🇻🇫🚨

@VirtualFragment

Freely sharing algorithm indicators and ideas for buy and sell signals. Not financial advice. Have a risk management strategy. Not all alerts follow-through!

Bạn có thể thích

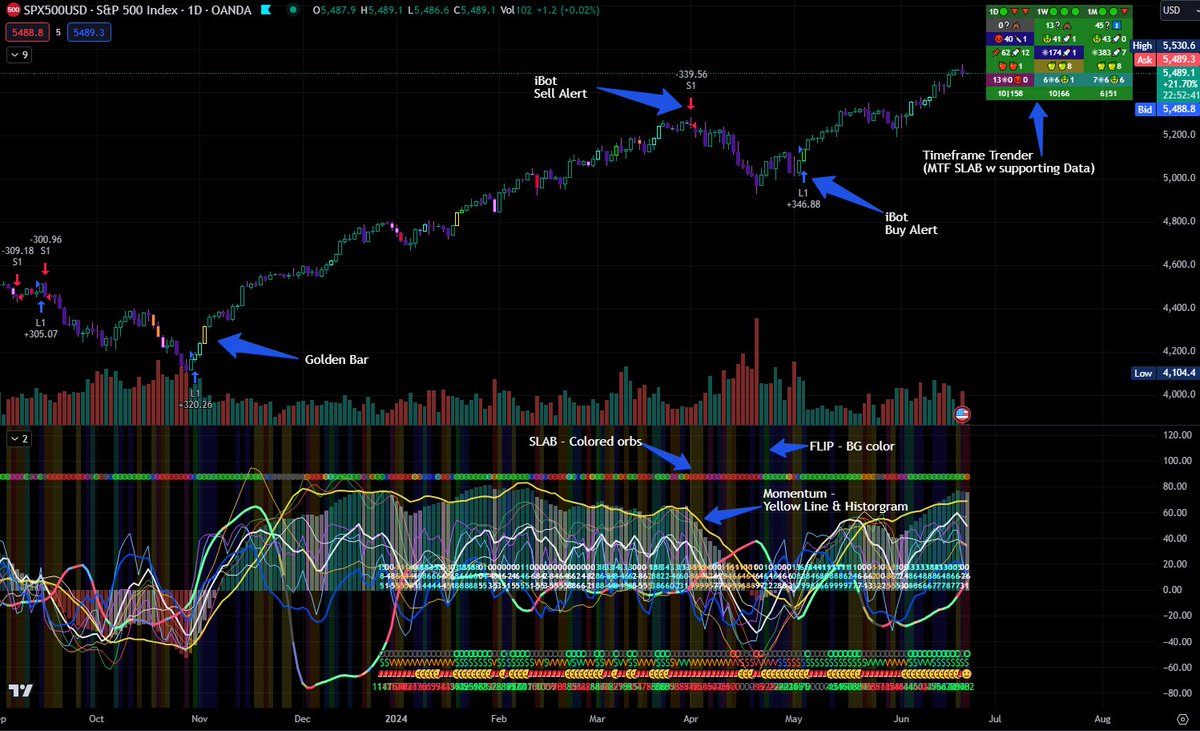

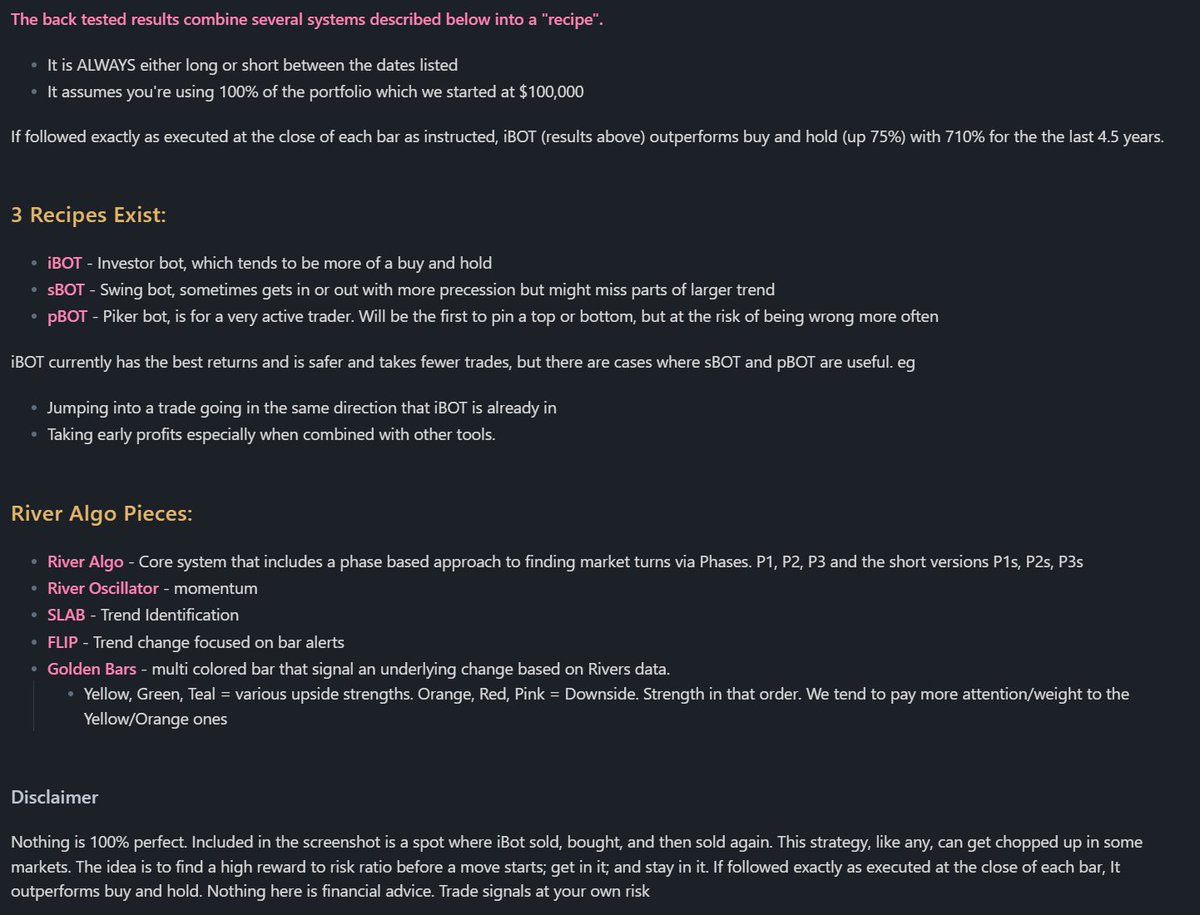

To understand screenshots we post of River Alerts read the images below. There are multiple systems which can be used independently or more ideally at the same time as we start providing Multi-Timeframe tables of when each "BOT" is in Buy or Sell Mode.

So the Chicago PMI print today was 36. In 25 years this has only been lower twice, during Covid in 2020 (32) and during the depths of the great financial crisis in 2008 (31). & nobody batted an eyelid.

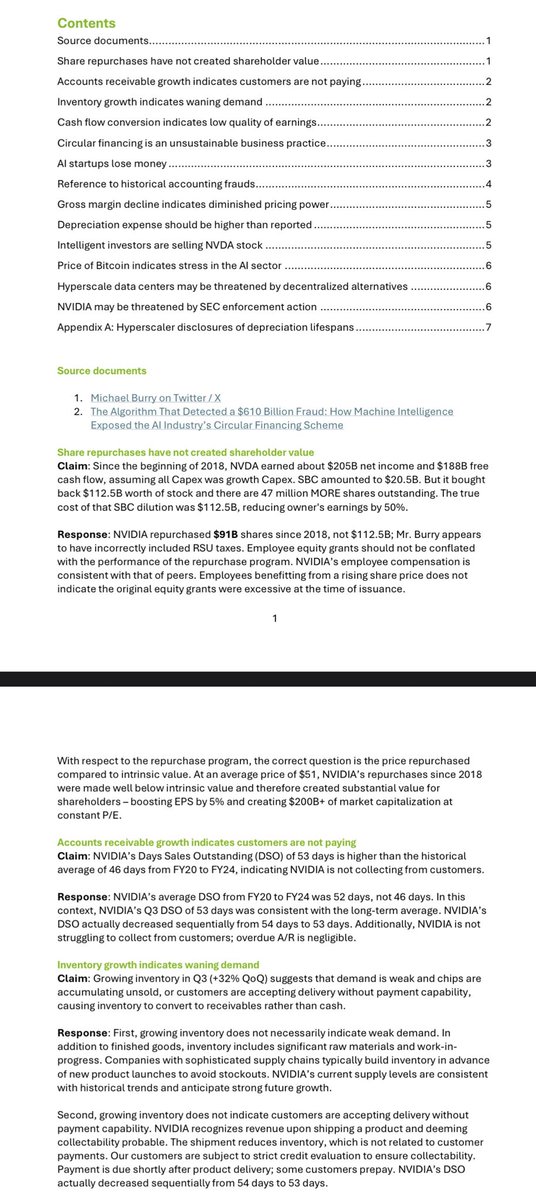

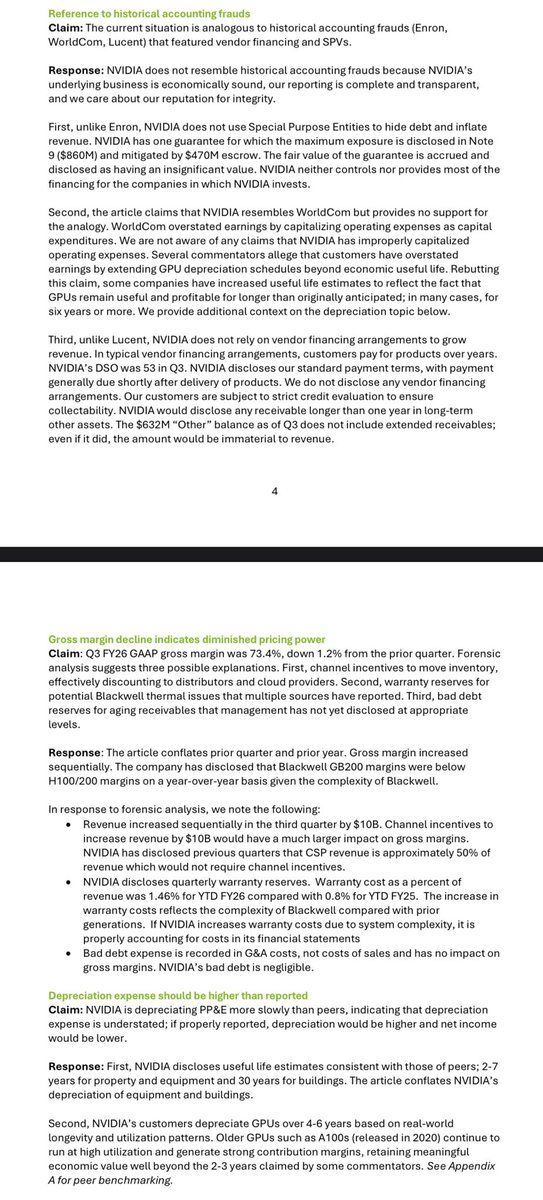

$NVDA opting for an informal analyst email over a formal 8-K filing. Transparency is dead, nothing to see here

Nvidia should have published this in an 8-K filing instead of just emailing a memo to Wall Street sell-side analysts.

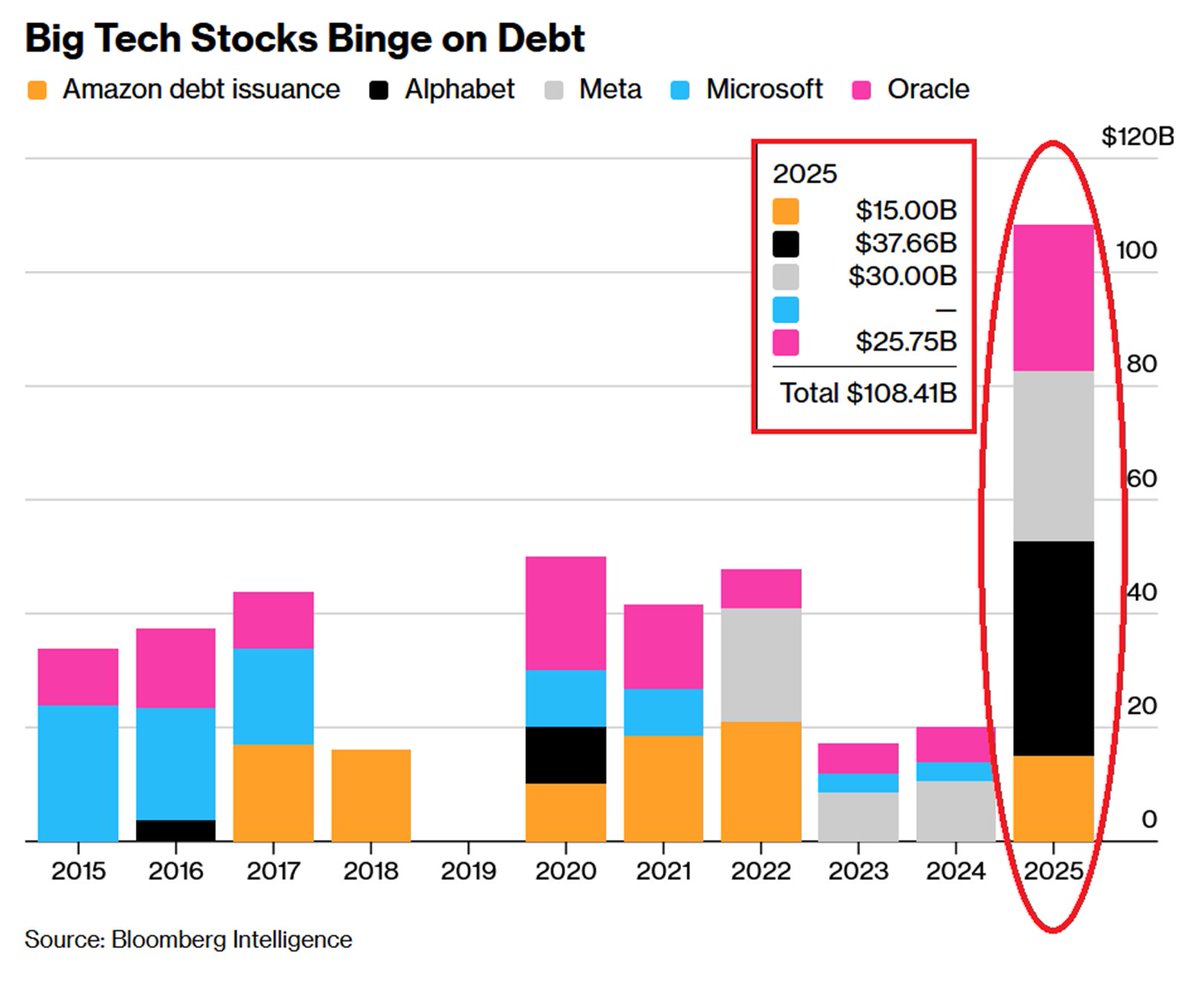

🔴AI debt is SKYROCKETING: US Big Tech stocks' bond issuance hit $108 BILLION so far in 2025, an all-time high. This is 5 TIMES more than in 2024 or 2023. Importantly, this does not include the off-balance sheet debt through Special Purpose Vehicles, which is also surging.

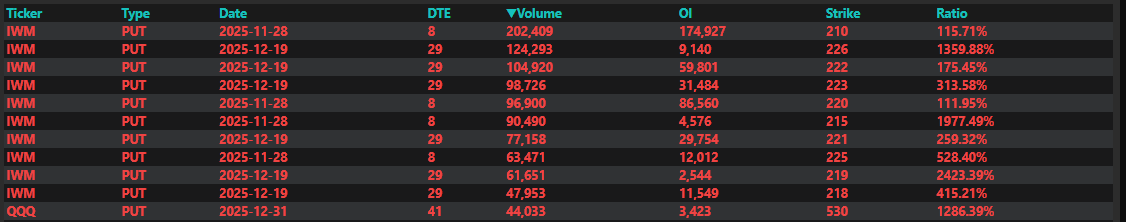

Chris Whalen @rcwhalen believes market liquidity will disappear beginning November 28th He's suggesting a REPO crisis as big banks close their lending books and liquidate positions.

The S&P 500 peaked the exact day Andrew Sorkin rang the opening bell on October 28th, celebrating the release of his book 1929. There are coincidences... and there is coordination. Which one is this?

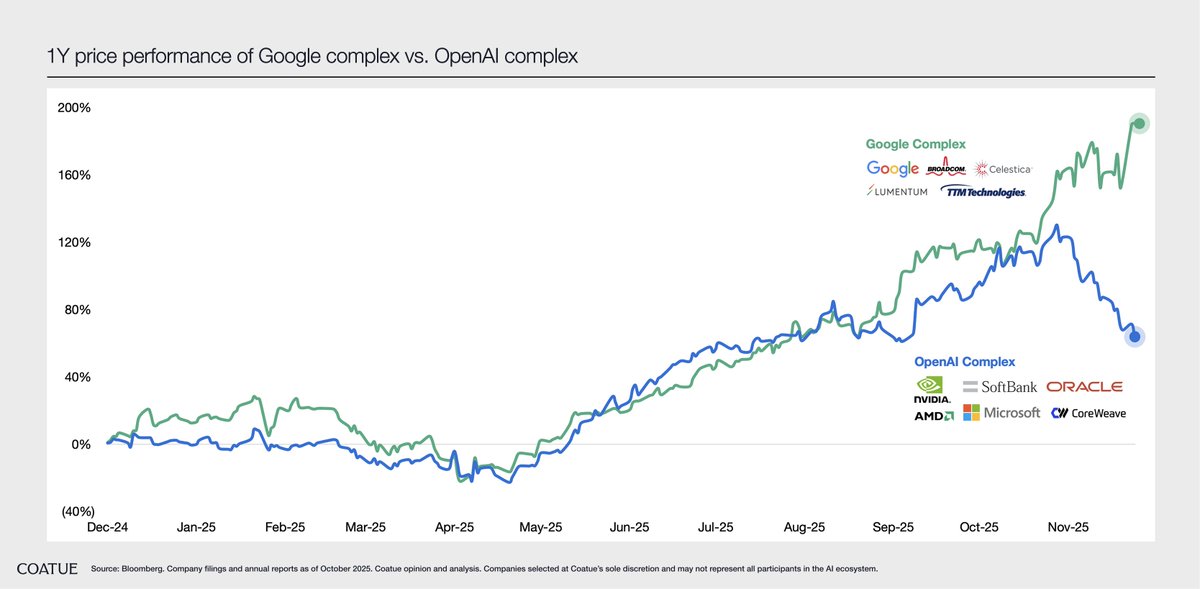

THE GREAT INVERSION Sam Altman just admitted what Wall Street refuses to price in. A November memo leaked three days ago reveals OpenAI warning employees of “rough vibes” and potential revenue growth collapsing toward 5 percent. This was written before Google launched Gemini…

I read a lot of quarterly letters, and most lately are about AI. Greenlight’s stood out: no internet-bubble history lesson or hype. Just simple questions, reasoning, and numbers. Quick and balanced read, worth checking out👇

If you zoom in on 1 minute it looks like distribution instead of a more bullish dip buy. Selling into strength as it ramped up in at least 3 different spots intraday. $RSP $SPY

Nvidia this, nvidia that, beneath the surface, today was the largest volume day for $RSP (equal weight S&P 500), ever. Question is, why?

$JPM monthly has a PEG1+5 on it (not shown) and ibot and sbot are flipping short on it.

$NVDA - Believe it or not, price is still lingering above this #3 trade / #4 level that was established weeks ago at $176.70. Price flattened out for a stretch beginning in late July, institutions traded a ton there on Sept OPEX, and they have been working that zone above ever…

Someone was very bearish on $META today. Also a big bet on a $NVDA recover with a deep ITM call.

BREAKING: The $610 Billion AI Ponzi Scheme Just Collapsed Last night at 4pm EST, something unprecedented happened. Nvidia stock rallied 5% on earnings, then crashed into negative territory within 18 hours. Wall Street algorithms detected what humans couldn’t: the numbers don’t…

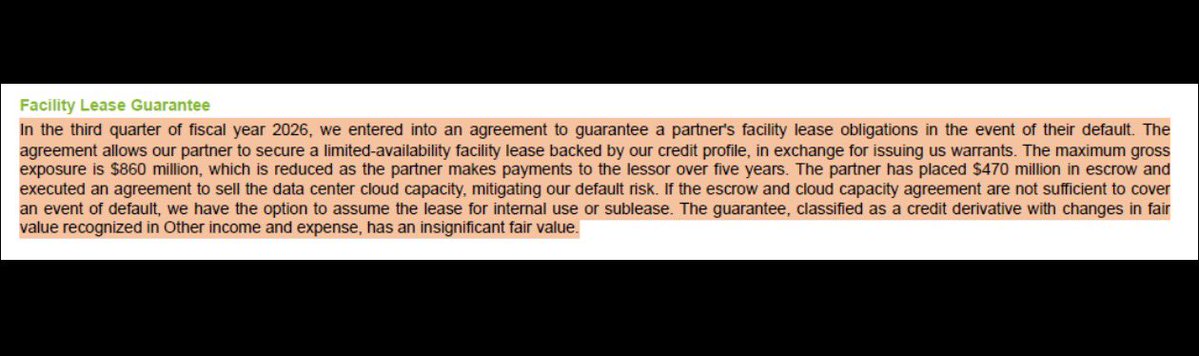

$NVDA appears to be using financial engineering that closely mirrors Enron-era tactics—without breaking any laws. $CRWV has taken on ~$15B in debt to build Nvidia GPU-dense data centers. NVIDIA, in turn, guarantees up to $860M in facility lease obligations for CRWV in case of…

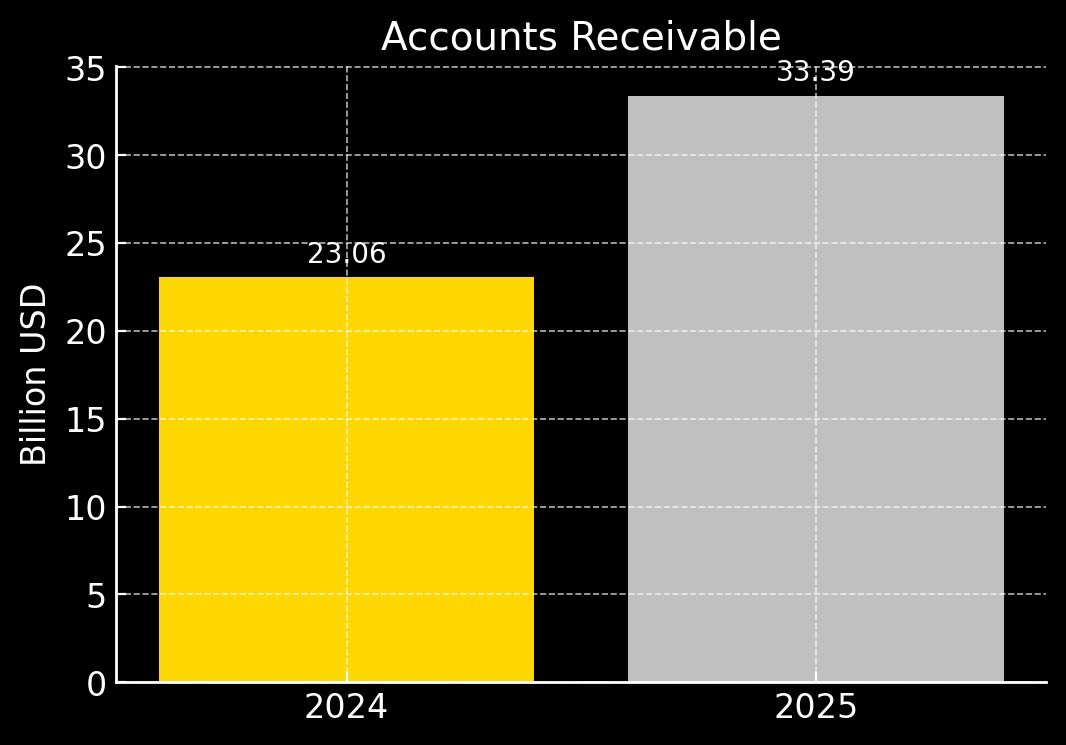

$NVDA Earnings: Blackmagic Surging inventory ↑96% — is demand really “off the charts”? AR balloons +45% — Declining Cash Flow Where’s the cash from the “Insane”demand? Did $Orcl or $Meta not get their SPV funding? 🚨 Full forensic breakdown: open.substack.com/pub/coastaljou…

Someone just unloaded ~$200M worth of $NVDA shares in after hours

As we head into $NVDA earnings, I'd like to share charts from several growth ETFs that have been printing disproportionately large trades at or near ATH over the last several weeks. All of them are heavily weighted towards $NVDA, and as a group, we've been tracking them for…

🚨 Fed Minutes: "Several participants highlighted possibility of disorderly fall in stock prices, especially in the event of abrupt reassessment of AI-related prospects." -what stage of cycle is: Fed watching stonk prices...

Through yesterday’s close the 5-day decline in the Russell 2000 and NASDAQ composite was greatest in 120 days, the 10-day decline in Russell 2000 and NASDAQ was greatest in 120 days, VXN gained 20% in 3 days, S&P 600 generated a 10/1 downside issue day, and the Russell…

United States Xu hướng

- 1. Happy Thanksgiving 203K posts

- 2. #StrangerThings5 310K posts

- 3. Afghan 347K posts

- 4. BYERS 72.1K posts

- 5. #DareYouToDeath 173K posts

- 6. DYTD TRAILER 114K posts

- 7. robin 109K posts

- 8. Turkey Day 14.6K posts

- 9. Dustin 63.4K posts

- 10. Vecna 71.9K posts

- 11. Holly 73.1K posts

- 12. Taliban 45.1K posts

- 13. Reed Sheppard 7,318 posts

- 14. noah schnapp 9,734 posts

- 15. Jonathan 77.4K posts

- 16. Rahmanullah Lakanwal 136K posts

- 17. Nancy 72.3K posts

- 18. Tini 11.6K posts

- 19. hopper 17.9K posts

- 20. Erica 20.5K posts

Something went wrong.

Something went wrong.