Kevin

@kevin3mith

Full time running the options wheel. Author of two options books. Creator Options Monitor - live high probability trade alerts for options sellers.

So How Risky Are Cash Secured Put Options? Wrong Question. The better question: How risky are you? Because you can make them: >> ultra conservative >> moderately flexible >> aggressively tilted >> practically synthetic income machines #SellingOptions #OptionsTrading

If you’ve ever dreamed of escaping the cubicle, reshaping your career, or building the kind of freedom that lets you navigate retirement on your terms… selling options is the way

Catholic Mass this morning. Five minutes after I took this, the whole church filled up with families and children. Such a peaceful way to start a Sunday.

Heading to Mass in the morning, then taking my little one to Evensong in the afternoon. Two very different services, but both bring a bit of peace to the Sunday 🙌🏽

Interesting…

Imagine this scenario: You’re trading $SPX futures & go short at 10am, Nov 20, 2008. But you need to use the bathroom. You enter the trade & go take a whiz 🚽. In the span of a few min $SPX drops another 264 points (in today’s levels). VIX is now 81. That really happened. 🛀🏻

So How Risky Are Cash Secured Put Options? Wrong Question. The better question: How risky are you? Because you can make them: >> ultra conservative >> moderately flexible >> aggressively tilted >> practically synthetic income machines #SellingOptions #OptionsTrading

In other news, my family are all tradesmen, so I’m using my prev business building skills to spin up a few niche local businesses One of them is garage conversions. Simple 3–4 week start to completion jobs starting from £4k+ FB ads go live this week… let’s see what comes in!

Just emailed all OM members as we’ve had a ton of new ones join this week w/ the black friday deal. No new short-put setups this week. Market’s jumpy and patience is an edge. We’ll take swings only when the high-probability, textbook setups return. #OptionsTrading

$SPY lived off that 1-SD band from the April VWAP all year. Now it’s slipping under it. When your “bounce line” stops bouncing… the character of the trend changes.

my random comments get way more views than my options selling posts 😆

with marriage. you marry two people. the person they are then and the person they want to become.

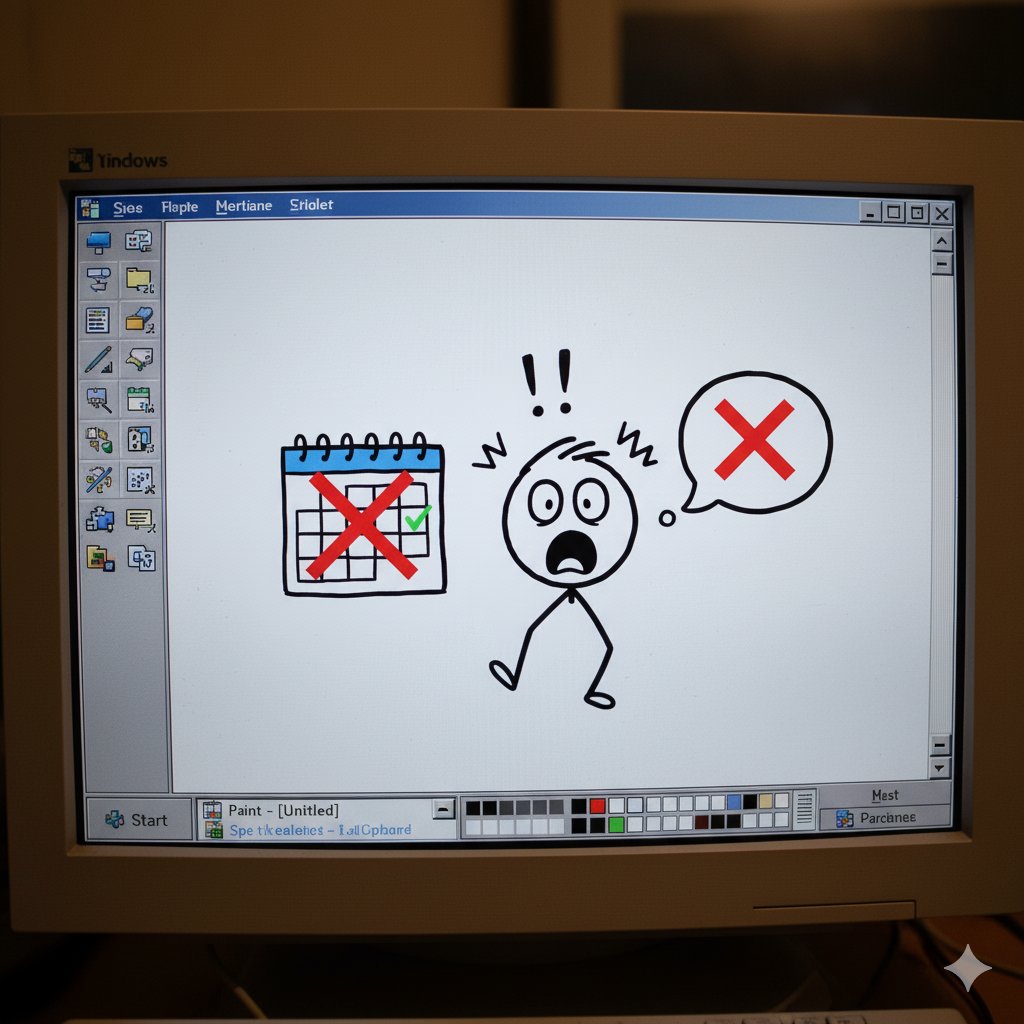

Why You Should Always Double-Check an Earnings Release Date When Selling Options When selling puts around earnings season, there’s one simple habit that avoids a surprising amount of trouble: Always verify the earnings release date directly from the company’s own website.…

dilution today. infinity $BTC tomorrow

⚠️ At what point does $MSTR become a forced seller of Bitcoin? Maybe sooner than you think Despite some misinformative posts, they don’t have BTC-secured loans anymore that would trigger automatic liquidation HOWEVER, in December they owe ~$120 in preferred dividends PLUS ~$24M…

I must have missed the chapter on TRT in Man’s Search for Meaning 😆

If you jumped into $MSTX LEAPS a few months back when they were the hot thing on here, I hope you sized the position right… or better yet, already took the exit when it was offered. Down 21% today. 🩸

United States Trends

- 1. Everton 127K posts

- 2. GeForce Season 3,079 posts

- 3. Comey 160K posts

- 4. Amorim 51.7K posts

- 5. Seton Hall 2,026 posts

- 6. Manchester United 76.1K posts

- 7. Mark Kelly 106K posts

- 8. Pickford 9,638 posts

- 9. #MUNEVE 14.9K posts

- 10. #MUFC 22.8K posts

- 11. Opus 4.5 7,415 posts

- 12. Dorgu 19.2K posts

- 13. UCMJ 15.8K posts

- 14. Zirkzee 22K posts

- 15. Hegseth 39.2K posts

- 16. Man U 33.5K posts

- 17. Amad 12.2K posts

- 18. Gueye 29.5K posts

- 19. Keane 18.1K posts

- 20. Will Wade N/A

Something went wrong.

Something went wrong.