You might like

NEW: Michael Saylor says MicroStrategy has a #Bitcoin reactor in the middle of the company that creates enormous shareholder value and “that’s how you outperform Nvidia” 🚀

The bond market has been a falling knife since the start of the year. With the Fed on a mission to hike, next month's meeting could continue to push prices down as yields rise. Again my year prediction is not looking so good :’)

If the major indices fall, I can see crypto markets getting cut by a third. But ultimately, hold that 1.61 fib and stay north of 1T

What goes up... I feel sub-4k $SPX is only a matter of when not if.

The $DXY peaked during covid and is putting in a double top; going to be interesting to see how this plays out. My year prediction is way off :’)

10s minus 2s and 30s minus 5s are nearly flat. Somethings gotta give soon. $TNX

These are the present yields at the belly of the US Treasury market: Three year yield: 2.14% Five year yield: 2.14% Ten year yield: 2.15% I am going to call that “flat”.

Crude $CL spiked so fast and so high, but I'm sure gas stations will milk $4+ gas prices for a while.

bitcoin is the only credibly neutral asset in crypto imagine not owning some

$DXY up with $GC and $CL. Is the dollar strengthening, or are other currencies just debasing faster? Crypto trading with markets on strong jobs #. 25bp almost seems for sure; the question is, can we see a 50bp hike.

Judging how many longs piling into $BTC, I suspect a floor will break here soon—red pitchfork vital area. The market has to swallow a fed rate hike this month. Vix > 30

From a multiyear investment standpoint, metals $XAU look very attractive compared against $SPX

Agree. On weekly perspective Fibonacci time series around May 7th. 5m sats seems inevitable. $ETH

Long term ETH/BTC uptrend looking more fragile with first trendline broken. Next support at 0.056 BTC.

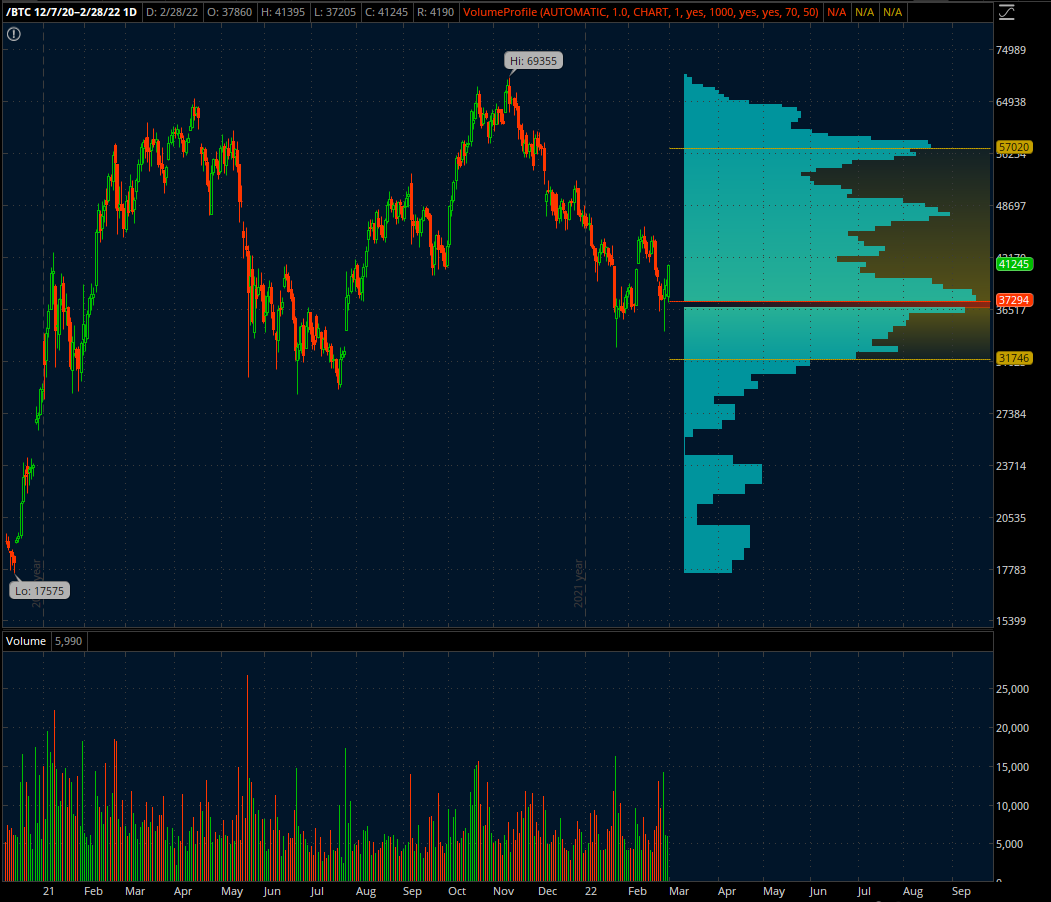

$BTC volume profile back to December of 2020. 37k solid base. IMO the network belongs north of 1T. So #Bitcoin under 50k is a bargain deal for a long-term holder. Just don't load the boat all in a single transaction.

CBDCs are digital enslavement tools. Avoid them at all costs. Bitcoin is our only hope for financial freedom in the Digital Age. Stack or die.

1/ There are no other constitutional rights in substance without freedom to transact Being meaning to write this for 6 months, but the Canadian response to the trucker protests is illustrating this so vividly, that today is the day.

Proof-of-Stake is legacy tech. It's what corporations and banks have run on for centuries. It's outdated and oligopolistic. And yet, still useful for centralized systems. Proof-of-Work is the new innovation, especially when combined with difficulty adjustments.

In one sense, OG bitcoiners had it easy. To adopt Bitcoin in 2010-'14 you mainly needed to be tenacious and a bit crazy—nobody took alts seriously. Today, newcomers must wade through a swamp of sleek shitcoin ("crypto") projects before they can appreciate Bitcoin's supremacy.

United States Trends

- 1. #GRAMMYs N/A

- 2. Cher N/A

- 3. Bad Bunny N/A

- 4. Benito N/A

- 5. Luther Vandross N/A

- 6. Billie N/A

- 7. sabrina N/A

- 8. Nicki N/A

- 9. D’Angelo N/A

- 10. Kendrick N/A

- 11. Trevor Noah N/A

- 12. Gaga N/A

- 13. Tyler N/A

- 14. Jelly Roll N/A

- 15. Album of the Year N/A

- 16. AOTY N/A

- 17. Pharrell N/A

- 18. Lauryn Hill N/A

- 19. Olivia Dean N/A

- 20. harry styles N/A

You might like

-

Investment Wisdom

Investment Wisdom

@InvestingCanons -

Louis Pereira

Louis Pereira

@louispereira -

dabl

dabl

@DablClub -

Scott🍁Trades

Scott🍁Trades

@Scottrades -

Wall Street trapper

Wall Street trapper

@Wallstreet504 -

CTM

CTM

@CryptoTalkMan -

LUKSO

LUKSO

@lukso_io -

Halving Tracker

Halving Tracker

@HalvingTracker -

🐦 rotki - own your data, protect your privacy

🐦 rotki - own your data, protect your privacy

@rotkiapp -

Nour Eldeen Al-Hammoury

Nour Eldeen Al-Hammoury

@NourHammoury -

Doc

Doc

@DrBitcoinMD -

SteveW

SteveW

@paracurve -

Polkaswap | Trade with Style and Freedom

Polkaswap | Trade with Style and Freedom

@polkaswap -

BC Richfield

BC Richfield

@BC_Richfield -

John 🔺

John 🔺

@dantwany

Something went wrong.

Something went wrong.