Two Rivers Analytics

@TwoRiversAnalyt

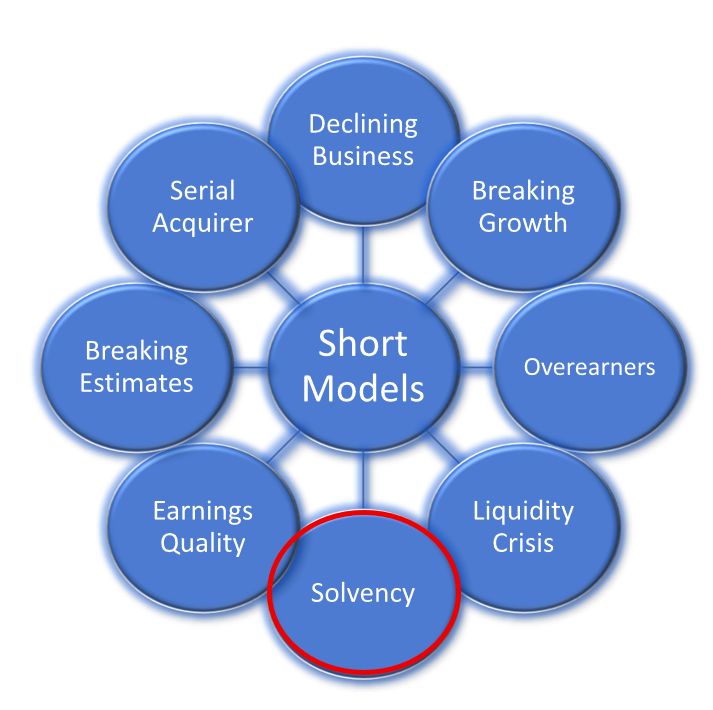

Short-sale research for pros. US SMID-cap growth busts, overearners, decliners, liquidity traps & earnings tricks. First principles + data | CFA | Newsletter 👇

You might like

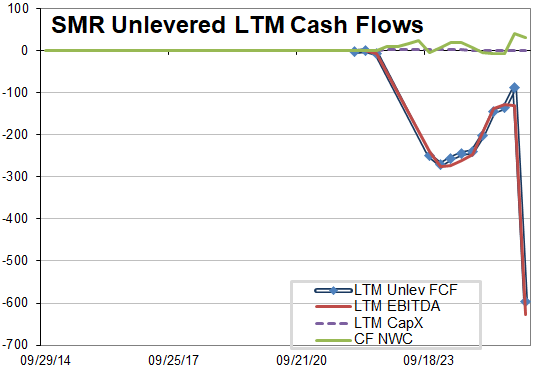

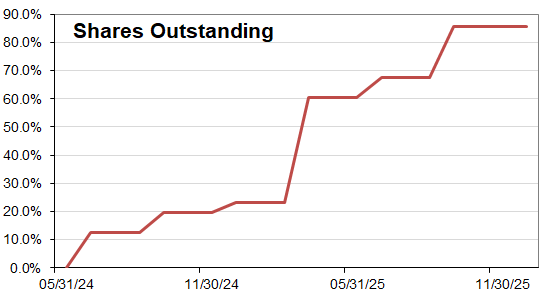

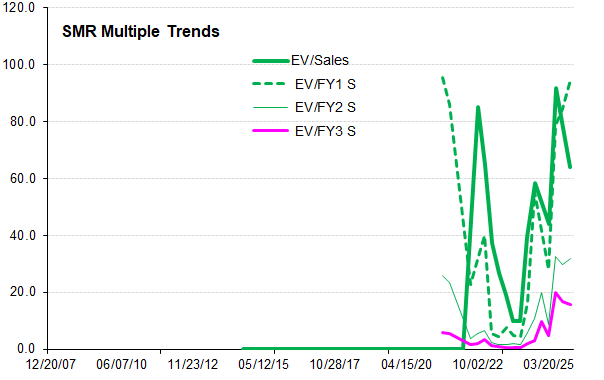

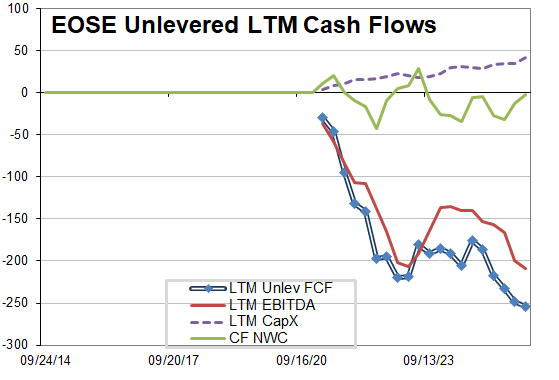

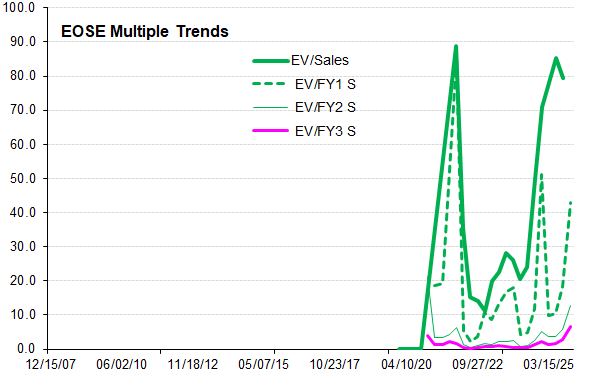

Right on. Deep cash burn, share dilution, sales/earnings misses, but available for only 32x 2026 sales! 😀

We are publishing an important update for $SMR 1/x iceberg-research.com/2025/11/14/nus…

iceberg-research.com

NuScale Wants to Sell 72 Reactors to a Company Based in a WeWork Office Shared with NuScale

Please refer to our disclaimer at the bottom of this report. Summary of findings Despite a market cap of $7bn, NuScale has not sold a single reactor in its 18 years of existence. None of the…

We agree RDNT AI is a very modest boost at best. Eventually, AI will be built into all radiology equipment, neutering most (all?) of RDNT's advantage. We wrote our RDNT report December 2023 (too early). DM for a copy.

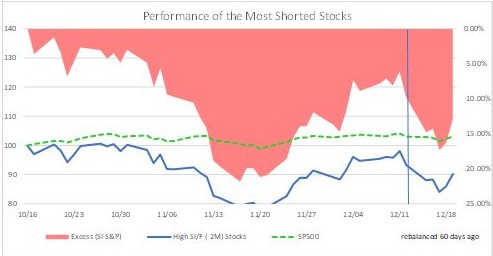

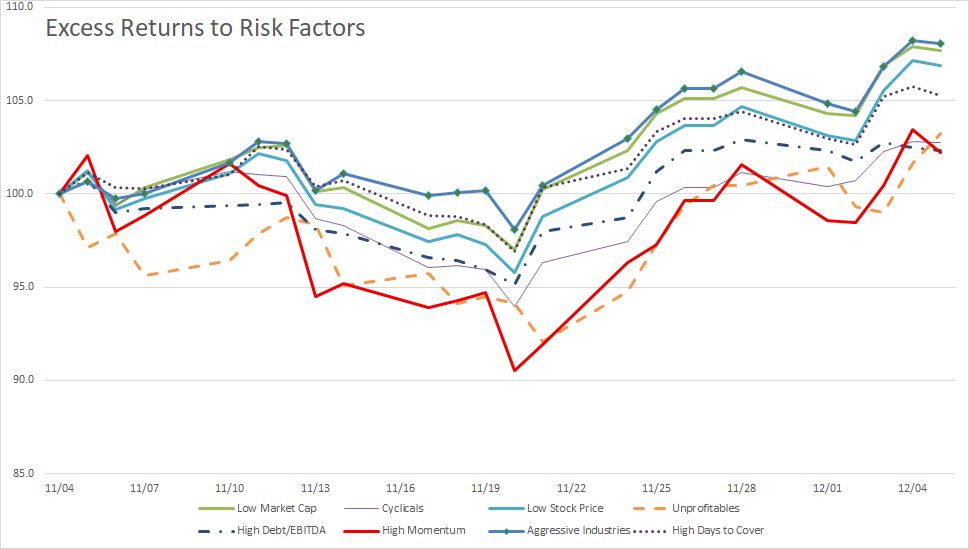

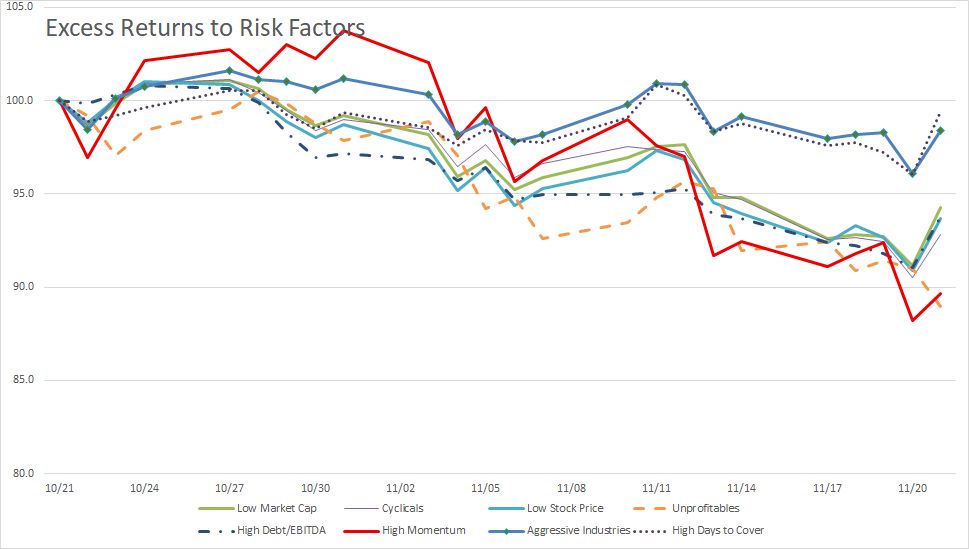

Short Risk Factors and Risk Appetites: Shorts gained some alpha last week; risk appetites largely unchanged short-n-sweet.beehiiv.com/p/short-risk-f…

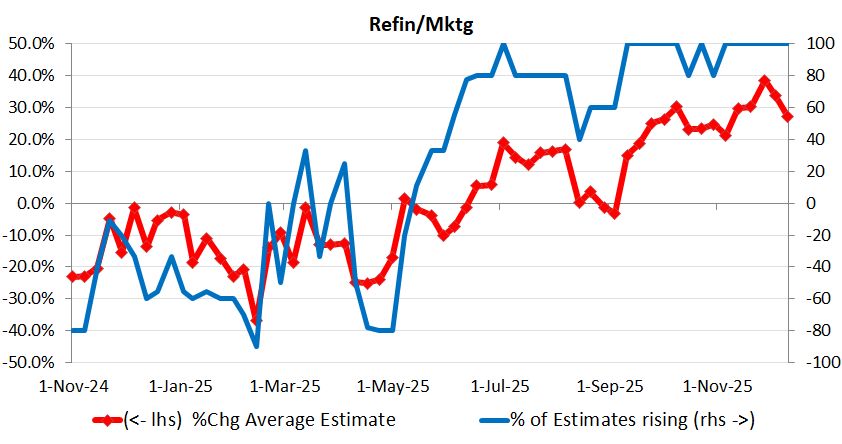

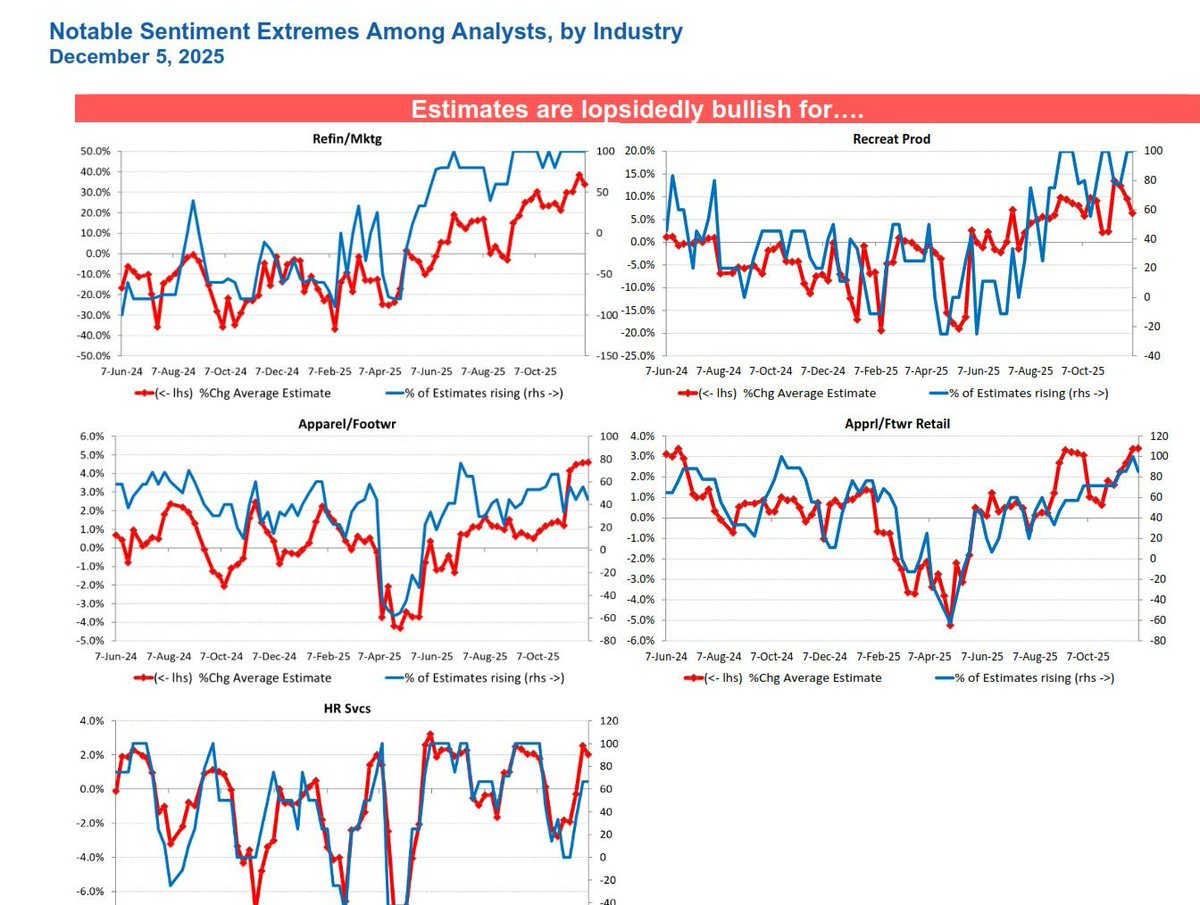

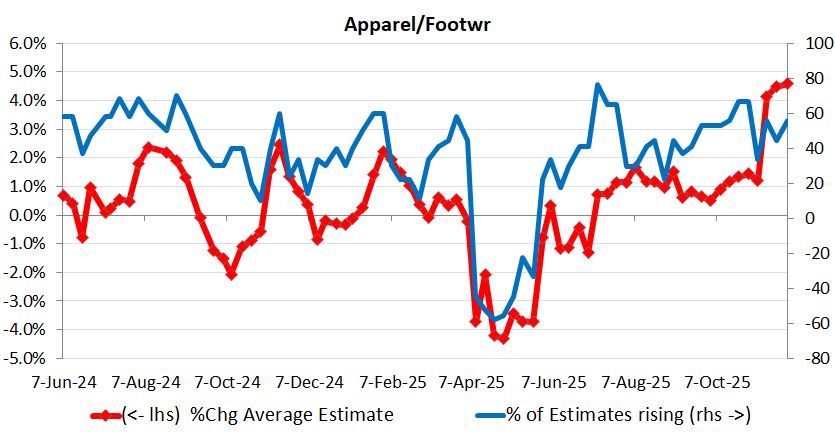

Estimates are crowded and toppy for Refiners, Recreational Products, Apparel & Footwear manufacturing and retail and HR Services.. short-n-sweet.beehiiv.com/p/analyst-sent…

Risk appetites flat; Unprofitable company stocks still running; shorts lose a little ground this week. short-n-sweet.beehiiv.com/p/short-risk-f…

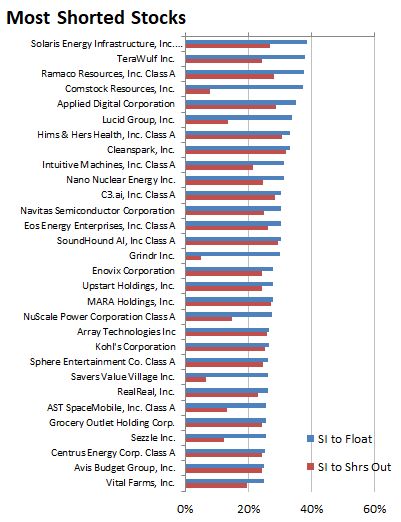

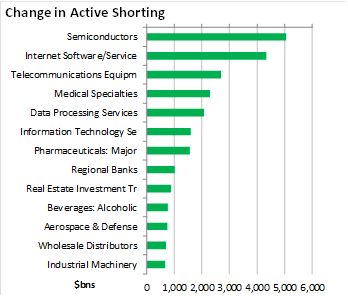

New FINRA short data is out. Where are the squeeze risks? short-n-sweet.beehiiv.com/p/new-finra-sh…

In the short term, a voting machine. In the long term, it's a weighing machine...

$EOSE I would need to ask breakout as to what percentage of short reports go green after release in the last months, but I'm sure it's >50%. I mean tbh, who goes short after an activist report nowadays...

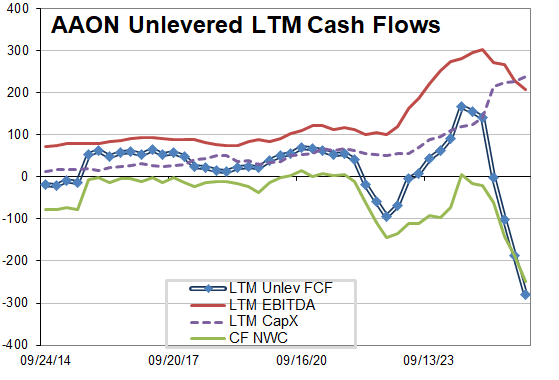

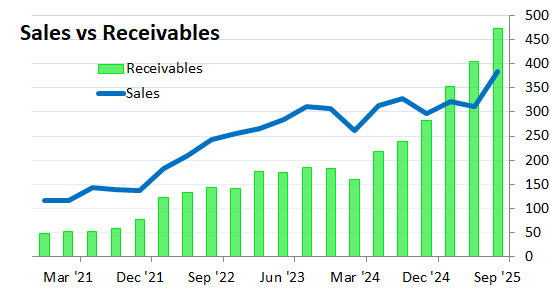

Wrapped up on datacenter cooling hype... profitability falling, receivables slowing, capex through the roof and high multiples. What's not to like?

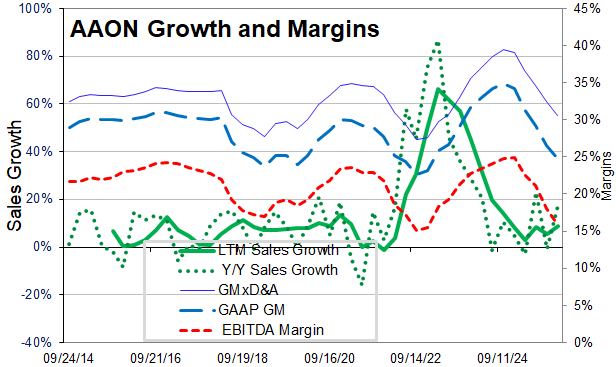

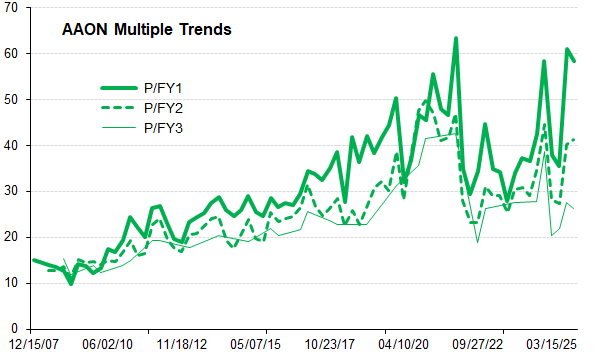

$AAON again a stock that is down over 10% in the 3 days before release and now doesn't react "meaningfully" to a short report. 🤡 I won't be exit liquidity 😘

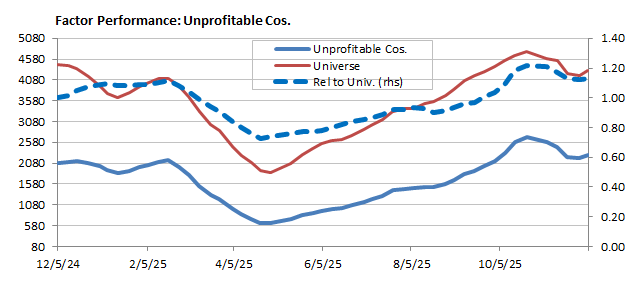

And the cycles in unprofitable company stocks are among the most reliable risk on/off metrics around:

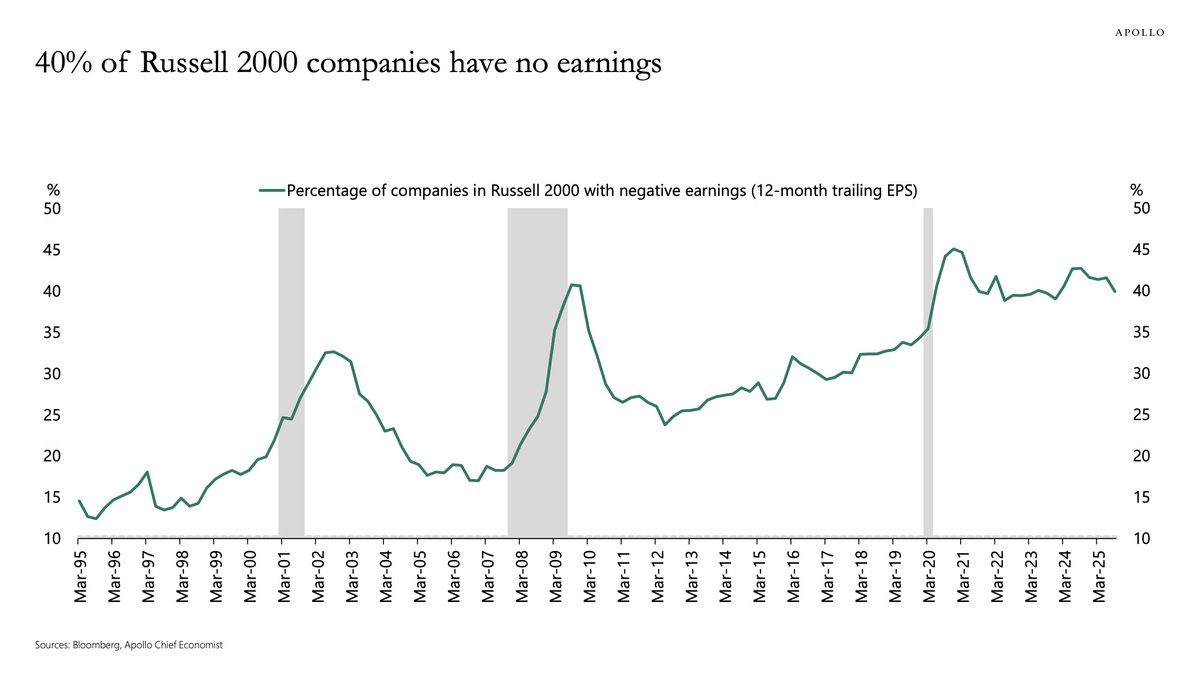

Today's chart from Torsten Slok illustrates the proliferation of companies whose primary business is being public. While there have been peaks of high percentages of small caps w/o earnings, those have followed significant recessions / dislocations and have subsequently reversed.…

Estimates are crowded and bullish for Refiners, Recreational Products, Apparel & Footwear manufacturing and retail and HR Services. short-n-sweet.beehiiv.com/subscribe

Short Risk Factors and Risk Appetites: Nearly every short-linked risk factor was up on the week. Unprofitable company and low-price shares rallied the most short-n-sweet.beehiiv.com/p/short-risk-f…

Estimates are crowded to the upside for Refiners, Recreational Products, Apparel & Footwear Retail and Major Telecom.short-n-sweet.beehiiv.com/p/analyst-sent…

Short Risk Factors and Risk Appetites;Risk appetites turned up but risk appetites still neutral. short-n-sweet.beehiiv.com/p/short-risk-f…

New FINRA short data is out. Semis/SW/Telco Equipment heavily shorted. short-n-sweet.beehiiv.com/p/new-finra-sh…

Short Risk Factors and Risk Appetites: Risk appetites down but still no reason to expect a bounce yet. short-n-sweet.beehiiv.com/p/short-risk-f…

Refiners, Recreational Products & several other groups show dangerously crowded sell-side raises short-n-sweet.beehiiv.com/p/analyst-sent…

United States Trends

- 1. #StrangerThings5 137K posts

- 2. Broncos 39.6K posts

- 3. Lakers 36.2K posts

- 4. Chris Jones 2,042 posts

- 5. jancy 19.9K posts

- 6. Dustin 99.6K posts

- 7. Lions 95.5K posts

- 8. Holly 47.5K posts

- 9. Goff 22.7K posts

- 10. Bo Nix 5,144 posts

- 11. Luka 38.3K posts

- 12. #AEWCollision 7,980 posts

- 13. Kelce 24.5K posts

- 14. Nigeria 322K posts

- 15. #ChiefsKingdom 4,040 posts

- 16. Vikings 47.8K posts

- 17. Lucas 64.1K posts

- 18. Dan Campbell 6,185 posts

- 19. Sutton 3,809 posts

- 20. Ben Johnson 6,879 posts

You might like

-

Nathaniel August

Nathaniel August

@alpha_exposure -

WPWAM

WPWAM

@WillauerProsky -

Jay Yoon

Jay Yoon

@jaysyoon -

FBCC

FBCC

@BiotechPort -

Marshall Hargrave

Marshall Hargrave

@im_marshalld -

Union Square Research Group

Union Square Research Group

@UnionSquareGrp -

CDM Capital

CDM Capital

@CDMCapital -

The Kinderhook Analyst

The Kinderhook Analyst

@OldKinderhook -

Paddington Short

Paddington Short

@PaddingtonShort -

Look at the CEO!

Look at the CEO!

@stupidwildtez -

⏳

⏳

@premortes

Something went wrong.

Something went wrong.