Adam Megginson

@adam_benchmark

Principal Analyst @Benchmarkmin | Leading price reporting agency & market intelligence for the lithium ion battery supply chain

You might like

⛏️You may have heard that US Defense needs Rare Earths... Crucial US military platforms such as the Arleigh Burke destroyer and Virginia-class submarine require 2.6mt and 4.6mt of #REEs to be precise. ✈️F-35 Fighter jets use 418kg of REEs, essential for weapons targeting…

🌍Beyond excited to join @benchmarkmin's inaugural #GigaAfrica conference in September. #Cell, anode and cathode producers are looking to derisk and diversify their supply chains, elevating the profile of projects in Africa. And these projects are now reaching further and…

"Benchmark's forecasts assume an end to US EV tax credits." As supply chain participants digest a cooling of the dramatic #tradewar between the US and China, a landmark bill is introduced into Congress which would see most tax benefits for EVs eliminated by the end of 2026. If…

🔎Why are lithium prices sliding? Sellers in China have expressed consternation given a robust domestic demand picture in April. But falling buying interest in the seaborne import markets of South Korea and Japan has weighed on prices. And now domestic sentiment is turning more…

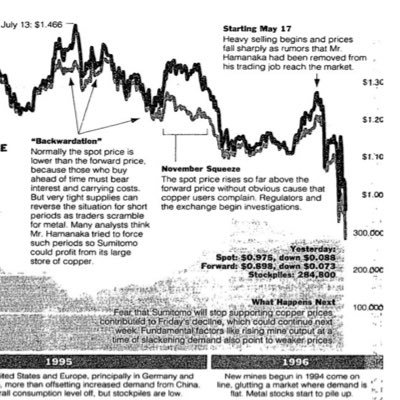

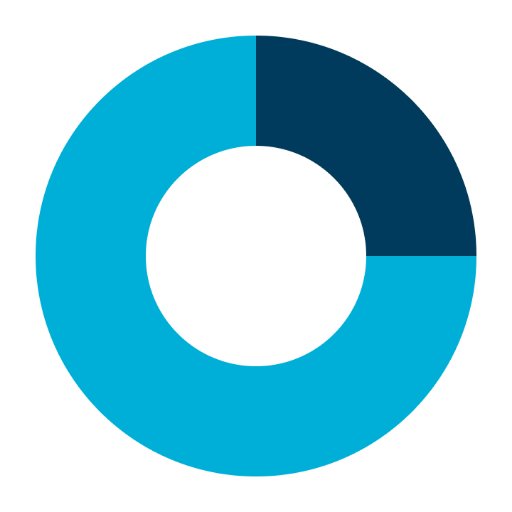

🚧 Our analysis shows the US is set to fall short of meeting most of its critical mineral demand domestically, even if all announced projects come online as planned. Take #lithium, domestic mining has the potential to meet 67% of #battery demand if all projects come online, as…

🌡️ Pet coke prices have been rallying due to a tightening supply picture, and are now pushing pet needle coke prices up too. Pre-calcined #petcoke prices have risen sharply by 80% year-to-date. This surge has been driven by new taxes in #China reducing the margins of domestic…

🔎 Benchmark LFP black mass prices have fallen 39.0% since they peaked in April 2024 at $645 per % of Li contained. On an EXW China basis, they are now down to $393 per % Li contained – a 14.2% decline in September versus August. 📉 Falling virgin lithium carbonate prices have…

💵 How to Finance the Energy Transition? It could be the biggest question facing this ambitious transition. The role of the private sector has always been top of mind, but the public sector's role has come into sharper focus since the US' ambitious IRA was signed into law in…

benchmarkminerals.com

Benchmark Event | Benchmark Week 2024

Since 2016, Benchmark Week has been the leading gathering for the world’s lithium-ion battery supply chain and the wider energy transition. This year, multiple content streams held simultaneously...

The largest acquisition in the lithium market to date. And at a hefty 90% premium to the current Arcadium share price. But why such a premium? The cash offer comes to $6.7bn, 56% higher than Arcadium’s average market capitalisation since it was formed from the merger of Livent…

🗞 Reports of a halt to production at CATL's mica mine in Jiangxi Province drove a notable rebound in lithium price sentiment in #China this week This was bolstered by Chinese #mica miner and processor, Jiuling Lithium, announcing it would pause operations for 10-15 days for…

Market led pricing, also known as indexing, is used in a wide range of #criticalmineral and other more mature #commodity markets as a mechanism to settle prices for long term supply contracts. Our goal is to provide the industry's most accurate and reliable price assessments,…

🔻The Benchmark Lithium Price Index falls 3.2%, despite bearish price sentiment easing somewhat in China Destocking of EV and finished cell inventory limits pressure for midstream players to procure raw materials and weighs on chemicals prices Meanwhile, sellers in #China show…

🌎 Benchmark Lithium Price Index falls 4.6% driven by falling prices outside China, as bearish summer sentiment extends into July 🇨🇳 In the Chinese domestic market prices tick down as short term demand expectations remain negative #Cell sales in June exceeded production, so…

🔻Benchmark lithium hydroxide prices in China fall marginally by 2.0% week-on-week as downstream demand sentiment turns gloomier. After strong consecutive month-on-month increases in cathode production figures in China during March and April, contacts reported lower expectations…

United States Trends

- 1. #GMMTV2026 745K posts

- 2. MILKLOVE BORN TO SHINE 128K posts

- 3. Good Tuesday 20.9K posts

- 4. #WWERaw 77.5K posts

- 5. TOP CALL 9,497 posts

- 6. AI Alert 8,179 posts

- 7. Brock Purdy 14.4K posts

- 8. Barcelona 142K posts

- 9. Bryce 21.3K posts

- 10. Keegan Murray 1,565 posts

- 11. Check Analyze 2,466 posts

- 12. Token Signal 8,740 posts

- 13. Timberwolves 3,921 posts

- 14. Finch 15K posts

- 15. Alan Dershowitz 2,797 posts

- 16. Market Focus 4,786 posts

- 17. Dialyn 7,947 posts

- 18. The Quickest 3,153 posts

- 19. Enemy of the State 2,613 posts

- 20. Niners 5,940 posts

You might like

-

Daisy Jennings-Gray

Daisy Jennings-Gray

@daisy_benchmark -

Caspar Rawles

Caspar Rawles

@CDMRawles -

Daniel Jimenez Sch

Daniel Jimenez Sch

@D_Jimenez_Sch -

Dr Cameron Perks

Dr Cameron Perks

@DrCamPerksBMI -

Matt Fernley

Matt Fernley

@matt_fernley -

Iola Hughes

Iola Hughes

@RhoMoIola -

Andy Leyland

Andy Leyland

@andyleyland1 -

Rock Stock Channel

Rock Stock Channel

@RKEquityRocks -

Keith Phillips

Keith Phillips

@keithdphillips -

Joe Lowry

Joe Lowry

@globallithium -

Rodney Hooper

Rodney Hooper

@RodneyHooper13 -

Lithium News

Lithium News

@INN_Lithium -

batteryjuniors

batteryjuniors

@batteryjuniors -

Mastermines

Mastermines

@Mastermines_HQ -

Haplo

Haplo

@HC_Haplo

Something went wrong.

Something went wrong.