Lectiophile

@_Lectiophile

Dedicated to the Love of Reading | Indophile | Books | History | Investing | Support on BMC: https://coff.ee/_lectiophile

I'm not fan, its value is mostly for stability, not big returns, so maybe just 5% for diversification. I'm more into equity.

the calmer you are, the clearer you think.

Research indicates that a "few-foods diet," which involves systematically eliminating and reintroducing foods, shows promise for children with #ADHD, potentially up to 60% responding positively. Despite conventional treatments, diet remains underexplored. zerohedge.com/medical/can-di…

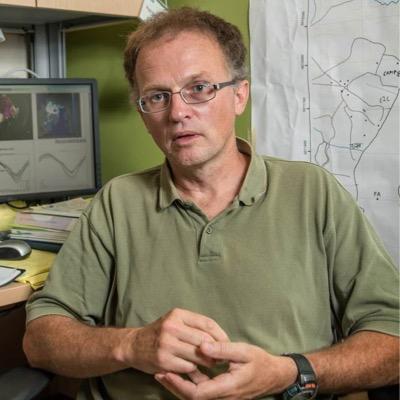

Prof. Aswath Damodaran isn’t just a valuation guru — he’s a master of investing discipline. Here’s how he builds, manages, and protects wealth. #Valuation #Investing #ValueInvesting

Only the disciplined ones in life are free.

The Most Valuable Financial Assets is not needing to impress anyone - Morgan Housel

20 Stocks in a portfolio gives sufficient diversification.

Risk Control No stock enters his portfolio above 5%. If it swells to 15–20%, he trims it down. Selling winners isn’t weakness — it’s discipline. On Activity Adds 3–5 stocks a year, sells 2–4. Calls himself an “incredibly lazy investor” — and that’s why he wins.

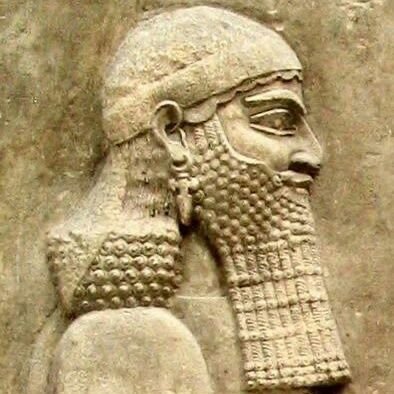

Doorway relief at Udayagiri–Khandagiri caves (1st BCE). Notice the sacred tree, guardian dwarf, animal motifs & scenes of daily life. A blend of Jain symbolism and royal patronage, carved in stone 2000 years ago.

United States Trends

- 1. Packers 99.9K posts

- 2. Eagles 128K posts

- 3. Jordan Love 15.4K posts

- 4. Benítez 13.5K posts

- 5. Veterans Day 30.9K posts

- 6. #WWERaw 137K posts

- 7. LaFleur 14.8K posts

- 8. #TalusLabs N/A

- 9. Green Bay 19.1K posts

- 10. AJ Brown 7,174 posts

- 11. McManus 4,496 posts

- 12. Grayson Allen 4,351 posts

- 13. JOONGDUNK BRIGHT SKIN 214K posts

- 14. Sirianni 5,129 posts

- 15. Kevin Patullo 7,082 posts

- 16. Jaelan Phillips 8,222 posts

- 17. Smitty 5,615 posts

- 18. James Harden 2,023 posts

- 19. Jalen 24.2K posts

- 20. Berkeley 63.4K posts

Something went wrong.

Something went wrong.