exit1floor

@exit1floor

exit 1 floor, world peace, degen, trader, IQ 100

Tal vez te guste

Unpopular opinion: As stocks in emerging markets and so-called major powers are rising across the board, expecting capital to flow into altcoins might be risky — if they don’t rise as much as anticipated, the downside risk could be significant.

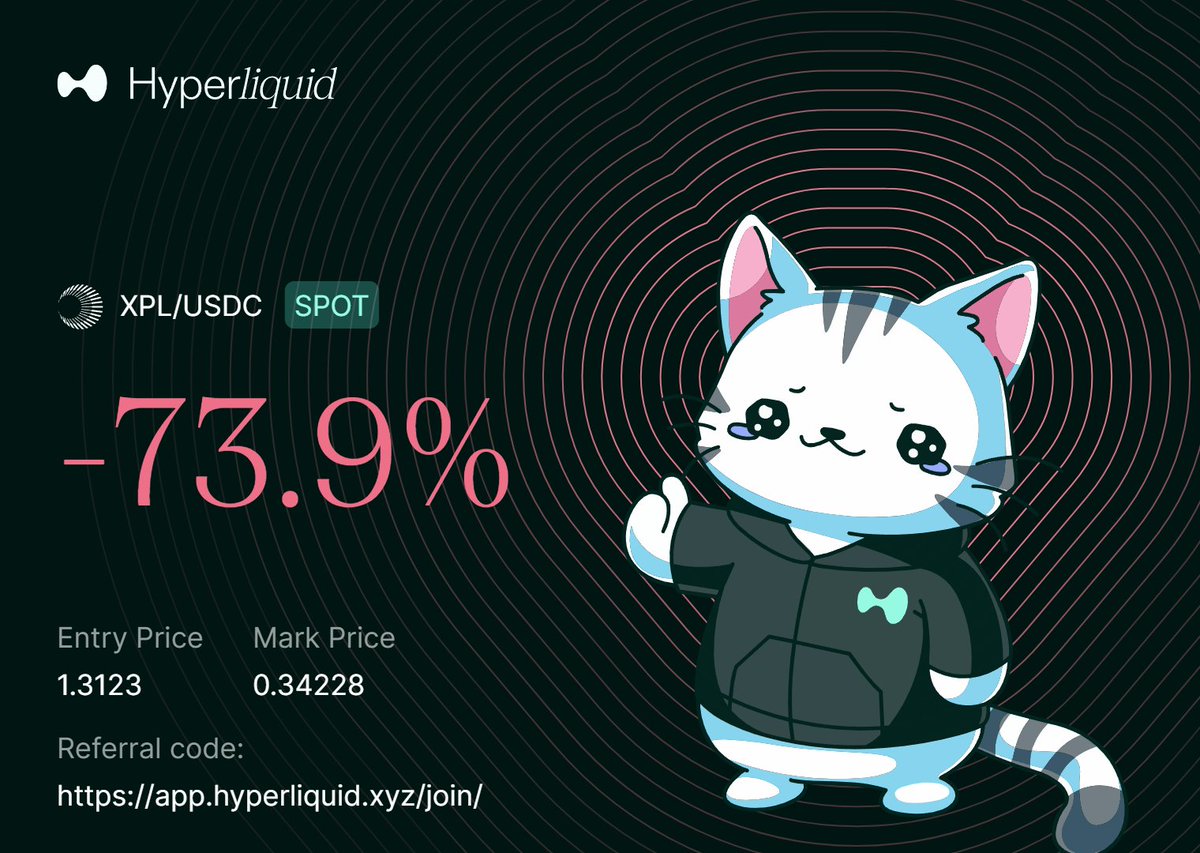

🚨 $22M DUMP Just Hit $XPL, Binance-Linked Wallets Unloading Fast; here’s what’s happening @Plasma (XPL) is down 7.4% in 24h, with $22M sold by one wallet linked to Binance. Main Seller: 0x3d343e > Bridged 60M $XPL → BNB Chain > Deposited all to Binance in chunks ($7M, $3.7M,…

Market dumping has happened again. It's like watching an insider meme coin dumping prices with dozens of wallets... This season's worst trade.😭😭😭 $XPL

*US SEPT. CONSUMER PRICES RISE 0.3% M/M; EST. +0.4% *US SEPT. CONSUMER PRICES RISE 3% Y/Y; EST. +3.1% *US SEPT. CORE CPI RISES 0.2% M/M; EST. +0.3% *US SEPT. CORE CPI RISES 3% Y/Y; EST. +3.1%

🚨 U.S. SEP CPI +0.3% (CONSENSUS +0.4%)

We're actually checking the inverse correlation with gold, but SPX has shown nearly 90% correlation with BTC over the past three months. Just looking at the SPX chart alone, it's clear we're not in a weak market structure yet lol

I challenge @cz_binance to a debate: Bitcoin versus tokenized gold. Which best satisfies the conditions of money, which include being a medium of exchange, a unit of account, and a store of value? Who wants to moderate?

BINANCE FOUNDER CZ AGREES TO A BITCOIN VS GOLD DEBATE WITH PETER SCHIFF

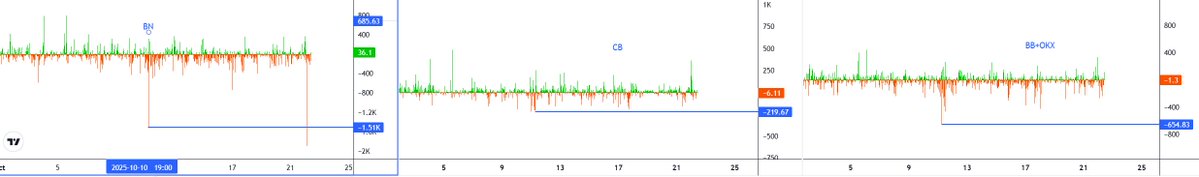

Wtf happening on bn spot? Why did bn spot experience a larger volume of sell pressure in a short period compared to the oct 11 crash?

This isn't the issuer's story. It's literally the story of Rail as a mediator. The fact that they've engaged in discussions with the U.S. Department of the Treasury, emphasizing their role not as issuers (BUSD, USDC, USDT) but as a mediator, is a much bigger deal than people…

🇺🇸 JUST IN: The Federal Reserve is studying a new “payment account” model that would give fintech and crypto firms limited access to Fed payment rails without full banking privileges.

Today, Plasma submitted a letter in response to the Treasury’s advance notice of proposed rulemaking regarding implementation of the GENIUS Act. The GENIUS Act was a historic first step in cementing stablecoins as a global financial tool, however, there's still work to be done.

United States Tendencias

- 1. #10SET N/A

- 2. $RDAC N/A

- 3. Good Tuesday 30K posts

- 4. Dodgers 284K posts

- 5. Freddie Freeman 79.1K posts

- 6. Jamaica 151K posts

- 7. #WorldSeries 224K posts

- 8. #tuesdayvibe 1,988 posts

- 9. Grokipedia 111K posts

- 10. Wikipedia 75.8K posts

- 11. #NationalFirstRespondersDay N/A

- 12. Klein 284K posts

- 13. $PYPL 33.8K posts

- 14. #PutThatInYourPipe N/A

- 15. USS George Washington 32.3K posts

- 16. PayPal 93.6K posts

- 17. Ohtani 147K posts

- 18. Hurricane Melissa 116K posts

- 19. Wordle 1,592 X N/A

- 20. Nelson 23.6K posts

Tal vez te guste

Something went wrong.

Something went wrong.