IVANWIND

@ivanwind_

US bonds & markets

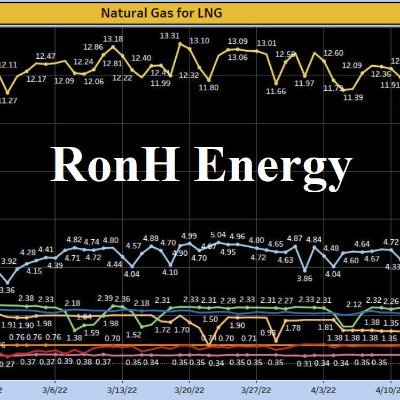

US $Bonds Short $TLT & #TMF 📉 •Producer prices surged despite falling inflation (TrueInflation) 📈 •Treasury’s TGA +$54B – second big jump in a row 💰 •Fed steps only expected closer to summer 🏦 •Big Monday auction: ~$180B 💵 •additional market signals emerging

Buy $TLT #tmf Inflation data is encouraging: positive consensus on PCE, France, Germany, and German import prices. May is one of the largest months for Treasury maturities. OPEC meets only on the 31st — no oil worries yet. Fed officials started talking rate cuts last week o><o

$tlt $qqq #tmf #spy I believe the market is rising today because, during Friday’s expiration, we saw a massive number of expiring puts. Today, we’re witnessing the assignment process, where market participants still holding puts must buy the underlying stocks at the strike price…

$tlt #tmf US Budget Deficit Hits Record Levels The US recorded a $307B deficit in February, nearing the 2021 record ($311B). FY2025 deficit (Oct–Feb) hit an all-time high of $1.14T vs. $0.82T in FY2024. Spending surges (+13.2% YoY, +$356B): •Healthcare: +$148.1B •Social…

$tlt #tmf January 6, 2025: U.S. Treasury yields climbed despite a weakening dollar and falling oil prices. Key drivers: •Rising PMIs in China, the EU, and the U.S. •Accelerating inflation in Germany •CDS swaps hitting 22 bps (highest since November) •Pressure from Trump’s…

🇺🇸 #debt #markets #USA #liquidity #stocks #BTC $TLT $TMF US banks are lobbying for easing the Supplementary Leverage Ratio (SLR) requirements. This topic has become one of the main headlines on Bloomberg. If the easing is implemented, banks will be able to purchase US government…

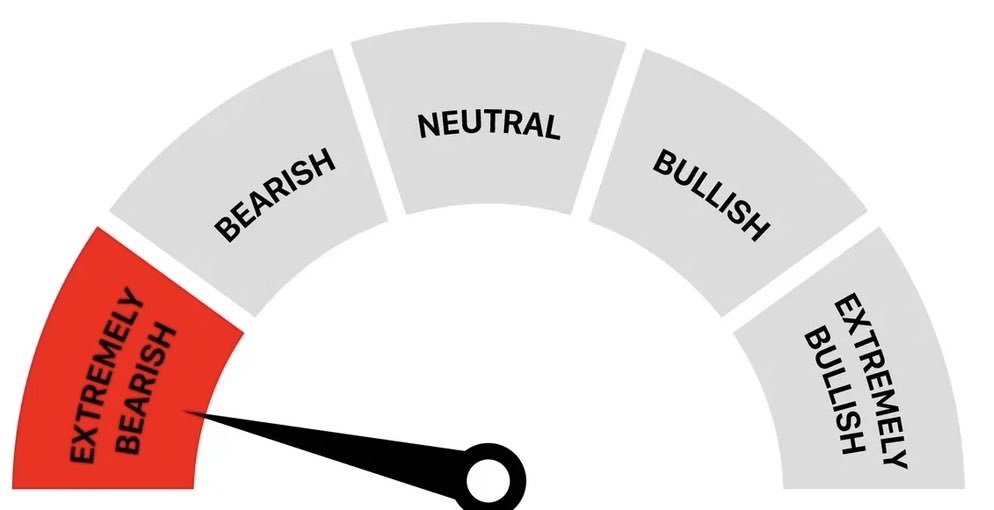

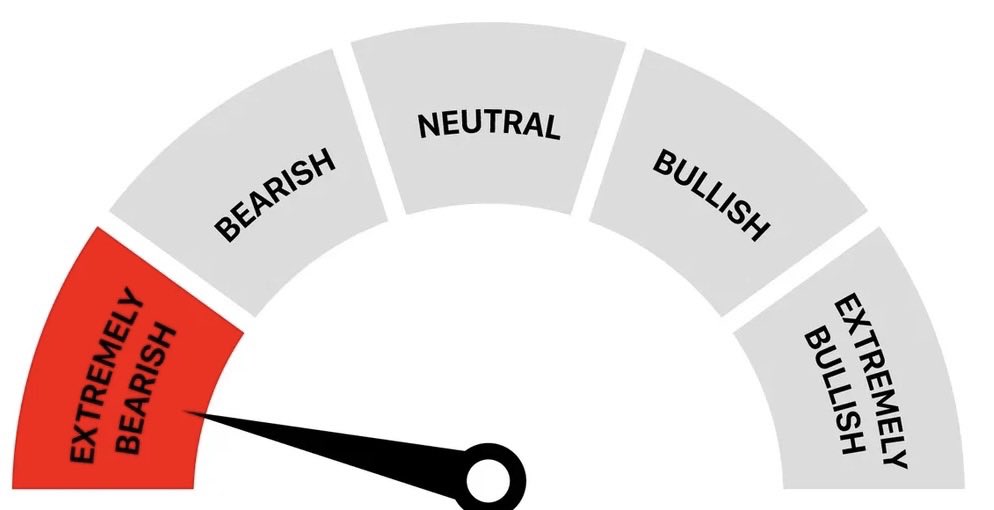

$SPY #QQQ Republican representatives in the House of Representatives intend to seek an increase in the debt ceiling ❗️this spring ❗️ to avoid panic in global markets, according to House Speaker Mike Johnson. 2 months BEARISH guys.

$TLT #TMF Weekly Fed Update (Jan 1): •Assets Cut: Fed reduced assets by $33B (-$18B Treasuries, -$12B MBS). •Liabilities Spike: Banks boosted reverse repo (RRP) by $322B to $888B for end-of-year reporting. NY Fed’s overnight RRP surged to $473B (from <$100B days prior).…

$TLT #TMF 3 January 2025 1.U.S. Treasury yields continue to rise on January 3, despite a drop in the Dollar Index (DXY). 2.Oil prices have been surging for the second consecutive day, fueling the upward trend. 3.Strong ISM and PMI data have further supported higher yields.…

31 December. US bonds. $TLT #tmf •Yields drop as maturity dates approach •Weak China PMI •Debt ceiling from Jan 1 •No Treasury auctions today •Minimal debt growth in Dec Negative: Rising oil prices. Overall, a strong day for bonds.

The US Treasury announced in early January 2025 that a debt ceiling will be imposed. This means the US will spend less, at least for a while. Negative news for all markets—NASDAQ, S&P, Russell, crypto—until a new ceiling is set, if it ever is. Expect Elon Musk & team to optimize…

“Why are bond yields rising 27 dec? 1/ Oil prices are climbing amid Middle East concerns, fueling inflation risks and pushing bond yields higher. 2/ EIA data disappointed, adding to market volatility. 3/ U.S. government debt decreased by $45 billion! For December, it has only…

Looking ahead to December 27, bond yields will likely be influenced by oil prices, which will depend on the EIA’s statement on crude inventory levels. A key positive factor is the absence of auctions tomorrow, and the fact that U.S. debt increased by just ~$60 billion this…

Bond yield situation on December 26: Today’s market was eventful: in the first half, yields rose under pressure from a $255 billion auction, but falling oil prices later in the day helped stabilize the situation. Yields dropped after the release of Money Supply (M1, M2)…

What to expect on Dec 26? •US debt fell by $300M, but oil prices remain uncertain due to Middle East & Russia risks during the holidays. •Key events: 1.Jobless Claims — major impact on yields. 2.EIA oil report — crucial for oil prices & yields. 3.$40B auction — small, limited…

Dec 24: Why did 10Y yields drop? •Oil prices rose (supports yields). •US debt fell by $300M.👍🏻 •Strong demand for today’s $70B 5Y auction.👍🏻 Key point: Jan 1, 2025 = debt ceiling limit. Treasury can’t issue new bonds. But before that, 4 auctions on Dec 26 will pressure…

United States Trends

- 1. Chloe Kim N/A

- 2. Ellison N/A

- 3. Nick Castellanos N/A

- 4. Real ID N/A

- 5. Joan Garcia N/A

- 6. Sochan N/A

- 7. Casty N/A

- 8. Latvia N/A

- 9. Hawley N/A

- 10. Shenae N/A

- 11. Phillies N/A

- 12. De'Aaron Fox N/A

- 13. Joe Judge N/A

- 14. ICE Barbie N/A

- 15. Trinidad Chambliss N/A

- 16. UCMJ N/A

- 17. Boasberg N/A

- 18. Bridgeland N/A

- 19. #SaveAct N/A

- 20. Fetterman N/A

Something went wrong.

Something went wrong.