Aram Attar

@TheVCFactory

Mindset-Based Investor in Emerging VC Managers.

You might like

Last Friday, I presented my report “Emerging VCs: Selection Through Mindset” to a select group of LPs and GPs in Austin. The report shows how current LP evaluation methods can significantly benefit from incorporating a structured analysis of Emerging GPs’ mindset: how they…

Truth

Ben Horowitz literally explains how he differentiates between mediocre CEOs & great CEOs.

Amazed to read so many comments who don’t get the joke.

Visited a startup accelerator in Palo Alto last week It was 10pm and the founders were still coding “Do you have a government permit to be working at this hour?” I asked them They looked at me and said “bro what are you talking about” in a typical condescending American way I…

I am deeply honored, humbled, and will have big shoes to fill. @roelofbotha changed my life. He believed in me, brought me to Sequoia, and taught me how to grow from a builder into an investor. He’s demanding and deeply caring — the rare kind of friend, mentor, partner who…

There’s a “scientific method” approach to venture investing: make assumptions, fund the trial, and course-correct without engaging in confirmation bias. You have to be both open and have conviction, which is why the phrase “strong conviction, loosely held” is so often heard in…

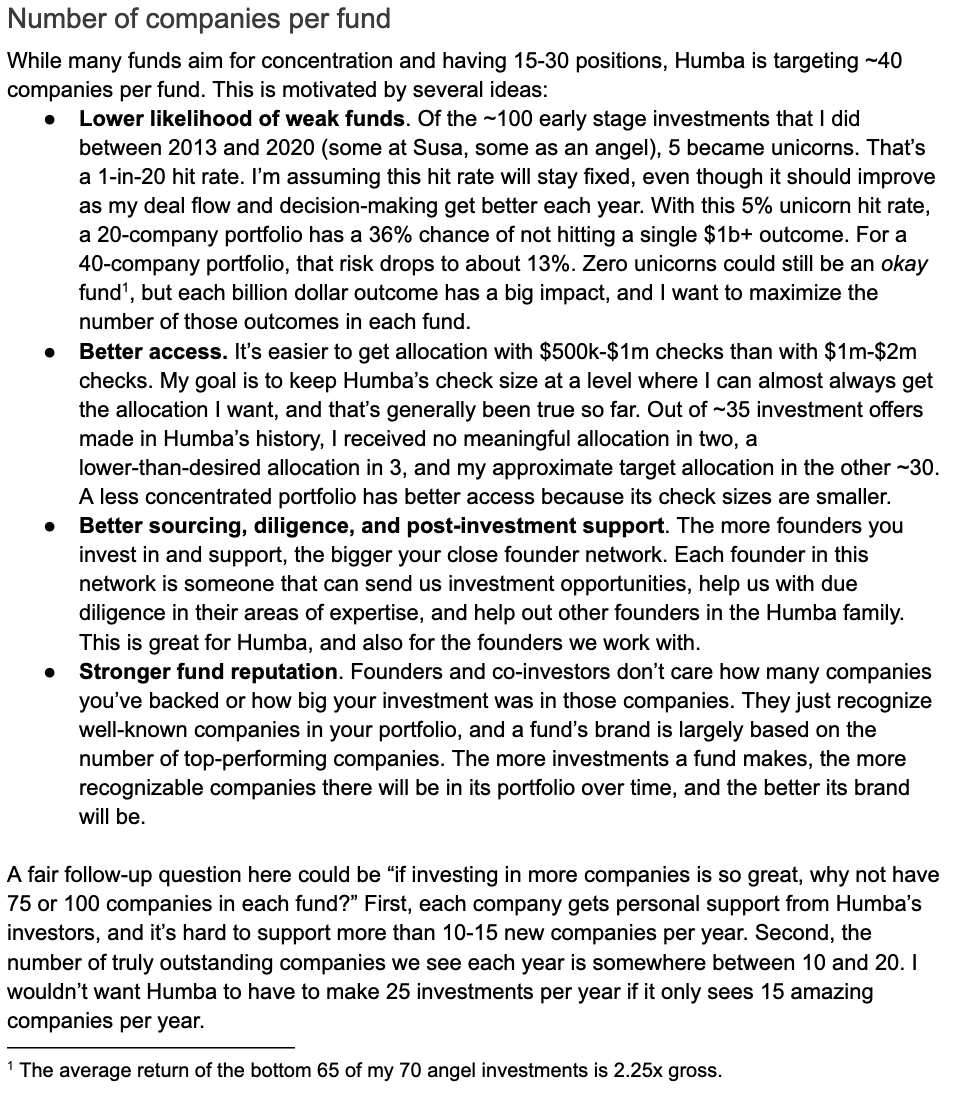

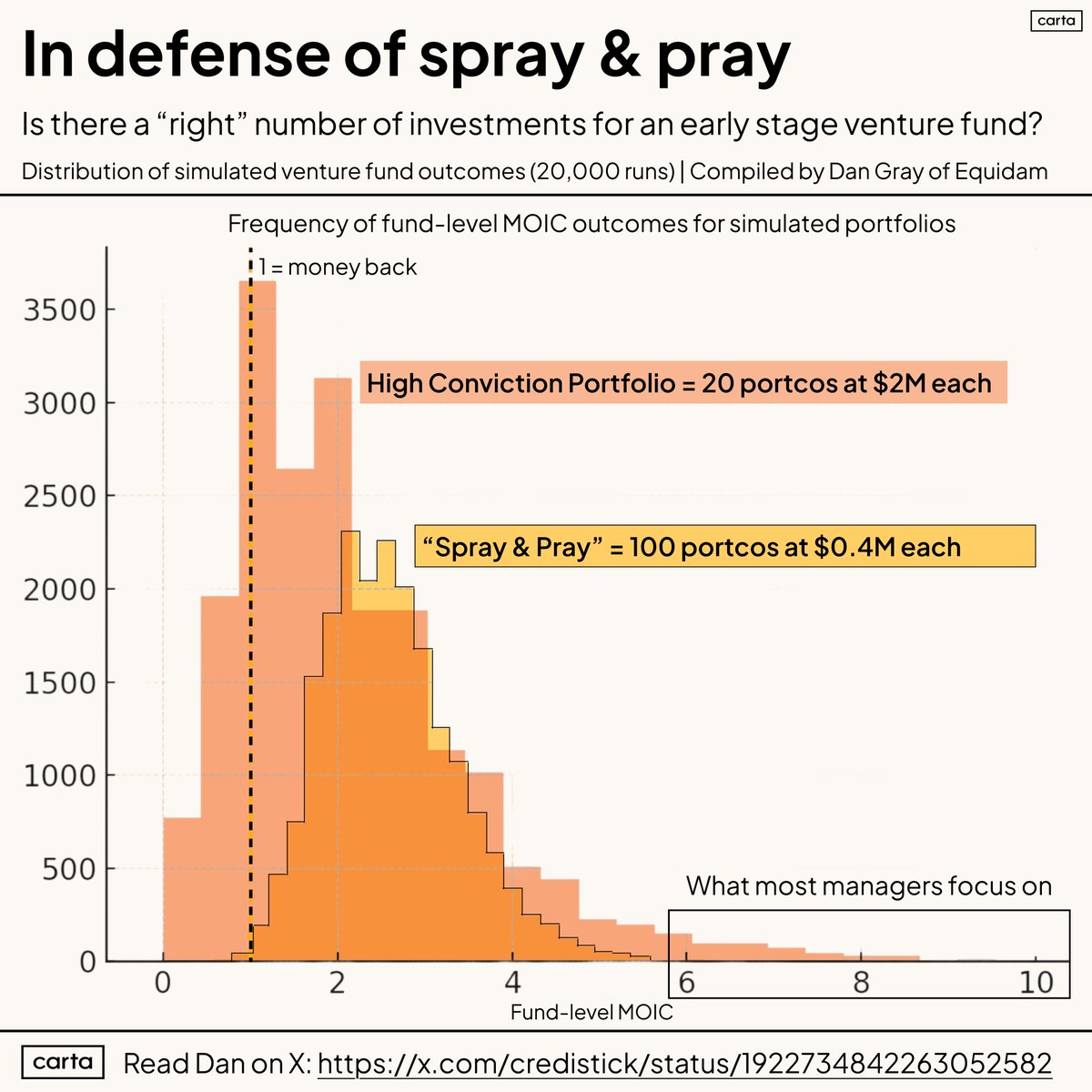

I covered this in a quarterly LP letter last year (screenshot below). IMHO larger VC portfolios are underrated: * Portfolio network effects -> better sourcing, diligence, support for founders * Brands are built on # of winners * More investments -> smaller checks -> easier access

"spray & pray" vs "concentrated" - lots of debate as always at RAISE this year on everyone's favorite VC topic. How has this debate changed in the last 18 months? - Following on into your best companies has gotten harder (usually because the next couple rounds are much larger…

AI “job displacement” is a legitimate concern, but what people often overlook is that many jobs are effectively carried out by human-like robots. This is especially true in customer service roles. Employees run a script that leaves no room for sensible resolutions and fail to…

How much time passes between the moment you shake a Founder’s hand and when their pitch starts tells you all you need to know about their salesmanship.

No matter what your friends tell you: if you speak more than your guest and change topics every 2 minutes for 90 minutes, you’re a poor interviewer.

People who are used to having an inner dialogue in life/work will thrive with AI chatbots.

Agreed. Non-consensus chasing requires a different mindset. thevcfactory.com/venture-capita…

The same 10 VCs every week: “this is the frothiest market I’ve ever seen. Every round is preempted at insane valuations. I don’t know how anyone will make money in this environment. Nobody can compete with the big firms” The reality: they’re only being exposed to the most…

My partner Bruce Dunlevie once asked "what could go right?" This is the defining attitude needed in VC investing. When they work .... Wow.

I made a $250M mistake by thinking I was smarter than a market. I met an incredible entrepreneur in 2020. Raising $2M on $10M post. I could have done a $250K investment. The founder; clearly brilliant. The market; I doubted could facilitate a $10BN+ new player. The…

Quick thoughts from participating in investment committee meetings for over 15 years: Listen more than you speak Changing your mind when presented with new data is ok Be humble: you’re not doing the work; you’re not the most knowledgeable person on the topic either When…

Unlikely to be a good return so fast. Shows how short-sighted many have become.

A question for LPs. If a venture fund has an early exit in year 2 of the fund, would you rather have the VC Manager:

102 vote · Final results

"PayPal raised $100M at a $500M valuation in March of 2000 - with no revenue. By June, we had 7 months of runway left. We got religion fast. Between June - Sept we: - Fixed fraud - Got users to link bank accounts - Cut transaction costs All the innovations that made PayPal…

THE LIBRARY OF MINDS: EPISODE 2 - featuring Roelof Botha (@roelofbotha) Managing Partner of Sequoia. Ex-CFO of PayPal. Early backer of YouTube, Instagram, Square. Quiet architect behind generational companies. We cover: • How elite orgs think like teams-not stars • The false…

United States Trends

- 1. LINGORM DIOR AT MACAU 156K posts

- 2. #GenshinSpecialProgram 10.8K posts

- 3. Josh Allen 41.1K posts

- 4. Texans 61K posts

- 5. Four Seasons 9,328 posts

- 6. Bills 152K posts

- 7. #FridayVibes 3,034 posts

- 8. Joe Brady 5,377 posts

- 9. OpenMind 51.7K posts

- 10. Niger 51.3K posts

- 11. Infinit 84.7K posts

- 12. #Ashes2025 26.6K posts

- 13. #MissUniverse 483K posts

- 14. Beane 2,981 posts

- 15. Miden 13.4K posts

- 16. McDermott 4,861 posts

- 17. Anderson 28.9K posts

- 18. FINAL DRAFT FINAL LOVE 1.35M posts

- 19. joon 13.8K posts

- 20. #LoveDesignFinalEP 1.25M posts

Something went wrong.

Something went wrong.