exit1floor

@exit1floor

exit 1 floor, world peace, degen, trader, IQ 100

Bạn có thể thích

Unpopular opinion: As stocks in emerging markets and so-called major powers are rising across the board, expecting capital to flow into altcoins might be risky — if they don’t rise as much as anticipated, the downside risk could be significant.

*US SEPT. CONSUMER PRICES RISE 0.3% M/M; EST. +0.4% *US SEPT. CONSUMER PRICES RISE 3% Y/Y; EST. +3.1% *US SEPT. CORE CPI RISES 0.2% M/M; EST. +0.3% *US SEPT. CORE CPI RISES 3% Y/Y; EST. +3.1%

🚨 U.S. SEP CPI +0.3% (CONSENSUS +0.4%)

We're actually checking the inverse correlation with gold, but SPX has shown nearly 90% correlation with BTC over the past three months. Just looking at the SPX chart alone, it's clear we're not in a weak market structure yet lol

I challenge @cz_binance to a debate: Bitcoin versus tokenized gold. Which best satisfies the conditions of money, which include being a medium of exchange, a unit of account, and a store of value? Who wants to moderate?

BINANCE FOUNDER CZ AGREES TO A BITCOIN VS GOLD DEBATE WITH PETER SCHIFF

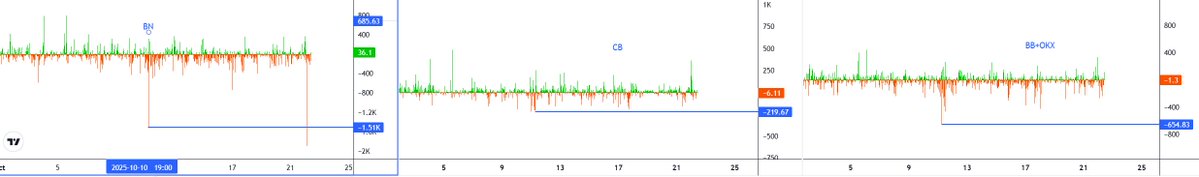

Wtf happening on bn spot? Why did bn spot experience a larger volume of sell pressure in a short period compared to the oct 11 crash?

This isn't the issuer's story. It's literally the story of Rail as a mediator. The fact that they've engaged in discussions with the U.S. Department of the Treasury, emphasizing their role not as issuers (BUSD, USDC, USDT) but as a mediator, is a much bigger deal than people…

🇺🇸 JUST IN: The Federal Reserve is studying a new “payment account” model that would give fintech and crypto firms limited access to Fed payment rails without full banking privileges.

Today, Plasma submitted a letter in response to the Treasury’s advance notice of proposed rulemaking regarding implementation of the GENIUS Act. The GENIUS Act was a historic first step in cementing stablecoins as a global financial tool, however, there's still work to be done.

Thank you to @RSSH273, @brendanpmalone and @CryptoTaxGuyETH for the support. You can view our letter to the Treasury below. app.box.com/s/y284km8v1doh… Trillions🕊️

많은 분들이 공유해주셔서 보고 있는데. 긍정적이고 지금 미국에서 핫이슈인데. 어디에 호재인지는 다들. 답이 없네요. 더 찾아보고 업데이트 하겠습니다. 🫡

🇺🇸 방금 들어온 소식: 연방준비제도는 핀테크 및 암호화폐 회사가 은행 특권 없이 연방 지불 레일에 제한적으로 접근할 수 있도록 하는 새로운 "지불 계좌" 모델을 연구하고 있습니다.

Second, we advocate for clarity around the taxation of stablecoins. We ask Treasury to treat stablecoins as cash under the Internal Revenue Code. Stablecoins are currently treated as property, which causes gain or loss recognition on ordinary consumer transactions under section…

In our letter, we ask the Treasury to afford builders with additional protections that are appropriate and ensure innovation happens within American borders without fear of prosecution by rogue agencies in the future. The digital asset ecosystem has operated from a place of fear…

Congrats bro🎉

$BYND meat the next comeback story like $OPEN? Looking for 10$+ here

United States Xu hướng

- 1. Luka 97K posts

- 2. Dodgers 122K posts

- 3. Blue Jays 81.9K posts

- 4. #WorldSeries 104K posts

- 5. #LakeShow 3,503 posts

- 6. #TheLastDriveIn 4,553 posts

- 7. Mavs 13.5K posts

- 8. Snell 14.4K posts

- 9. Halo 163K posts

- 10. Toronto 67.8K posts

- 11. Marcus Smart 3,561 posts

- 12. #SmackDown 34.3K posts

- 13. Nico Harrison 2,486 posts

- 14. Vando 2,653 posts

- 15. Kyshawn George 4,230 posts

- 16. Addison Barger 18.1K posts

- 17. #BostonBlue 5,489 posts

- 18. Blazers 10.8K posts

- 19. Wizards 10.6K posts

- 20. Naz Reid N/A

Bạn có thể thích

Something went wrong.

Something went wrong.