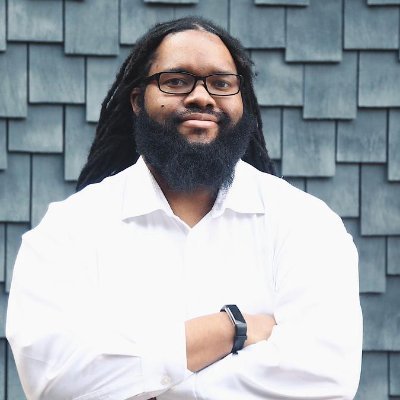

David @ NextView

@davidbeisel

Co-Founder & Partner @NextViewVC, seed investing in Founders redesigning the Everyday Economy including: @attentivemobile @TripleLiftHQ @thredUP @ParsecTeam

Może Ci się spodobać

1/ Thrilled to unveil NextView Ventures' fresh new look! It’s more than a facelift—it represents how far we’ve come while staying true to our mission of backing seed stage founders as high conviction, hands-on investors: nextview.vc

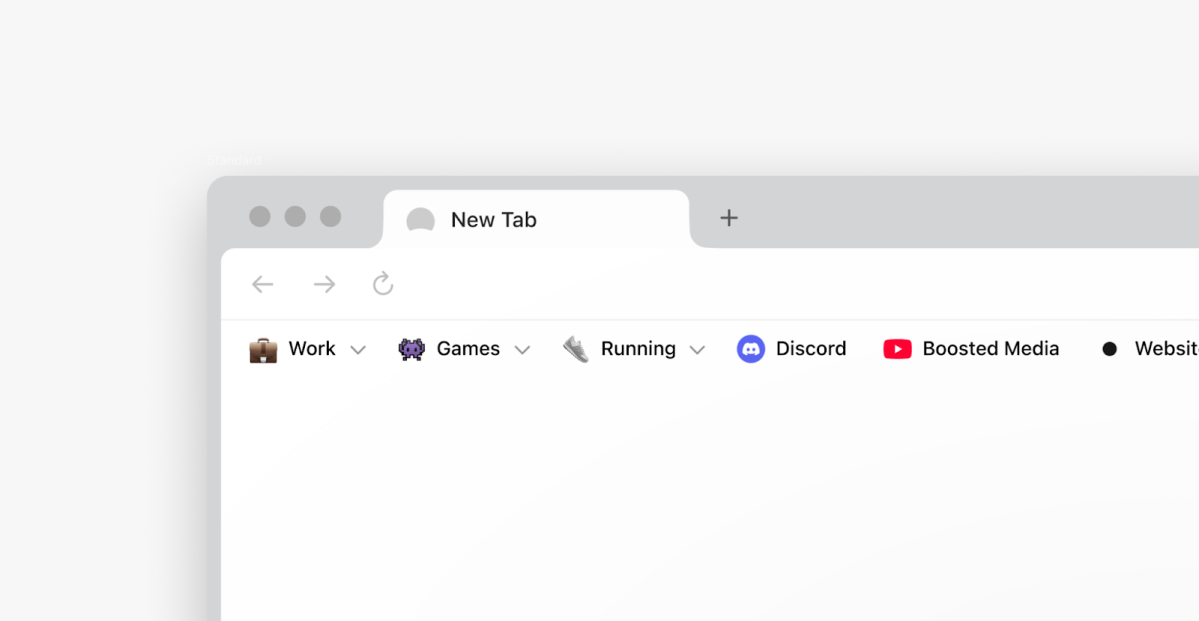

For 40 years the file browser hasn’t changed. Today, we’re launching with $8 million in seed funding to rebuild the file browser into something more intelligent, searchable, and delightful. The world is in the middle of a data explosion. We’re generating and using more files…

Every great story has an Arc. Thrilled to see @NextViewVC's portfolio company @browsercompany's next chapter is with @Atlassian. theverge.com/web/770947/bro…

Thrilled to see my partner @melodykoh expand her role as Partner & CPO at @NextViewVC to lead our AI + data efforts—supercharging how we support founders. 🚀

After 6 years as a Partner at @NextViewVC, I'm expanding my role to lead our AI and data initiatives as Partner & Chief Product Officer. The window to build competitive advantages in VC is now—what we build in the next few years will reshape how we invest for the decade ahead.…

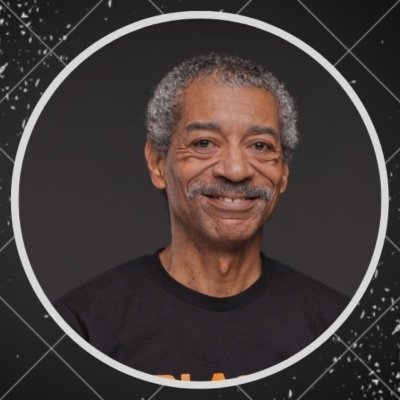

Last week, my partner @robgo at @nextviewvc explained why seed VC is in crisis. This week, he explores what comes next. No silver bullets—but a clear framework for firm adaptation and optimism in the AI Supercycle.

Here's the follow-up to my post about the existential crisis facing seed VCs. Spoiler alert: I'm not going to give "the answer". I'm keeping that locked in the mystery box. But I'll share a few thoughts on the potential path forward. Full read: nextview.vc/blog/a-path-fo… TLDR:

I see four forces that are creating a serious threat to the seed VC model: 1. Industry maturation eroding profits for sub-scale players 2. The nearly unstoppable forces of YC and the megafunds 3. Power-law thinking becoming consensus 4. The AI platform shift

Seed venture capital is at an inflection point—one that demands clear-eyed reflection and an honest assessment of the forces reshaping our industry. My partner @robgo has articulated this moment of existential questioning with unusual clarity.

Seed VC is facing an existential crisis. This isn't hyperbole. And it's not just a regular business cycle. It's a real crucible moment. My full thoughts here: nextview.vc/blog/a-crisis-… But if you want the TLDR, here you go:

United States Trendy

- 1. #DMDCHARITY2025 528K posts

- 2. #TusksUp N/A

- 3. #AEWDynamite 20.7K posts

- 4. #TheChallenge41 2,184 posts

- 5. Ryan Leonard N/A

- 6. #Survivor49 2,864 posts

- 7. Skyy Clark N/A

- 8. Diddy 75.1K posts

- 9. Jamal Murray 7,056 posts

- 10. Claudio 29.6K posts

- 11. Yeremi N/A

- 12. Earl Campbell 2,165 posts

- 13. Hannes Steinbach N/A

- 14. Steve Cropper 6,099 posts

- 15. seokjin 154K posts

- 16. Klingberg N/A

- 17. Monkey Wards N/A

- 18. Ryan Nembhard 3,756 posts

- 19. Milo 12.7K posts

- 20. Hilux 6,609 posts

Może Ci się spodobać

-

Rich Miner

Rich Miner

@richminer -

General Catalyst

General Catalyst

@generalcatalyst -

Rob Go

Rob Go

@robgo -

Spark Capital

Spark Capital

@sparkcapital -

Jeff Bussgang

Jeff Bussgang

@bussgang -

Aydin Senkut

Aydin Senkut

@asenkut -

Bessemer

Bessemer

@BessemerVP -

Eric Paley

Eric Paley

@epaley -

Lee Hower

Lee Hower

@leehower -

davidcowan

davidcowan

@davidcowan -

David Cohen

David Cohen

@davidcohen -

Jeff Clavier

Jeff Clavier

@jeff -

ryan sweeney

ryan sweeney

@ryanjsweeney -

Josh Stein

Josh Stein

@JoshSteinVC -

Ajay Agarwal

Ajay Agarwal

@ajay_bcv

Something went wrong.

Something went wrong.