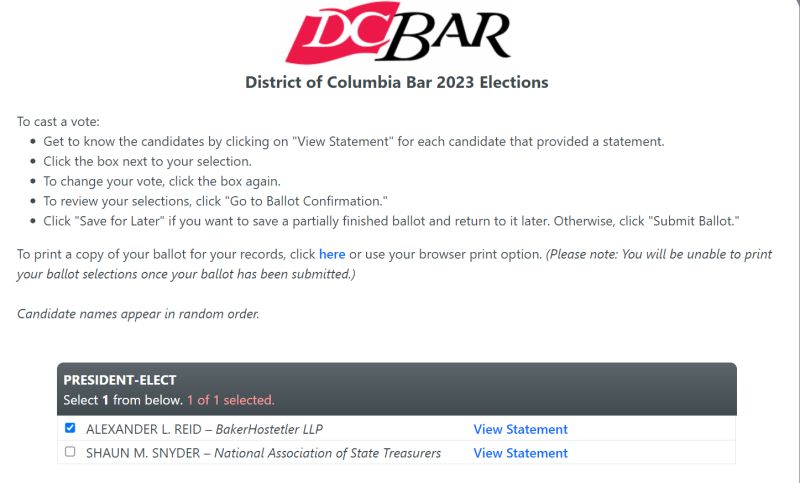

Alexander Reid

@alex_reid

Partner @BakerHostetler specializing in tax law and public policy. My views do not necessarily reflect those of the firm or its clients.

You might like

"Nor, this Court has held, do speakers shed their First Amendment protections by employing the corporate form to disseminate their speech. This fact underlies our cases involving everything from movie producers to book publishers to newspapers." And yet,…lnkd.in/gahXqWJy

Supreme Court on DEI: Race alone is not enough--you also have to write an essay. Fortunately, there's an app for that. lnkd.in/ga3879Eh

Supreme Court holds Harvard and UNC's admissions programs violate the equal protection clause of the 14th Amendment; however, "nothing prohibits universities from considering an applicant's discussion of how race affected the applicant's life so long as t…lnkd.in/gcp-5ZKM

Supreme Court will decide whether Congress has the power to tax unrealized gains under XVI Amendment (Moore v US). This has enormous significance for wealth taxes on The Great ($78T) Intergenerational Wealth Transfer, and, therefore, charitable giving. Th…lnkd.in/e7XaTs89

linkedin.com

Supreme Court will decide whether Congress has the power to tax unrealized gains under XVI Amendm...

Supreme Court will decide whether Congress has the power to tax unrealized gains under XVI Amendment (Moore v US). This has enormous significance for wealth taxes on The Great ($78T) Intergeneratio...

Attention sports fans! IRS says Name Image Likeness charities don't qualify for tax exemption because they benefit the players too much. Maybe try scholarships instead? lnkd.in/gxT7EXeM

A (di)lemma: 95% of lawyers choose not to vote in D.C. Bar elections because, beyond licensure, the DC Bar is not relevant to their daily practice. Like all institutions, the DC Bar focuses on those who engage with it, i.e. the 5%,…lnkd.in/dkCWMksn lnkd.in/eazMsYPf

Election update: 6,000 of 115,000 D.C. Bar members have voted, which represents 5.2%. Apathy is still winning by a landslide, but we are making progress. To the 109,000 of you who have yet to vote: what are you waiting for? The ele…lnkd.in/eWCeWqme lnkd.in/eazMsYPf

In this D.C. Bar podcast, Howard University School of Law Dean, Danielle Holley, and I reflect on civil rights, nonprofits, and our time together at Yale University. Take a listen! lnkd.in/eFffUTiw

How much nonexempt activity a social welfare organization can conduct depends on whether it is medical or political. lnkd.in/eG22TUCd

DC Bar election update: 3,796 votes have been cast with 15 days to go. Only 3.3% of our 115,000 members have voted. We need your help to get that number up! Please take a moment now to vote lnkd.in/eazMsYPf. Thank you for y…lnkd.in/dTZVsQzW lnkd.in/dE-dBgAA

Apathy kills membership organizations. Please vote! There are 115,000 members of the DC Bar and only 2,000 votes have been cast. Let's see if we can get above 5%! lnkd.in/eazMsYPf lnkd.in/extri4tx

I am running for President-Elect of the DC Bar. Voting starts today! Please vote and encourage your colleagues to do likewise. Thank you. lnkd.in/eazMsYPf lnkd.in/ewMTK_7F

Will Congress take up the mantle of nonprofit oversight, and is that a good thing? lnkd.in/eDxgjAHB lnkd.in/egpqyTF8

Some advice from Tax Court judge Joe Nega in anticipation (get it?) of St. Patrick's Day: "Gift before sale, all is well; sale before gift makes you feel sick!" In other words, "To avoid an anticipatory assignment of income on the contribution of apprecia…lnkd.in/eTF2RYdY

President proposes $214B revenue raiser to apply ordinary income tax rates (i.e. 39.6%+) to long-term capital gains and qualified dividends of those earning more $1 million, and to treat gifts and bequests as taxable realization events (other than gifts t…lnkd.in/eeraV8Bd

President's Budget proposes to modify private foundation minimum distribution requirement by disqualifying (1) grants from private foundations to DAFs and (2) compensation and other payments to foundation insiders from counting toward foundation's minimum…lnkd.in/eqwyJ6vW

Happy new year! Here are some predictions for what may be in store for exempt organizations. lnkd.in/g8htqgTv lnkd.in/gvZcyq3C

Charitable deduction for syndicated conservation easements limited in new legislation. Charitable contributions made by a partnership in a conservation easement transaction are not qualified conservation contributions if the amount of the contribution exc…lnkd.in/gekRQhsM

Legacy IRA Act included in Omnibus! One-time, tax-free distribution from individual retirement accounts (IRAs) to split interest entities like charitable gift annuities (CGAs) and charitable remainder trusts (CRTs). Maximum lifetime contribution limit is…lnkd.in/gYy2XA4d

Big news for international nonprofits! New regulations provide a general license for humanitarian relief, democracy building, education, development, environmental protection, and peacebuilding. Thanks OFAC! lnkd.in/gyHbQHMb

United States Trends

- 1. Cowboys 55.3K posts

- 2. Eagles 88.6K posts

- 3. Ceedee 13.5K posts

- 4. George Pickens 8,273 posts

- 5. Browns 71.8K posts

- 6. Tom Brady 9,484 posts

- 7. Raiders 46.2K posts

- 8. Nimmo 15.1K posts

- 9. Saquon 5,202 posts

- 10. Shedeur 75K posts

- 11. Mets 21.3K posts

- 12. Trevor Lawrence 3,367 posts

- 13. Myles Garrett 8,262 posts

- 14. Patullo 7,221 posts

- 15. Jalen 21.2K posts

- 16. Jags 5,290 posts

- 17. Semien 9,726 posts

- 18. #PHIvsDAL 6,638 posts

- 19. Aubrey 8,094 posts

- 20. Philly 14.2K posts

Something went wrong.

Something went wrong.