Waypoint Forensic Accounting

@WaypointCPA

Forensic accounting firm focused on investigation & financial analysis. Damages, lost profits, income analysis, equitable distribution. Expert testimony by CPA

Forensic accounting insights focused on facts, process, and accountability. Shared from the perspective of an attorney/CPA who now practices exclusively in forensic accounting, with commentary on fraud, financial disputes, internal controls, and how financial investigations…

Most kickback schemes don’t look like crimes. They look like accounting. This one ran for years because nothing looked wrong.

Great point. Verifying reported numbers is often what separates an assumed outcome from an accurate one.

Completely accurate assets/liabilities and income/expenditure analysis is of the utmost importance in a divorce, because this will be used to determine the division of assets, maintenance and even child support. Discover more: buff.ly/ZpFOrfQ

Business valuation is a frequent point of contention in divorce and not just in high net worth cases. Solid discussion on the topic by @Memphis_Divorce

How Are Business Assets Divided in Divorce? ow.ly/7YT950WXOXR "How Are Business Assets Divided in Divorce?" Thank you, Melissa Gragg for inviting me on your Valuation Podcast. Melissa is a nationally recognized valuation expert witness.

Nearly 42% of divorces involve hidden debt. The impact on equitable distribution can be significant when liabilities — not just assets — are undisclosed. High-profile cases like the David Geffen divorce draw attention to complex wealth structures, but the underlying issue is…

thewealthadvisor.com

David Geffen's $9.1 Billion Divorce: Accusations Of Hidden Assets Emerge In Ongoing Split

Court documents filed on October 23, 2025, reveal crazy new accusations in the divorce of billionaire David Geffen and his estranged husband.

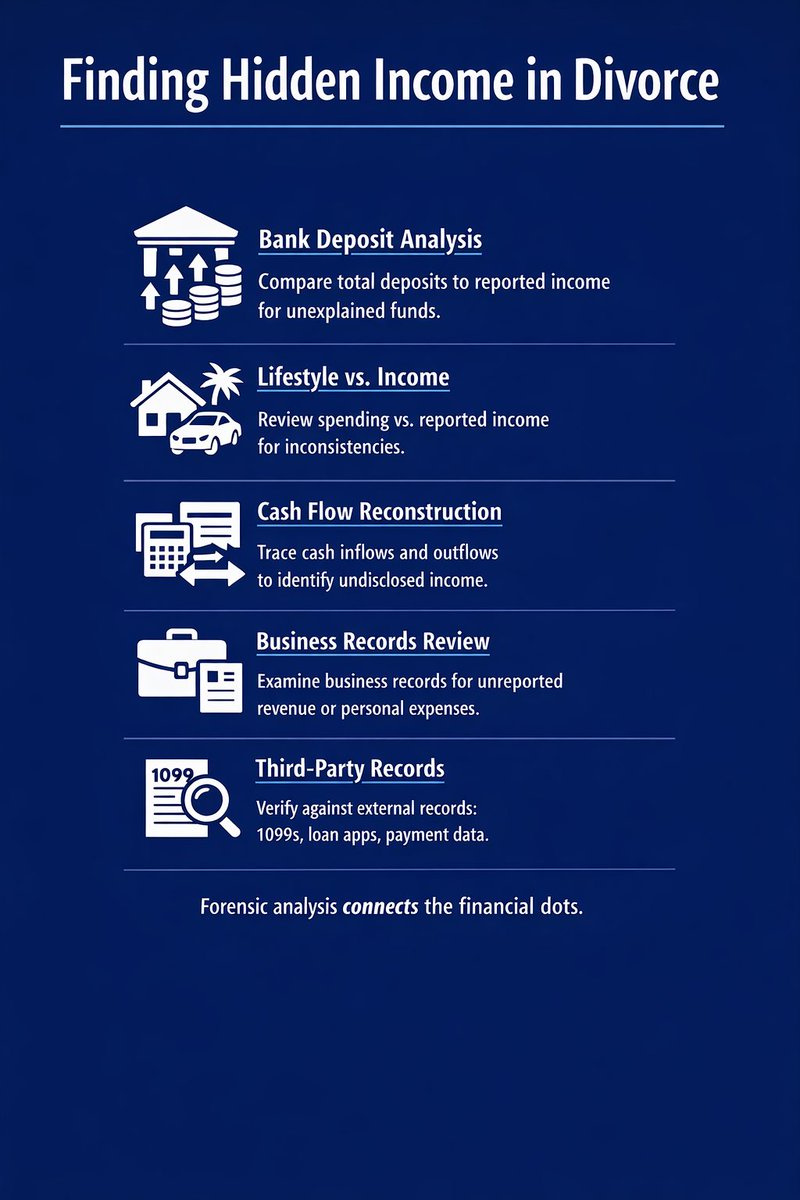

In divorce matters, an accurate support number and a fair division of assets depend on understanding what income and assets actually exist. Forensic analysis examines bank activity, lifestyle, business records, cash flow, and third-party documents to identify what is truly…

I know I shouldn't be surprised, but the speed at which these new schemes are developing is disturbing. Now, fraudsters are using generative tools to fake resumes, documents, and credentials, and background screening providers are seeing a surge in suspicious submissions. This…

AI Fraud Has Exploded. This Background-Check Startup Is Cashing In. Read more: forbes.com/sites/iainmart…

In a nearly $5 M scheme, a Texas couple pled guilty to conspiracy to commit wire fraud after marketing fake renovation services, collecting payments, and abandoning unfinished work. Proper vetting, contracts, and documentation can help mitigate these kinds of losses.…

One of the more counterintuitive findings in fraud research: While about 30% of employee frauds occur in the first three years of employment, roughly 70% are committed by employees with 4–35 years of tenure. Experience, access, and trust often matter more than tenure alone when…

Hidden assets and hidden income are common issues in divorce cases. From a forensic perspective, identifying them depends on access to records, careful analysis and coordination with counsel to obtain the right information through discovery.

What happens when one spouse intentionally hides assets in a Massachusetts Divorce

This is an important point. Forensic analysis is only as good as the information available. In divorce and other financial disputes, the real work often starts with obtaining the right records through discovery. Coordinating effectively between counsel and forensic professionals…

Think your spouse is hiding money? A forensic accountant can’t help you find it in your divorce without THIS key step. #offthefence #divorcecoach #diovrcepodcast #divorcelaw

This is what accountability looks like when investigations lead to evidence, prosecution, and recovery. Strong controls and oversight matter — and when they fail, forensic investigations play a critical role in uncovering what happened and supporting enforcement.

Founder of Casa Ruby sentenced to 33 months in prison and ordered to repay $956,215 in stolen funds. Let it be a message to everyone, this office will always prioritize protecting our D.C. community and if you steal money from the government, you will be investigated and…

The size of that number is striking, and even more important, solving the problem requires understanding its true magnitude by distinguishing what is fraud, what is waste, and what results from weak controls. That kind of analysis is exactly what forensic accounting is designed…

The lowest estimate for yearly U.S. fraud tops $521 billion. $521,000,000,000. You work your entire life. Weekends and Holidays. You pay half your salary to the government. And it's handed right over to fraudsters.

Good thread by @SamAntar highlighting Tracy Coenen’s forensic framework for proving intent. The analysis is interesting from a fraud-methodology standpoint, with one important caveat: the Letitia James criminal case was dismissed on procedural grounds, not on the merits. Legal…

MAJOR: Independent forensic accountant Tracy Coenen (CPA, CFF) just published her analysis of how to prove intent in the Letitia James mortgage fraud case. Her conclusion? "The record strongly points to 'yes'" - the evidence shows James intended to deceive. Read Tracy Coenen's…

The global forensic accounting market continues to expand as fraud detection, compliance demands, and financial oversight grow. Data analytics and technology are increasingly central to modern investigations. openpr.com/news/4346580/f…

The Minnesota fraud case is a good reminder of what forensic accounting actually involves. Audits ask whether numbers are fairly stated. Forensic accounting asks how the money moved, who touched it, and why it looks wrong. Following the money is the work. 🔗…

Whoops!

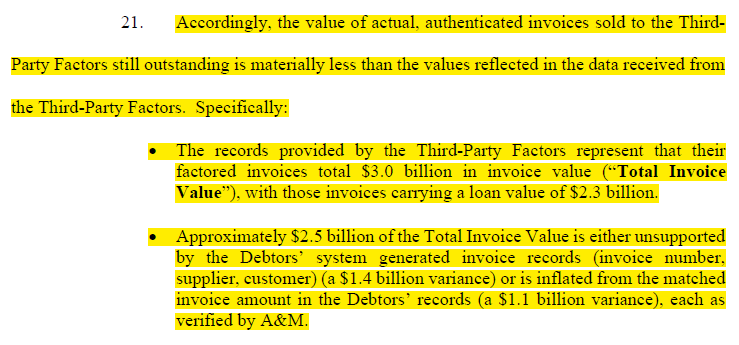

The first accounting forensic analysis is coming out in the First Brands BK. Of the $3B in factored invoices, $2.5B was fraudulent. Totally crazy.

United States Trends

- 1. Bill Belichick N/A

- 2. Bill Polian N/A

- 3. #TheMaskedSinger N/A

- 4. Hall of Fame N/A

- 5. Brady N/A

- 6. HOFer N/A

- 7. Spygate N/A

- 8. NFL HOF N/A

- 9. #DelcyPorLaPaz N/A

- 10. Webb N/A

- 11. #DelcyConMiguelCabrera N/A

- 12. The HOF N/A

- 13. Kraft N/A

- 14. Derrick Moore N/A

- 15. Terrell Owens N/A

- 16. 8 Super Bowls N/A

- 17. Iowa N/A

- 18. #drwfirstgoal N/A

- 19. Palat N/A

- 20. Joe Lombardi N/A

Something went wrong.

Something went wrong.