Jakub Polec

@jakubpolec

Building Profitable Algo Strategies | Quantitative Researcher & Dev | Financial Data Scientist | ML Investing | Sharing Code for Algorithmic Systems | PhD

🚨 How to play it in future: Liquidity ↑ (TGA↓ or RRP↓) → Gold ↑ Liquidity ↓ (TGA↑ or RRP↑) → Gold ↓

Correlation of gold vs. DXY ≈ −0.7 (strong). Correlation of gold vs. real yields ≈ −0.8 (very strong). Correlation of gold vs. net liquidity ≈ +0.4 to +0.6 (moderate, regime-dependent)

context extended - it's the main AI feature people are requesting now.

Agree, thnx

🇪🇺 Telegram sent this message to all its users in France regarding Chat Control. People must know the names of those who try to steal their freedoms: Today, the European Union nearly banned your right to privacy. It was set to vote on a law that would force apps to scan every…

he's better than Musk at his best years.

The stock market just erased -$450 billion in 7 minutes because President Trump threatened to start producing cooking oil in the US.

True

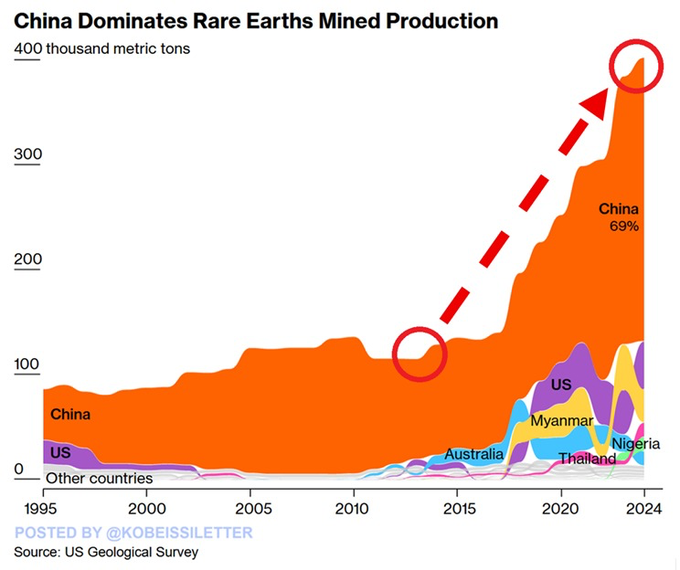

China doesn’t dominate the mining of rare earth elements, which are not really rare. China absolutely dominates the refining capacity of REE.

So you know

Rare earths have been very important for Trump. Between a Ukraine deal and the US-China trade war, Trump has prioritized rare earths. These metals are CRUCIAL for the production of weapons, chips, AI, and strategic leverage. The US gets ~70% of its rare earths from China.

He wrote this in his book years ago. Agree with him.

BREAKING: Ray Dalio now expects a Civil War.

Silver has entered what I call "the wrecking ball" stage of the rally; this is when the volatility is ramping up and the silver futures market is running stop-loss orders on both sides of the market. I can envision a correction back to the $45-$46 area, followed by another…

Don’t be fooled, the trend is clear.

This is silver's 30-min chart. There is no silver crash, just a small blip...

Clear, don’t trust anyone, mostly people for whom you’re nobody.

At the peak of the Housing Bubble 2008 Fed Chair Bernake told the American people that the housing bubble causing a recession was highly unlikely and prices going down -50% was unlikely. Stocks prices fell -50% & housing prices nationally fell -20%

We made a lot of money by the decision to not to be fully invested - Warren Buffett.

As per our work recently - complex systems emerge from Iterations on simple designs

Volatility is now being driven by excitement, not fear. The VIX is rising because speculation has reached extreme levels. There’s also a growing gap between realized volatility (how much the market actually moves) and implied volatility (how much traders expect it to move).…

United States 趨勢

- 1. Vandy 9,702 posts

- 2. Brian Kelly 4,328 posts

- 3. No Kings 884K posts

- 4. Diego Pavia 3,004 posts

- 5. Vanderbilt 7,572 posts

- 6. Clark Lea N/A

- 7. Dork Cult Protest Day 39.9K posts

- 8. Nuss 3,254 posts

- 9. #GoBlue 2,462 posts

- 10. Tony Vitello 1,940 posts

- 11. Beamer 2,231 posts

- 12. South Carolina 10.8K posts

- 13. Joe Sloan N/A

- 14. Duke 68.6K posts

- 15. #AnteX N/A

- 16. Shula 1,941 posts

- 17. Tulane 1,765 posts

- 18. Arsenal 153K posts

- 19. Demond 1,258 posts

- 20. Cole Sullivan N/A

Something went wrong.

Something went wrong.