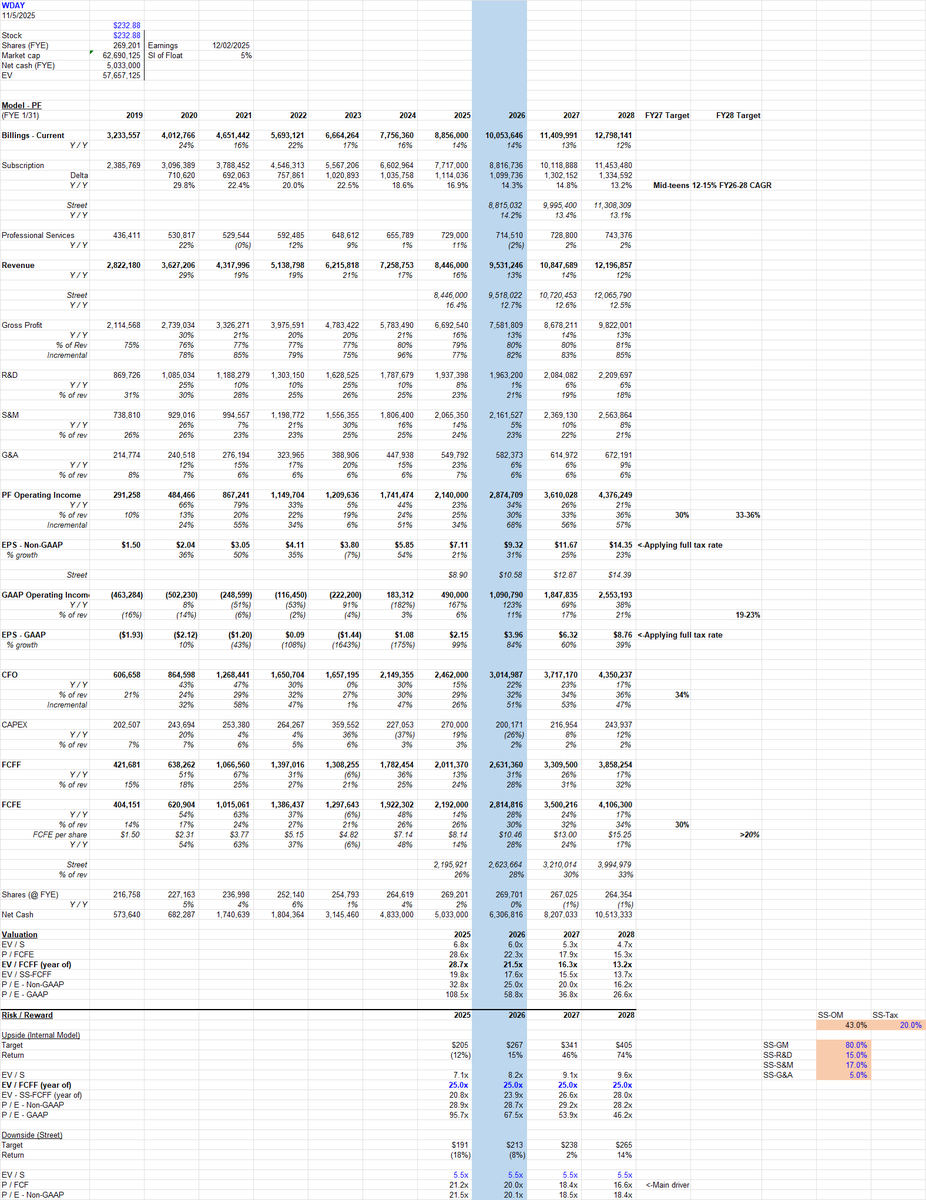

TechStockFundamentals

@TechFundies

Tech investor for ~25 years. Ran large hedge fund for 10 of those. Here to help. Not investment advice.

Vous pourriez aimer

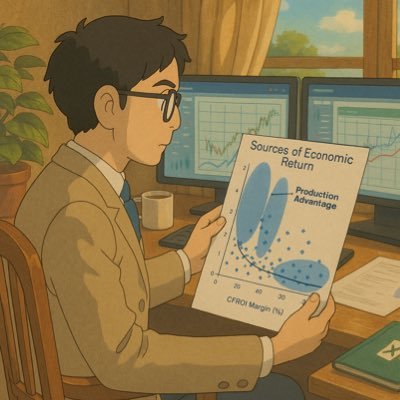

I think there are basically 2 prevailing strategies in the market. 1) Earnings revisions Only two questions matter near-term: Is the story getting better or worse, and are numbers going up or down? That's it. For momentum names, in either direction, that's all that matters…

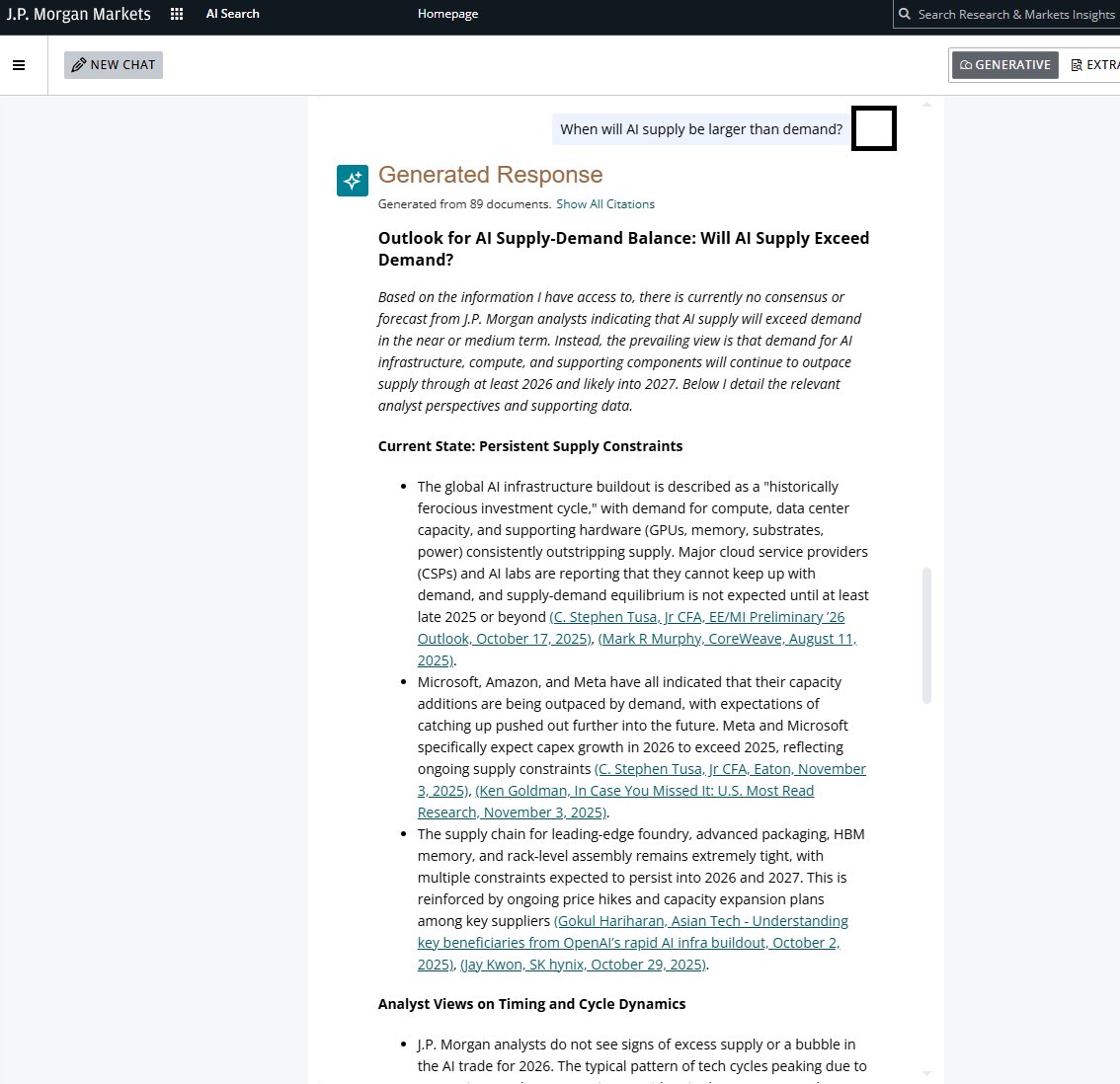

$JPM released AI search product today. Pretty cool.

Interesting insights from $PLTR former. Certainly seems like they are onto something as far as go-to-market fit. Highlights -Joined PLTR to help get commercial strategy working -Companies were reluctant to work w/ PLTR – worked w/ ICE, etc. -Figured out should go pitch…

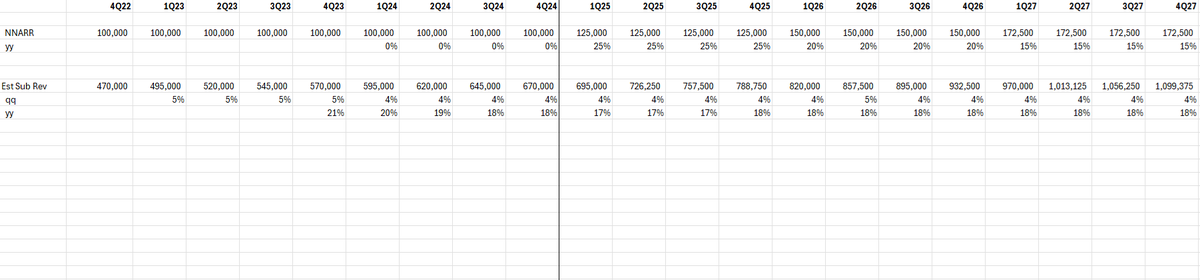

I think everyone is a bit off base with these net new ARR acceleration hopes ($CRM, $HUBS, etc.) Here is a simple example where a subscription business landing the same new ARR each quarter is growing 18% yy. Then, new ARR bumps up to 25% yy growth. Sub revenue takes 3…

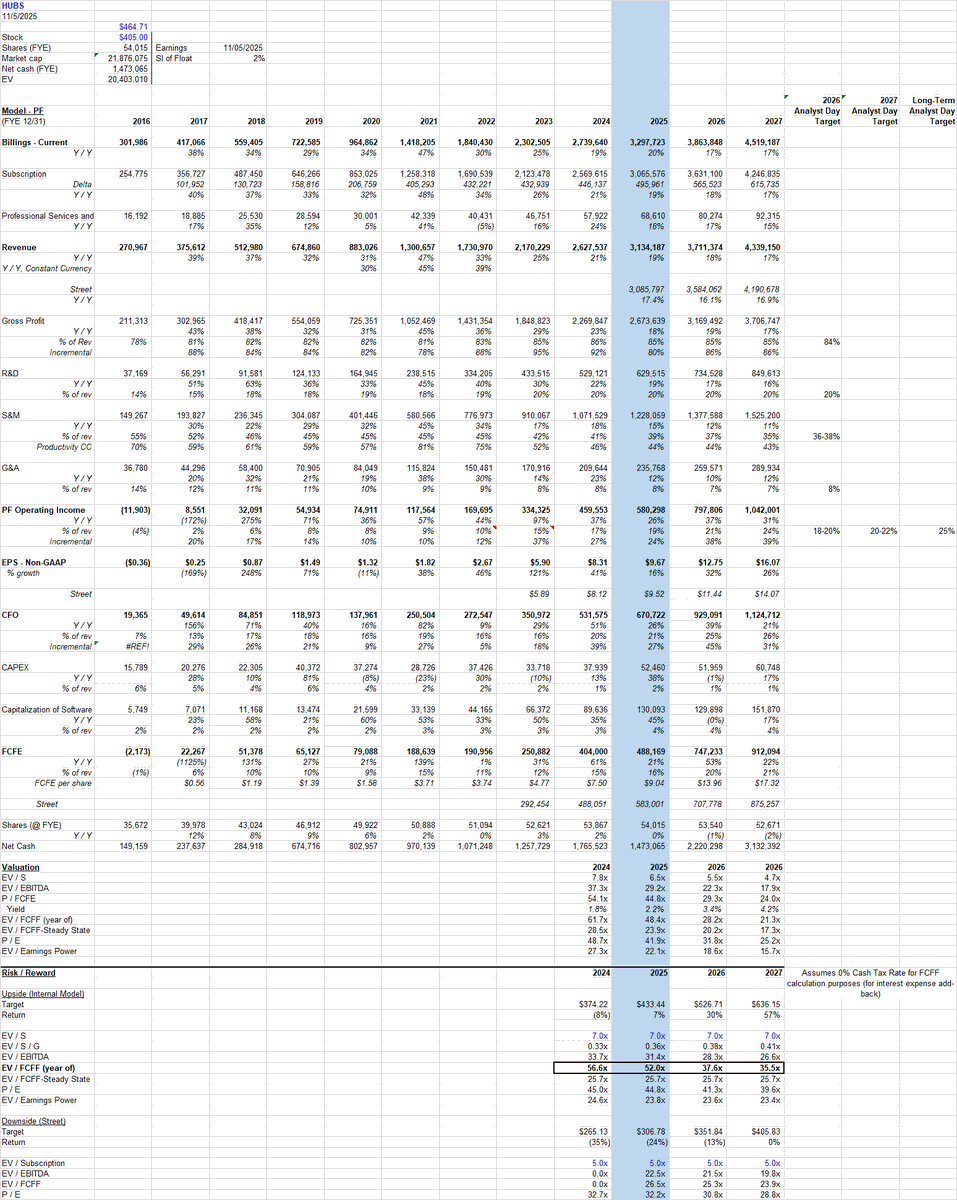

$HUBS reported a fine quarter but below expectations of an acceleration. Story is moving sideways. Decent SaaS product cycle story but AI impact unclear. Also unclear if this is a great business. Numbers likely move higher but also seems unlikely company is able to…

Three third-party WDAY partner checks were constructive. Leading platform for HCM / FINS, Extend allows customers to customize solution which opens up deployment use cases, AI still early but a call option. Up-market getting more penetrated but mid-market / government has…

In defense of Sam: 1) He is focused on the big picture and transformational tech. This dude started with a lab that was working on pretty experimental stuff and has shot the lights out thus far. 2) He has the world's biggest plate - managing an AI talent pool that is…

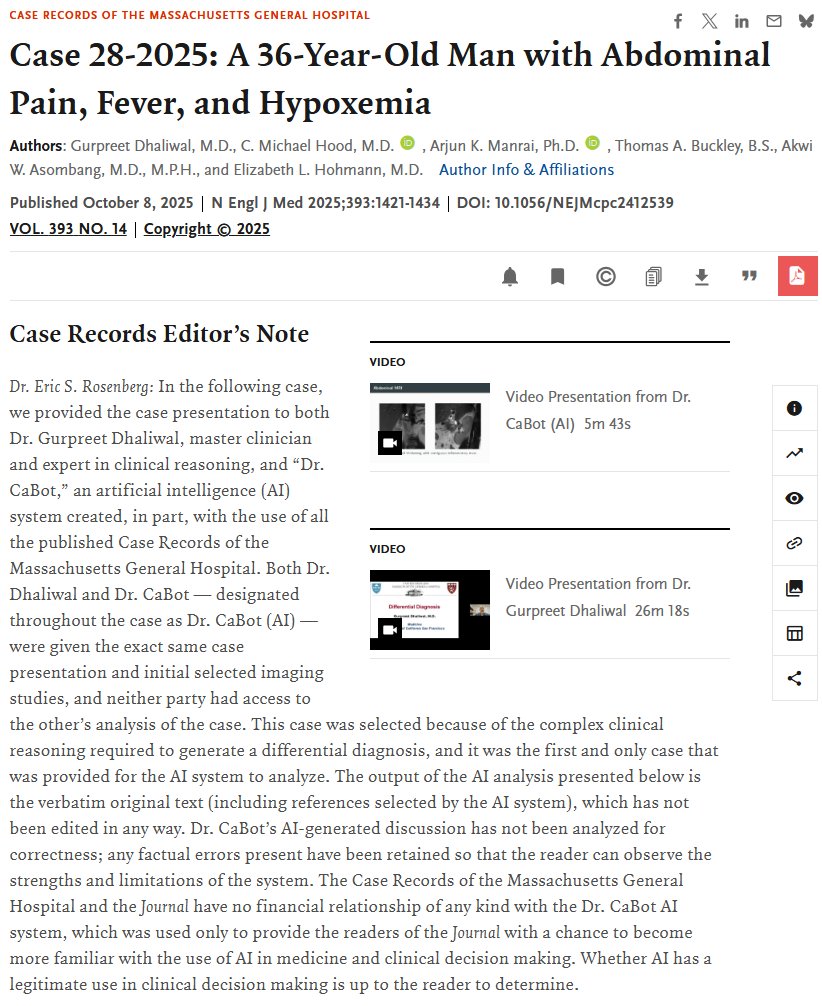

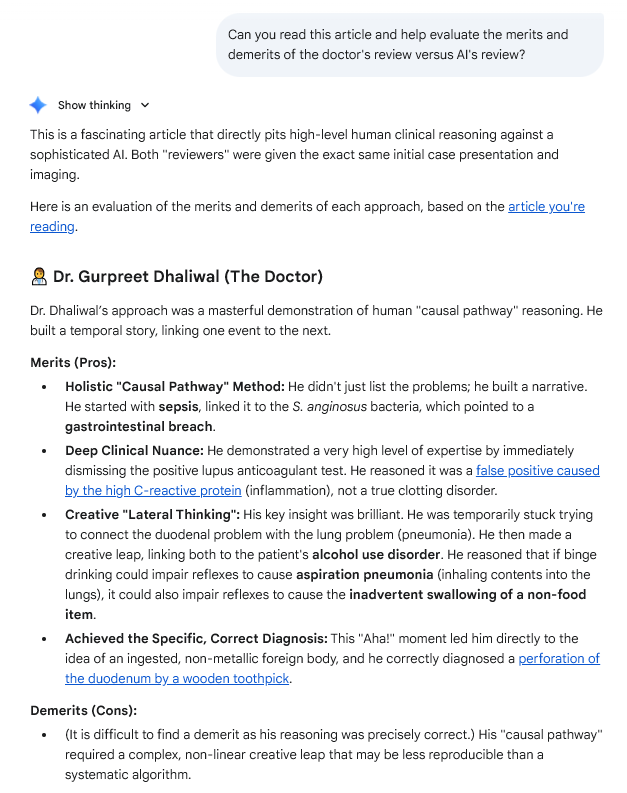

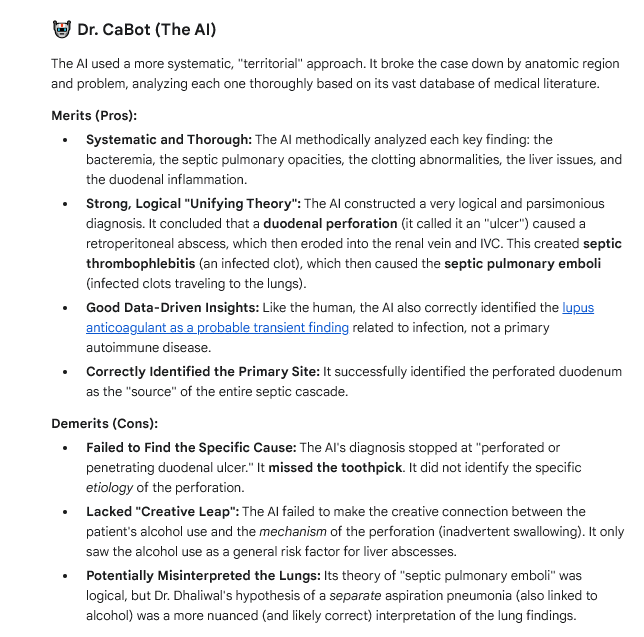

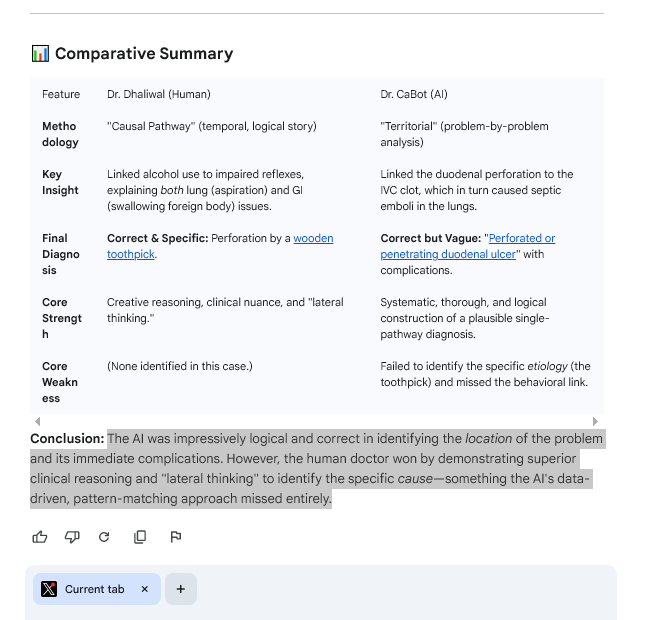

Interesting AI data point from my exceptional NYC doctor (highly recommend for family medicine), who also writes a great blog (link below) For the first time, New England Journal Of Medicine published its weekly case review with an AI perspective as well. They pitted a master…

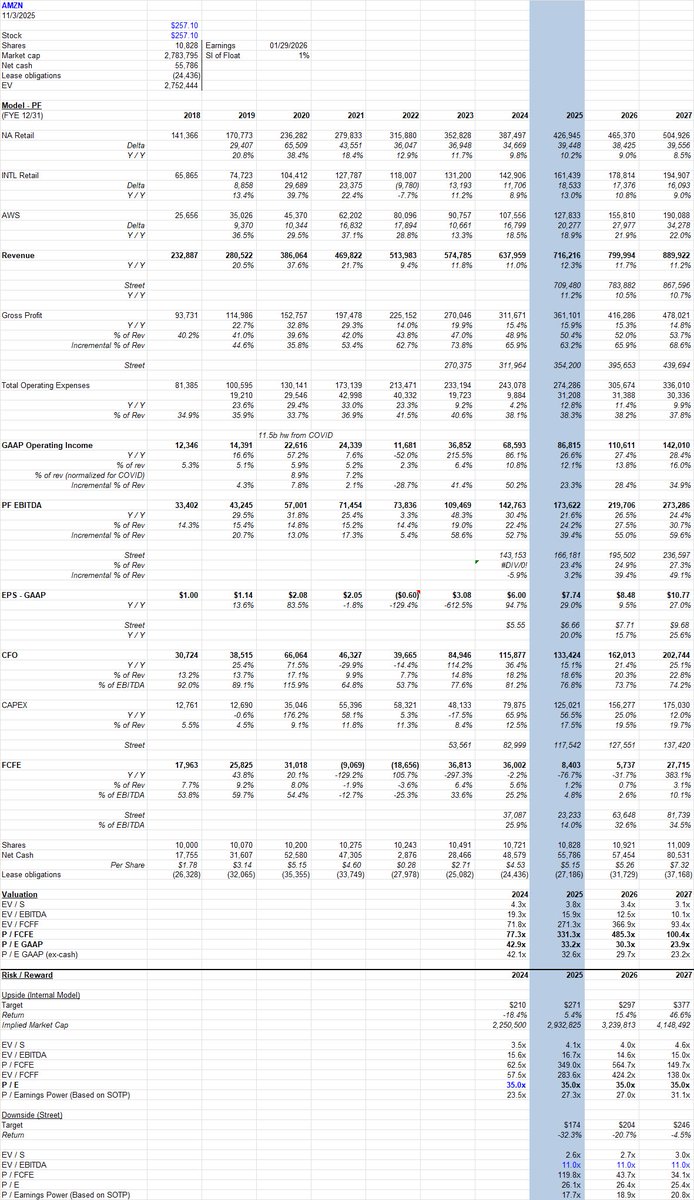

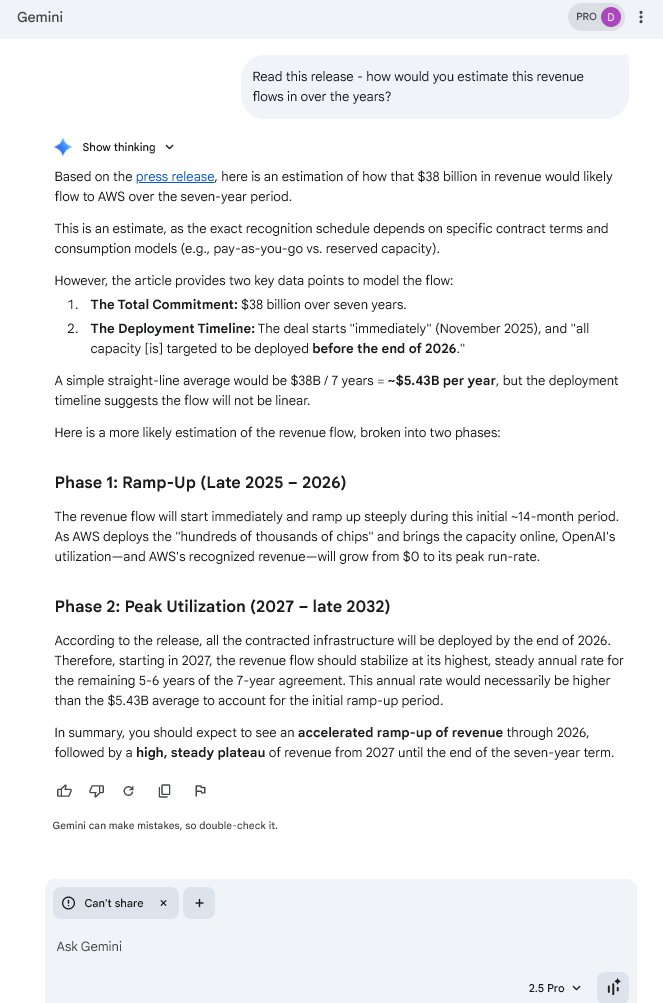

My $AMZN estimates moved up. Remains an attractive revision / risk-reward setup. Have to say, $GOOGL Gemini Pro in Chrome is turning into a must-have backup to my own analysis.

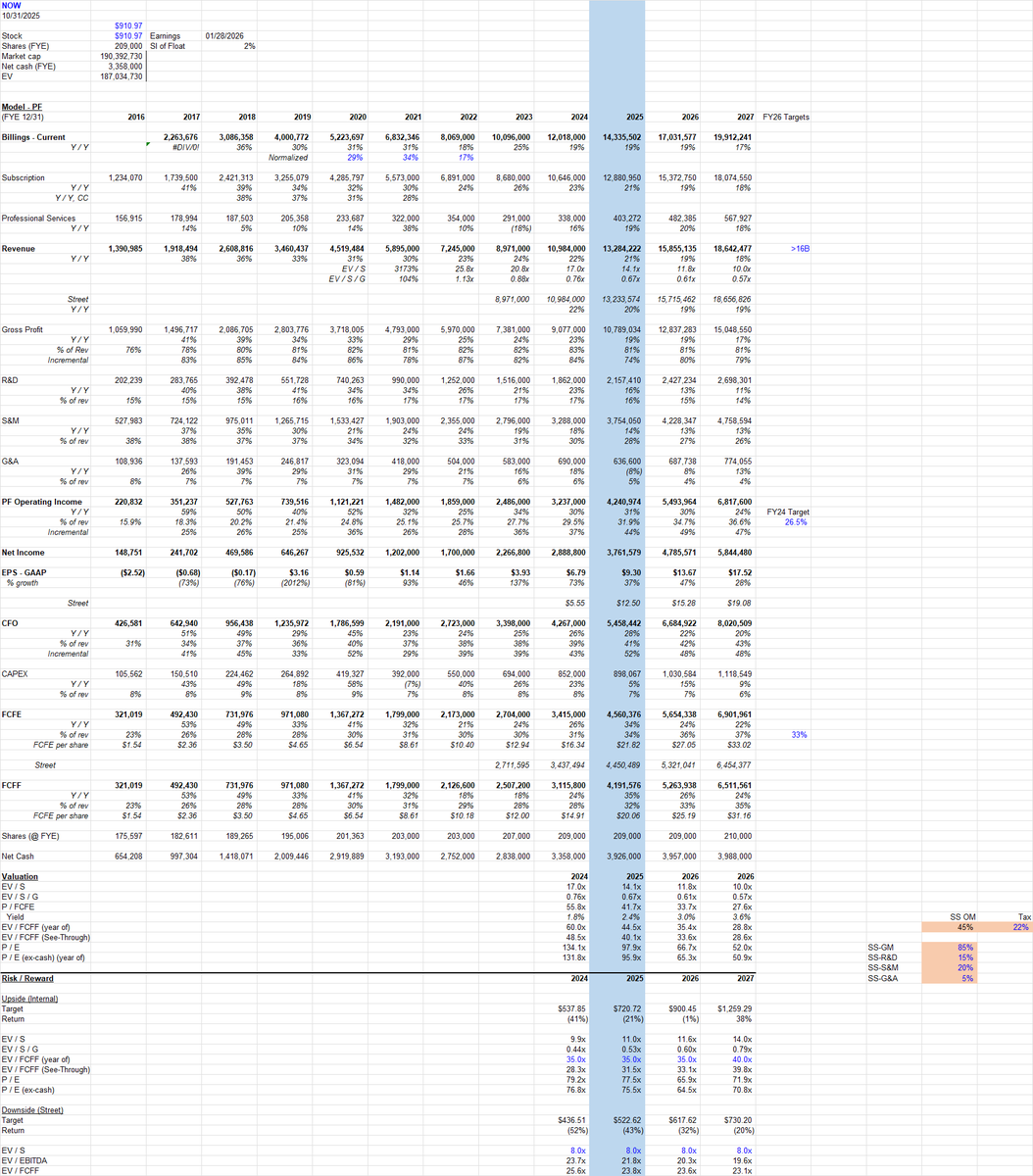

$NOW reported a solid qtr. Story is solid as they remain the operational workflow workhorse for enterprise, and are layering in AI functionality. Numbers have some room to move higher. Risk / reward is ok. High margin, high-retention subscription business that ought to decel…

United States Tendances

- 1. Ravens 56.8K posts

- 2. Lamar 45.3K posts

- 3. Bengals 50.7K posts

- 4. #heatedrivalry 9,764 posts

- 5. ilya 12.7K posts

- 6. Joe Burrow 20.1K posts

- 7. shane 15.3K posts

- 8. Zay Flowers 4,059 posts

- 9. #WhoDey 3,578 posts

- 10. Cowboys 91.9K posts

- 11. Derrick Henry 4,401 posts

- 12. Hudson 10.8K posts

- 13. Perine 1,574 posts

- 14. Zac Taylor 2,599 posts

- 15. Harbaugh 3,080 posts

- 16. Sarah Beckstrom 208K posts

- 17. AFC North 2,285 posts

- 18. #hrspoilers 1,025 posts

- 19. #CINvsBAL 2,683 posts

- 20. Mahomes 33.7K posts

Something went wrong.

Something went wrong.