Molly

@bigmagicdao

# semi-retired # prev @_btcinc @wxblockchain

Może Ci się spodobać

Naka’s PIPE investors got in at $1.12 with no lockup—455M shares. At $20, they’re sitting on a 20x. But with average daily volume around $2M, there’s $10B in potential sell pressure waiting to dump. Post-merge, things are going to get ugly. Imaging the dummy buys at $20…

Here’s why you shouldn’t buy NAKA, no matter how low the mNAV is: mNAV means nothing when the Bitcoin they claim to ‘hold’ isn’t actually theirs. Don’t touch it until they publicly disclose exactly how much of their BTC has been pledged as collateral.

NAKA’s announcement with Antalpha doesn’t improve the situation : it just reshuffles the same debt. Also signals that not many buyers wants their debt , since this time already secured by Bitcoin. The company retired its $200M Yorkville convertible note using a $203M credit…

Naka NT-10Q recap: 1.Missed the quarterly filing. 2.The numbers explain why: • $1.4M realized loss • $22.1M unrealized loss • $14.5M debt-extinguishment loss • $59.8M merger loss • +$21.8M FV gain Net loss: ~$75.8M. You’d miss the deadline too if you quarterly looks…

David Bailey tried to hijack Bitcoin’s credibility while dragging along fiat-era debt, bad accounting and a bloated acquisition they never understood. This $NAKA filing exposes a company collapsing under the weight of Bailey's vanity & incompetence. Loss after loss after loss.

Naka raised about 750m ish and paid 179m in fees , lol

Banks printing silly amounts of cash from DAT mania > Cohen Capital Markets disclosing $179 million ($20m cash + $159m shares) in fees for the $NAKA / Kindly deal ($740m raised) > Fwiw even though total # is nutty, don't think they're doing anything wrong. Just providing a…

Pretty sure crypto is currently pricing in the fall of Donald Trump Stupid reason to nuke but given the market is weak, it takes any excuse it's given And given the entire crypto sector foolishly sucked his dick and went all in on him for some brief temporary gains while he…

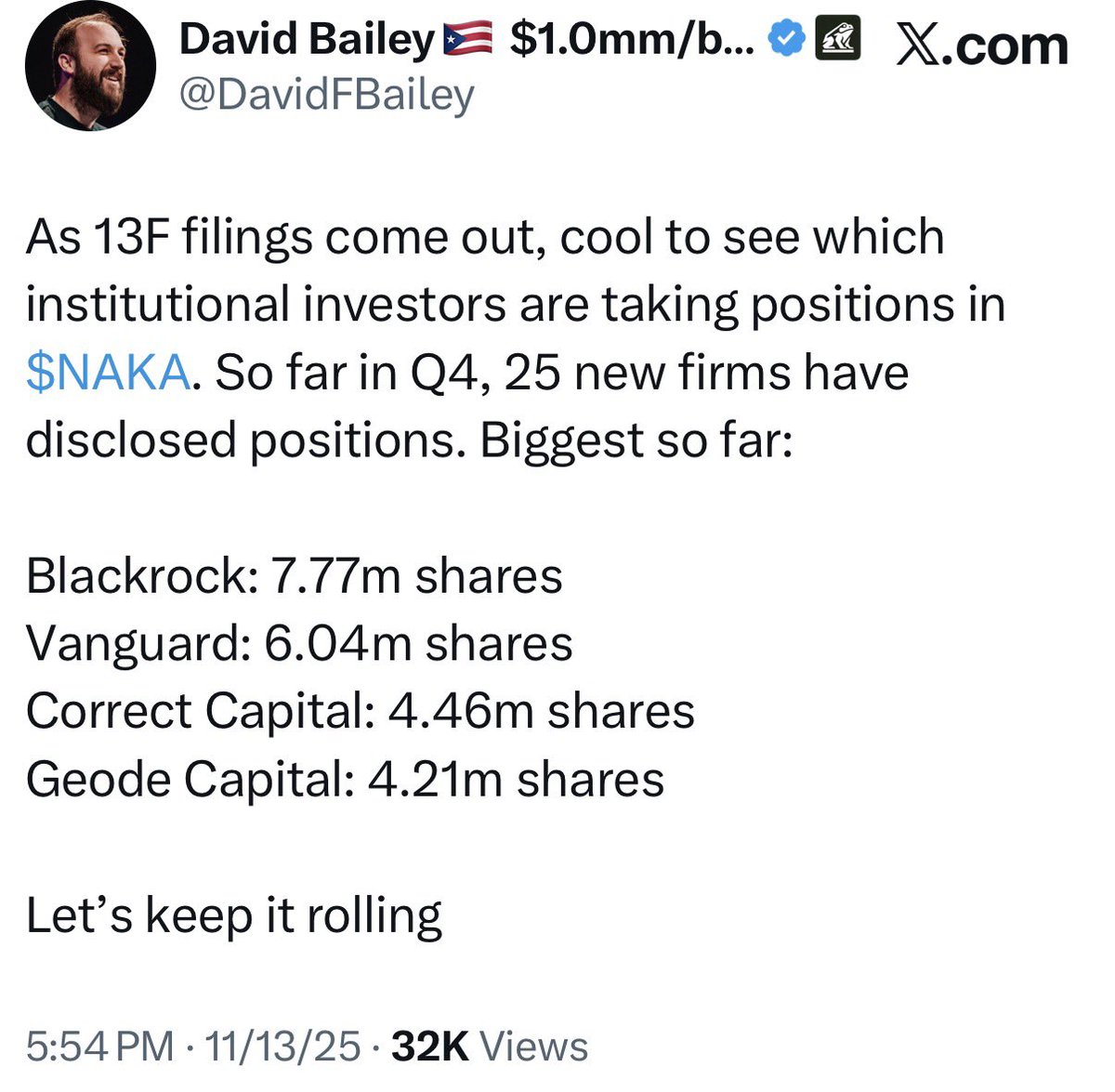

Friendly reminder: this is a misleading tweet. 13F ≠ institutions buying your stock. BlackRock/Vanguard hold tiny positions in thousands of companies because index rules force them to. Their microscopic positions only look ‘big’ on NAKA’s shareholder list because there were no…

Advice to CT “life coaches”: Stop giving life advice. Especially pretty, recycled clichés.

Molly is correct: Post-2020, Trump stared down a $454 million civil fraud judgment in New York that had the state gearing up to seize properties like 40 Wall Street if he didn't pony up. He dodged it by posting a slashed $175 million bond.

After Trump’s last term, his assets got frozen. And this term he’s in it for the money even more. But legacy wealth only survives if you have power , and power doesn’t last, and it sure can’t be inherited. Bitcoin is the only asset today that’s free from power politics.He knows…

United States Trendy

- 1. $NVDA 57K posts

- 2. #ใครในกระจกEP5 9,340 posts

- 3. #happybdayTYGA N/A

- 4. GeForce Season 4,470 posts

- 5. Peggy 36.5K posts

- 6. Jensen 17.9K posts

- 7. Martha 18.3K posts

- 8. Saba 10.8K posts

- 9. Sumrall 1,687 posts

- 10. Sonic 06 3,469 posts

- 11. Comey 52.6K posts

- 12. Poverty 50.7K posts

- 13. Jason Crow 1,672 posts

- 14. Halligan 23.7K posts

- 15. MLB TV 2,070 posts

- 16. Stargate 5,609 posts

- 17. NASA 49.2K posts

- 18. The Fugitive 2,756 posts

- 19. Sunday Night Baseball N/A

- 20. #ComunaONada 5,277 posts

Może Ci się spodobać

-

Dovey "Rug the fiat" Wan (hiring)

Dovey "Rug the fiat" Wan (hiring)

@DoveyWan -

Darren Lau

Darren Lau

@Darrenlautf -

eGirl Capital 仙女資本

eGirl Capital 仙女資本

@egirl_capital -

區塊先生 🐡 ⚠️ (rock #58)

區塊先生 🐡 ⚠️ (rock #58)

@mrblocktw -

Arthur

Arthur

@Arthur_0x -

Irene Zhao

Irene Zhao

@Irenezhao_ -

Kay Capital

Kay Capital

@keyahayek -

Delphi Digital

Delphi Digital

@Delphi_Digital -

llamacorn.eth

llamacorn.eth

@llamacorneth -

Art of The CMS

Art of The CMS

@cmsholdings -

Khun🐯Pedro

Khun🐯Pedro

@CaoArmand -

qw

qw

@QwQiao -

Alex Svanevik 🐧

Alex Svanevik 🐧

@ASvanevik -

MapleLeafCap

MapleLeafCap

@MapleLeafCap -

mable.sol (we're hiring

mable.sol (we're hiring

@Mable_Jiang

Something went wrong.

Something went wrong.