QuantAlgo

@joinquantalgo

Building institutional-grade indicators & strategies for retail traders & investors worldwide - https://joinquantalgo.com/

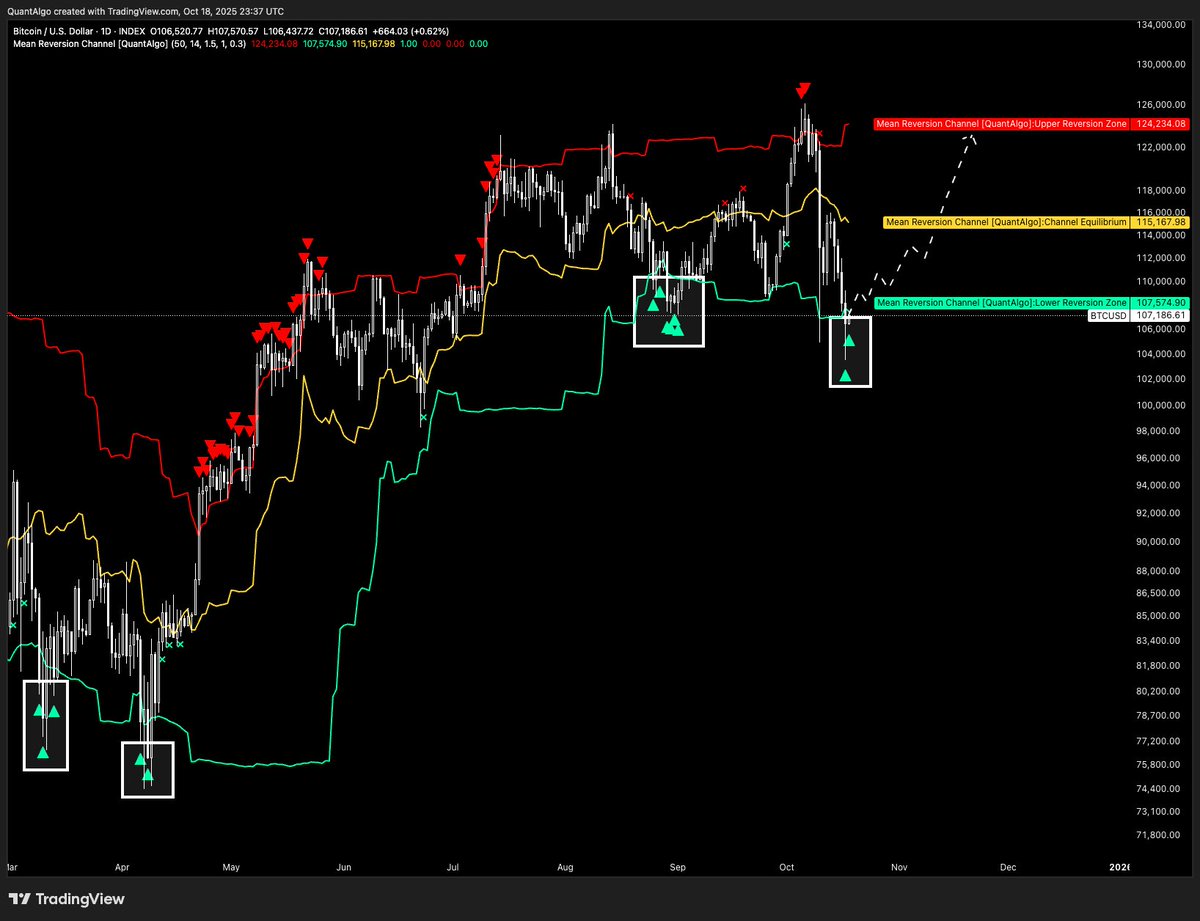

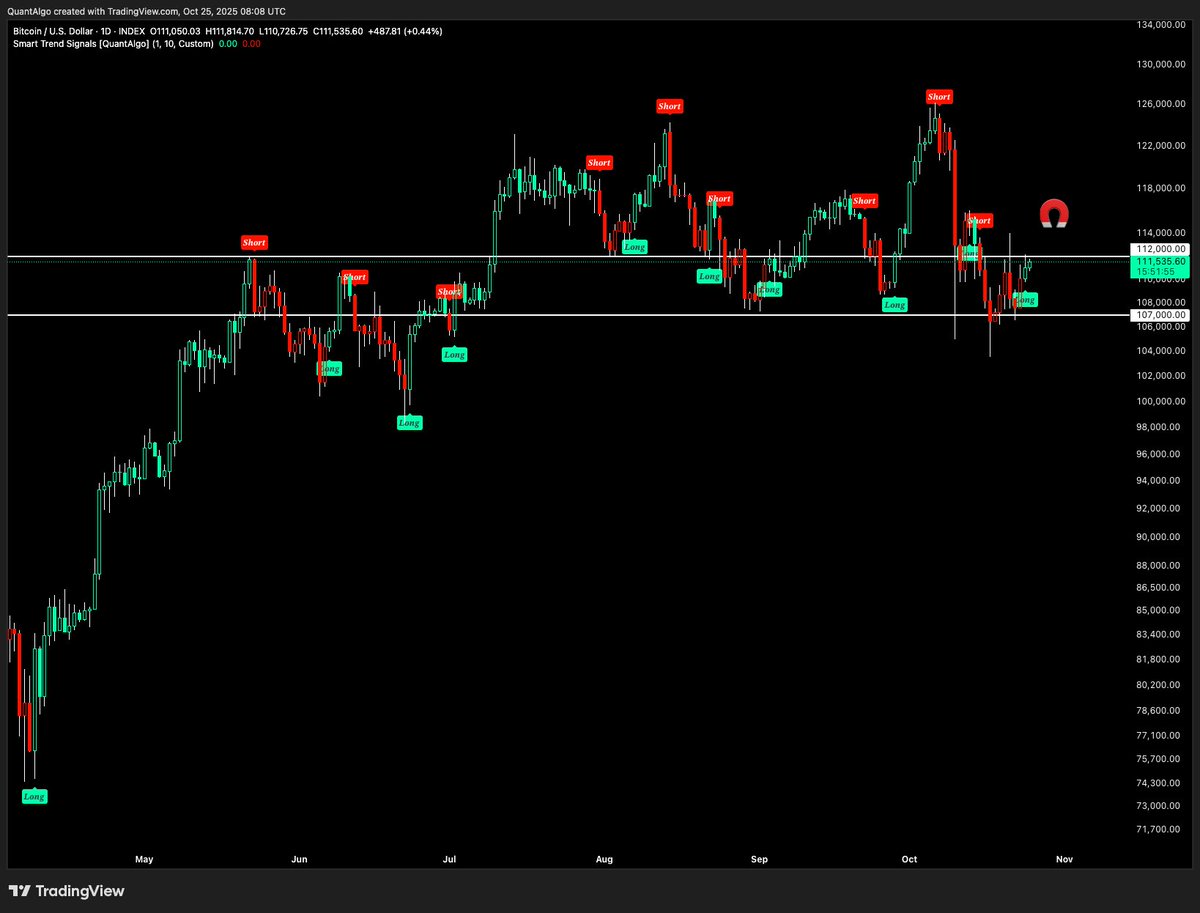

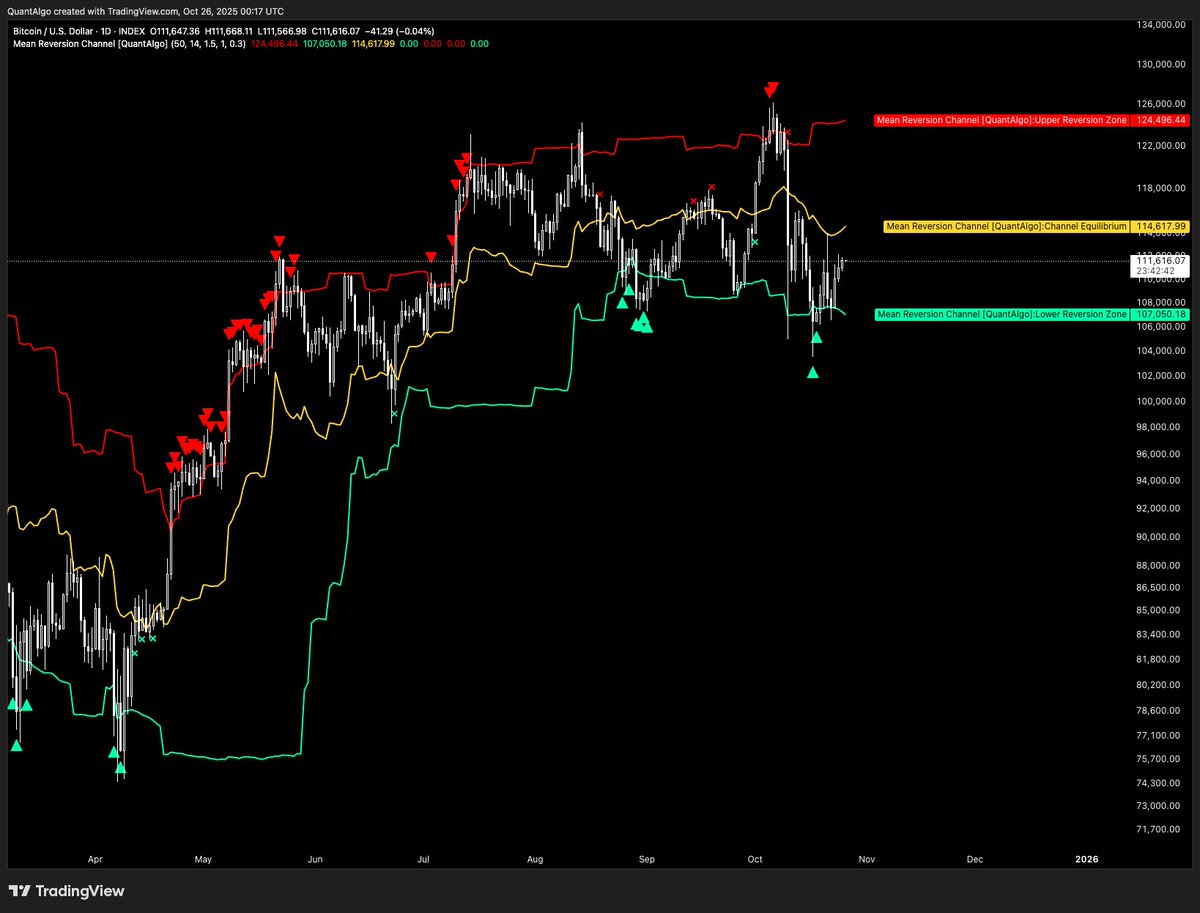

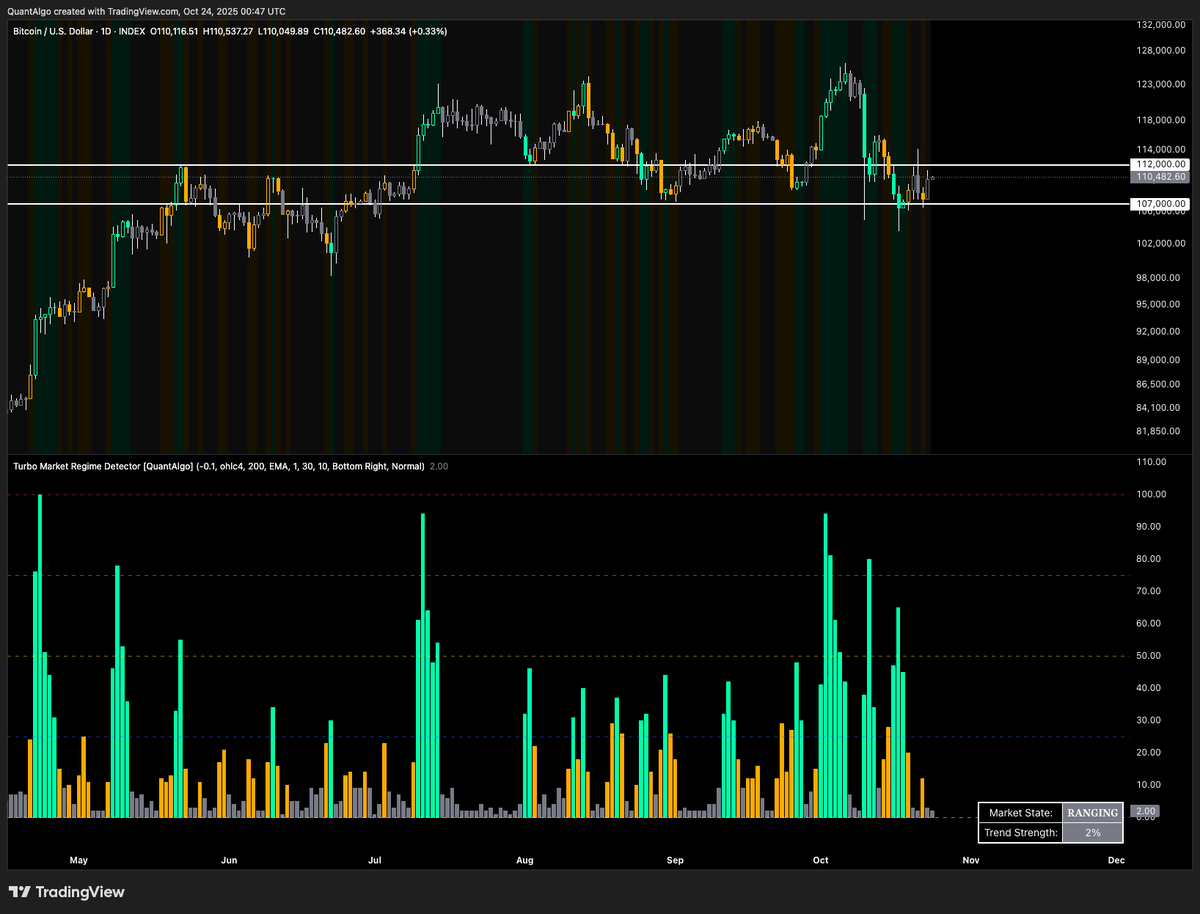

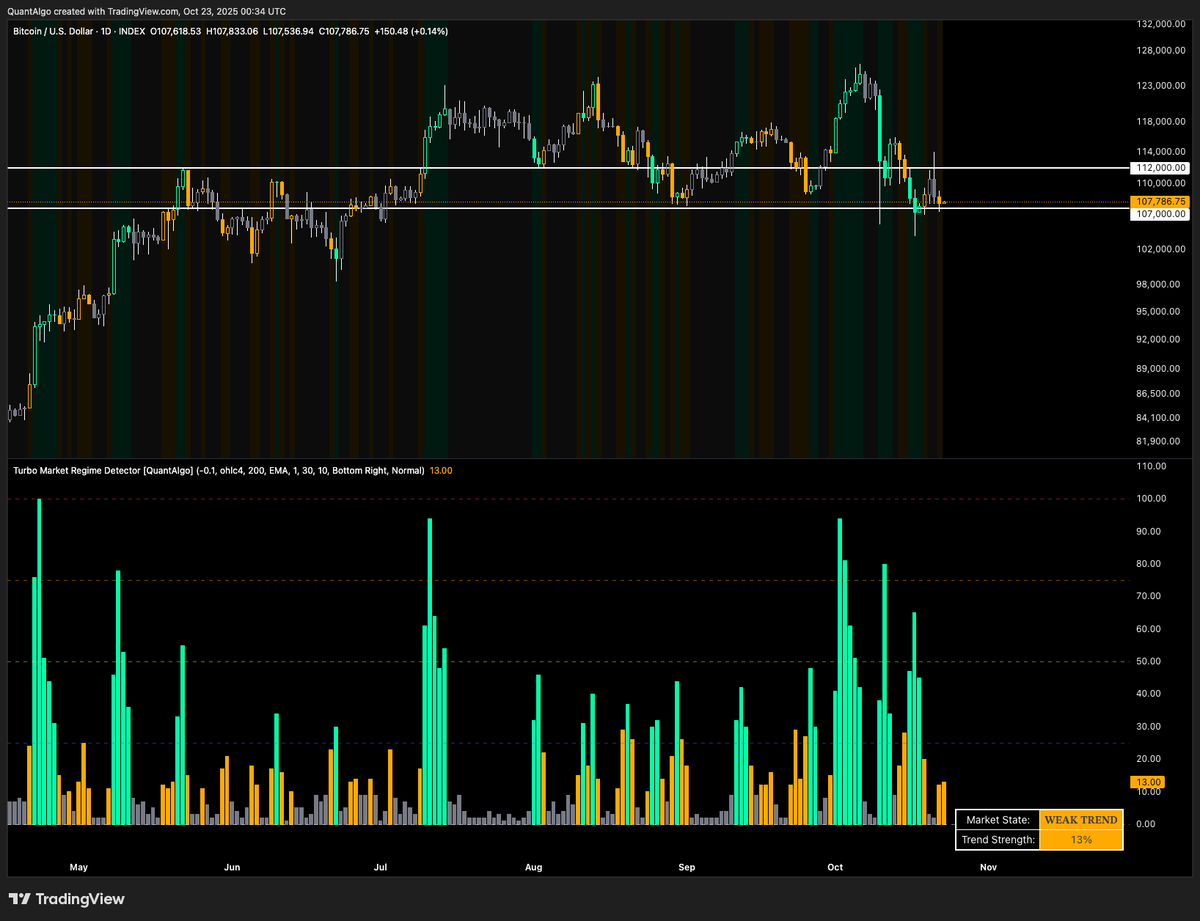

And just like that, we got the bounce from $107k on BTC 🎯 It rejected at the $116k level, but not significant enough to warrant caution at this stage, in my opinion. Let's see how it plays out post-FED meeting, which starts in around 18 hours from now.

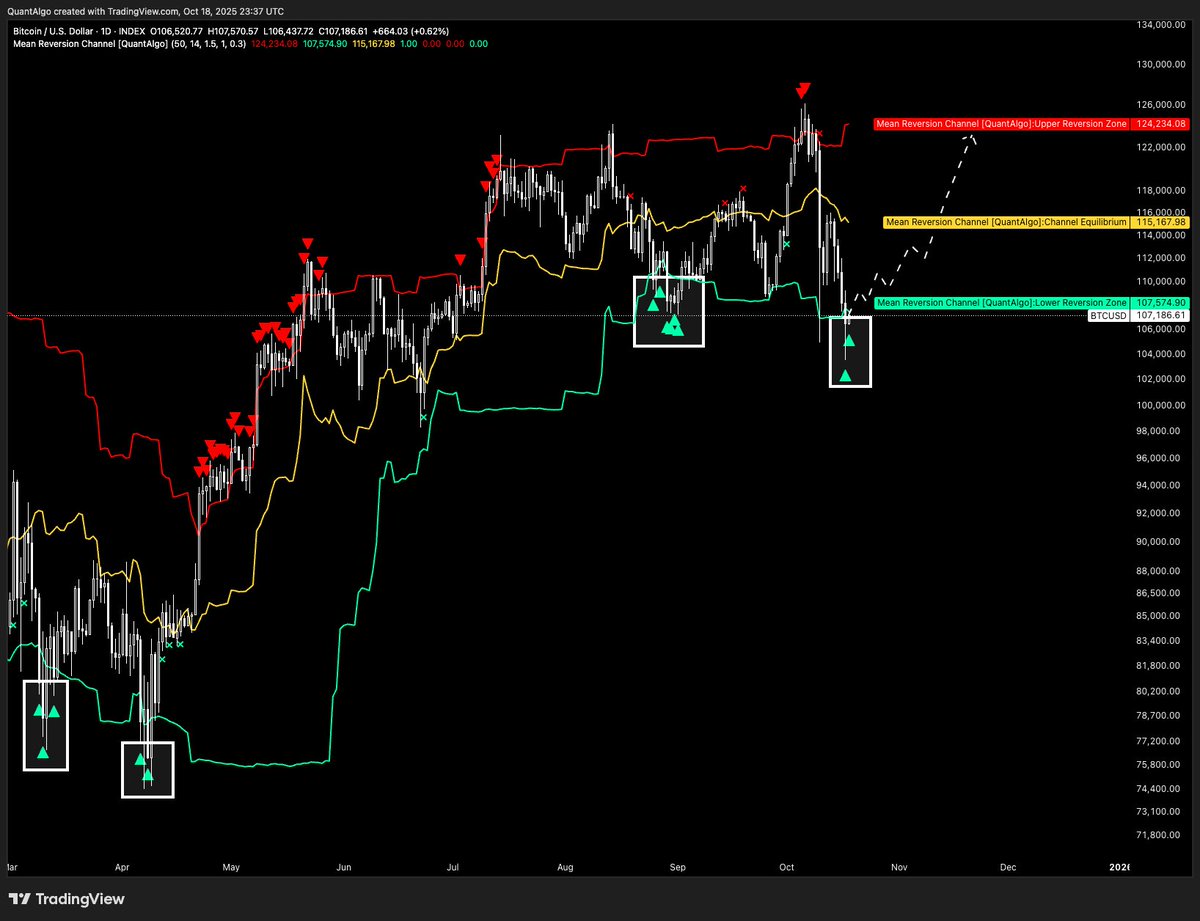

🚨 My Mean Reversion Channel indicator is flashing potential buy signals for #Bitcoin. Historically, these setups have marked solid bounce opportunities. Question is: Do we bounce back to equilibrium ($115k, yellow line) and retest ATH zone ($124k+, red line)? Or does BTC need…

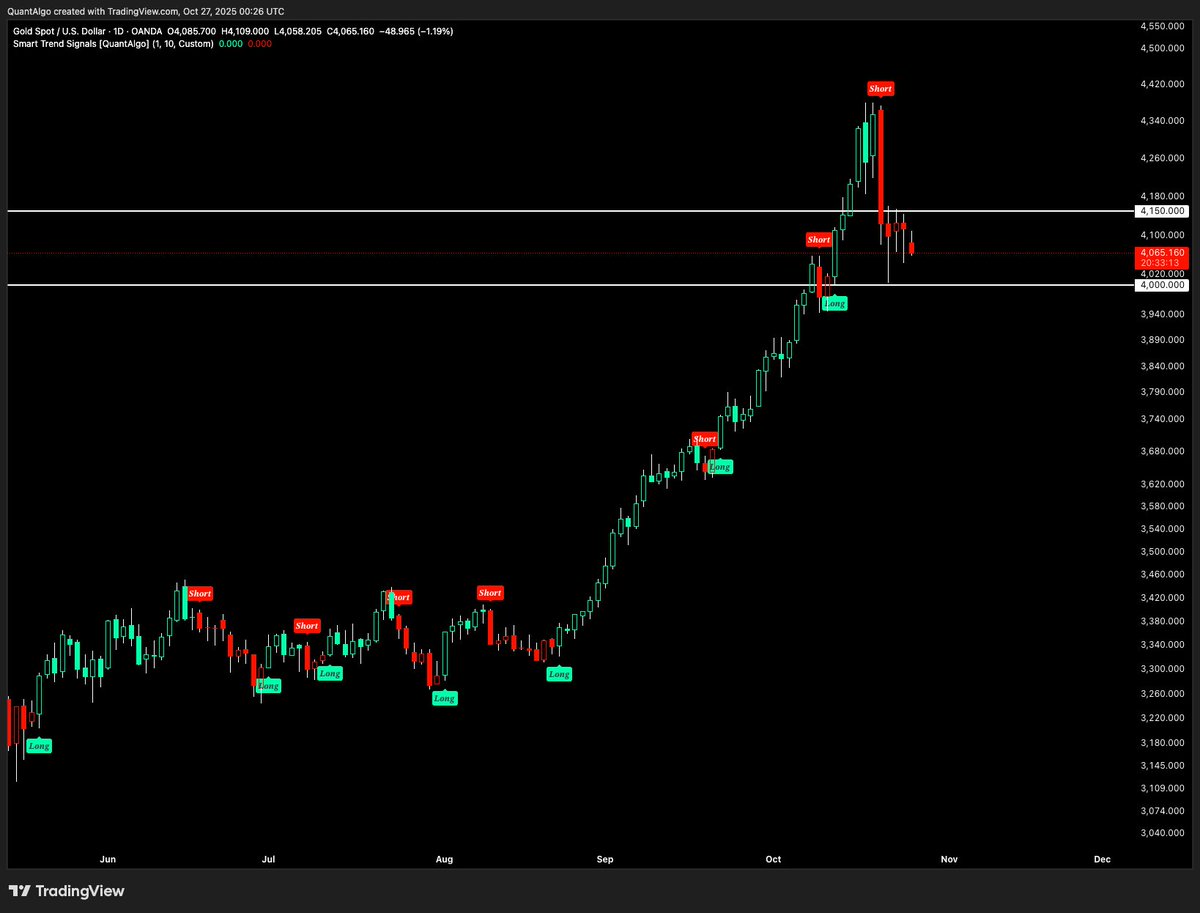

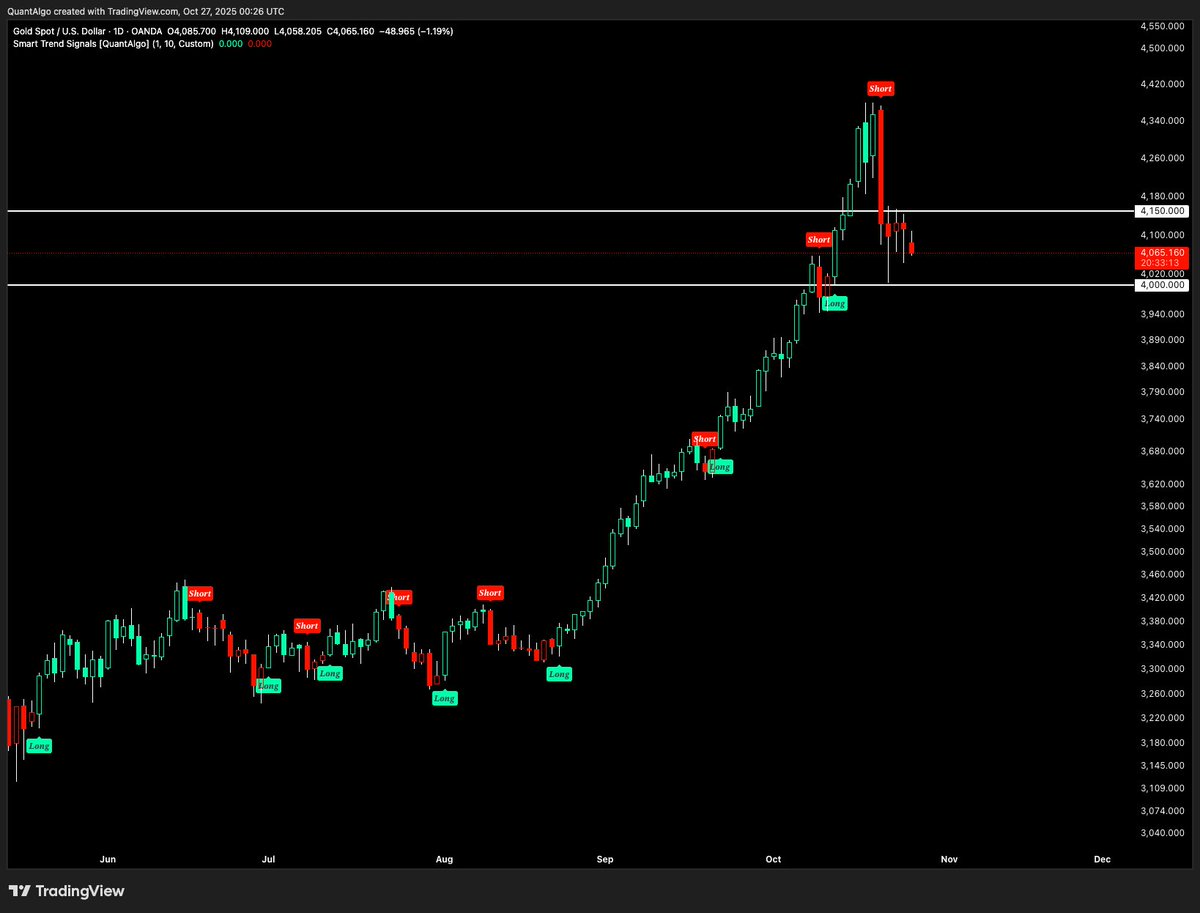

Which line will Gold hit first? $4,150 or $3,500? 👀

$4,000 remains a key psychological support level for Gold, while $4,150 is the resistance wall it needs to break and stay above for a new ATH to still be on the cards toward year-end.

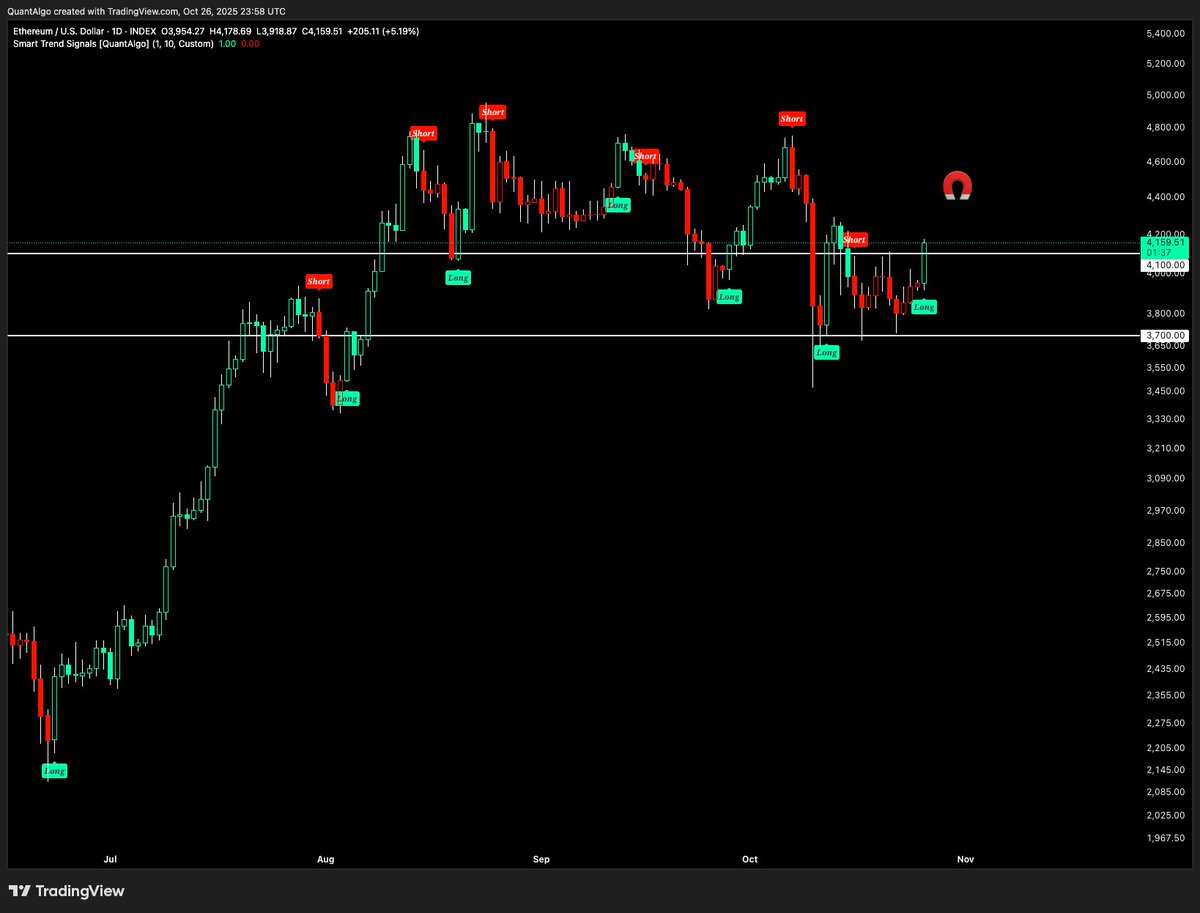

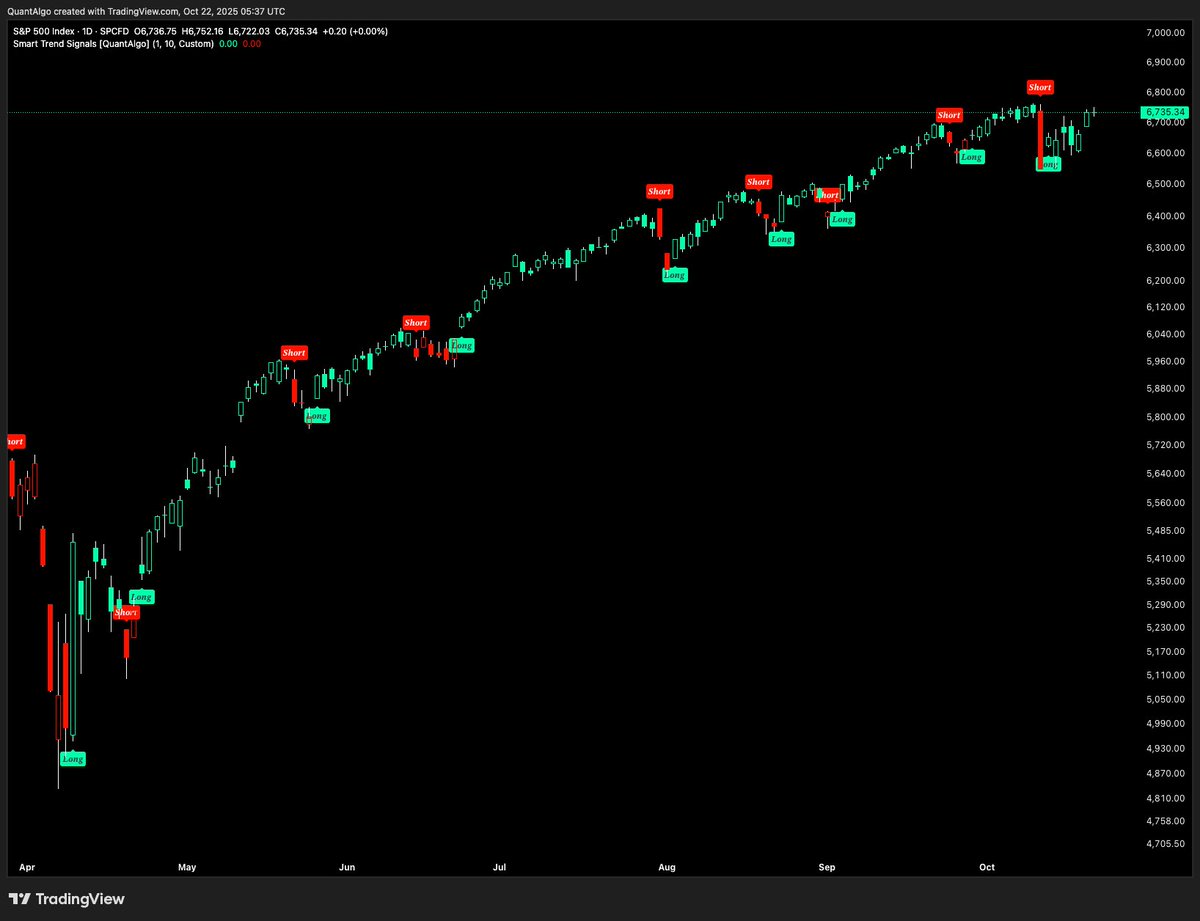

Positive news regarding the US and China trade deal over the weekend helped $BTC and $ETH break out from their lower range and transition to a potentially sustained upward momentum. Risk appetite appears to be coming back, albeit a bit more cautiously this time, in my opinion.…

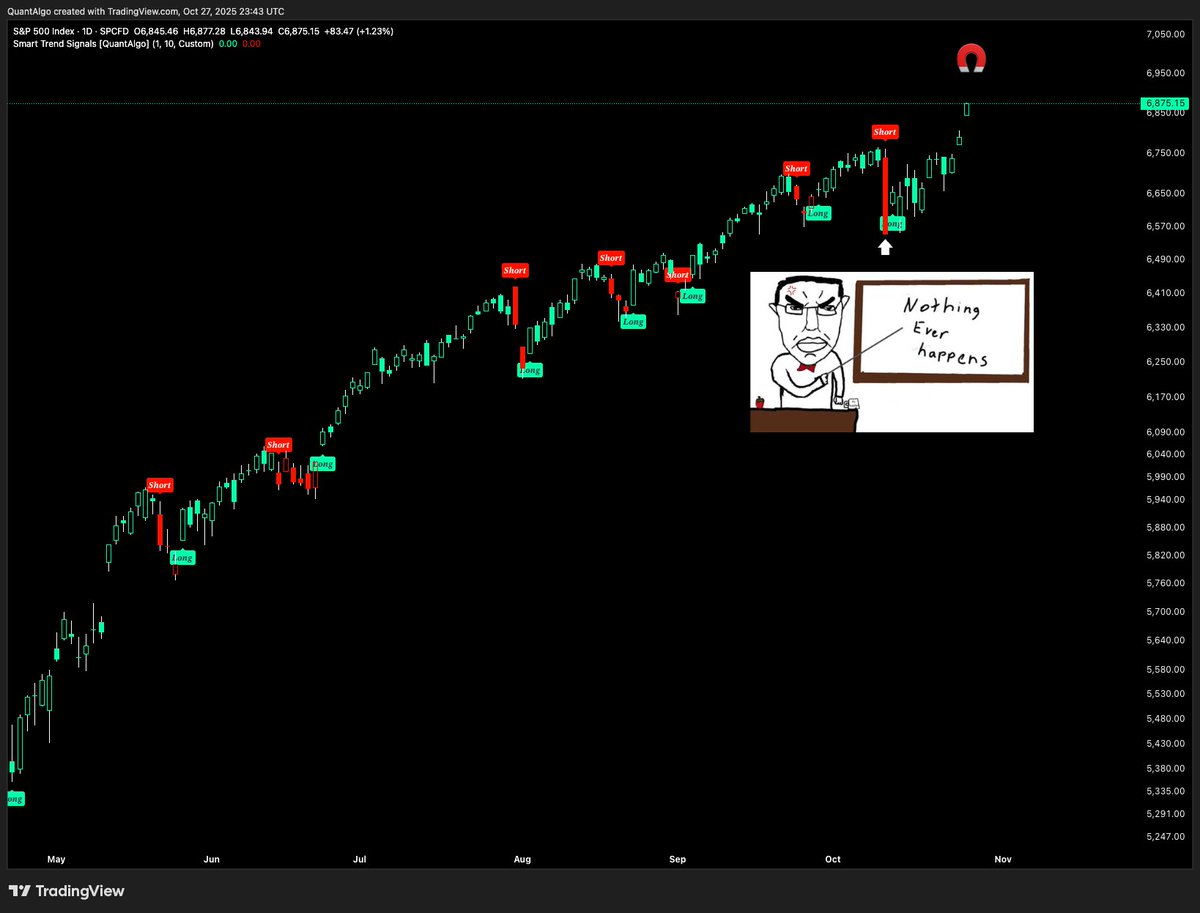

🚨 NEW UPDATE: A Long signal has fired after today's bar close on BTC. The S&P 500 is still bullish and just hit a new ATH, whereas ETH and Gold are still ranging with no clear directional move (yet). I'm still cautiously bullish, but let's see how things play out leading up…

$4,000 remains a key psychological support level for Gold, while $4,150 is the resistance wall it needs to break and stay above for a new ATH to still be on the cards toward year-end.

Gold, on the other hand, just had a -5% drop as I anticipated in my recent post about its valuation (x.com/joinquantalgo/…). However, there still seems to be very strong demand at $4,000, so it's definitely a very important level to watch.

JUST IN: 🇺🇸 S&P 500 closes above 6,800 for the first time in history (new ATH).

The stock market reflects this potential Recovery pretty well. The 10/10 candle got bought up swiftly as if nothing had ever happened 👀

UPDATE: the recovery we talked about last week? It's picking up speed fast 📈👀 In just 3 days since the last update, we're seeing confirmation across multiple vectors. Bitcoin went from $111k to $114k, and the risk matrix z-score jumped from -0.48 to -0.04. We're basically…

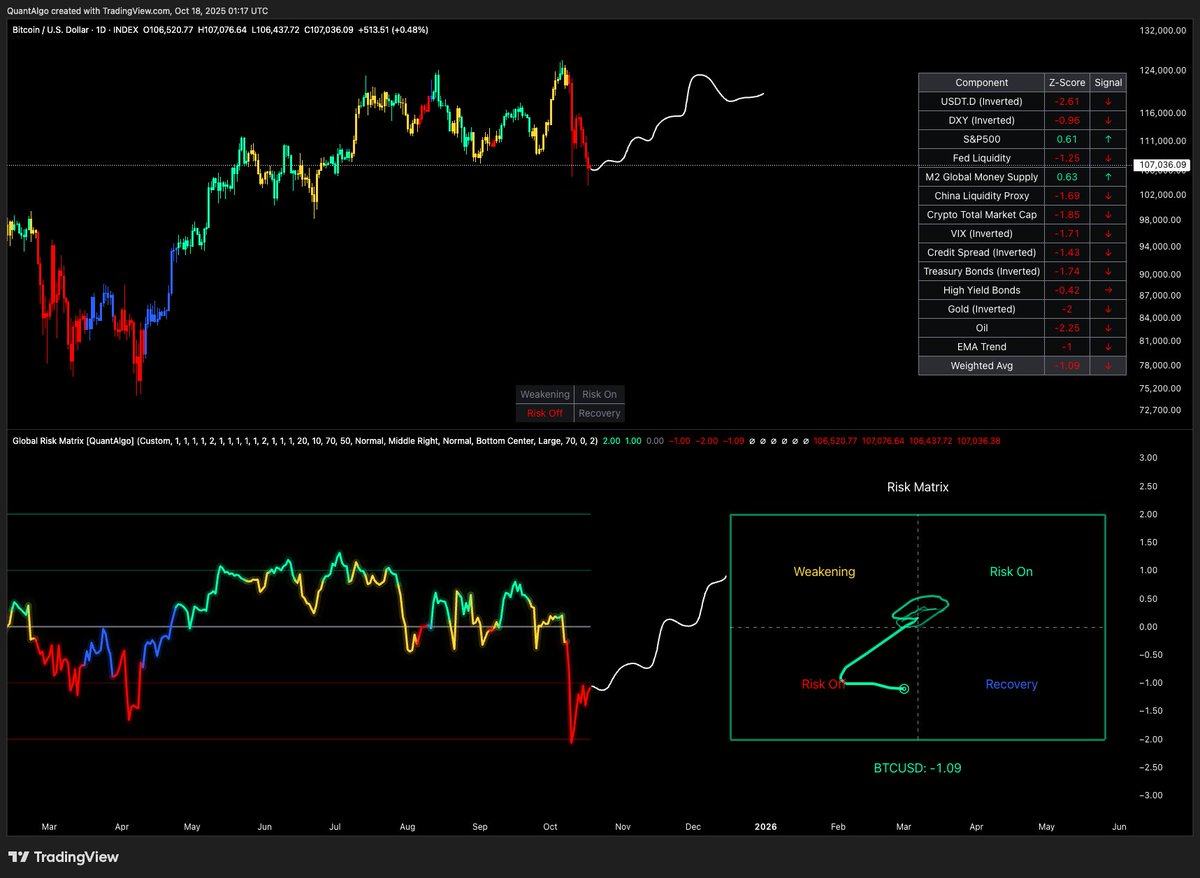

UPDATE: "Recovery" Phase Activated ✅ The "breadcrumbs of hope" from last week have materialized into an early risk-on rotation. What changed? 1/ Oil's dramatic reversal: → Bounced from extreme weakness (-2.25) to near-neutral (-0.01). This was the key catalyst we were…

BTC dip buyers got rewarded, so congrats to those who bought. As I've discussed in my previous posts, risk assets in general still have another decent leg up toward year-end. Looking forward to next week 🫡

🚨 My Mean Reversion Channel indicator is flashing potential buy signals for #Bitcoin. Historically, these setups have marked solid bounce opportunities. Question is: Do we bounce back to equilibrium ($115k, yellow line) and retest ATH zone ($124k+, red line)? Or does BTC need…

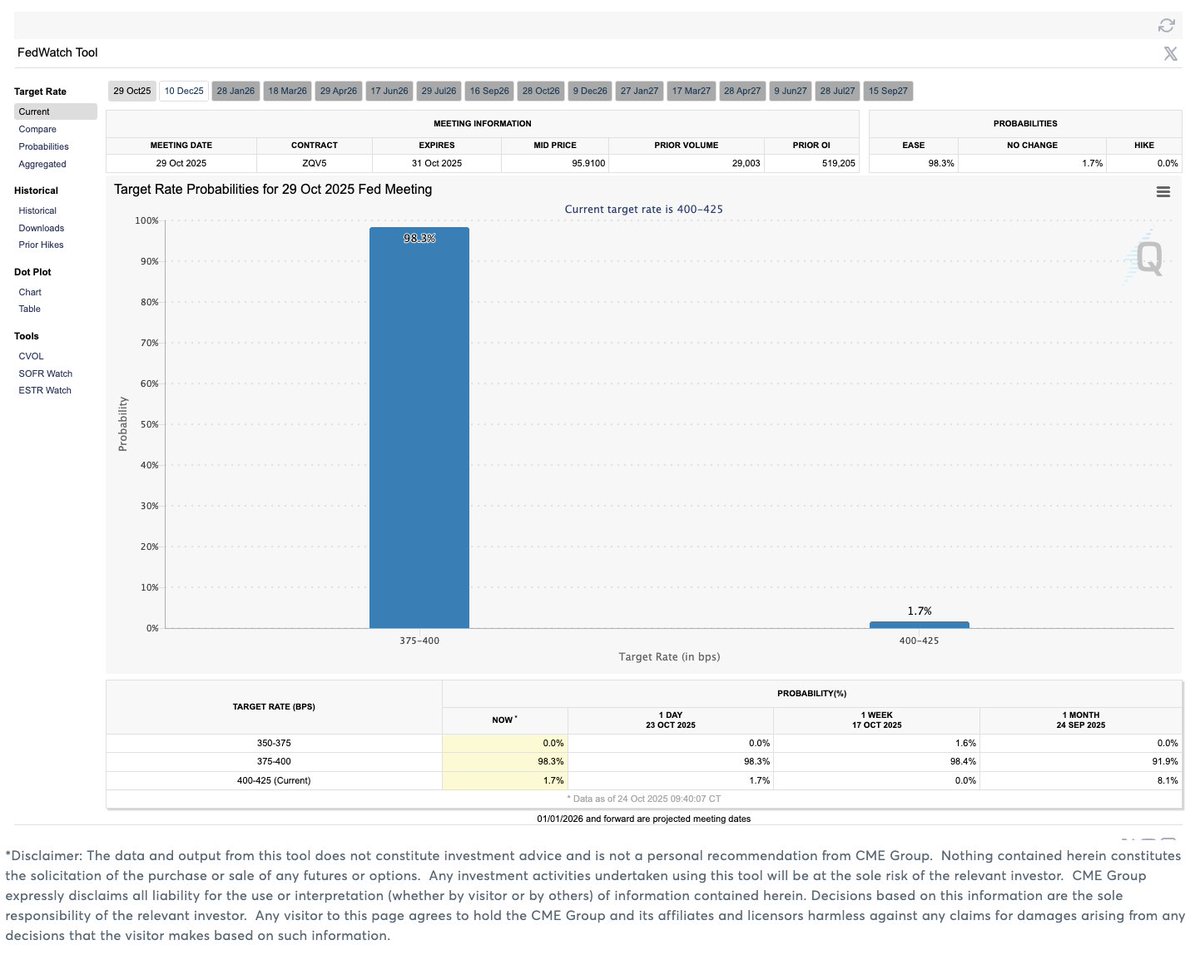

The next FED meeting is in 4 days. What do you think will happen? 👀

UPDATE: "Recovery" Phase Activated ✅ The "breadcrumbs of hope" from last week have materialized into an early risk-on rotation. What changed? 1/ Oil's dramatic reversal: → Bounced from extreme weakness (-2.25) to near-neutral (-0.01). This was the key catalyst we were…

⚠️ The risk-off cascade continues with most macro indicators still flashing red 1/ Key negatives 🔴 → China liquidity & crypto market cap deeply negative → Oil showing extreme weakness (-2.25 z-score) → Credit spreads/bonds signaling stress 2/ But... breadcrumbs of hope for…

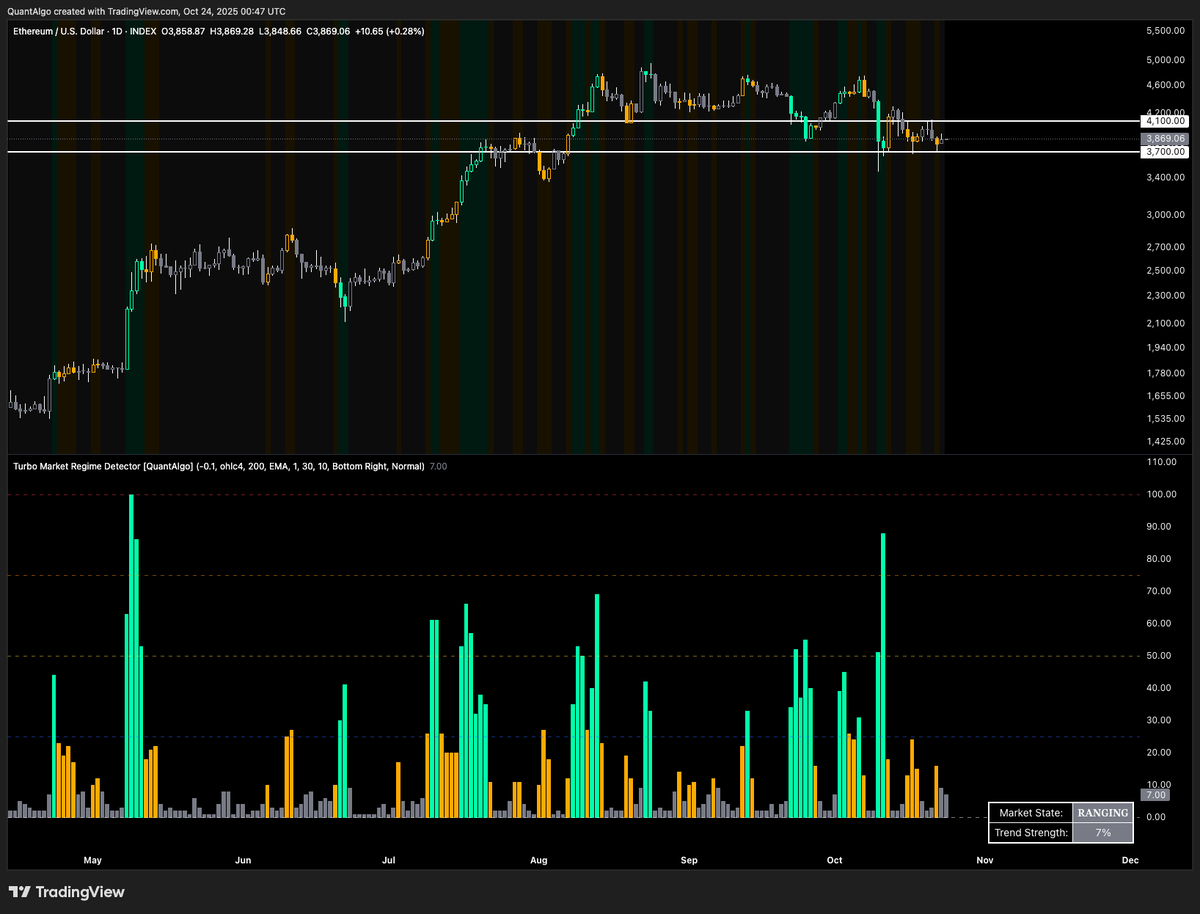

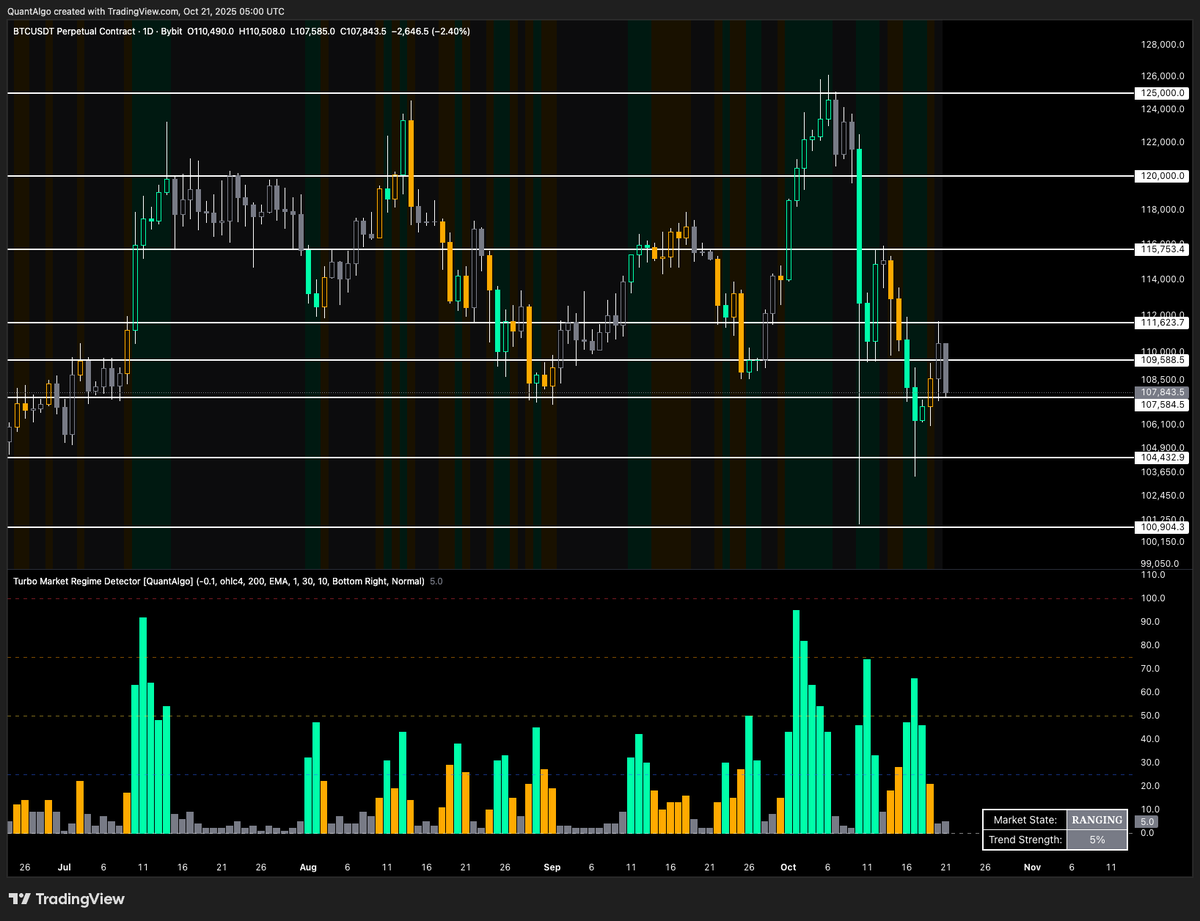

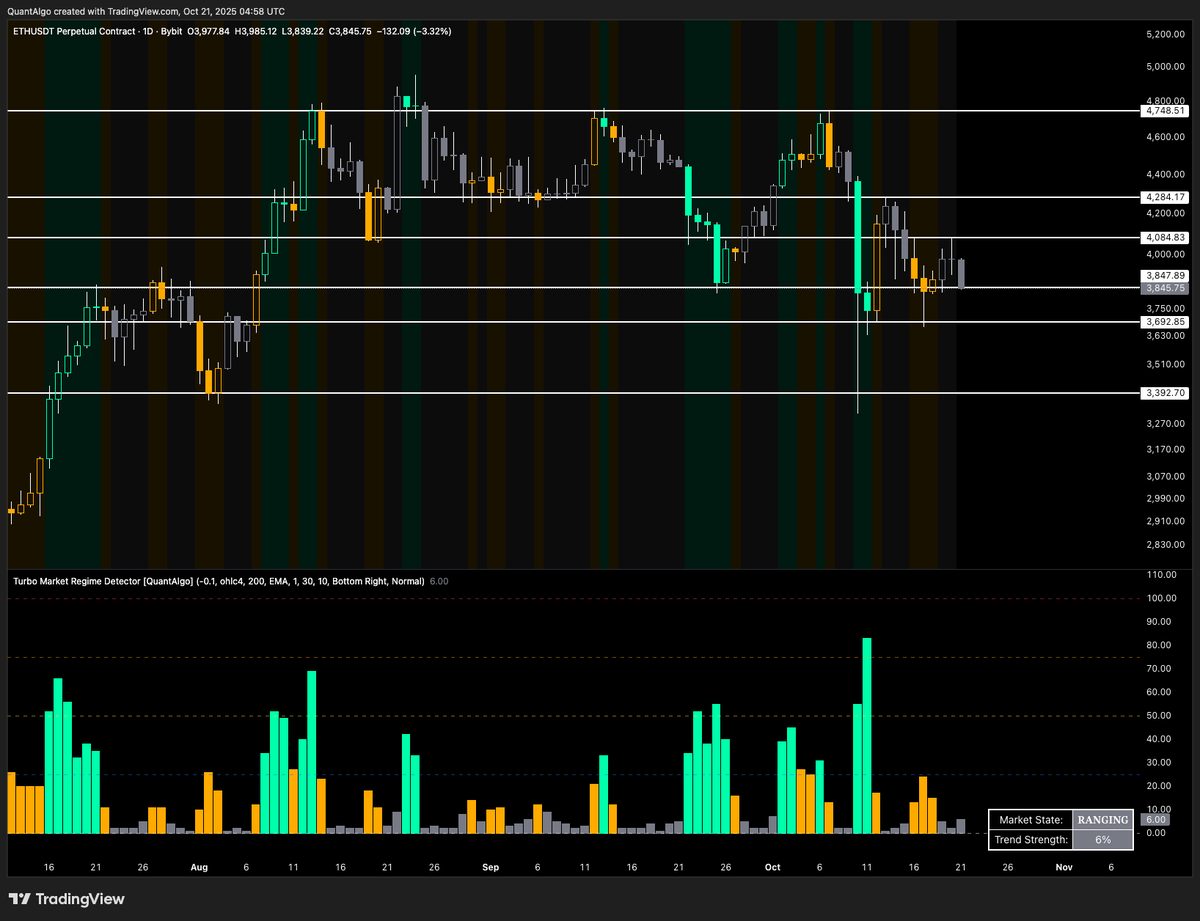

Both BTC and ETH are back in a "ranging" phase. Key support levels: $107k for BTC and $3,700 for ETH. As mentioned in my previous analysis, there's no clear directional move yet. However, an upward move is more likely than a significant drop, imo.

🚨Market Update: One of my very fast systems is still signaling Short on BTC. It did fire long intraday, but the entire pump candle reversed due to overwhelming sell pressure that appeared before yesterday's bar close :/

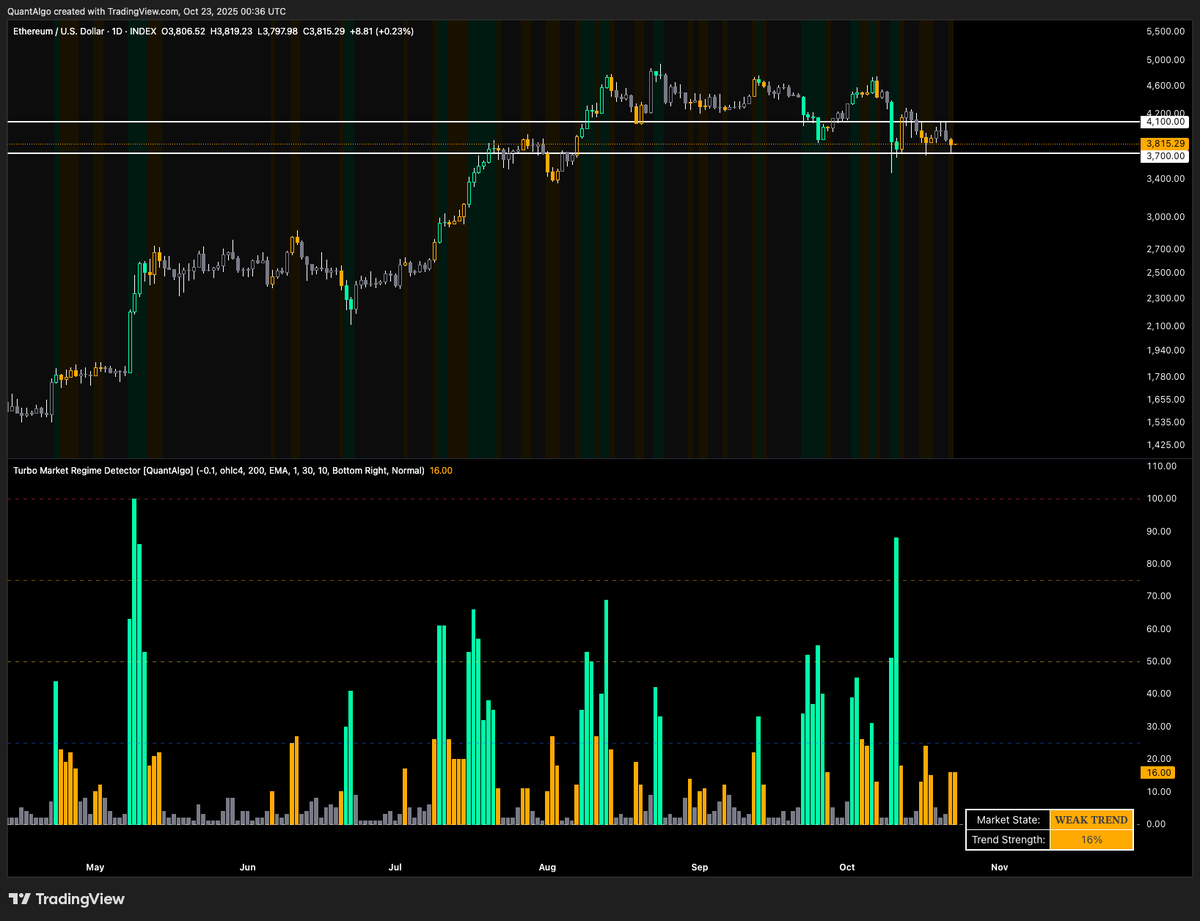

Weak downtrend on both BTC and ETH currently 👀

BTC and ETH are still ranging with no clear directional move (yet). We'd have to wait till the burgers wake up to see if there's any change in positioning. 8 days left before the next FOMC meeting on 29/10.

United States トレンド

- 1. StandX 5,216 posts

- 2. #NationalCatDay 1,402 posts

- 3. Huda 18.1K posts

- 4. Good Wednesday 30.4K posts

- 5. Hump Day 16.6K posts

- 6. #wednesdaymotivation 3,710 posts

- 7. South Korea 127K posts

- 8. $XHLD $0.27 N/A

- 9. Happy Hump 10.2K posts

- 10. #MAYATVAWARDS2025 1.51M posts

- 11. FOMC 33.2K posts

- 12. #Wednesdayvibe 2,057 posts

- 13. Jay Z 7,941 posts

- 14. Mandy Patinkin 5,363 posts

- 15. ZNN AT MAYA25 747K posts

- 16. $NVDA 104K posts

- 17. Nvidia 83.2K posts

- 18. Xabi 21K posts

- 19. #WednesdayWisdom N/A

- 20. Sovereignty 26.6K posts

Something went wrong.

Something went wrong.