YieldReport - Your Income Advantage

@YieldReport

Australia’s leading online research and data platform on Interest rates, Income focused Managed Funds, ETF, LIC and the factors that move them.

You might like

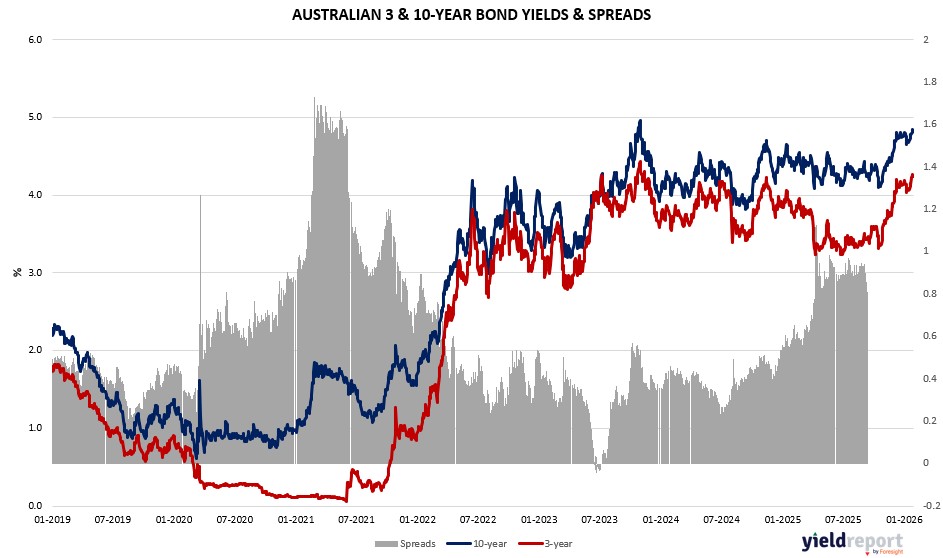

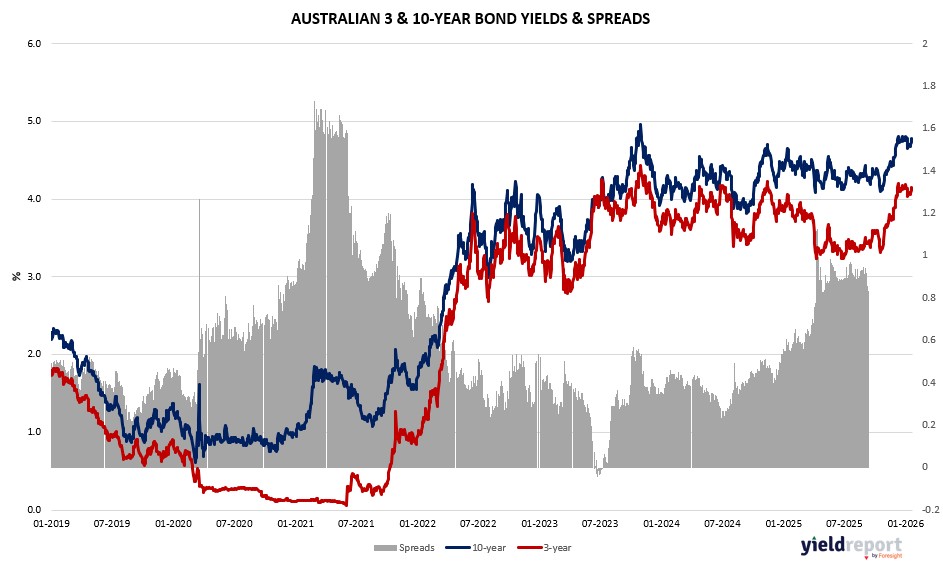

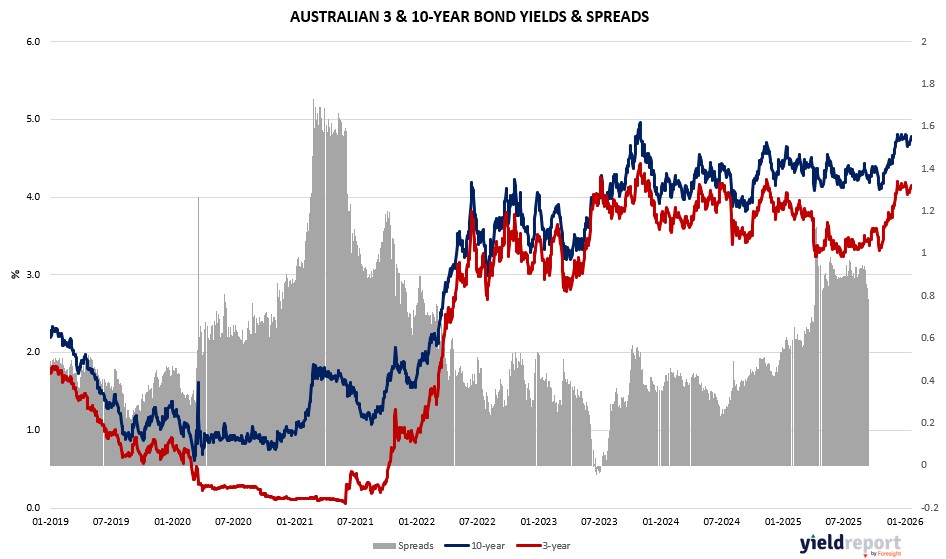

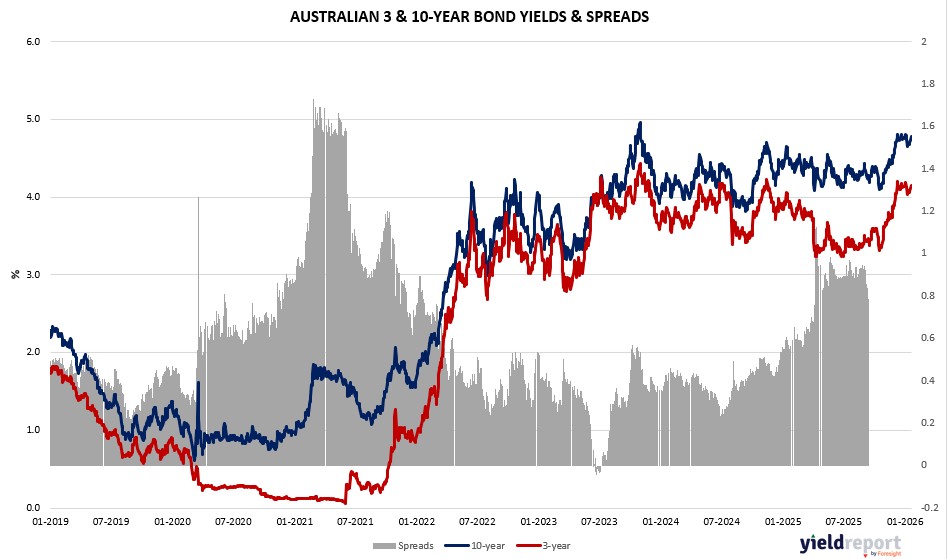

𝐇𝐞𝐫𝐞 𝐢𝐬 𝐨𝐮𝐫 𝐝𝐚𝐢𝐥𝐲 𝐛𝐨𝐧𝐝 𝐲𝐢𝐞𝐥𝐝 𝐮𝐩𝐝𝐚𝐭𝐞: Australian government bonds declined on January 28, 2026, with yields falling after hotter Q4 CPI data reinforced RBA hike expectations. yieldreport.com.au/category/daily… #YieldReport #FixedIncome #bondmarket

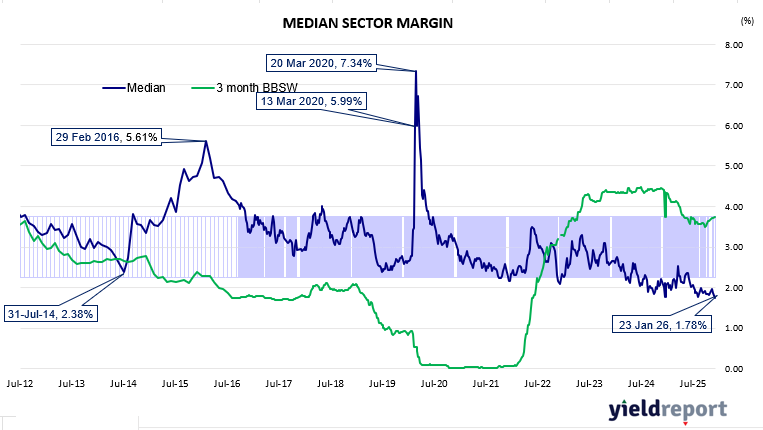

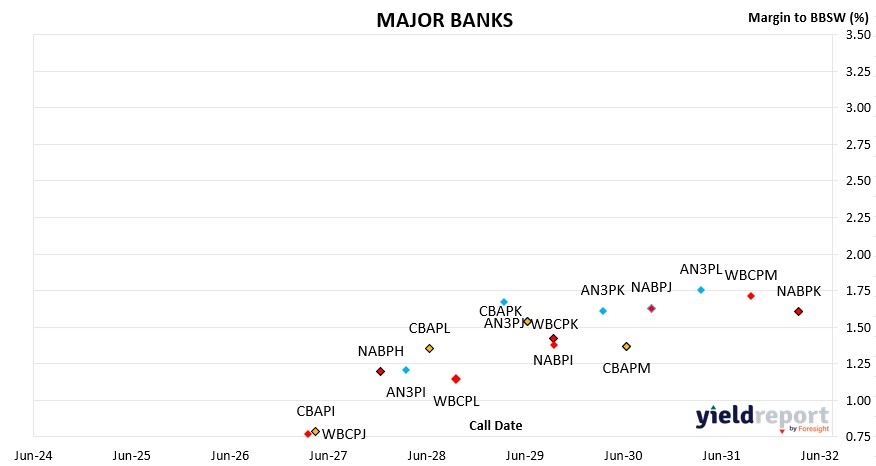

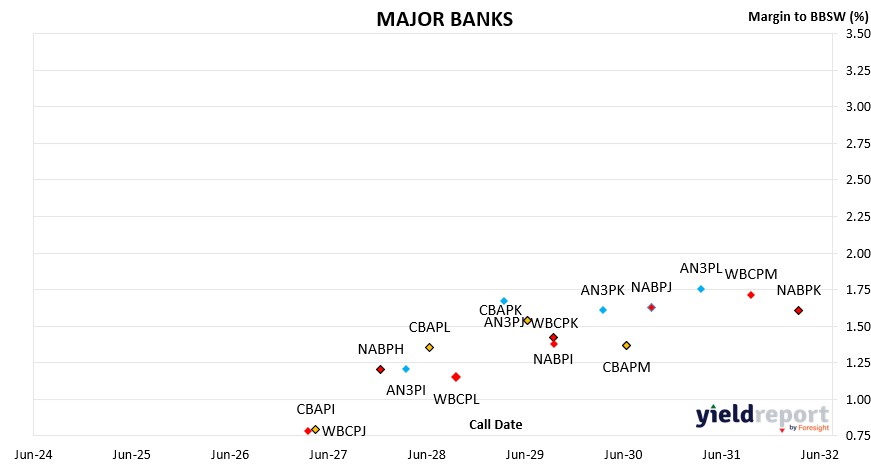

The ASX-listed hybrid market remained steady over the week, with both standard and non-standard instruments showing stable trading conditions. Day-to-day moves were modest, indicating a broadly calm trading environment. zurl.co/Pq0IW

Here is our ASX-listed daily hybrid update. zurl.co/XxaON Subscribe to Yield Report Weekly via LinkedIn to access detailed commentary and analysis. zurl.co/oEpnK #YieldReport #FixedIncome #BondMarket #asxhybrids #austrliaequity

𝐇𝐞𝐫𝐞 𝐢𝐬 𝐨𝐮𝐫 𝐝𝐚𝐢𝐥𝐲 𝐛𝐨𝐧𝐝 𝐲𝐢𝐞𝐥𝐝 𝐮𝐩𝐝𝐚𝐭𝐞: yieldreport.com.au/category/daily… Subscribe to the Yield Report Weekly via LinkedIn to access detailed commentary and analysis. linkedin.com/build-relation… #YieldReport #FixedIncome #bondmarket

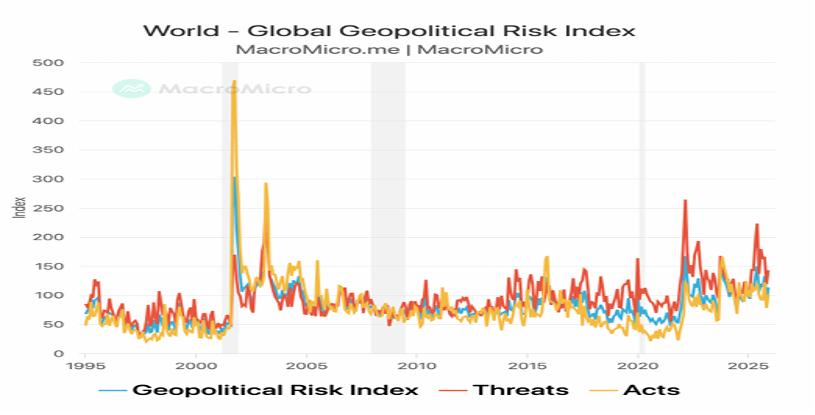

Chart of the Week –Global Geopolitical Risk Remains Elevated Global geopolitical uncertainty has remained elevated and volatile over the past few years, punctuated by sharp spikes during major global shocks. yieldreport.com.au #GeopoliticalRisk #GlobalUncertainty

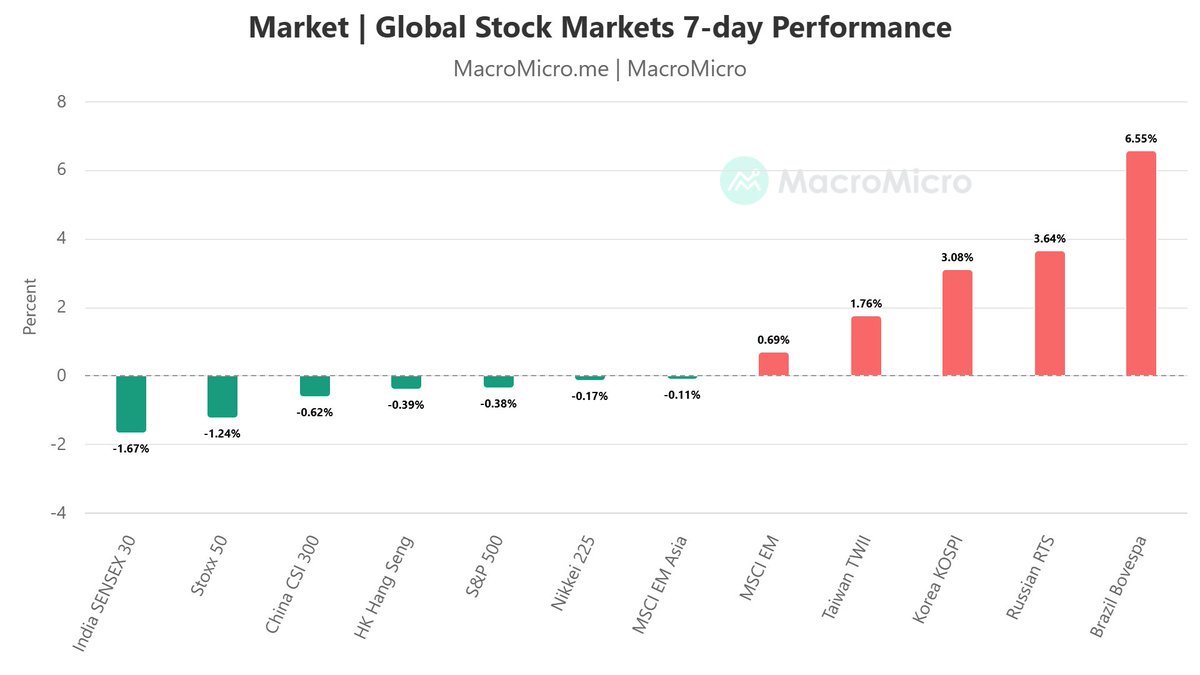

Here is our 47th edition of 2026 YieldReport Weekly, where we spotlight key market movements and corporate insights shaping Australia’s investment landscape. Top Story of the week - Emerging Markets: Bullish Inflexion Point yieldreport.com.au

Happy Australia Day 🇦🇺 At YieldReport, we’re proud to contribute to Australia’s financial ecosystem by delivering clear data-driven insights across markets from equities & bonds to yields & macro trends. Wishing our readers & the broader investment community a safe Day. #yield

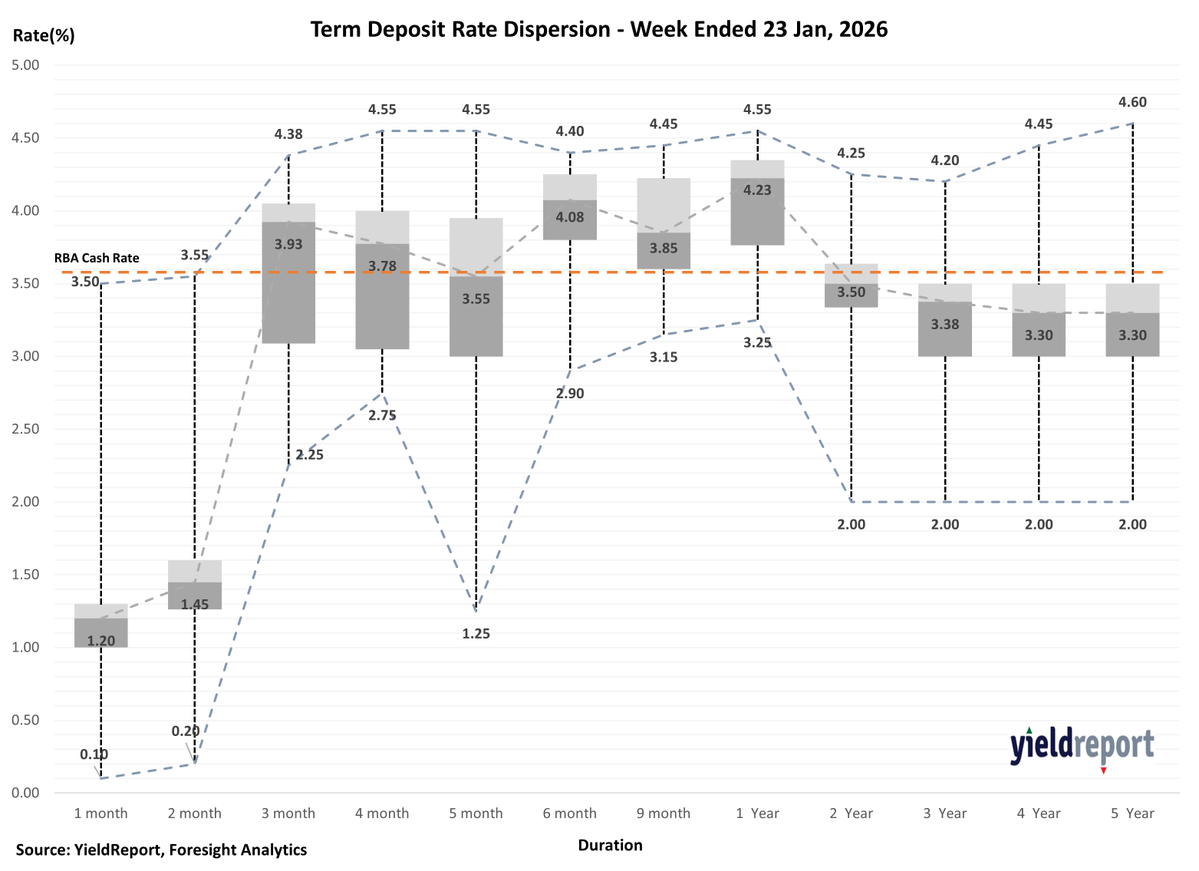

The movements in term deposit rates by major and non-major banks continue to show stability this week. Over the past week, ending January 23, 2026, there were minimal adjustments, with notable consistency across most terms despite some isolated tweaks. zurl.co/SZDwo

Here is our ASX-listed daily hybrid update. zurl.co/4alP8 Subscribe to the Yield Report Weekly via LinkedIn to access detailed commentary and analysis. zurl.co/AI73g #YieldReport #FixedIncome #asxhybrids

Australian government bond yields eased slightly on January 21, 2026, tracking US Treasuries lower amid global relief from Trump’s Greenland tariff avoidance, though domestic caution persisted ahead of key data. yieldreport.com.au/category/daily… #bonds #asx #usstock #government #tariff

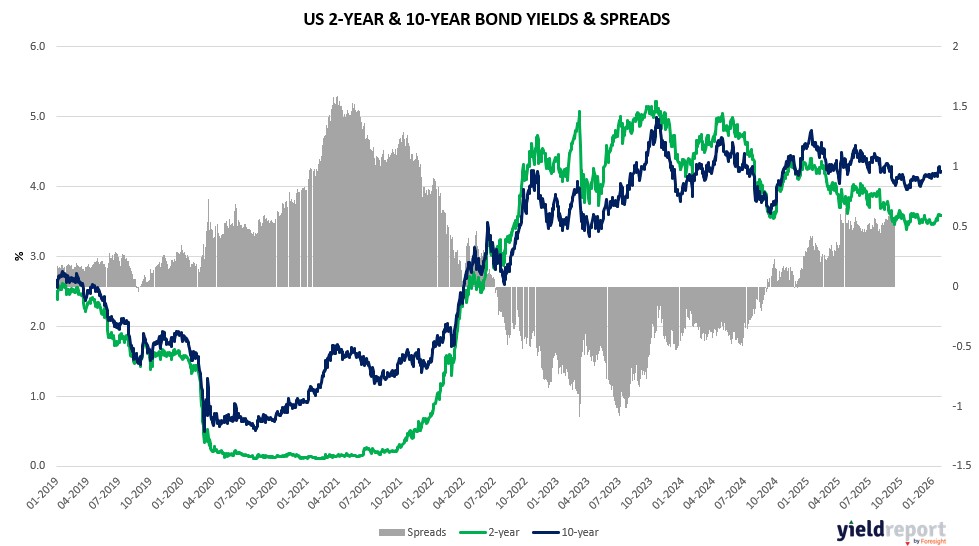

U.S. inflation ended 2025 in a relatively contained position, giving the Federal Reserve greater flexibility as it balances lingering price pressures against a cooling labour market. zurl.co/dgoQA

𝐇𝐞𝐫𝐞 𝐢𝐬 𝐨𝐮𝐫 𝐝𝐚𝐢𝐥𝐲 𝐛𝐨𝐧𝐝 𝐲𝐢𝐞𝐥𝐝 𝐮𝐩𝐝𝐚𝐭𝐞: zurl.co/LgmL6 Subscribe to the Yield Report Weekly via LinkedIn to access detailed commentary and analysis. zurl.co/sfPRn #YieldReport #FixedIncome #bondmarket

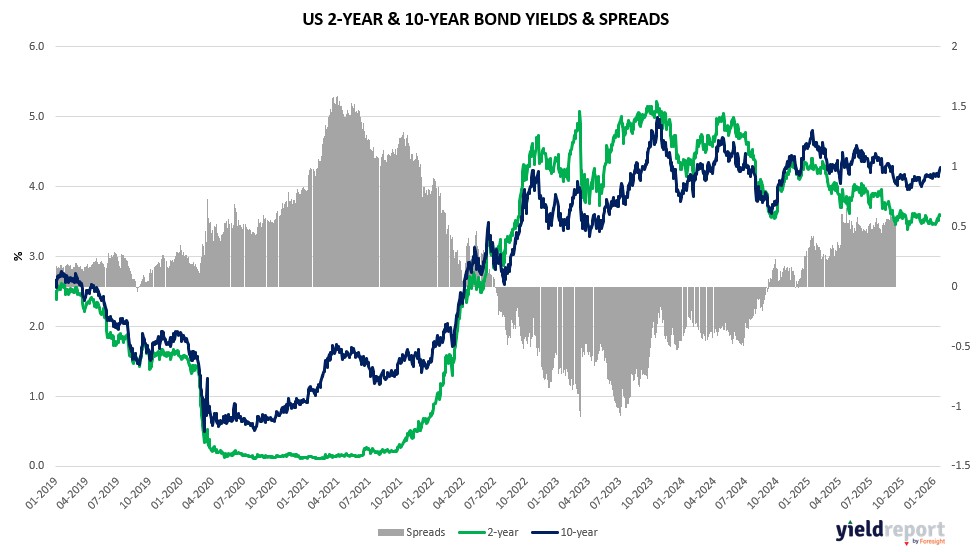

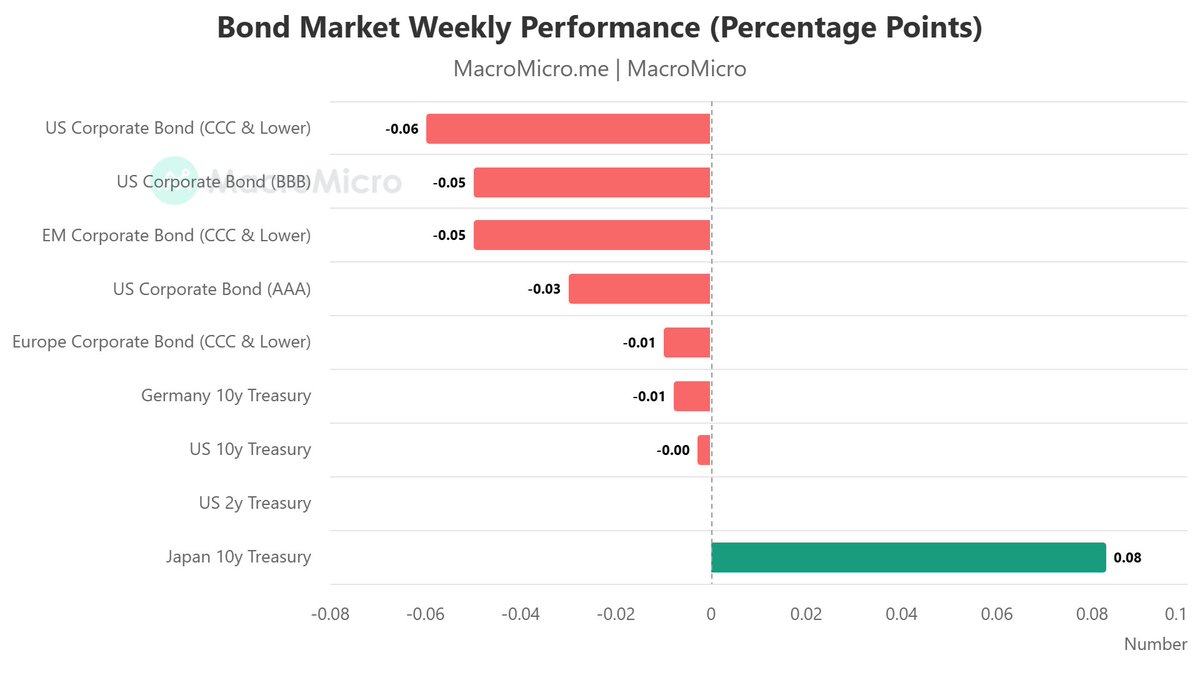

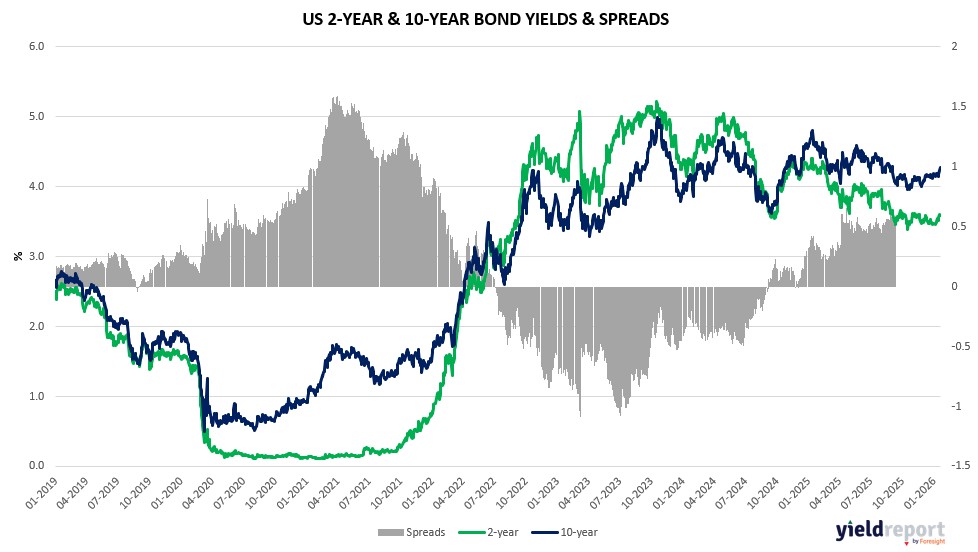

Weekly overview of the Bond Markets Global markets entered the final stretch of the week with optimism but sentiment softened after comments from Donald Trump raised doubts about the direction of US monetary policy leadership. yieldreport.com.au #asx #bond #globalmarket

Overview of the Australian Bond Market Australian government bond yields rose on January 20, 2026, tracking global selloffs as US Treasury turmoil from Greenland tensions and Japan’s fiscal worries pressured sentiment. yieldreport.com.au/category/daily… #government #bond #Australian

U.S. inflation ended 2025 in a relatively contained position, giving the Federal Reserve greater flexibility as it balances lingering price pressures against a cooling labour market. linkedin.com/pulse/us-infla…

The ASX‑listed hybrid market remained steady over the week, with both standard and non‑standard instruments showing stable trading conditions. Income levels in several non‑standard securities continued to stand out. Read full update here - zurl.co/Et7M6 #asxlisted

𝐇𝐞𝐫𝐞 𝐢𝐬 𝐨𝐮𝐫 𝐝𝐚𝐢𝐥𝐲 𝐛𝐨𝐧𝐝 𝐲𝐢𝐞𝐥𝐝 𝐮𝐩𝐝𝐚𝐭𝐞: zurl.co/HreNe Subscribe to the Yield Report Weekly via LinkedIn to access detailed commentary and analysis. zurl.co/jztSj #YieldReport #FixedIncome #bondmarket '

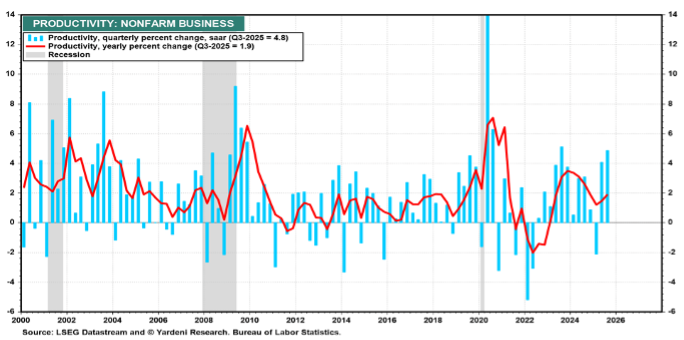

Chart of the Week -US Productivity & Inflation The surge in US productivity in 2025 played a decisive role in easing inflation pressures.Unit labour costs fell materially, with annual growth slowing to levels consistent with stable 2% inflation yieldreport.com.au

Markets treated the U.S. invasion of Venezuela as a geopolitical shock with surprisingly little immediate credibility as a “barrels‑off‑the‑market” event. linkedin.com/pulse/venezuel… #yieldreport #fixedincome #usinvasion

United States Trends

- 1. #Bridgerton N/A

- 2. Benedict N/A

- 3. Sabalenka N/A

- 4. Svitolina N/A

- 5. Fulton County N/A

- 6. Sophie N/A

- 7. Rockets N/A

- 8. #AEWDynamite N/A

- 9. Spurs N/A

- 10. USOR N/A

- 11. Sengun N/A

- 12. Wemby N/A

- 13. Mikey N/A

- 14. Ciampa N/A

- 15. #HandmadeWithLove N/A

- 16. Optimus N/A

- 17. Dylan Harper N/A

- 18. Donald Duck N/A

- 19. Castle N/A

- 20. Andrade N/A

You might like

-

Warren Hogan

Warren Hogan

@_warrenhogan -

Shane Oliver

Shane Oliver

@ShaneOliverAMP -

christopher joye

christopher joye

@cjoye -

Lea Waters AM, PhD

Lea Waters AM, PhD

@ProfLeaWaters -

Sean Callow

Sean Callow

@seandcallow -

Square Peg

Square Peg

@SquarePegCap -

David Scutt

David Scutt

@Scutty -

Rudi Filapek-Vandyck

Rudi Filapek-Vandyck

@Filapek -

Spotlight on China

Spotlight on China

@spotlightoncn -

James Glynn

James Glynn

@JamesGlynnWSJ -

Martin Whetton

Martin Whetton

@martin_whetton -

Matt Williams

Matt Williams

@Matt_Williams67 -

FIIG Securities

FIIG Securities

@FIIGSecurities -

Peter McInerney

Peter McInerney

@peter3DWagga -

Jonathan Pain

Jonathan Pain

@ThePainReport

Something went wrong.

Something went wrong.