Capital Currents

@_capitalcurrent

Flows Related Market Research | All Tweets Are My Own Thoughts | None of My Tweets Are Investment Advice | I May Own/Trade the Assets/Markets Mentioned

You might like

A lot of discussion on Fed tapering and rate hikes Here is a quick thread on what I believe is the primary driver of past macro cycles and potentially the next one: The Federal Reserve's Balance Sheet

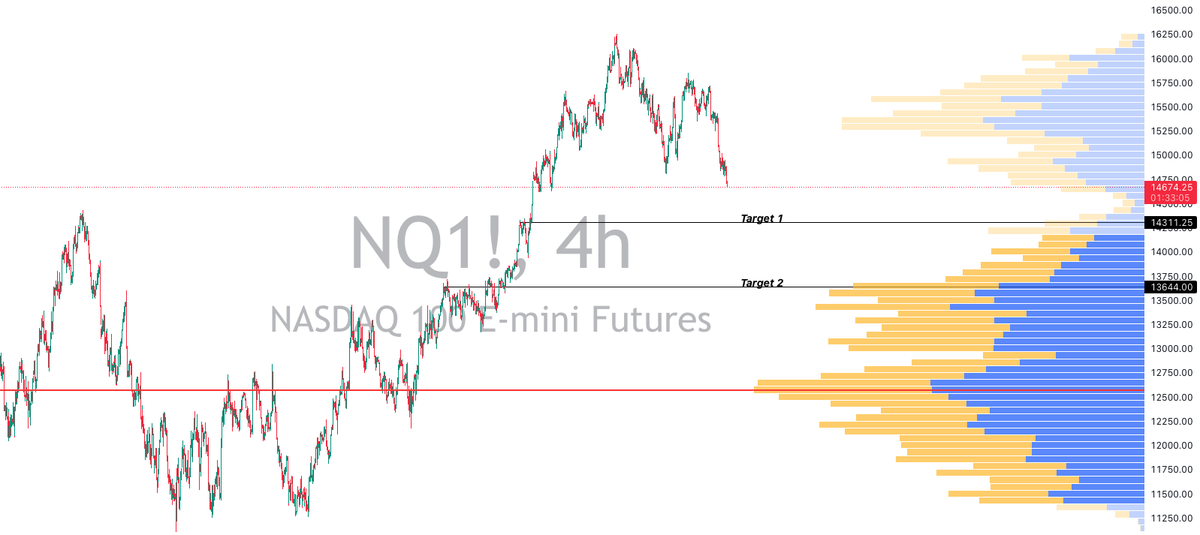

$NDX update. Broken structure, but hasn't followed through yet, this just builds the bias to the downside. Typically we can see a bounce after such a critical break of structure. Final confirmation will be if and when it revisits and follows through. #NDX $NQ $QQQ #US100

Unless there is bullish impulse into close, $NQ will cleanly broke Aug low today Now in a low volume void with no support until 14.3k and minimal support until 13.7k

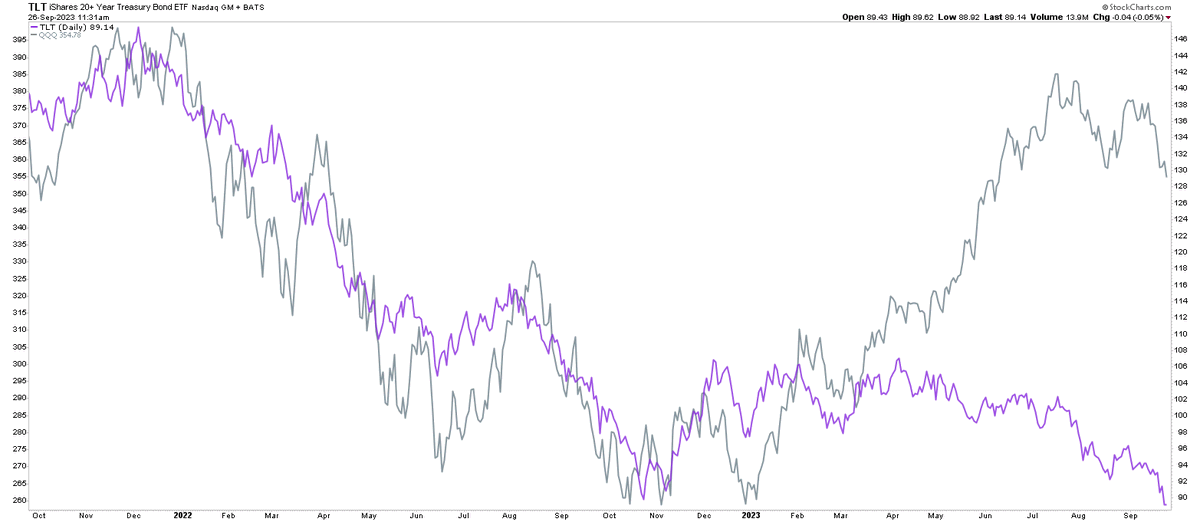

Unpopular opinion: $QQQ vs $TLT actually does matter And $TLT is saying $QQQ has more room lower over the intermediate term

✅

Thoughts on Gold... Higher Bond Yields -> Stronger USD -> Pressure on Gold Low volume zone on Gold between 1950 and 1963 Looking for a clean break below previous low of 1963

Thoughts on Gold... Higher Bond Yields -> Stronger USD -> Pressure on Gold Low volume zone on Gold between 1950 and 1963 Looking for a clean break below previous low of 1963

Once again 30-year bonds are making new lows in price, going back to levels we haven't seen since 2011. This is putting pressure on tech, growth, biotech, and other longer duration risk as well as the greater market. Don't ignore the bond market.

$QQQ and $TLT diverging again Once again, think it settles with equities catching up to downside

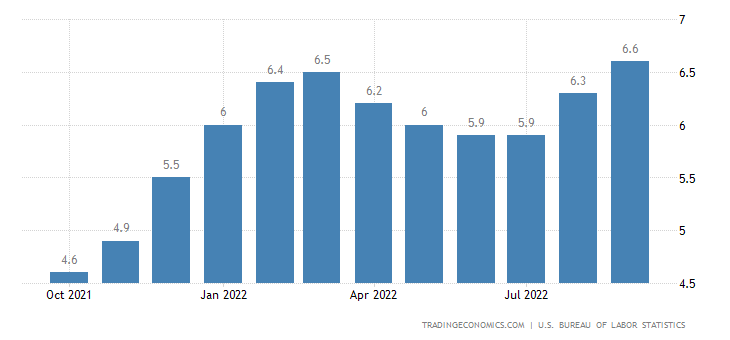

The difference between last month CPI and this month Last month everyone was levered long going into it, this month most markets were net short or at least flat risk

Bonds are just puking. What a bloodbath in the 30-year.

Long end bonds are in free-fall while $QQQ and $SPY try to stabilize Positioning in the two assets was similar heading into CPI, which would suggest stocks have some catching up to do

Core CPI came in at its highest print all year Remember, the Fed use core and not headline CPI to monitor inflation and guide its policy Source: tradingeconomics.com

After a brief divergence last week, $QQQ and $TLT have come back in line Once again $QQQ caught up on the downside, this time post NFP

Gap between $QQQ and $TLT widening with $TLT leading the downtrend In the previous four widenings, the gap has closed with $QQQ catching up to the downside downside

Target reached, closed half of risk Letting other half run with a trailing stop

Not sure if anyone here looks at long-end treasury futures But I like a $UB short if we get a break below current channel

Currently unfolding

Market starting to find support post NFP Will look to short a break below blue box with the expectation that underwater OI will have to unwind Targeting bottom of range ~19k-19.1k

BTC showing strength amidst the equities and rates sell-off Think that these late shorts get rinsed with any pop in $QQQ or $TLT Still bearish medium term into CPI

Market starting to find support post NFP Will look to short a break below blue box with the expectation that underwater OI will have to unwind Targeting bottom of range ~19k-19.1k

NFP tomorrow at 8:30am Given this week's rally in stocks, a strong print (>250k) likely to have a greater effect than a weak print If we print higher than last month (315k), expecting the majority of the rally to be reversed

United States Trends

- 1. #UFC324 N/A

- 2. Paddy N/A

- 3. Alex Pretti N/A

- 4. Derrick Lewis N/A

- 5. Derrick Lewis N/A

- 6. O'Malley N/A

- 7. #SNME N/A

- 8. Suga N/A

- 9. Silva N/A

- 10. #Skyscrapperlive N/A

- 11. Moro N/A

- 12. Song Yadong N/A

- 13. #UFCParamount N/A

- 14. Kyle Rittenhouse N/A

- 15. Mavs N/A

- 16. Battle of Gods N/A

- 17. Dragon Ball N/A

- 18. #MuratallaCruz N/A

- 19. Minneapolis N/A

- 20. Ayton N/A

You might like

Something went wrong.

Something went wrong.