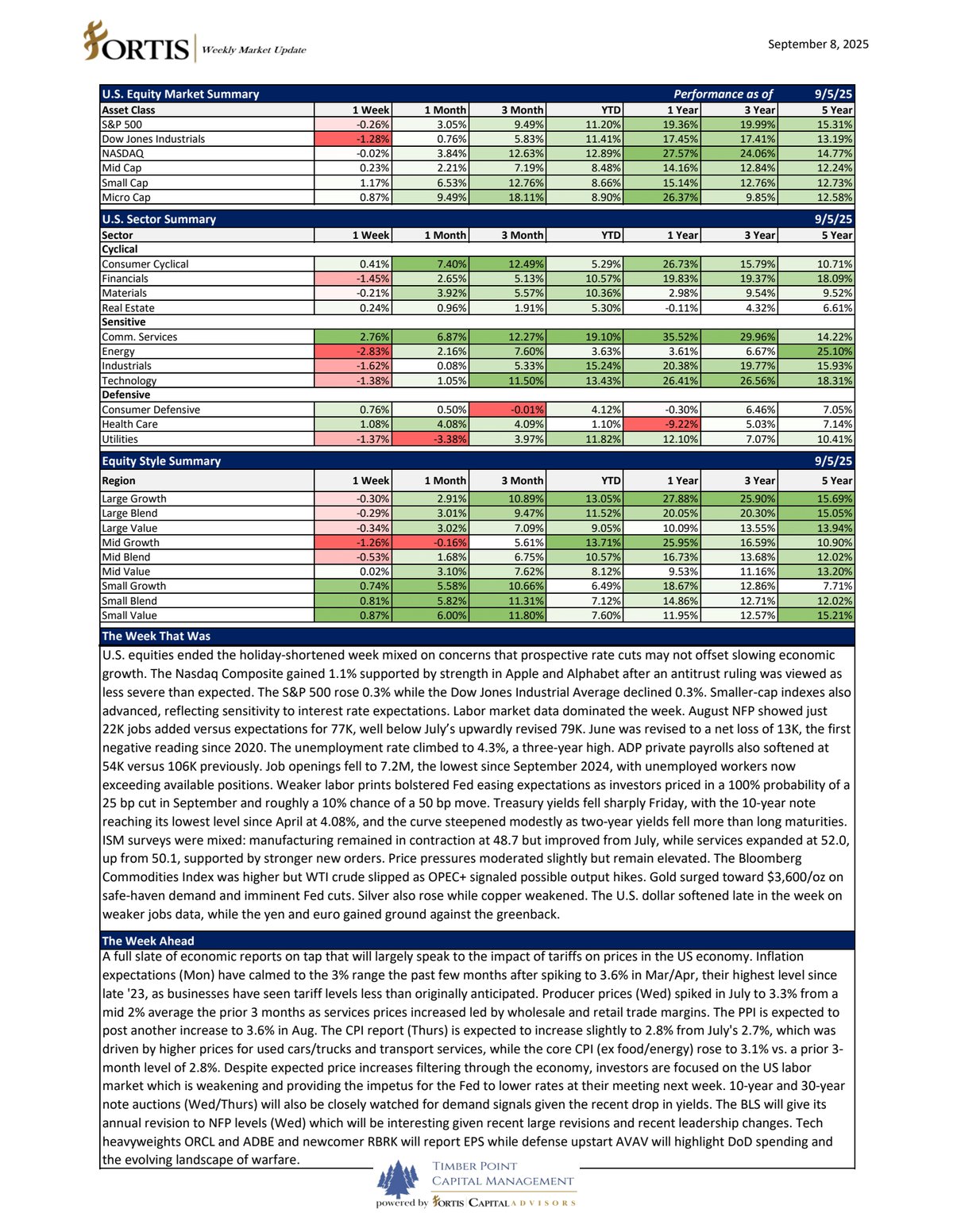

Weak employment data from last week possibly meets stronger inflation data this week so calls for "stagflation" will surface anew. The data doesn't really support meaningfully higher inflation, and both the Atlanta and New York Fed now-casts are still calling for 2.5% - 3% GDP…

Challenger job cuts data for August announced at 85,979 - up 39% m/m and 13% y/y. YTD, job cuts are up 66% vs. YTD '24...yikes. ADP employment also out today and unimpressive at 54K...all eyes on NFP tomorrow as labor market takes center stage ahead of tariff-induced transitory…

Employment data will be the focus of the week with JOLTS, ADP, Challenger and NFP all posting August results. Our Chart of the Week speaks to the strength in BABA while Stocks To Consider include gap ups on volume from AMBA and TRIP along with high volume gainers ESTC and REAX.…

United States 趋势

- 1. Thanksgiving 2.06M posts

- 2. Jack White 5,992 posts

- 3. Packers 40.2K posts

- 4. Dan Campbell 2,504 posts

- 5. #GoPackGo 6,492 posts

- 6. Jordan Love 7,123 posts

- 7. Goff 6,932 posts

- 8. Watson 12.3K posts

- 9. #GBvsDET 3,300 posts

- 10. Thankful 412K posts

- 11. #OnePride 5,873 posts

- 12. Wicks 4,259 posts

- 13. Gibbs 7,293 posts

- 14. Turkey 265K posts

- 15. Jameson Williams 1,754 posts

- 16. Green Bay 6,171 posts

- 17. Tom Kennedy 1,062 posts

- 18. Jamo 3,352 posts

- 19. Amon Ra 2,626 posts

- 20. Seven Nation Army N/A

你可能会喜欢

-

jameswyper

jameswyper

@jameswyper -

Cameron Macgregor

Cameron Macgregor

@ceamac -

John M. Larrier

John M. Larrier

@DefenseBulletin -

Tom Sloan

Tom Sloan

@BratvasRevenge -

DMI

DMI

@DMI_Marketing -

Trent Aric

Trent Aric

@TrentAricTV -

𝗦𝗮𝗹 𝗕𝗮𝘆𝗮𝘁

𝗦𝗮𝗹 𝗕𝗮𝘆𝗮𝘁

@Sal_Bayat -

レトマト33🏴☠️🤎

レトマト33🏴☠️🤎

@BGGzRUMrxSCIGkb -

Bill Simpson

Bill Simpson

@bsimpson45 -

にゃお

にゃお

@naokiroquai -

ESG101

ESG101

@AlmbergDaardi -

Rob (Nvidia goes POP!) C

Rob (Nvidia goes POP!) C

@TheindIznere -

Hastings Athletics

Hastings Athletics

@HoHAthletics -

Indy Steve

Indy Steve

@Stevents51 -

Becca Piano

Becca Piano

@BeccaPiano

Something went wrong.

Something went wrong.