Daniel Fadeley | CORE5 Tradecraft

@core5dan

Trading Coach · Building disciplined thinkers in volatile markets. Institutional logic for the modern trader.

If the setup requires debate, it isn’t a setup. Real opportunities are obvious the moment your criteria hit. Anything else is noise dressed like a decision. — CORE5DAN Institutional Logic. Modern Technology. Real Freedom.

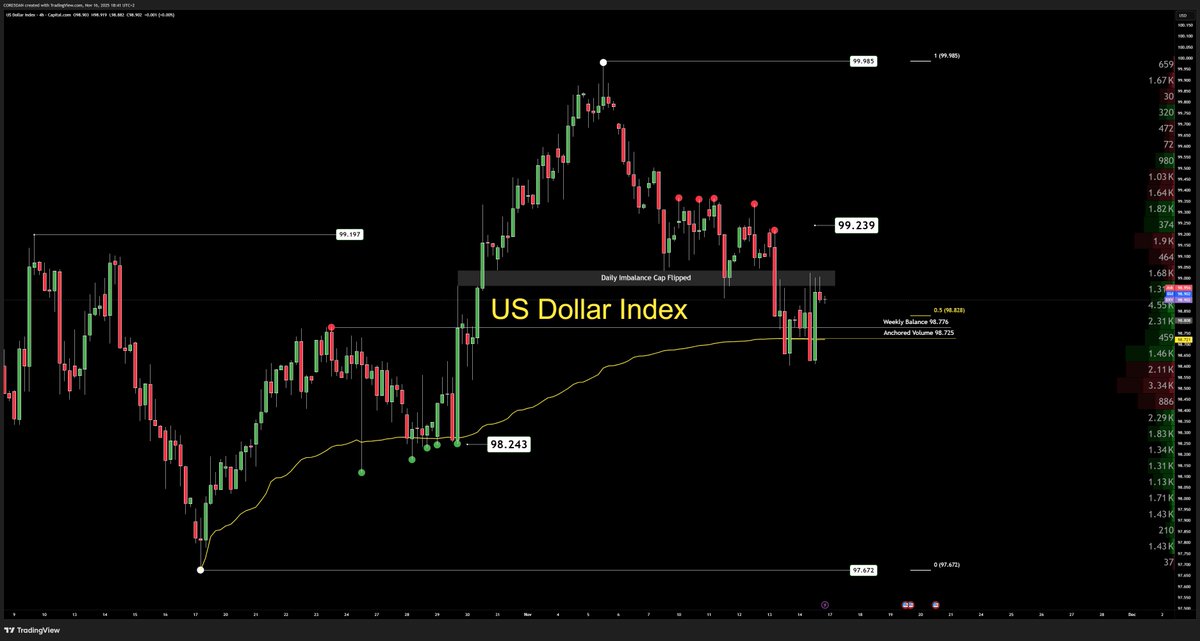

The Dollar hit the weekly high at 100.36 and failed to hold it. Momentum cooled. Behaviour stretched. Yields softened. Next week’s tone belongs to Tuesday–Wednesday data, not last week’s move. Conditions matter more than momentum. — CORE5DAN Institutional Logic. Modern…

If your criteria are loose, your decisions will always feel risky. Tighten the rules and the whole session gets easier to navigate. Standards fix more than strategy ever will. — CORE5DAN Institutional Logic. Modern Technology. Real Freedom.

If your criteria are loose, your decisions will always feel risky. Tighten the rules and the whole session gets easier to navigate. Standards fix more than strategy ever will. — CORE5DAN Institutional Logic. Modern Technology. Real Freedom.

Bitcoin is approaching 74,420.69 — the key structural level that defines its next long-term regime. Macro conditions are tightening. Liquidity is thinner. Major catalysts ahead (CPI, Core CPI, PPI, FOMC Minutes, labor data, month-end flows) sit directly in front of this test.…

Unclear conditions = unclear execution. Stop trying to fix your results. Fix your criteria. — CORE5DAN Institutional Logic. Modern Technology. Real Freedom.

Dollar is pressing into a major cross-asset high. London kept DXY inside range — no clean breakout. 2Y is firm. 10Y is indecisive. ES holds the Nvidia gap, but VIX near 21 keeps risk fragile. Gold stays neutral. Mixed signals = stop-time. The market pauses here. This is a PEM…

Most traders chase consistency even though the market changes every single day. The problem isn’t the market. It’s trying to control outcomes instead of controlling behavior. Professionals repeat the routine — not the result. Dial in your process. Define your conditions. Let…

Dollar pushing up. 10Y and 2Y easing. ES holding an inside-day. Gold lifting on softer yields. No leadership yet — the market’s waiting for NY to show intent. First spike = noise. Structure decides the real move. — CORE5DAN

BTC rejected the original distribution gap at 88,804.64 again and is still holding inside Monday’s range (91,158–95,950). Structure remains neutral. No confirmed resolution. What looks like “sideways” is the market restoring balance before showing intent. Operator rule: let NY…

Most traders aren’t inconsistent. They’re unclear. - When conditions are vague, every move feels like a mistake. - When conditions are defined, execution becomes automatic. Clarity beats talent. Every session. — CORE5DAN Institutional Logic. Modern Technology. Real Freedom.

PRE-LONDON CONDITIONS Yesterday’s volatility set the tone. Asia kept DXY trapped in range while yields fell and ES extended downside. DXY 98.99–99.59 → third inside bar. 0.6 premium zone. No bias until London breaks range. 10Y / 2Y 10Y: -1.01% (Asia) 2Y: -1.27% Curve still…

PRE-NY CONDITIONS — 17 Nov London hands NY a defensive tape: • DXY steady in mid-range • 10Y ~4.15% / 2Y ~3.60% — firm, stable tone • ES weaker after London selloff • Gold lower • VIX higher → thinner liquidity NY opens into a cautious environment. — CORE5DAN…

PRE-LONDON CONDITIONS — 17 Nov 2025 Dollar neutral overnight. Yields stable across the curve. Equities firm but stretched. Volatility still elevated after Friday’s spike. Liquidity cautious into a heavy macro week. Six-Chart Snapshot: (Structural notes visible on chart image.)…

DXY opens the week with incomplete visibility. The 43-day shutdown left gaps in inflation, sentiment and activity data, and price holds mid-range while liquidity waits for clarity. Key drivers: FOMC Minutes (Nov 20) and Consumer Sentiment (Nov 22). Full breakdown in the War…

Bitcoin isn’t trending — it’s negotiating value. Price is rotating in the deep-discount zone of the 74,420 → 126,402 bullish range, anchored at the 94,353.90 NPOC. MSM: Daily structure shows inside-bar behaviour. Balance, not breakout. VFA: NPOC still the participation hinge.…

NY Session: Dollar holding mid-range. DXY opens New York rotation around the 0.50 region near 98.828 — stable structure with flow driven almost entirely by macro tone. This week brought softer growth signals, delayed datasets, and a more patient Fed. Risk appetite improved,…

BTCUSD — Market Structure Mapping Monthly bullish structure balance is now filled. Higher-timeframe map stays intact. BTC holding a clean bullish range and still in the discount zone. Range low (invalidation): 78.167 Range high (continuation): 123.231 Cross-market context: •…

The dollar has reached its decision point. DXY has completed its discount drive, filled its inefficiencies, and is now pressing directly into the weekly balance at 98.766 — the level that decides rotation or continuation. Tomorrow’s PPI and jobless claims set the tone. Markets…

BTCUSD | Bearish Range | Daily Price stuck between volume fractal pivots — 106463 and 100996. Still hovering at the lower end of the range (116410–98892) with no real push. Volume midrange at 108333 = balance, not conviction. CPI ahead — market just loading liquidity before it…

United States Trends

- 1. #GMMTV2026 2.31M posts

- 2. MILKLOVE BORN TO SHINE 387K posts

- 3. Good Tuesday 27.9K posts

- 4. #tuesdayvibe 2,024 posts

- 5. WILLIAMEST MAGIC VIBES 54K posts

- 6. Chelsea 212K posts

- 7. MAGIC VIBES WITH JIMMYSEA 58.1K posts

- 8. Mark Kelly 212K posts

- 9. #JoongDunk 87.2K posts

- 10. Barcelona 158K posts

- 11. Alan Dershowitz 3,146 posts

- 12. #ONEPIECE1167 8,278 posts

- 13. TOP CALL 9,233 posts

- 14. AI Alert 8,096 posts

- 15. Barca 82K posts

- 16. Jim Croce N/A

- 17. Unforgiven 1,162 posts

- 18. Maddow 14.9K posts

- 19. Check Analyze 2,420 posts

- 20. Token Signal 8,486 posts

Something went wrong.

Something went wrong.