Goran Bash

@goranbash

Freelance TRADER, In Markets since 2010 - Finance & Economics, Market Analyst #STOCKS #BONDS #METALS #CURRECNIES #CRYPTO.

Dit vind je misschien leuk

Pit Lane to P3, had an unlucky puncture resulting in pitting early and finishing 10s of the lead. MAX VERSTAPPEN - SIMPLY LOVELY 👌🏎️ vt.tiktok.com/ZSyq52uod/

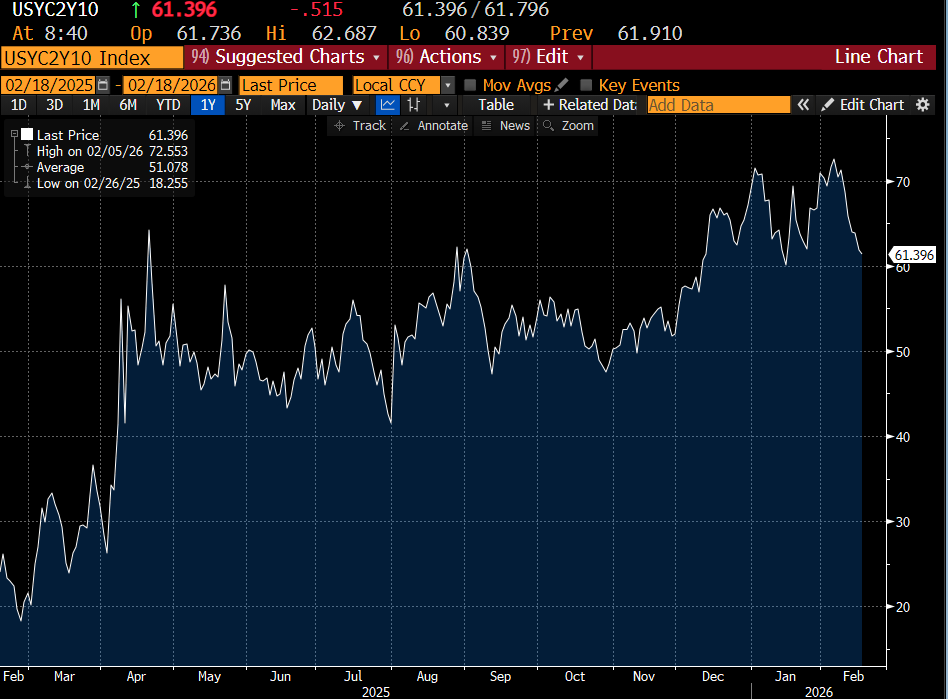

Yesterday, we looked at the curious case of the 4% yield on 10-year US government bonds. The plot thickens with the recent flattening of the US yield curve (please see the Bloomberg chart on 2s-10s below). #economy #markets #bonds

The Puzzle of US Yields After dipping to 4.01% earlier this morning, the yield on the 10-year US government bond is currently hovering around 4.03%—a level that seems disconnected from both fundamentals and valuations. From a fundamental perspective, last week’s

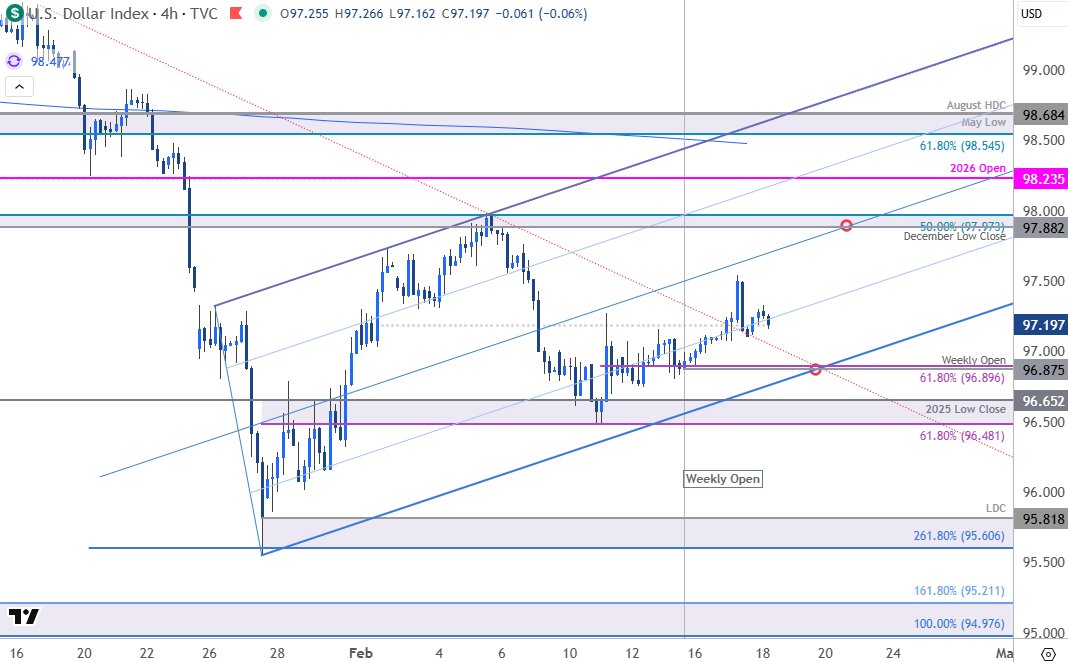

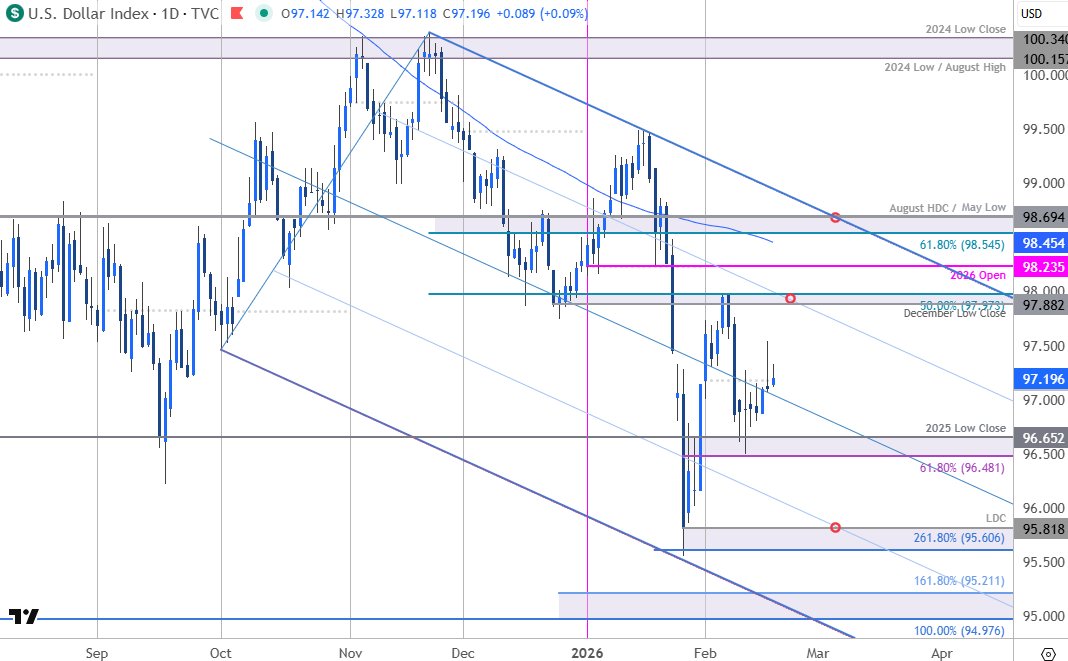

US Dollar Short-term Outlook: USD Coils Between Key Levels – Breakout Looms forex.com/en-us/news-and… $DXY Daily & 240min Charts

Happy Wednesday

Gold legitimately breaks out from a week-long bullish wedge...

$FTSE is finally breaking that major ascending resistance from May 2025. #ftse100

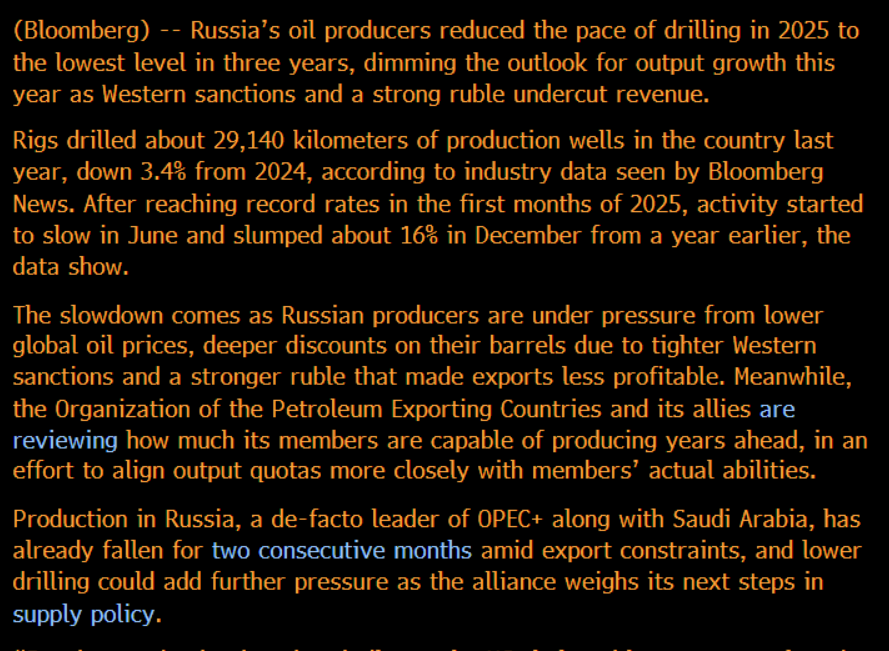

Russia Cuts Oil Drilling as Money Dries Up, With Output at Risk

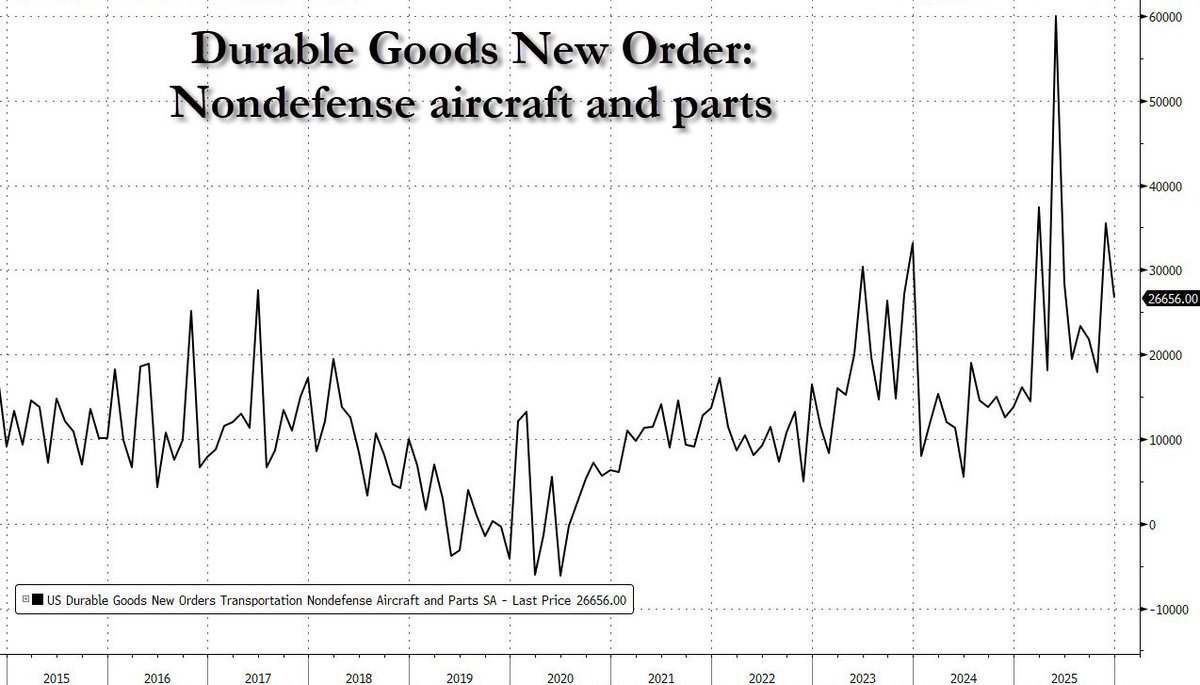

Durable orders for Nondefense aircraft have become more volatile than bitcoin

#EURUSD in focus with key Us data coming this week. Will it hold this key support area? 👉 forex.com/en-us/news-and…

Good Morning from Germany, which can once again borrow at slightly lower rates, helped by the new bond-market narrative that AI is deflationary. At today’s auction of 10-year Bunds, Berlin paid an avg yield of 2.73%, down from 2.85% and 2.83% at previous sales. Demand, however,

Brent #crudeoil trades higher, but still below $70 in response to @axios top story that the Trump administration is closer to a major war in the Middle East than most Americans realize, and that it could begin very soon, with sources saying it would likely be a massive, week-long

#CRUDEOIL consolidation above the 200-day average is positive.

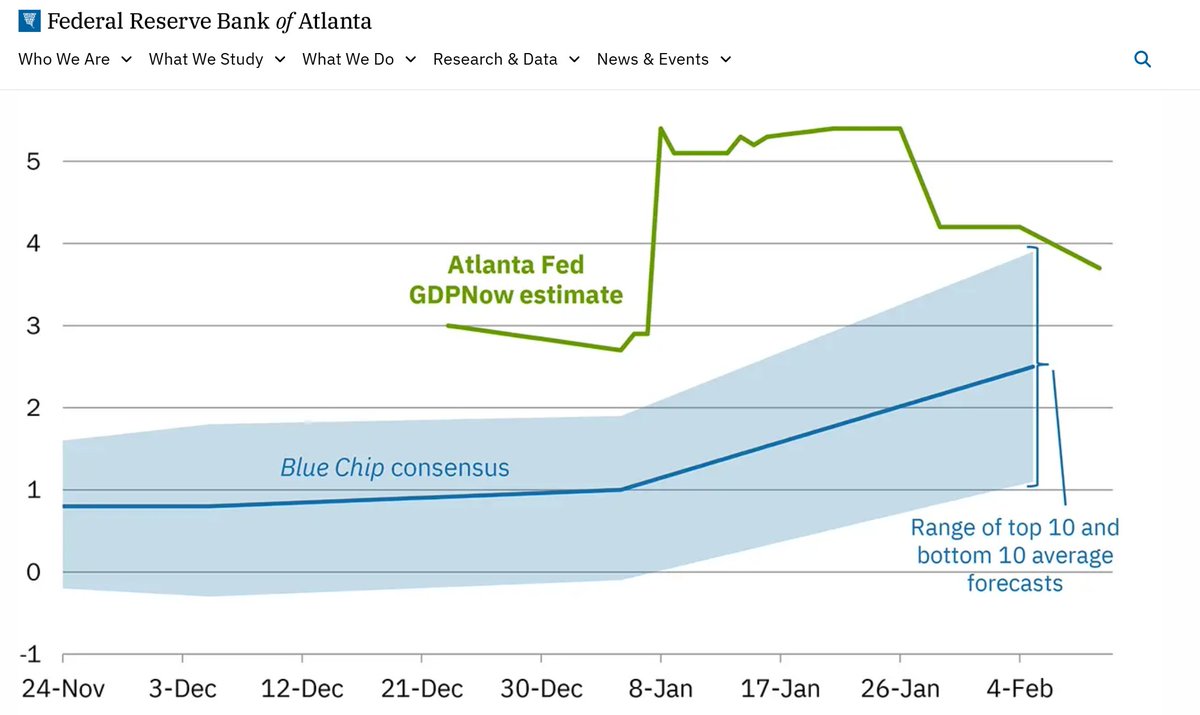

Ahead of Friday’s release of the US Q4 GDP estimate, the chart below tracks the evolution of the Atlanta Fed’s GDPNow estimate for Q-4 growth (currently 3.7%) over the past three months, including relative to the "Blue Chip" consensus. While on growth, US industrial production in

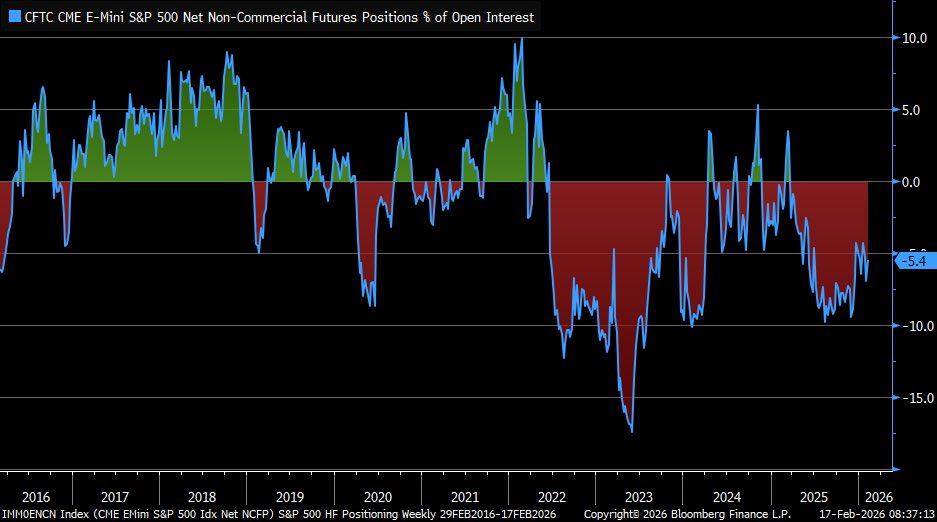

Large speculators remain net short S&P 500 futures (haven't been net positive since beginning of 2025)

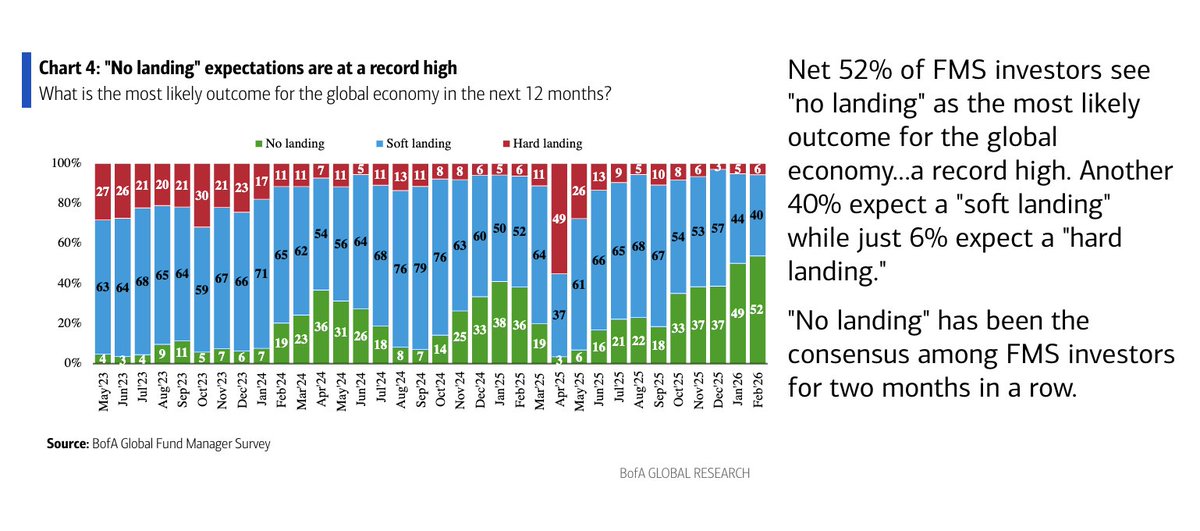

BofA FMS shows the highest number of investors see "no landing" as the most likely outcome for the global economy over the next 12 months.

Gold dropped more than 2% on Tuesday, as holidays in major markets hit liquidity, while easing geopolitical tensions and a stronger dollar added to the pressure. reuters.com/world/asia-pac…

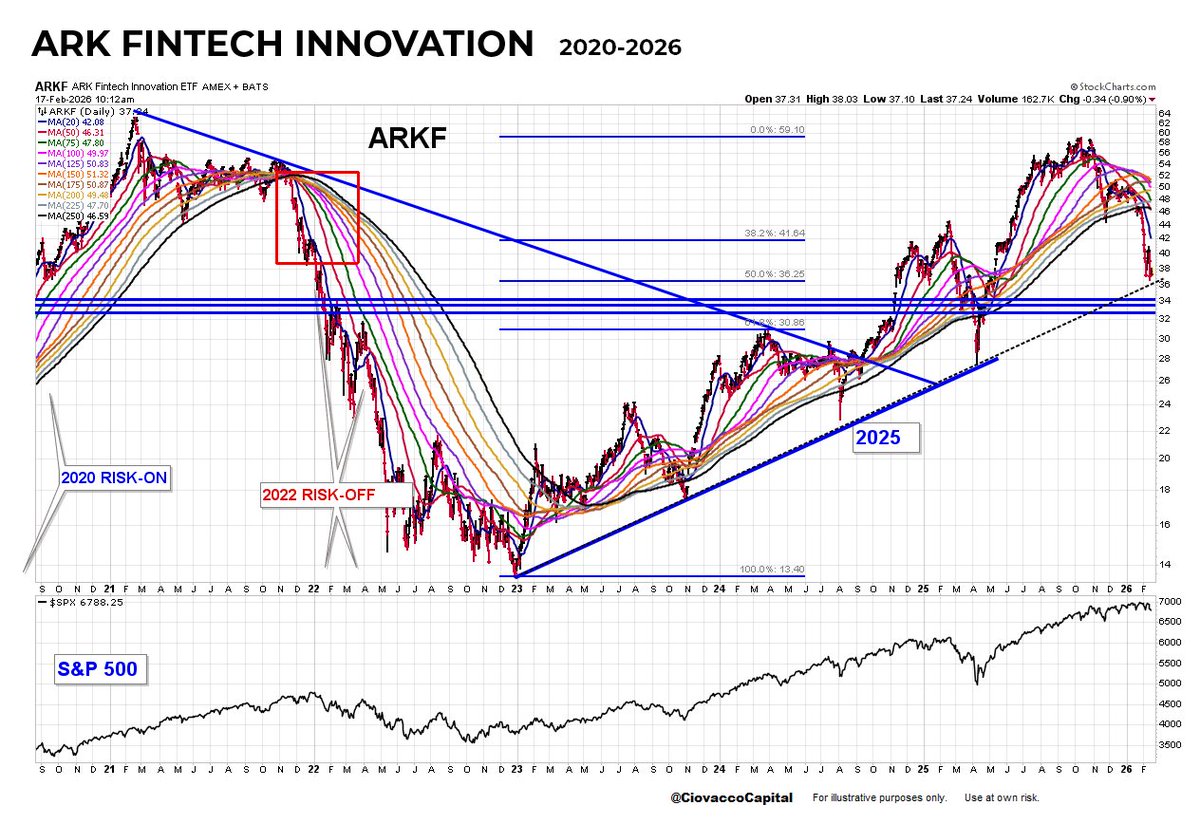

ARKF is back to the risk-on trendline that has held since 2022 NASDAQ low. Trend is more vulnerable which means we should be open to both outcomes (hold & break). Click image to enlarge. S&P 500 bottom panel.

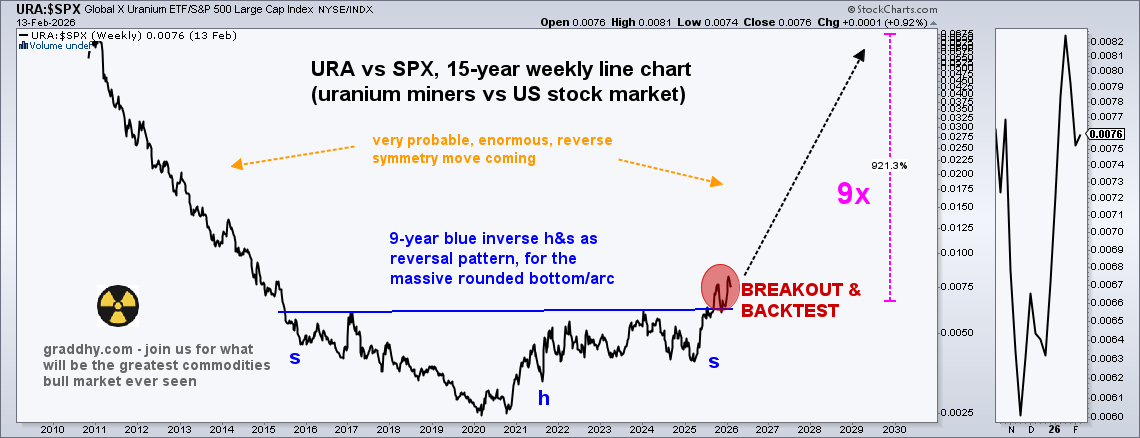

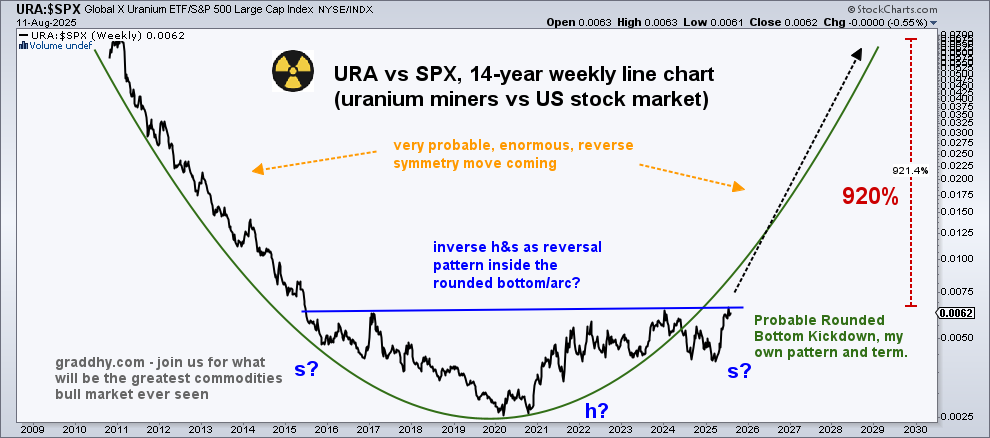

Uranium miners did 580% in its baby bull move. Still, just getting started. ☢️ Note on the chart below that the big breakout is here, as posted in the linked post would come. Plus also note that the chart also has a backtest plus a higher high after the breakout high, i.e. the

#uranium miners did 580% in its baby bull move.☢️ Still, just getting started. Below is a brilliant, bullish roadmap setup for this ratio. That is a very symmetrical, blue inverse head & shoulders pattern. The glorious commodities bull market will be the greatest opportunity in

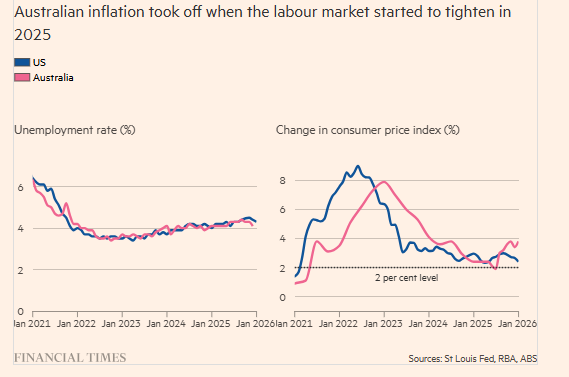

It's tempting to say the US is following the Australian economic path...and inflation will follow labour market tightening Much too tempting My newsletter ft.com/content/1faba8…

Crypto Fear & Greed Index: 10/100 - Extreme Fear

United States Trends

- 1. LINGORM FAN MEET IN SG N/A

- 2. #LingOrm2ndFMinSingapore N/A

- 3. Luka N/A

- 4. Dr Pepper N/A

- 5. Clippers N/A

- 6. Tucker N/A

- 7. Manon N/A

- 8. #DistrictV N/A

- 9. #GMMTVFANFEST2026JP N/A

- 10. #SmackDown N/A

- 11. Huckabee N/A

- 12. $Lobstar N/A

- 13. #LakeShow N/A

- 14. Ayton N/A

- 15. Batum N/A

- 16. MARCUS SMART N/A

- 17. Kris Dunn N/A

- 18. Mathurin N/A

- 19. Austin Reaves N/A

- 20. Abraham N/A

Dit vind je misschien leuk

Something went wrong.

Something went wrong.