ivanhoff.com

@ivanhoff02

Full-time Options & Stock trader. I have a subscription service: http://ivanhoff.com/premium. Author of books on swing trading: http://amzn.to/25hyvo *Not investment advice*

Not many of these so worth mentioning - this is a new all-time high for $DECK. It's up 500x since 2000. Rumor has it that walking 5 miles a day in their shoes works just like ozempic and they are also great storage for coal.

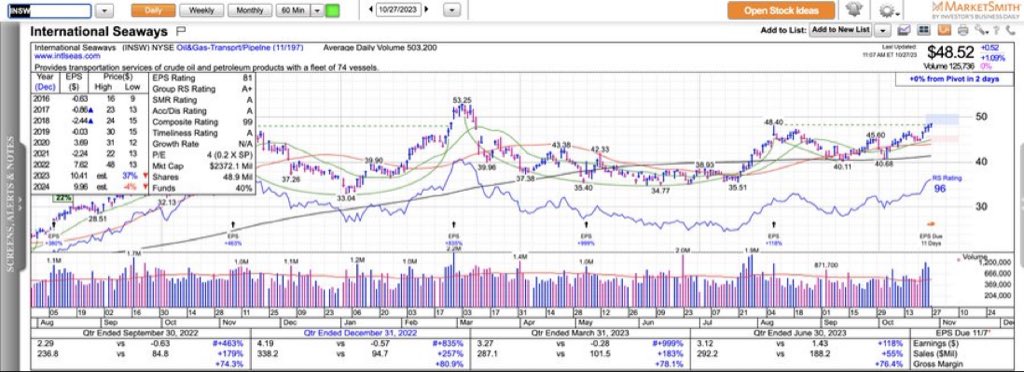

Crude oil transportation and storage stocks continue to look hot. Here’s $INSW but also look at $FRO, $TNK $DHT $TK etc.

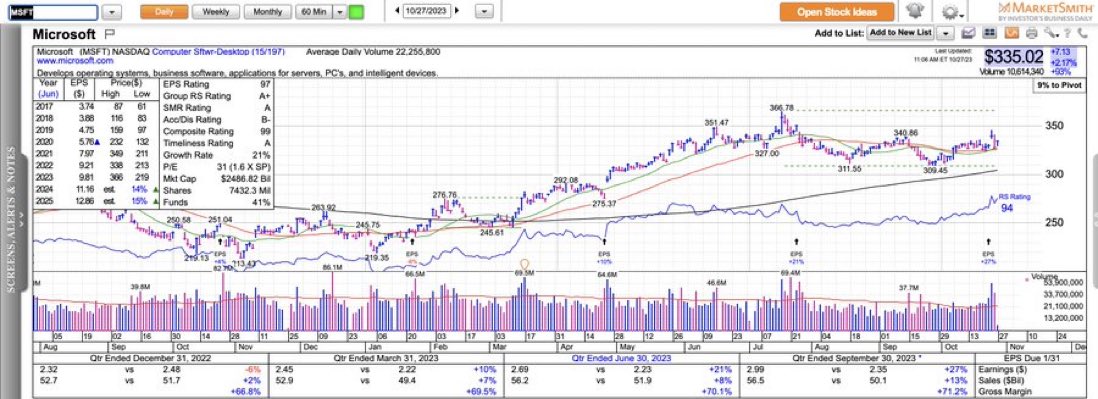

$MSFT found support near its 50dma. Notice how their margins have gradually improved in the past few quarters. All that cost cutting is paying off.

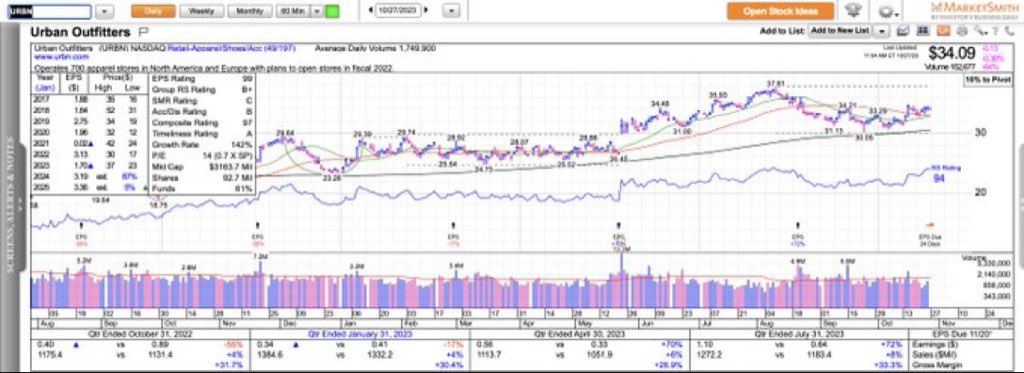

For whatever reason, apparel stores stocks continue to show relative strength. Here’s $URBN but also look at $ANF, $GPS, etc.

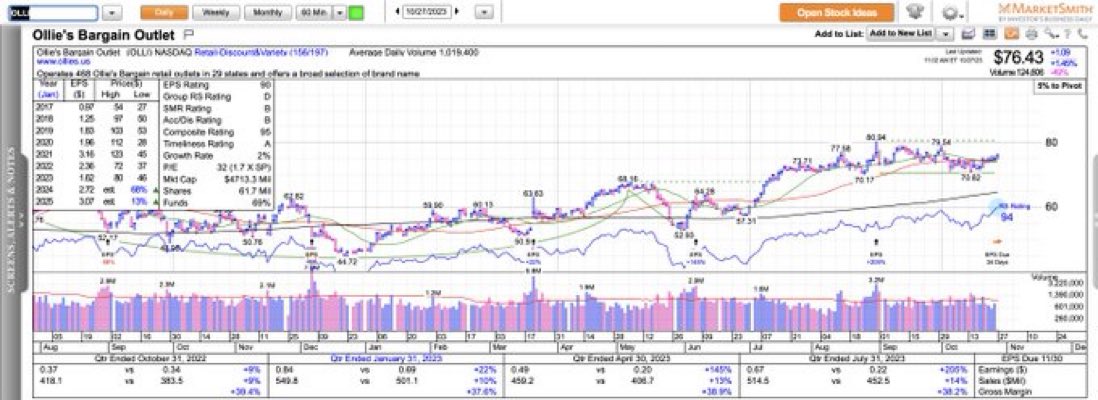

$OLLI is not a fast mover but it is acting constructively so far. New 52wk relative strength high + accelerating earnings and sales growth. IBDinvestors MarketSmith

Bull markets - “I only look at daily charts. Everyone who looks at intraday charts is a degenerate” Bear markets - “I can’t live without my 2-minute charts”

The reaction to earnings is what matters because the market is forward-looking. The approximate current market reactions: Double beat and raise guidance - down 2% Double beat only - down 5% Miss - down 20% $SPY $MSFT $META $GOOGL etc.

Education stocks rallying, waste management stocks perking up, consumer staples starting to make higher lows. It's as if the market is pricing in a potential recession. The only thing missing is a rally in Treasuries. IBDinvestors MarketSmith #IBDpartner bit.ly/44IcxO1

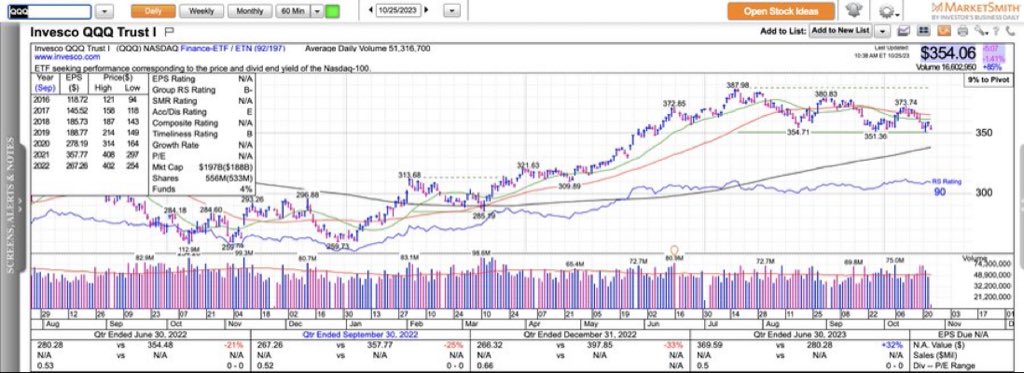

If $QQQ loses 350, it is likely to test 340 which is its 200dma and its YTD VWAP. If it closes below 340 at some point, it is likely to test 320.

Suing Facebook for causing harm to teens is the same as suing any restaurant that offers french fries.

What's your plan of action if the next 10 years look like this?

$TNK - not a glamorous business but notably bullish price action. It is working on the right side of a big base.

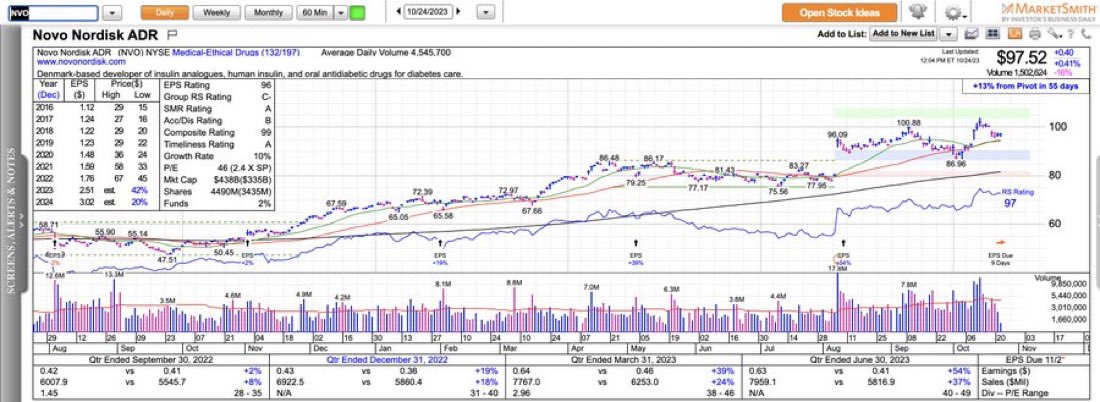

$NVO is in a range contraction near its 20dma. $LLY is a similar setup. They are like Pepsi vs Coke for weight-loss pills.

Chinese stocks are bouncing today. $MNSO has a relative strength rating of 99.

This must be the only bull market in history where Russell 2k is making new 52wk lows. $IWM is not too far from reaching oversold levels and 160 is potential support. Some of the biggest rallies happen during bear markets.

$LNW - global gaming stock, consolidating near its all-time highs. It's been public since 1985.

$BRBR - another fitness drinks and nutrition stock hovering near all-time highs. The market seems fascinated with the industry after the success of $CELH which ran 50x in four years.

Defense stocks continue to show relative strength. Here's $KTOS setting up on a weekly time frame. Reports earnings next week. IBDinvestors MarketSmith #IBDpartner bit.ly/44IcxO1

Momentum Monday – Bear Market Price Action ivanhoff.com/2023/10/22/mom… howardlindzon MarketSmith $QQQ $TNX $IWM $GLD $BTCUSD

Bull market = tell me which stocks are holding the best, so I tell you which stocks are likely to outperform. Bear market = tell me which stocks are holding the best so I tell you which stocks are going to get hit next.

United States Trends

- 1. Sean Mannion N/A

- 2. Dignity N/A

- 3. SpaceX N/A

- 4. FORTNITETOOZ N/A

- 5. Luigi Mangione N/A

- 6. Hugh Morris N/A

- 7. #NewYearNewGearGiveaway N/A

- 8. #BridgertonS4 N/A

- 9. shane hollander N/A

- 10. Senator Grassley N/A

- 11. USA 250 N/A

- 12. #ICEoffOurStreets N/A

- 13. Nintendo N/A

- 14. The Cowsills N/A

- 15. $SNDK N/A

- 16. Pocahontas N/A

- 17. #GreenWall N/A

- 18. Mark Anderson N/A

- 19. $AAPL N/A

- 20. Pepsi N/A

Something went wrong.

Something went wrong.