Jakub Polec

@jakubpolec

Building Profitable Algo Strategies | Quantitative Researcher & Dev | Financial Data Scientist | ML Investing | Sharing Code for Algorithmic Systems | PhD

True

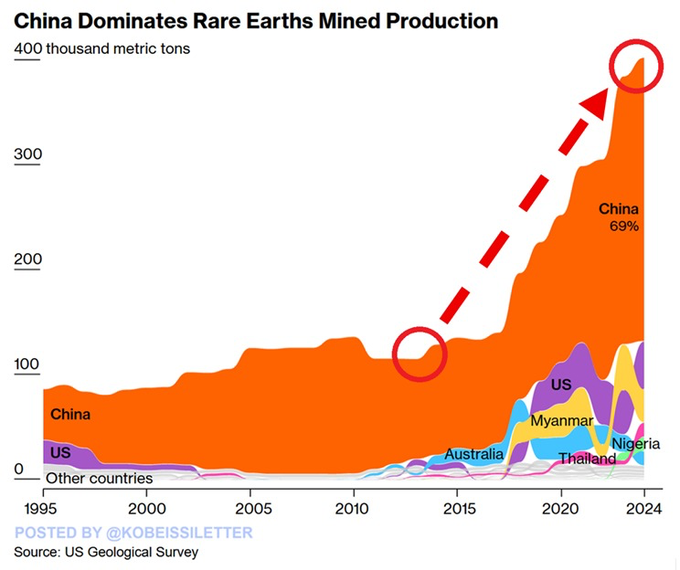

China doesn’t dominate the mining of rare earth elements, which are not really rare. China absolutely dominates the refining capacity of REE.

So you know

Rare earths have been very important for Trump. Between a Ukraine deal and the US-China trade war, Trump has prioritized rare earths. These metals are CRUCIAL for the production of weapons, chips, AI, and strategic leverage. The US gets ~70% of its rare earths from China.

He wrote this in his book years ago. Agree with him.

BREAKING: Ray Dalio now expects a Civil War.

Silver has entered what I call "the wrecking ball" stage of the rally; this is when the volatility is ramping up and the silver futures market is running stop-loss orders on both sides of the market. I can envision a correction back to the $45-$46 area, followed by another…

Don’t be fooled, the trend is clear.

This is silver's 30-min chart. There is no silver crash, just a small blip...

Clear, don’t trust anyone, mostly people for whom you’re nobody.

At the peak of the Housing Bubble 2008 Fed Chair Bernake told the American people that the housing bubble causing a recession was highly unlikely and prices going down -50% was unlikely. Stocks prices fell -50% & housing prices nationally fell -20%

We made a lot of money by the decision to not to be fully invested - Warren Buffett.

As per our work recently - complex systems emerge from Iterations on simple designs

Volatility is now being driven by excitement, not fear. The VIX is rising because speculation has reached extreme levels. There’s also a growing gap between realized volatility (how much the market actually moves) and implied volatility (how much traders expect it to move).…

Obvious. Gold ↑ + USD ↑ = risk aversion / flight to safety

Make sense..

If you’re short OIL, I’ve got some bad news for you. The correlation between crude oil and the 5-year breakeven inflation rate is deeply negative right now, which is a rare event. Historically, whenever this weekly correlation stayed below –0.35, the following 12-month…

Years back we made strategy to play against Goldman. Funny we got more then them in such fund.

GOLDMAN SACHS: NO STOCK BUBBLE YET Goldman Sachs says the market shows some bubble-like signs but remains driven by strong fundamentals. Tech valuations are high, but leading firms are financially solid, and the AI sector is still concentrated among major players. The bank…

Typical for end-game. My taxi driver told me to buy gold.. I’ve been there already.

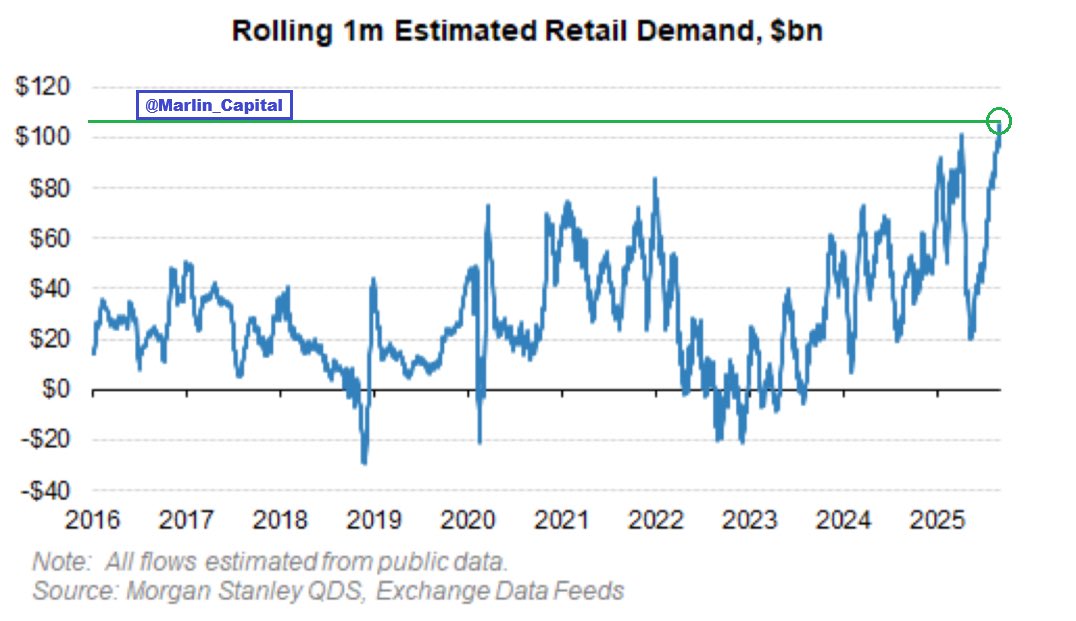

We have just witnessed the largest Retail Investor buying EVER. Retail has bought over +$100B of US stocks in the last month, the largest 1M buying on record. $SPX $QQQ $IWM $NVDA $TSLA

True.

One, tow, three…

United States Tendenze

- 1. Columbus 118K posts

- 2. #WWERaw 47.9K posts

- 3. Middle East 208K posts

- 4. #IndigenousPeoplesDay 7,586 posts

- 5. $BURU N/A

- 6. Seth 43K posts

- 7. Darius Smith 2,697 posts

- 8. Thanksgiving 51.7K posts

- 9. Marc 43.4K posts

- 10. Mike Shildt 1,339 posts

- 11. #IDontWantToOverreactBUT 1,228 posts

- 12. Macron 198K posts

- 13. Egypt 215K posts

- 14. Apple TV 3,789 posts

- 15. Flip 52.8K posts

- 16. #SwiftDay 10.1K posts

- 17. THANK YOU PRESIDENT TRUMP 62.3K posts

- 18. The Vision 96.9K posts

- 19. #LightningStrikes N/A

- 20. Mears N/A

Something went wrong.

Something went wrong.