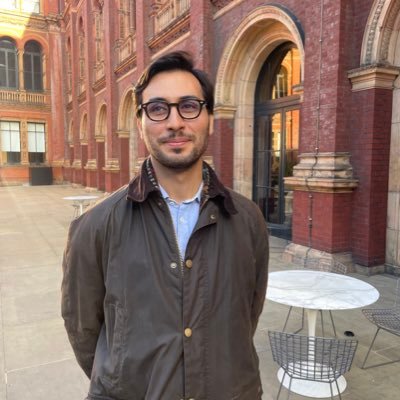

Jonathan Ching

@chingjon

startups. tech. venture capital. opinions are my own.

You might like

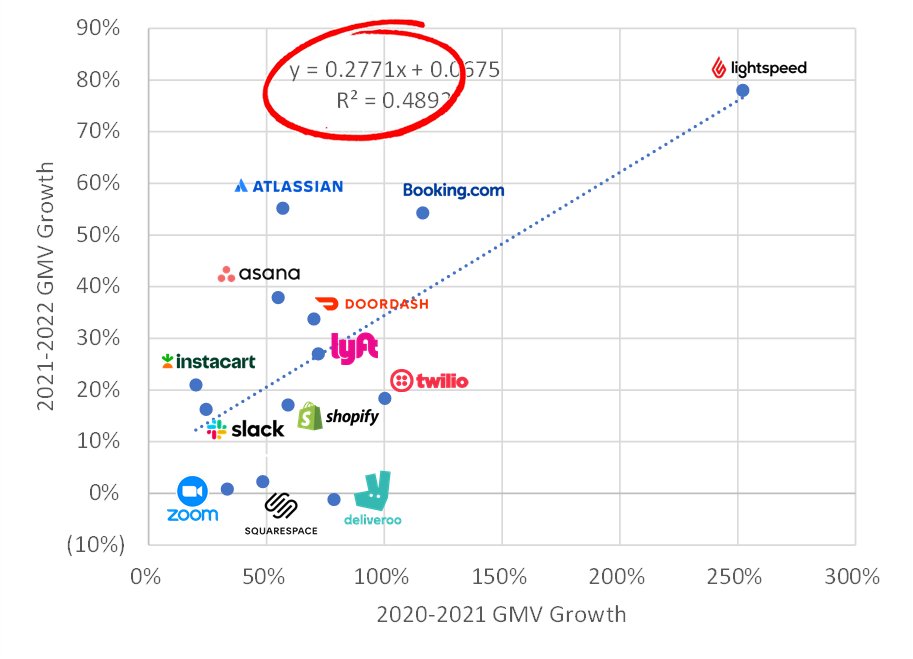

"you can build a pretty accurate mosaic of how well [Stripe] is doing by interpolating all the other data from public companies" - @chamath from @theallinpod Built a regression to interpolate @stripe's growth endurance from its larger public customers chingjon.medium.com/demystifying-p…

![chingjon's tweet image. "you can build a pretty accurate mosaic of how well [Stripe] is doing by interpolating all the other data from public companies"

- @chamath from @theallinpod

Built a regression to interpolate @stripe's growth endurance from its larger public customers

chingjon.medium.com/demystifying-p…](https://pbs.twimg.com/media/FqOW7MqXsAIxumZ.jpg)

Just released from @theinformation - @stripe net revenue of $3.2B in 2022 (but only $2.8B after deducting fraud-related losses) and new Series I looks to raise $4B at a $55B valuation, which is lower than its latest 409A valuation. theinformation.com/articles/insid…

theinformation.com

Inside Stripe’s $55 Billion Pitch to Investors

Stripe is trying to raise a huge sum of money from investors, so it has tried to craft a compelling pitch: The payments giant is growing faster this year than some of the biggest names in tech. It...

signs of a broader slowdown, particularly in #ecommerce. Analysis of @stripe's top customers such as @Shopify and @DoorDash signal that growth in 2022 might be down 62% relative to 2021 Check out full analysis here: medium.com/p/b19adef5f984 #GrowthEndurance @mcadonofrio

Stripe will be one of the most anticipated public listings in 2023. But how will its valuation hold up relative to the broader decline in public #fintech? chingjon.medium.com/demystifying-p… Thanks to @tanayj for historical #stripe estimates and @aschmitt111 for the Growth Endurance model.

At $6.5 billion, it looks like this knife has finally fallen far enough to get caught New @Klarna valuation implies 4x sales multiple, which now makes sense relative to @Affirm trading at 7x but growing 2x as fast wsj.com/articles/klarn…

Further reduced valuation of $15B would imply a ~10x sales multiples for @Klarna, but still a bit higher than @Affirm which trades at ~7x and is growing faster. #growthequity #venturecapital #fintech #BNPL pymnts.com/bnpl/2022/klar…

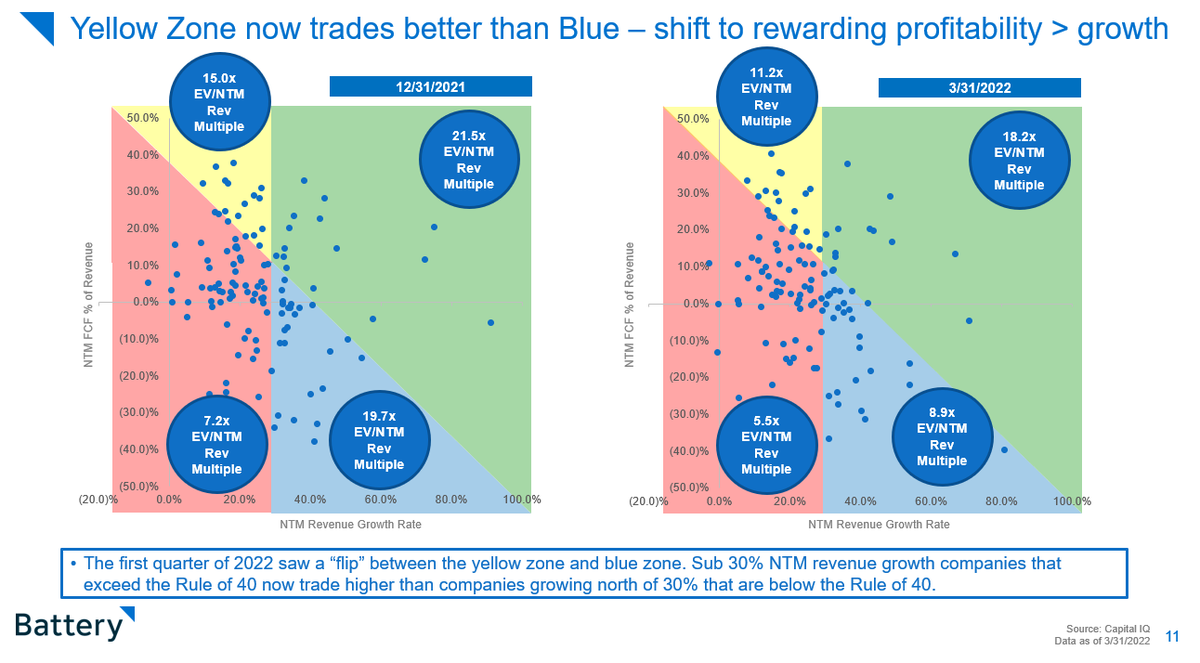

8) But one quarter later, and the zones have flipped: Yellow has overtaken Blue for the first time since we began this exercise. Profitability > Growth

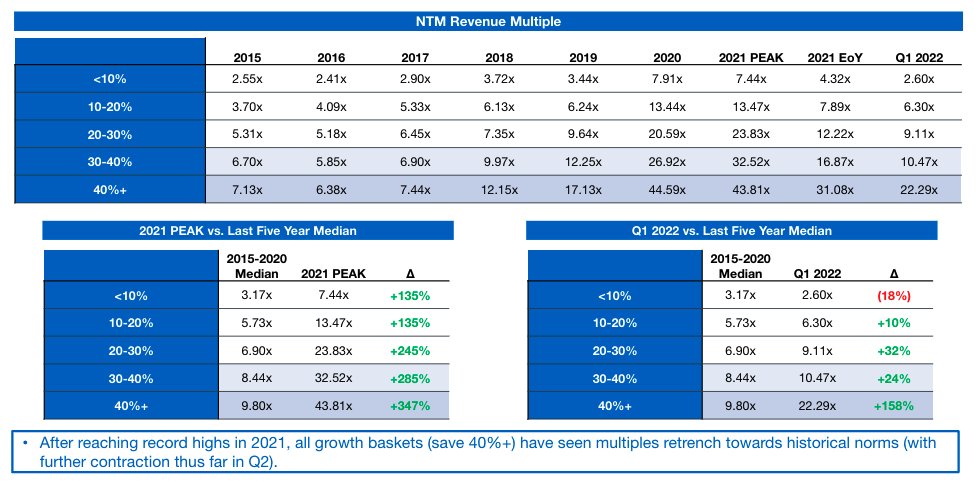

Public #SaaS multiples nowhere near 2021 peaks but still at a premium to the 5-year historical average - especially for software growing over 20%. @alex, @BatteryVentures - what does the data look like for bands of "Rule of 40"? #VentureCapital techcrunch.com/2022/06/05/the…

Opportunities abound in the late-stage venture names, but you never want to "catch a falling knife" #venturecapital #startups #fintech chingjon.medium.com/when-to-catch-… Thanks to @profgalloway, @mfriedrichARK, @Forge_Global for supporting content

chingjon.medium.com

When to catch a falling knife

How to make sense of tech stock valuations when prices have dropped 50%+

The revenue model keeping #neobank's in business: debit interchange vis-a-vis the Durbin Amendment...great thread by @heysamir_

1/16 Spend enough time in neobanking fintech & you'll inevitably hear somebody talk about the "Durbin Amendment". It's the reason every neobank exists AND the biggest dependency risk to their business model. But what if I told you the downside risk isn't as bad as it seems?

Great summary of #neobank tech providers, along with several top names in each category

0/ If you want to build a US challenger bank from scratch, you're not going to be able do it alone (if you want to move fast). To make modern fintech banking happen quickly, here's the 13 most important strategic partnerships you need + common deal unit economics 👇 👇

The One Thing that Square, the Neobanks, and Buy-Now-Pay-Later All Have In Common link.medium.com/qNmwmw6Askb

link.medium.com

The One Thing that Square, the Neobanks, and Buy-Now-Pay-Later All Have In Common

How Square’s pivot to Cash App has defined a generation of Fintechs

Great insight from @aikaussenova into @CashApp's exposure to BTC...also check out her substack for the full deep dive aika.substack.com/p/cashapp-is-k…

80% of revenue, but only ~8% of gross profit. Bitcoin margins are less than 2% vs transactions of 40%, and fees of 70%. So bitcoin might have brought customers, but not monetisation. Incidentally, I just wrote about Cash App and breakdown of its GP/ARPU. aika.substack.com/p/cashapp-is-k…

Common theme with @thomabravo's acquisition of @RealPage and @GoDaddy's acquisition of @Poynt? link.medium.com/QZZbF6QSxcb #payments #SaaS

Web hosting @GoDaddy acquiring @Poynt to add #payments capabilities...another sign of Integrated Payments? pymnts.com/news/partnersh… via @pymnts

Flying under the radar, Integrated Payments are shaping the future of enterprise software #payments #fintech #software #startup #VentureCapital link.medium.com/wumauMSMRbb

highlights from @Visa's preemptive strategy with @Plaid, and a book recommendation (from @maiab and @siddiquiahmed) - Issue #33 fintechradar.substack.com/p/issue-33-vis…

With @twilio as the leading public market example of an #API powered business, are API #startups (@NoyoHQ , @AlpacaHQ) going to eat the world next? techcrunch.com/2020/10/08/inv…

Thinking about all of those payments unicorns but don't know where to start? Here's a detailed look at how companies make money in the payments value chain #payments #fintech #venturecapital link.medium.com/5F0TLrk2z7

United States Trends

- 1. Epstein N/A

- 2. #VERZUZ N/A

- 3. Mike Will N/A

- 4. Don Lemon N/A

- 5. #DragRace N/A

- 6. Pusha N/A

- 7. Hit Boy N/A

- 8. Hanoi Jane N/A

- 9. Bill Gates N/A

- 10. Jay Z N/A

- 11. #OPLive N/A

- 12. Catherine O'Hara N/A

- 13. Jeremy Fears N/A

- 14. #SmackDown N/A

- 15. Michigan State N/A

- 16. #Unrivaled N/A

- 17. Helicoide N/A

- 18. Izzo N/A

- 19. Tisch N/A

- 20. FACE Act N/A

Something went wrong.

Something went wrong.