kmac

@comox99

Retired, stock-trading, prairie boy. Proponent of common sense and believer in freedom. The biggest threat to my financial health is . . . Ottawa.

You might like

Asked Gemini to put together the 2026 FCF/EV and 2026 growth % for the following names at strip. $TVE $SU $ARX $CVE $PEY $CNQ $HWX $TOU $ATH

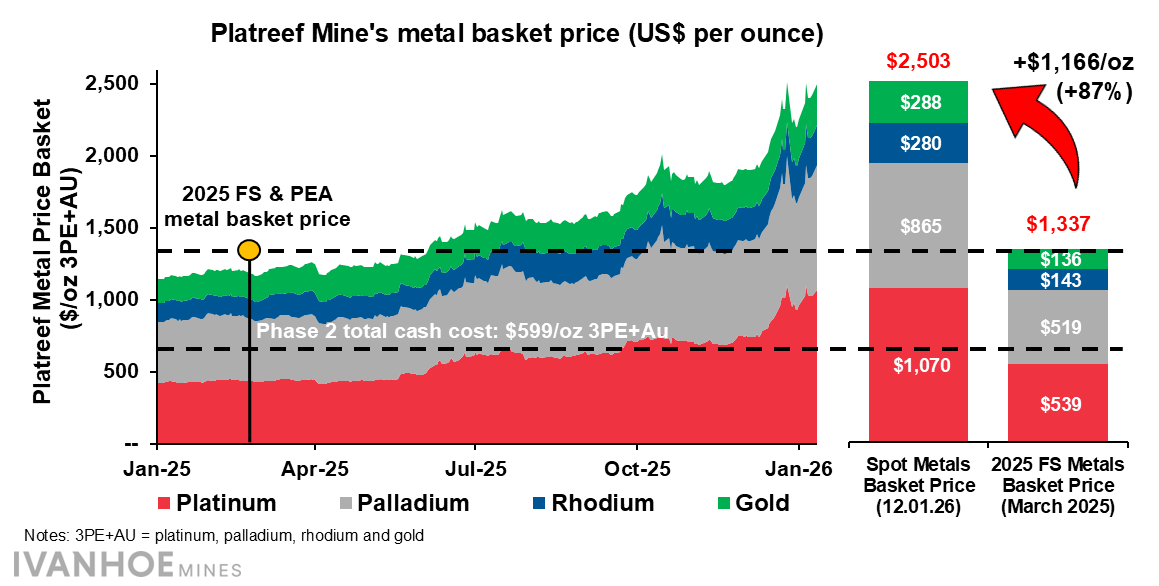

In February 2025, Ivanhoe Mines released a study on the robust economics of the tier-one Platreef Mine, outlining our path to making it one of the largest producers of precious metals... Today, the prices for platinum, palladium, rhodium, and gold are up almost 90% from those…

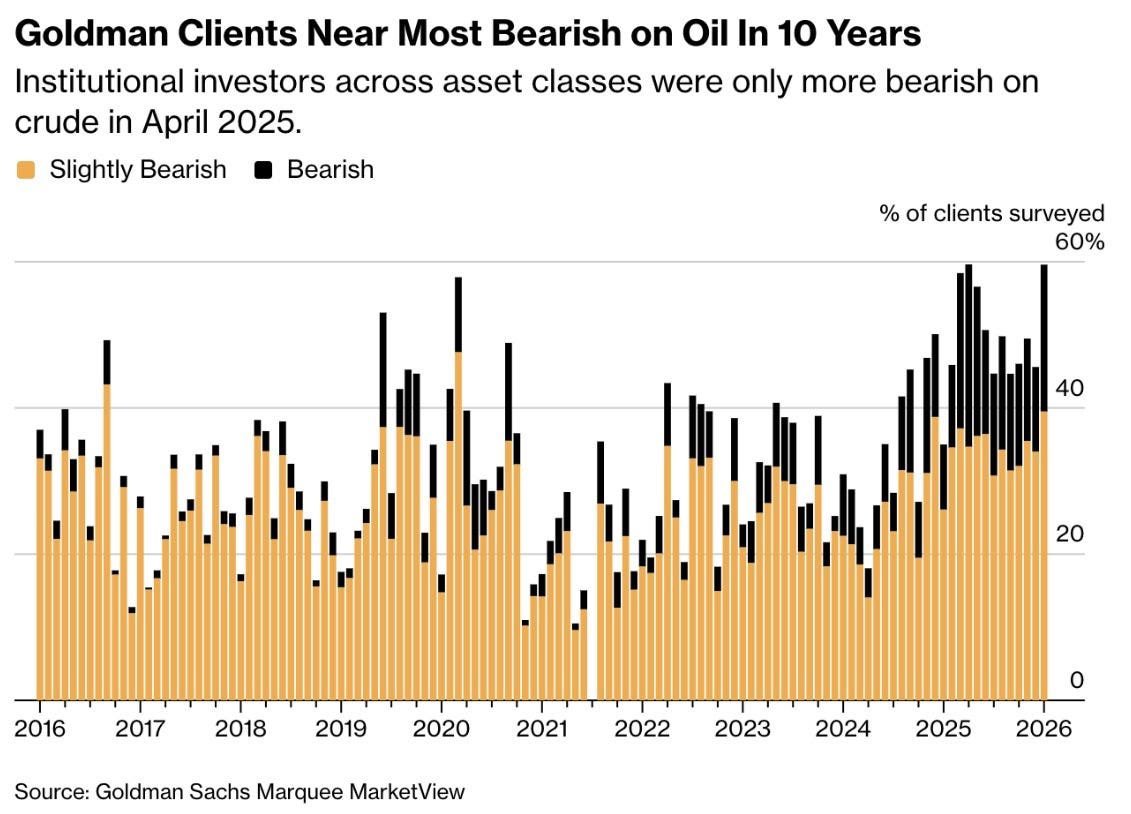

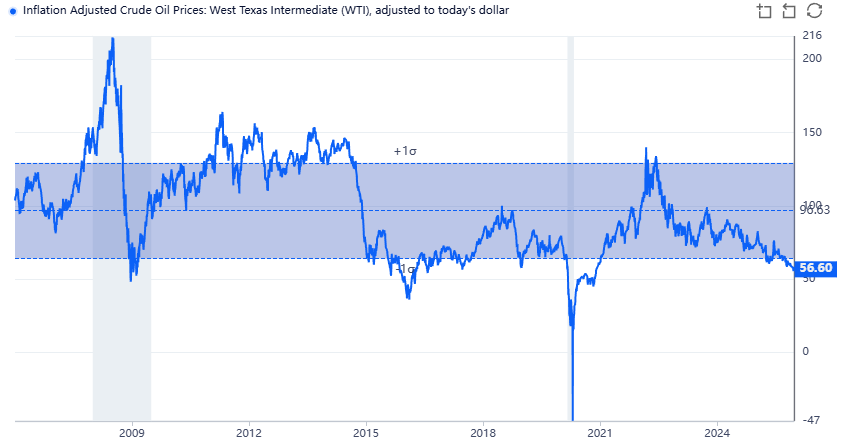

Goldman Sachs clients are the most bearish on oil in roughly a decade. Futures positioning confirms this pessimism, sitting near one of the most negative extremes on record. Meanwhile: Oil rig counts have been in sustained decline for nearly three years, as WTI prices are also…

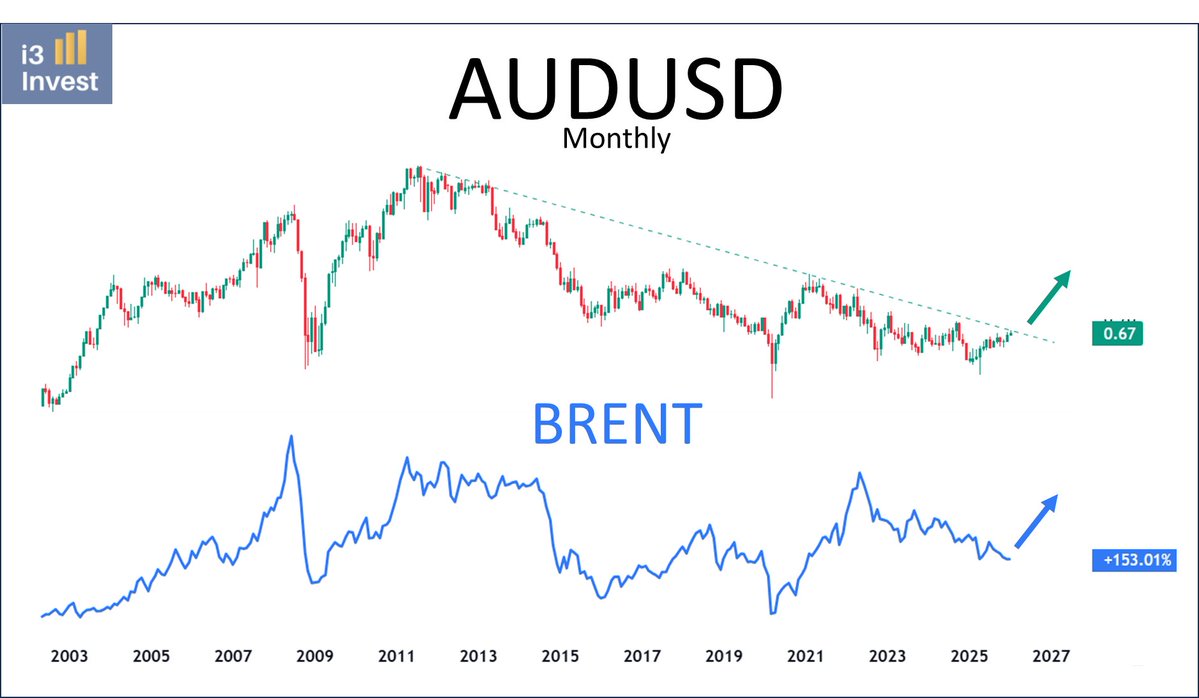

The Aussie dollar is close to triggering a massive long-term bullish breakout. This could be a positive leading signal for commodities in general, especially one of the most underrated right now: oil.

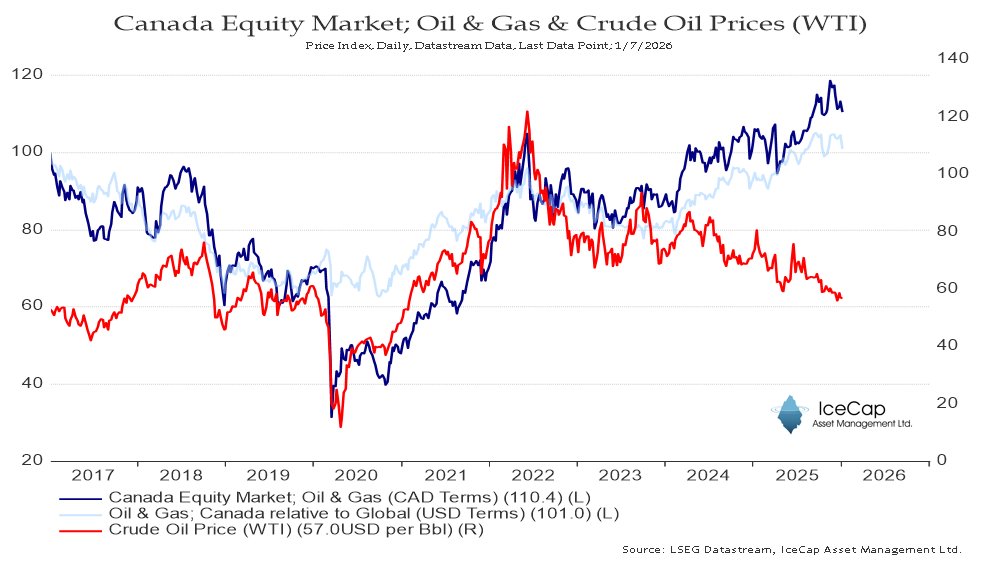

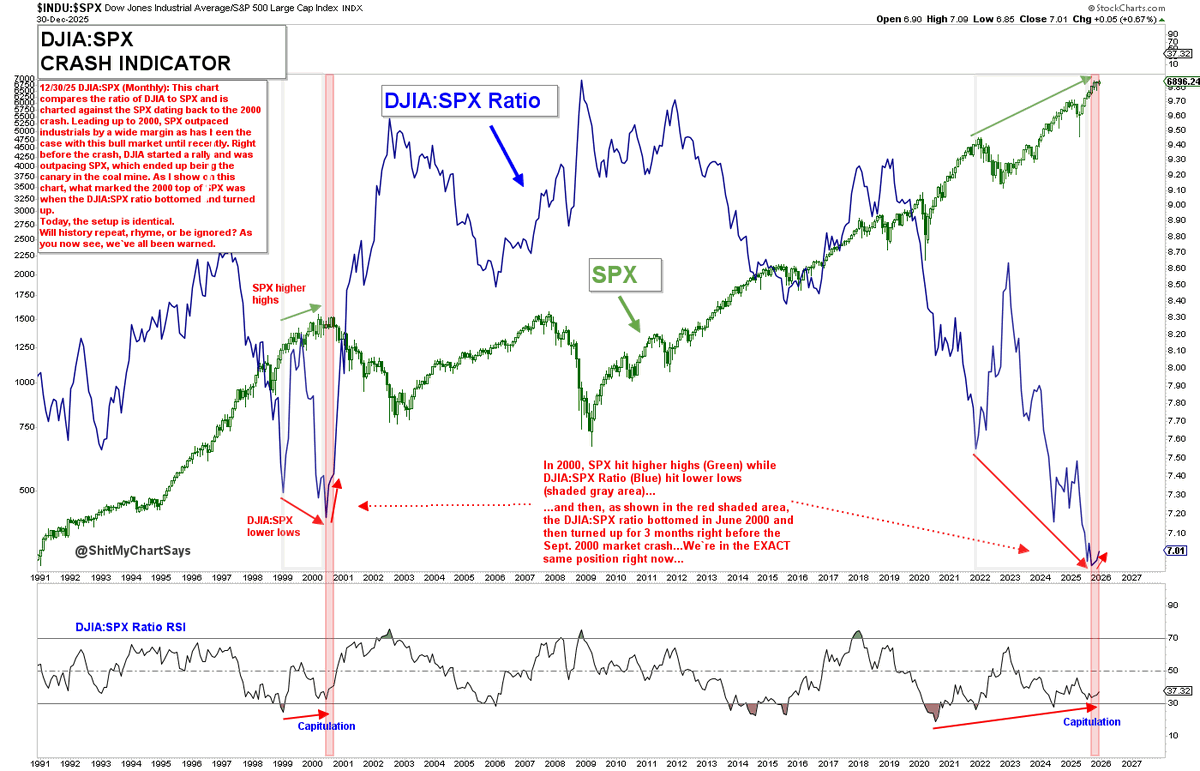

One scary chart.

The Canadian Oil & Gas equity Index decoupled from Crude Oil prices in late 2024ish. They also outperformed Global Oil & Gas stocks - the light blue line. It will be interesting to see how the market prices in the threat of new heavy crude oil supply, or not.

Athabasca starting to get oversold, I think around this green line it will find strong support, if it falls to there and is oversold, strong buy imo. $ATH @RazorOil

"Let me get straight to the point: there’s only one reason I’m interested in silver. I’m not interested in silver as money—it’s inferior to gold. I’m not interested in its industrial applications either. I’m interested in silver for one reason only: it’s prone to explosive,…

$ARX.TO at key support. If we fail here, $21.80 is in play... Imagine the downtrend continues and someday in 2026 it get's bought with 30% premium at $27...😢😵💫#oott #eft #com

Oil - Sooner or later this dog will have it's day. Just observe the chart for timing 👇

When everyone is looking down, it pays to look up

Oil at 20-year lows in real terms, yet people call for $30–50 glut bear scenarios. Downside: maybe -5–10%. Upside: 2–3× to the upper range? That’s asymmetric risk/reward — and I like that trade.

This. ✅🫡🪒

I work in a very specialized part of the Venezuelan oil industry. Their crude is all extremely sour and at the best has to run in refineries built to handle it and sometimes even then needs light cutter stock purchased from the Middle East. I’ve been in oil all my life and I…

Fantastic chart. ~ {Uranium/Gold} Ratio at historic extreme. Precious metals (Silver) have had the spotlight in 2025, but the uranium sector looks poised to be the next big mover in 2026. $SMR $OKLO $CCJ $UEC $DNN $URA $UUUU $UEC $NXE #uranium #gold #silver #platinum #palladium

URNM bull flag breakout! Time for uranium miners to take another turn!

$T Telus Tax loss selling complete and up another 1.23% today Looking forward to next week and seeing if the stock continues to rise and dividend percentage will decrease to the 8% level as a start 🤣

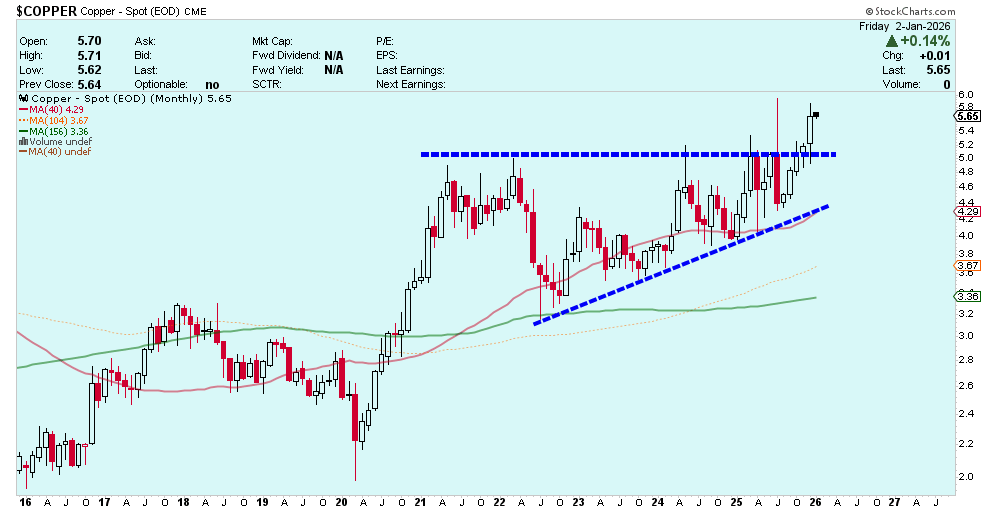

RBE’s Top Commodity Themes for 2026: Just getting started: • Fertilizers • Nickel Already moving: • Copper • Lithium If you’re hunting outperformance in 2026, it’s going to be hard to beat these four.

$DJIA : $SPX Crash Indicator: This ratio was the 2000 crash canary as shown on the chart. When the ratio hit lower lows, bottomed, and turned up while SPX hit new ATHs, it was the imminent tell. We're in the exact same spot right now. Will history repeat, rhyme, or be ignored?

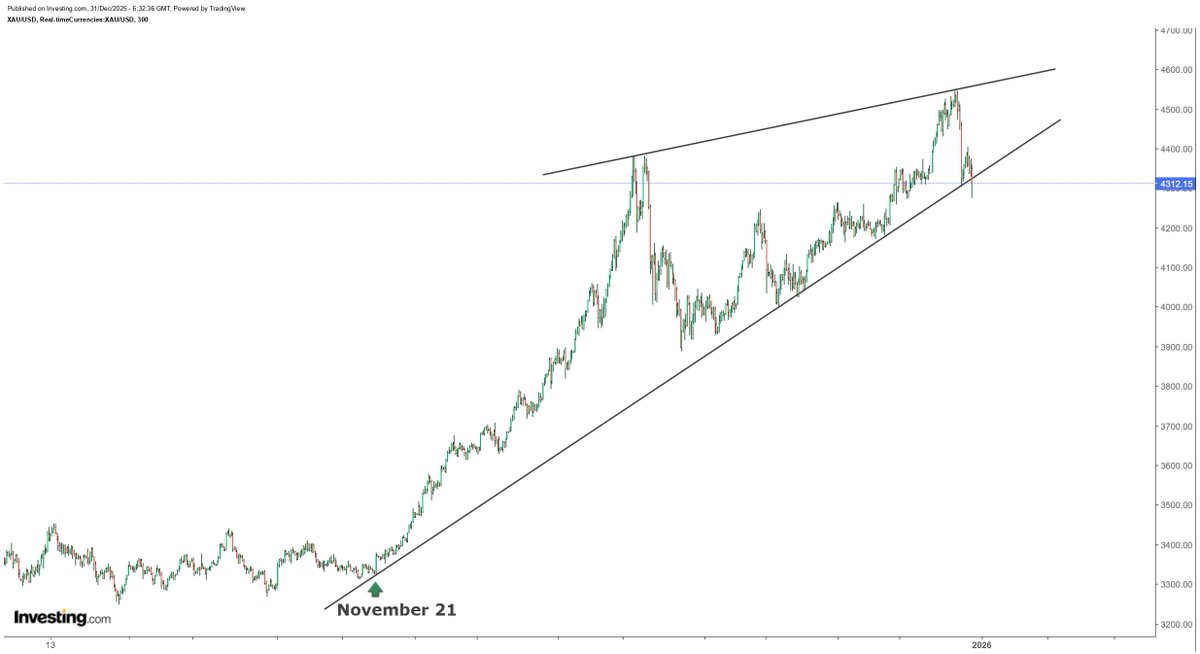

Gold's 6-week rising wedge broke down, which is a requirement for the next leg up. Support is broken triggering a shakeout. I doubt gold sits here for too long. This breakdown, in my opinion, going to turn out to be a false one and rip higher...

United States Trends

- 1. Tomlin N/A

- 2. Scott Adams N/A

- 3. Ford N/A

- 4. Dilbert N/A

- 5. Jim Jordan N/A

- 6. Claudette Colvin N/A

- 7. Clinton N/A

- 8. #ErfanSoltani N/A

- 9. Supreme Court N/A

- 10. Cowher N/A

- 11. Daboll N/A

- 12. AFC North N/A

- 13. Zac Taylor N/A

- 14. Pittsburgh N/A

- 15. Kai Cenat N/A

- 16. Secret Service N/A

- 17. Semenyo N/A

- 18. Marcus Freeman N/A

- 19. Deadpool N/A

- 20. Joe Rogan N/A

You might like

-

Ed PB Gloater Jr

Ed PB Gloater Jr

@MugsLuck -

Mike

Mike

@rtdmoh -

David François

David François

@DavidFrancois77 -

Kevin Haight

Kevin Haight

@HaightK -

Brandon Perry

Brandon Perry

@Brandon19869581 -

Steve

Steve

@consuminginfo -

FamilyManCG

FamilyManCG

@family_cg -

Jack Bunney

Jack Bunney

@bunney_jack -

The Gold Bull

The Gold Bull

@ben90357282 -

CuriousBystender

CuriousBystender

@CBystender -

pscott44

pscott44

@pescott -

Allie

Allie

@westcoastallie1 -

Chris McGilton

Chris McGilton

@mcgiltonchris -

Moshe Fogel

Moshe Fogel

@realmoshefogel -

Rob Pushor

Rob Pushor

@robpushor

Something went wrong.

Something went wrong.