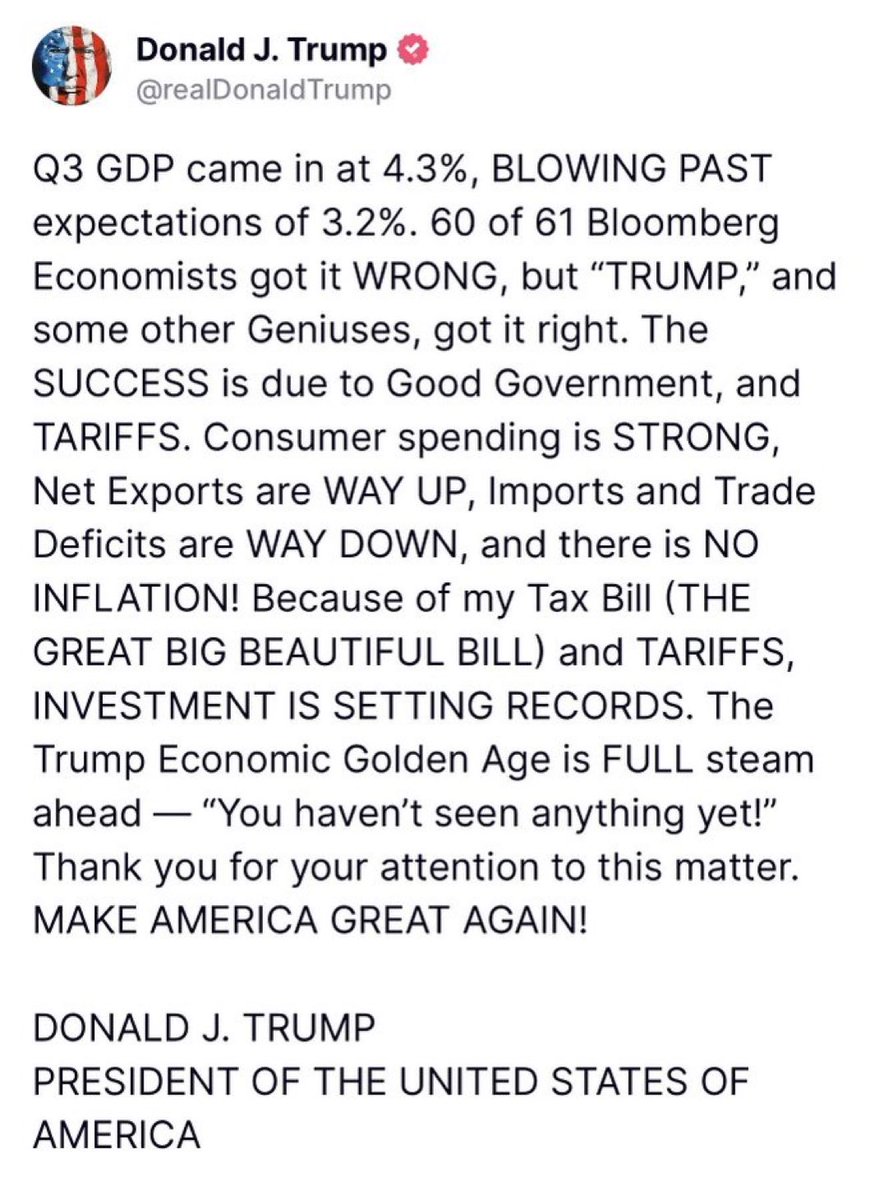

おすすめツイート

It’s gonna be ok you’re gonna live with me now

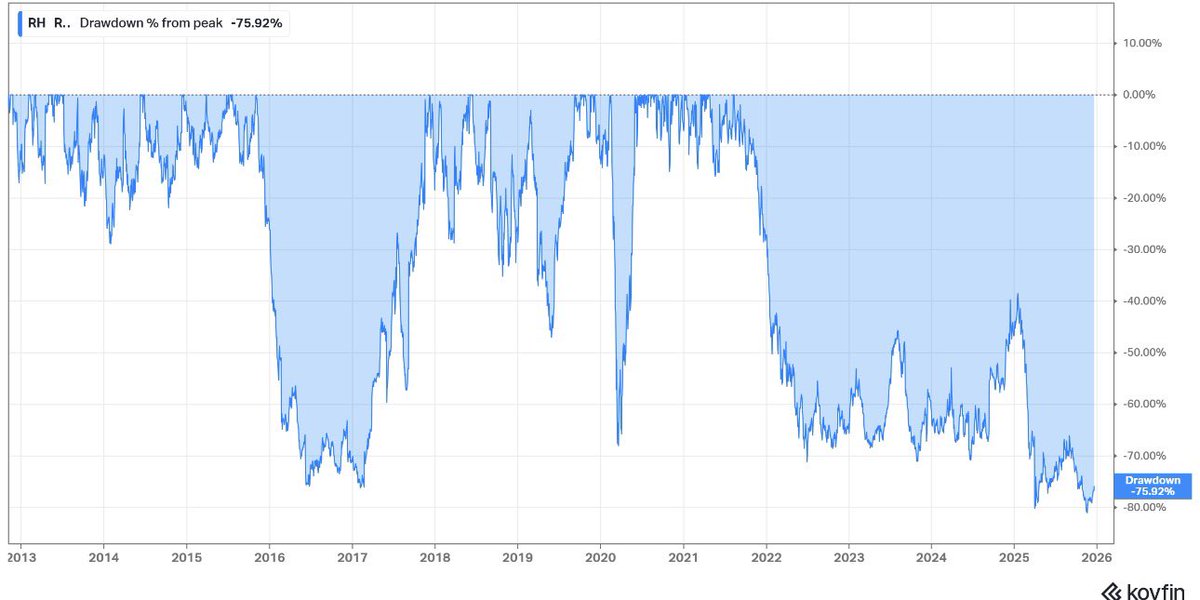

$RH now largest drawdown in history of the company -77% This is what happens when you’re too overpriced for regular folks but not exclusive enough for wealthy people

NYC vacation mode observations that sound dumb but here goes: > The car wash I’ve gone to for 20+ years has nearly no workers now. You go through an automated tunnel, then pull into a self-cleaning area and finish the job yourself. Before it was 3–4 guys detailing your car at…

When the fundamentals marry the charts and they have a cute baby $RDDT

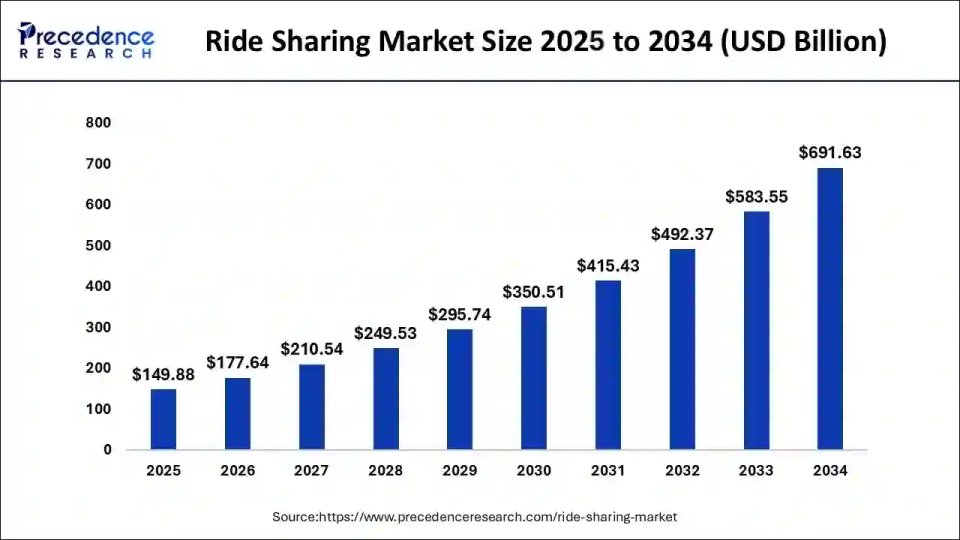

Absolutely insane that Waymo is now valued at $110B with a run rate of $350M while $UBER sits at only $165B with $10B of FCF. Yes yes yes growth rate bla bla bla but I'll take my chances here

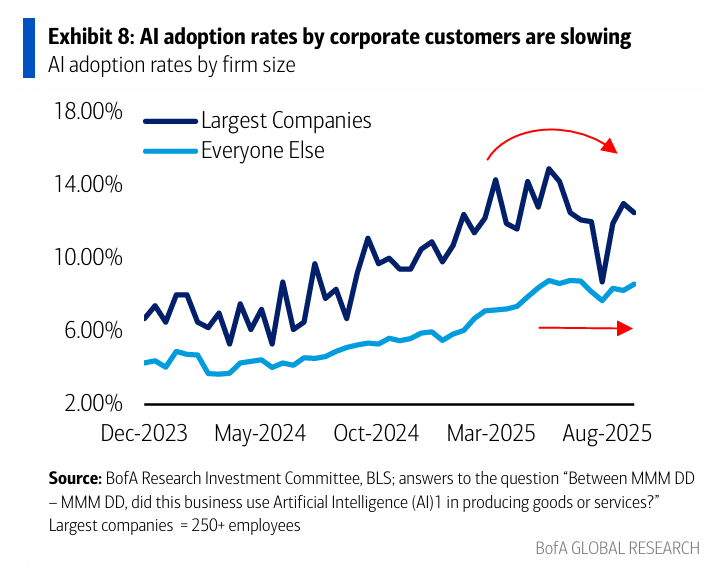

You can't call it a bubble when the corporate adoption rate for AI is 15%

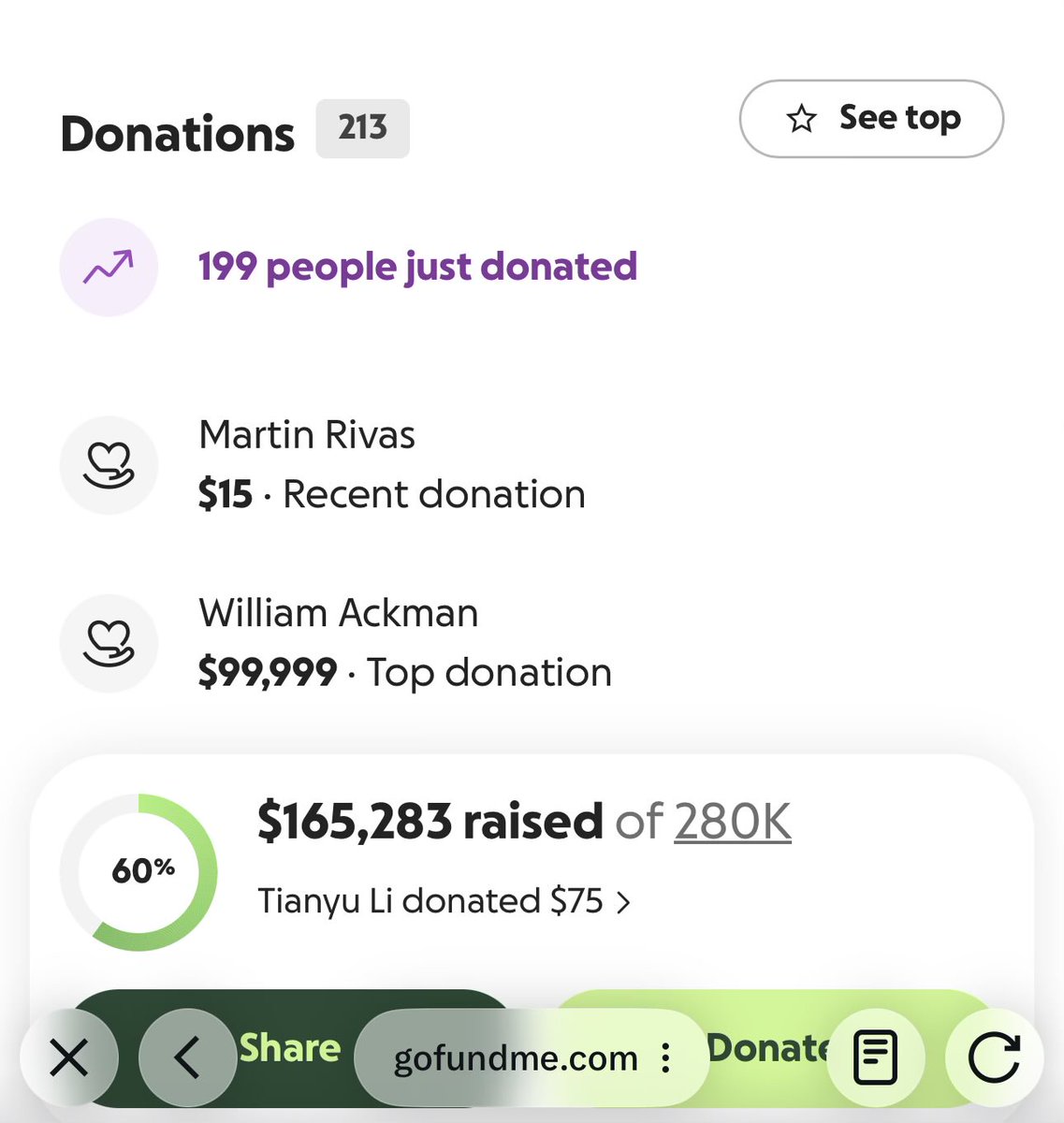

Graceful move by @BillAckman for being The Top Donation for the Muslim Hero that saved countless lives.

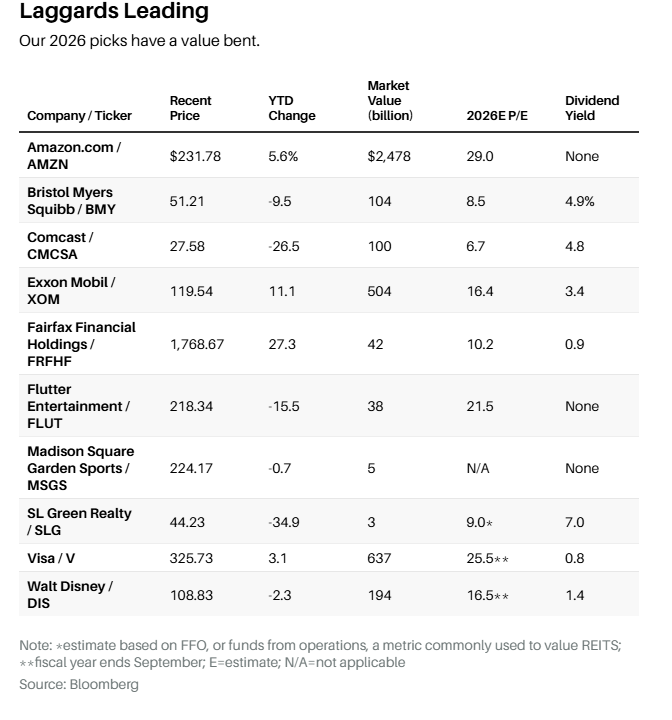

Seeing $AMZN on the Barron's Top 10 Picks for 2026 Haven't we suffered enough

LOL

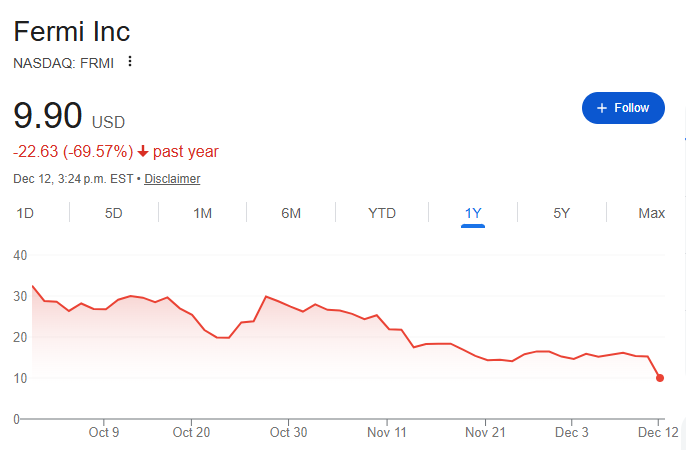

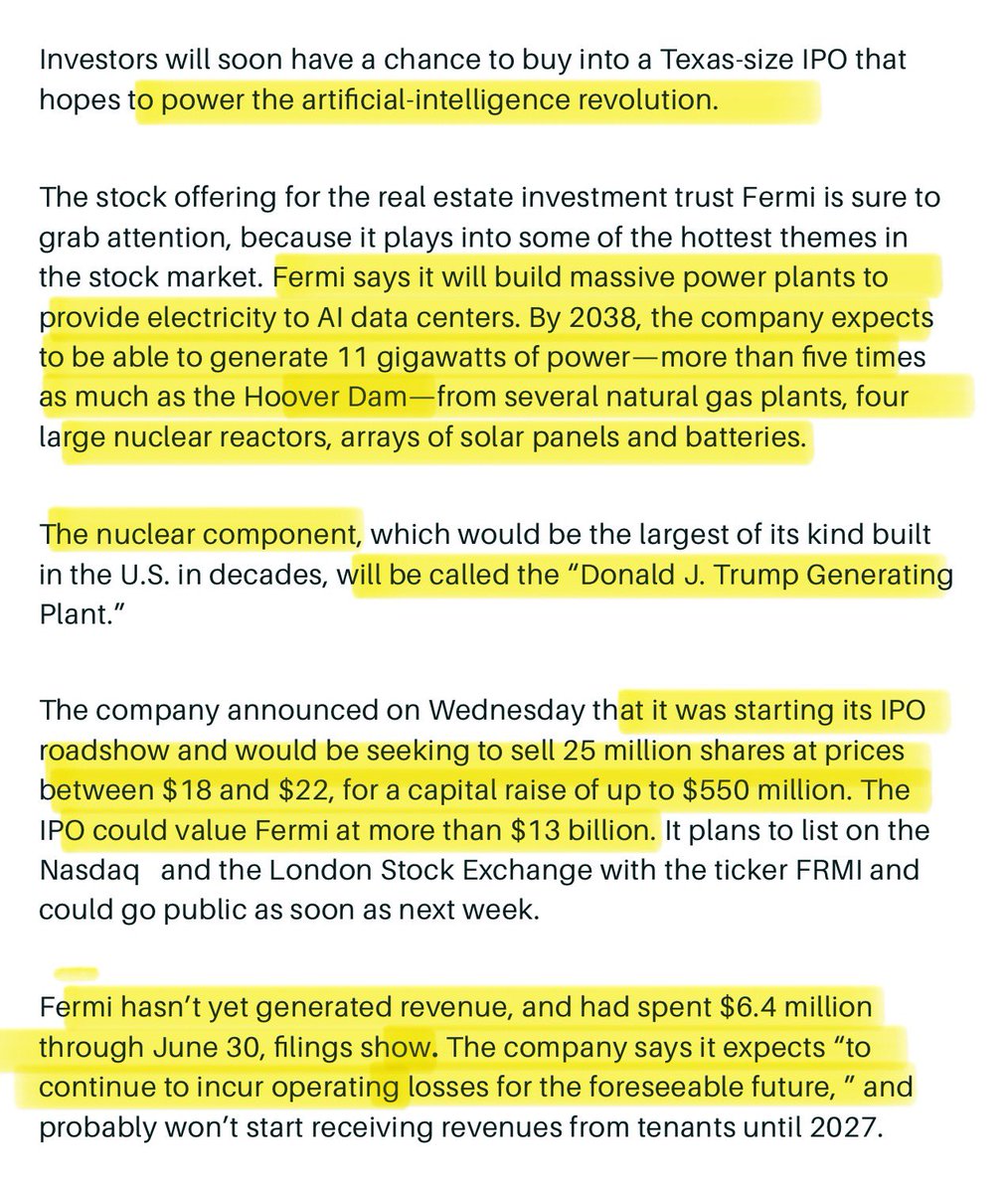

The upcoming Fermi IPO will be the most 2025 IPO All the red flags are there , literally every single one: > No revenue > $13B valuation > Powering AI by 2038 > Nuclear component will be called “The Donald J Trump Generating Plant.” Which could only mean one thing: BUY

At this point is “The Information” labeled as a terrorist organization yet with all these lies lol

$ORCL - ORACLE: THERE HAVE BEEN NO DELAYS TO ANY SITES REQUIRED TO MEET OUR CONTRACTUAL COMMITMENTS, ALL MILESTONES REMAIN ON TRACK

BREAKING: Depression prescriptions spike as Nasdaq drops -1.6% and is now a mind-blowing -3.3% from All Time Highs, authorities urge everyone to call their loved ones to make sure they're okay

Apollo, the predatory lender of last resort which 85% of AUM is debt related is telling you to stay away from equities. There fixed it for you lol

have fun staying poor Apollo casually predicting ZERO returns for the S&P 500 over the coming DECADE.

If you’re not married and over 40 you wouldn’t get it 🥹🥹

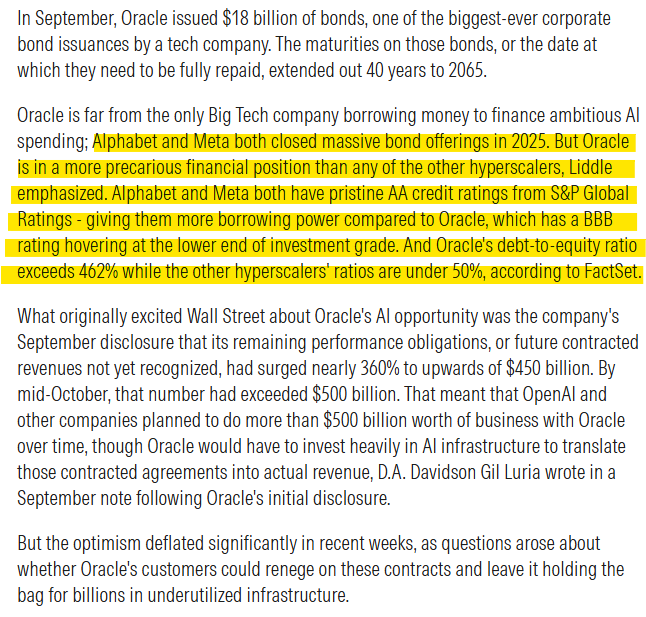

With $ORCL the problem isn’t the bold targets it’s keeping their IG badge while having a 462% debt-to-equity ratio. That’s a tightrope. But if they hold that rating through the next 12–24 months? The equity setup is stupidly good from here

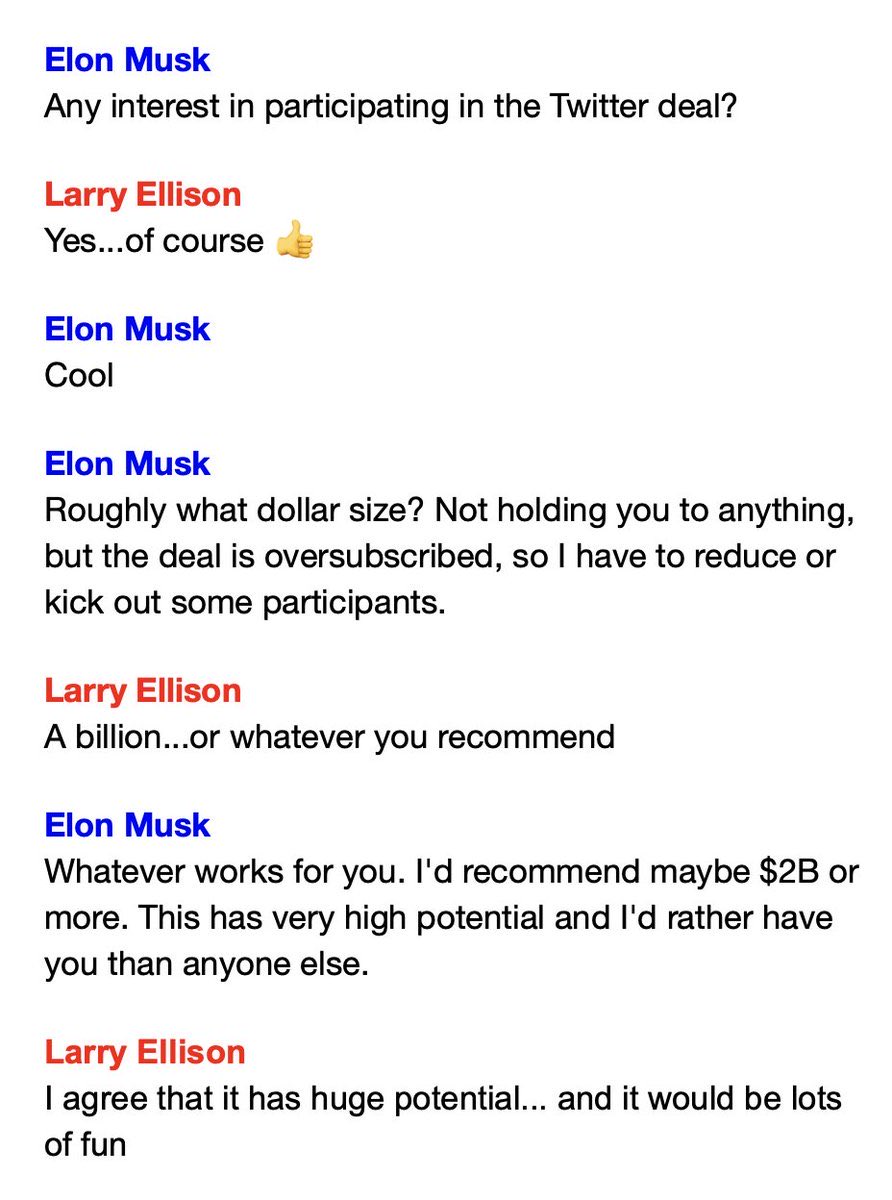

Semi-Serious question: between the Warner Bros push, the AI datacenter moonshot, and front-loading capex… like how levered are the Ellisons really? Maybe these CDS buyers aren’t just idiot bears?? At some point the math ain’t mathin’ But then again…Larry knows a good deal

Every time Waymo drops a milestone $UBER trades like someone launched teleportation. Relax folks they’re scaling off a tiny base. Cool product but the pie is huge and only growing. Plenty of room for multiple winners and $UBER is the only one printing cash.

United States トレンド

- 1. Spurs 42.9K posts

- 2. Cooper Flagg 10.6K posts

- 3. UNLV 2,390 posts

- 4. Chet 8,976 posts

- 5. Merry Christmas Eve 36.4K posts

- 6. #Pluribus 16K posts

- 7. Randle 2,569 posts

- 8. Mavs 6,051 posts

- 9. #PorVida 1,591 posts

- 10. SKOL 1,578 posts

- 11. Rosetta Stone N/A

- 12. #WWENXT 11.5K posts

- 13. #GoAvsGo N/A

- 14. Keldon Johnson 1,334 posts

- 15. Yellow 58.9K posts

- 16. Nuggets 12.3K posts

- 17. #VegasBorn N/A

- 18. Ohio 67.6K posts

- 19. Scott Wedgewood N/A

- 20. Trae 14.7K posts

おすすめツイート

-

Puru Saxena

Puru Saxena

@saxena_puru -

Beth Kindig

Beth Kindig

@Beth_Kindig -

Ian Cassel

Ian Cassel

@iancassel -

From Growth To Value

From Growth To Value

@FromValue -

Markets & Mayhem

Markets & Mayhem

@Mayhem4Markets -

Stock Market Nerd

Stock Market Nerd

@StockMarketNerd -

Kaushik

Kaushik

@Wiseman_Cap -

Brian Stoffel

Brian Stoffel

@Brian_Stoffel_ -

Chris Perruna

Chris Perruna

@cperruna -

Rihard Jarc

Rihard Jarc

@RihardJarc -

Jamin Ball

Jamin Ball

@jaminball -

Brandon Beylo

Brandon Beylo

@marketplunger1 -

Mostly Borrowed Ideas

Mostly Borrowed Ideas

@borrowed_ideas -

Leandro

Leandro

@Invesquotes -

Max Bosenko

Max Bosenko

@MaxTheComrade

Something went wrong.

Something went wrong.