Manoj Gupte

@ali2asuk

Senior Finance Professional I IIM A I Microcap Investor I Long Term Investor I Sharing Data/ Personal Views not recommendation | Not Sebi Registered

🎇 My Diwali 2025 Stock Picks — 5-Year Multibagger Stories in the Making 🇮🇳✨ These are not just stocks… these are transformational stories unfolding across Defence ⚔️, Renewable Energy ☀️, EPC 🏗 & Manufacturing 🏭. Valuations look compelling vs growth runway👇 #showmore

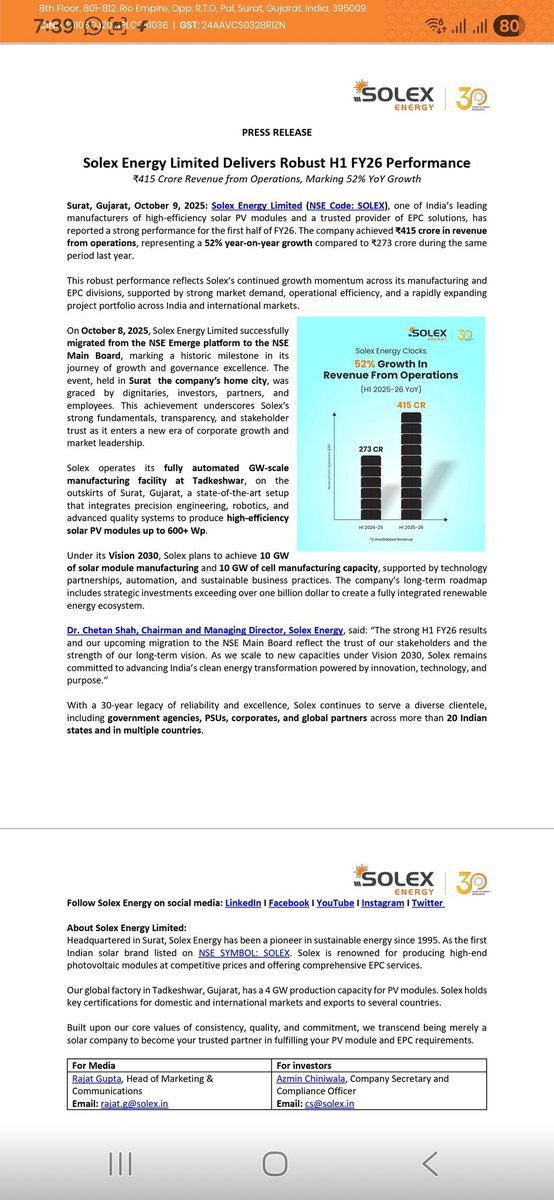

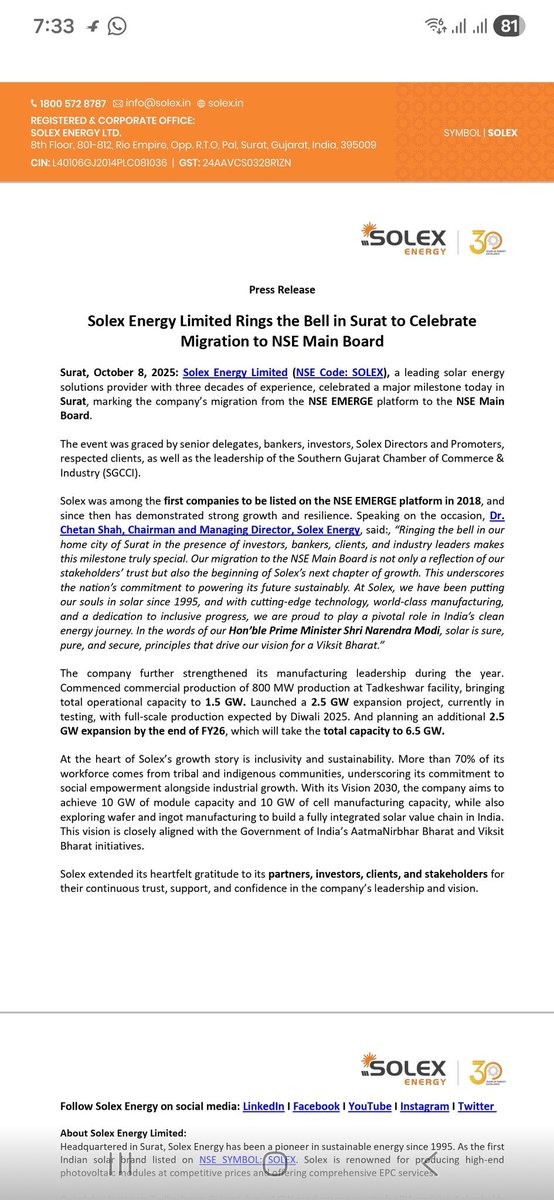

🚨 #SOLEX — A Solar Powerhouse in the Making ⚡️🇮🇳 H1 FY26 Revenue: ₹415 Cr ✅ H2 Run-rate: 4 GW × ₹20/W → @ 50% utilisation for 5months ₹1,700-1900 Cr potential 🌞 📊 FY26 Outlook Topline ₹2,100–2,300 Cr PAT ₹130–160 Cr (6–7 %) @25 × → MCap ₹3,250–4,000 Cr #showmore

⚔️ 2️⃣ Sunita Tools ($SUNITATOOLS) > ⚔️ Defence manufacturing microcap… artillery shell production just the beginning. Second pick from my #DiwaliPicks2025 👇 [🧵 Original Thread] x.com/ali2asuk/statu…

🎇 My Diwali 2025 Stock Picks — 5-Year Multibagger Stories in the Making 🇮🇳✨ These are not just stocks… these are transformational stories unfolding across Defence ⚔️, Renewable Energy ☀️, EPC 🏗 & Manufacturing 🏭. Valuations look compelling vs growth runway👇 #showmore

🕌✈️📈 From Taj to Trillion 🇮🇳 — Tourism Can Power India’s Next Growth Wave Tourism is more than just leisure — it’s a powerful economic engine: 💰 $247 Bn – Contribution to India’s GDP in FY23 (~9.2% of total) 🌍 $1 Trillion+ potential by 2047 (FICCI / WTTC) 👷♂️ 100 #showmore

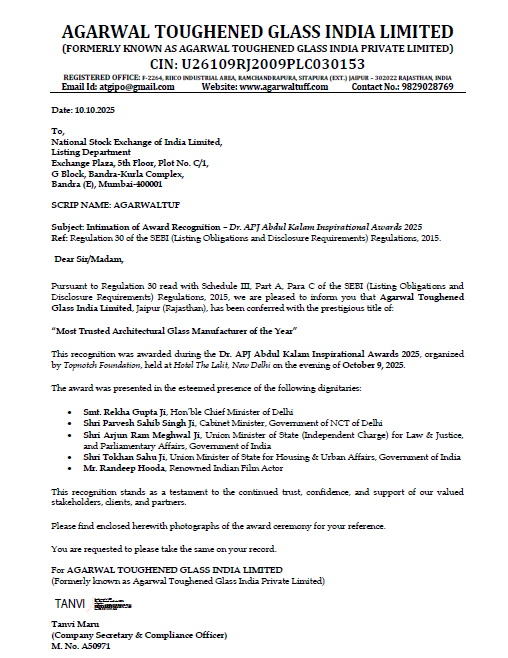

🏆 Agarwal Toughened Glass India Ltd (AGARWALTUF) has been honoured as “Most Trusted Architectural Glass Manufacturer of the Year”🏅 📍 Dr. APJ Abdul Kalam Inspirational Awards 2025 📅 Oct 9 | Hotel The Lalit, New Delhi #showmore x.com/ali2asuk/statu…

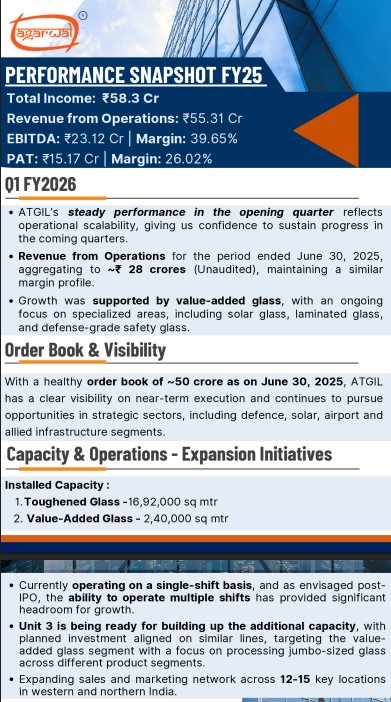

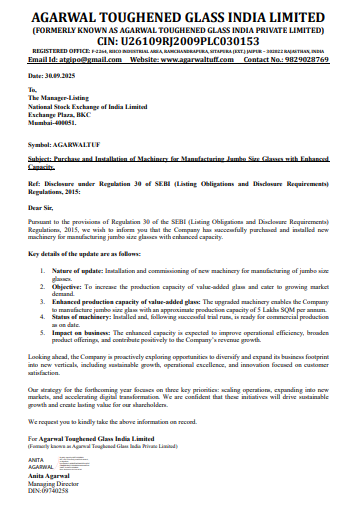

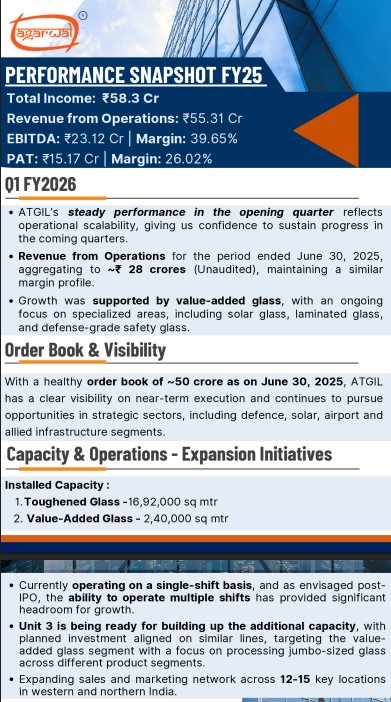

🚀 $AGARWALTUF – Agarwal Toughened Glass Ltd 📊 FY25 Snapshot Revenue: ₹55.3 Cr EBITDA: ₹23.1 Cr (≈ 40% margin) PAT: ₹15.2 Cr (≈ 26% margin) 📌 Q1 FY26 & Order Book Q1 (unaudited) revenue: ~₹28 Cr Order book as of June 30, 2025: ~₹50 Cr #showmore

🚀 $AGARWALTUF – Agarwal Toughened Glass Ltd 📊 FY25 Snapshot Revenue: ₹55.3 Cr EBITDA: ₹23.1 Cr (≈ 40% margin) PAT: ₹15.2 Cr (≈ 26% margin) 📌 Q1 FY26 & Order Book Q1 (unaudited) revenue: ~₹28 Cr Order book as of June 30, 2025: ~₹50 Cr #showmore

📈 Equity Markets: More Than Just Numbers 💭 Over the years, I’ve realised that the equity market is not just a place to invest money — it’s a place where we invest emotions, patience, and belief. I’ve seen cycles of euphoria and fear…🔄 Moments when everything seems #showmore

United States Trends

- 1. Texans 36.5K posts

- 2. World Series 106K posts

- 3. CJ Stroud 6,494 posts

- 4. Mariners 90.2K posts

- 5. Blue Jays 92.4K posts

- 6. Seahawks 34.3K posts

- 7. Seattle 50.8K posts

- 8. Springer 65.3K posts

- 9. Nick Caley 2,442 posts

- 10. Dan Wilson 4,162 posts

- 11. #WWERaw 58.7K posts

- 12. White House 298K posts

- 13. Nico Collins 2,092 posts

- 14. Kenneth Walker 2,462 posts

- 15. Baker 37K posts

- 16. Bazardo 3,057 posts

- 17. Sam Darnold 4,149 posts

- 18. Demeco 1,708 posts

- 19. Munoz 10.2K posts

- 20. LA Knight 7,676 posts

Something went wrong.

Something went wrong.