Krishna Kovid 🇺🇸 🐻📈

@kovid2012

Just be yourself,Pls retweet,thanks

You might like

For World Emperor, @realDonaldTrump Achievements go to magapill.com and see all his Accomplishments. Have a great day All.

Edinburgh Winners Biggest Tesla investment winners are not in London or New York, but an Edinburgh-based investment fund that began backing Musk’s electric car company in 2013. Scottish Mortgage Investment Trust’s investments in Tesla have made an extraordinary £21bn so far!

Over 10 years, Scottish Mortgage Investment Trust NAV total return ranks 1st out of a peer group that comprises 2,408 investment vehicles, says Investec #SMT returned 757% vs 134% for the peer group average and 172% for the MSCI ACWI index

The price of spodumene concentrates rises by $20 per ton to $2,920 per ton, the average price of #lithium metal rises by 175,000 yuan per ton to 3.05 million yuan per ton on March 24. The price of #nickel briquettes up 41,700 yuan per ton to 260,700 yuan per ton.-MySteel, China

$MULN $CLHI moving back to 0.70 with this SS IS 🔥🔥

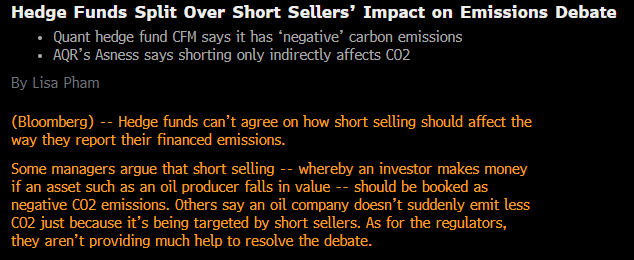

OMG this is peak ESG stupidity!!! 🤦🤦 "Some managers argue that short selling ... should be booked as negative CO2 emissions" This is a proposal by those who lost a fortune shorting oil stocks, as an excuse that they did it to save the planet. Plant a tree instead ffs!!!🌳😂😂

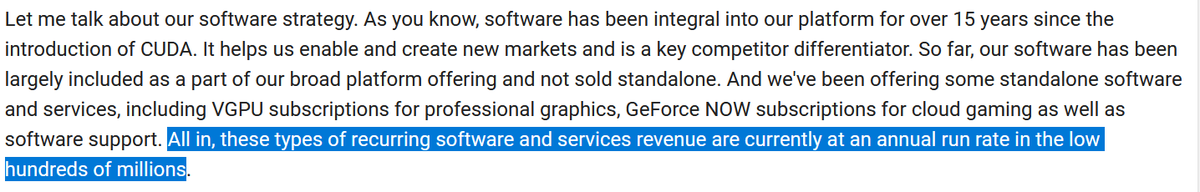

NVIDIA discloses its current software and services annual revenue run-rate is low hundreds of millions (<$200 m?). Intel, on the other hand, had $100 m software revenue in 2021 and is targeting $150 m in 2022.

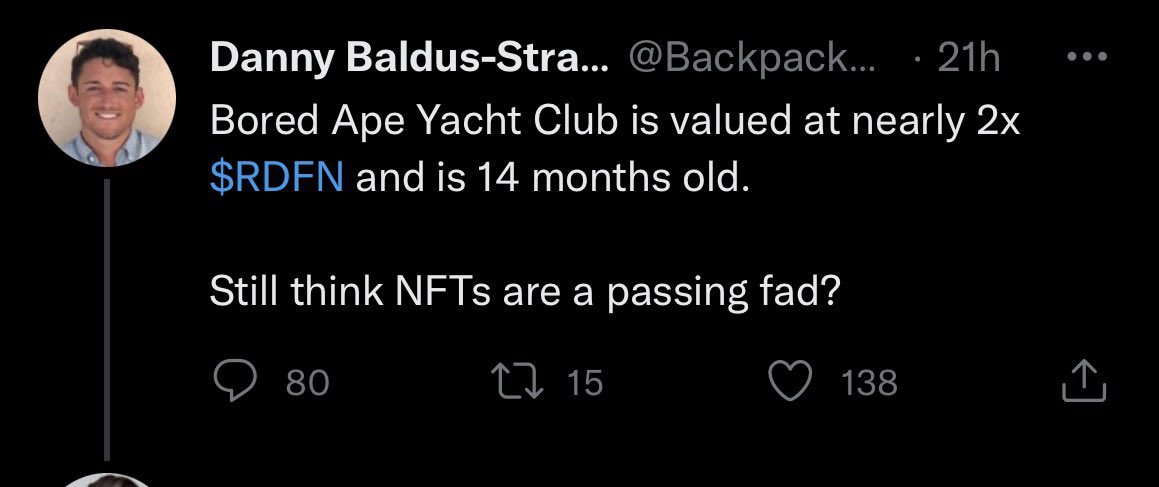

I've been on Twitter long enough to remember when this huckster hosted the CEO of $RDFN.

BARRONS: Oil Investor Who Made 390% Last Year Explains 3 Stock Picks barrons.com/articles/oil-i…

$MELI announced it will invest US$ 3.5 billion in Brazil this year, 70% more than last year The market leader know there’s still a lot to conquer

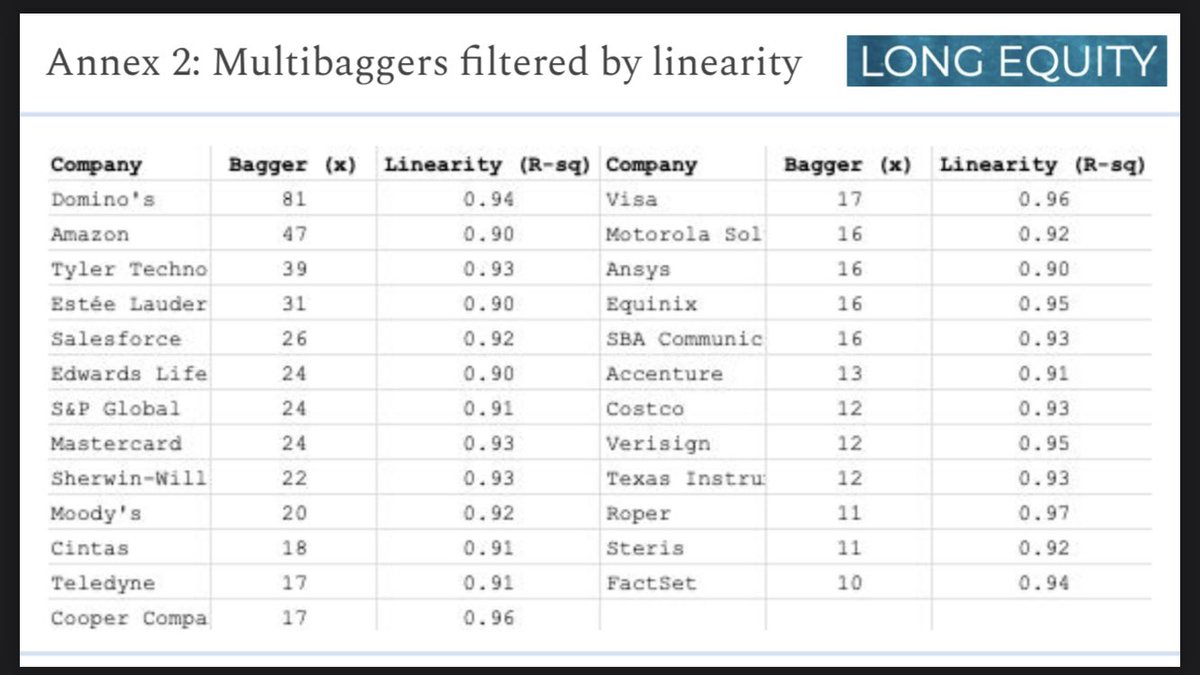

Here’s the S&P 500’s complete list of “linear multibaggers”. Each has at least 10x its share price steadily and consistently over nearly 15 years.

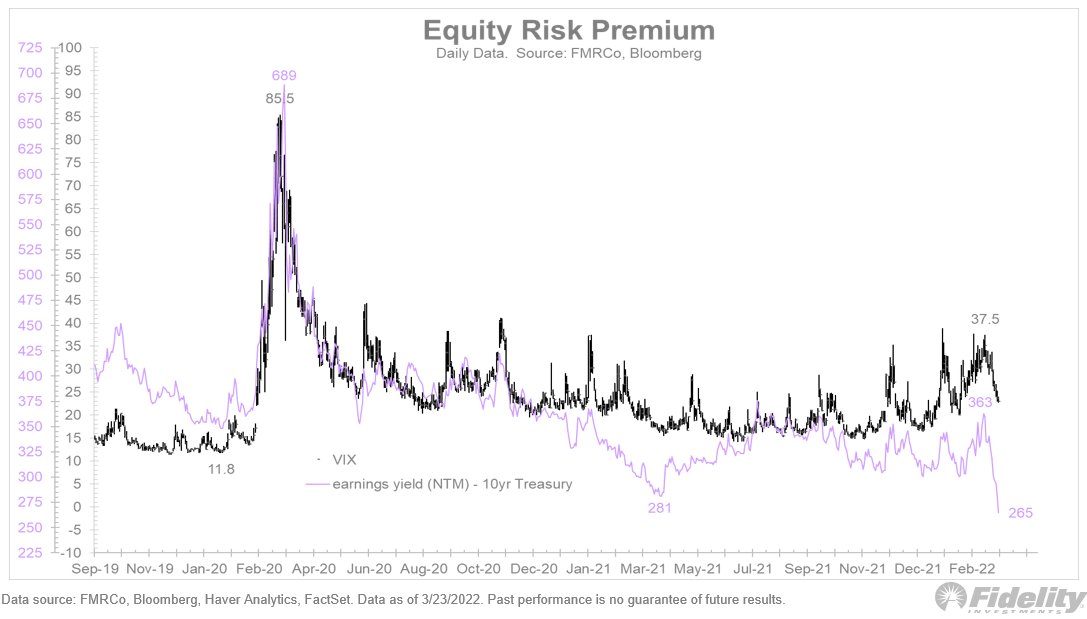

Valuation dynamics: what the risk-free rate taketh away, the equity risk premium giveth back. These two form the discount rate used in the discounted cash flow (DCF) model. A sharply lower risk premium has offset the jump in rates, leaving the discount rate about the same (5%).

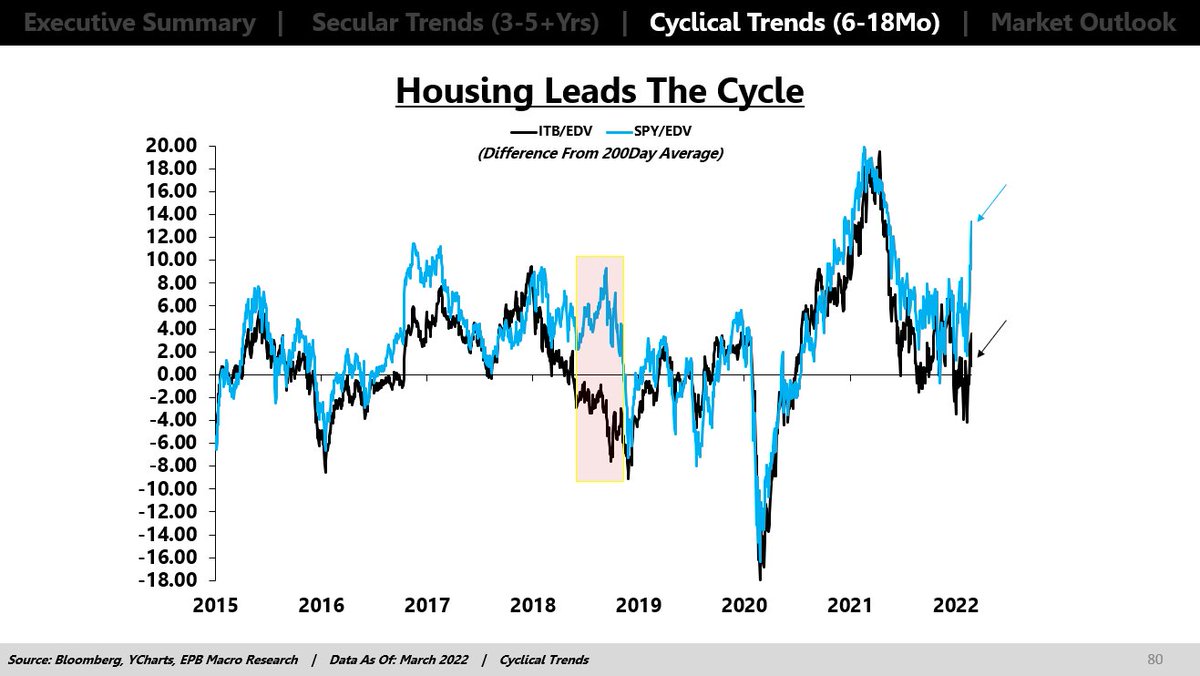

Housing is a leading indicator. Housing leads in economic data and equity pricing. There's a major gap between housing stocks and broader S&P 500 pricing. The last major directional gap between housing and broader equities was 2018.

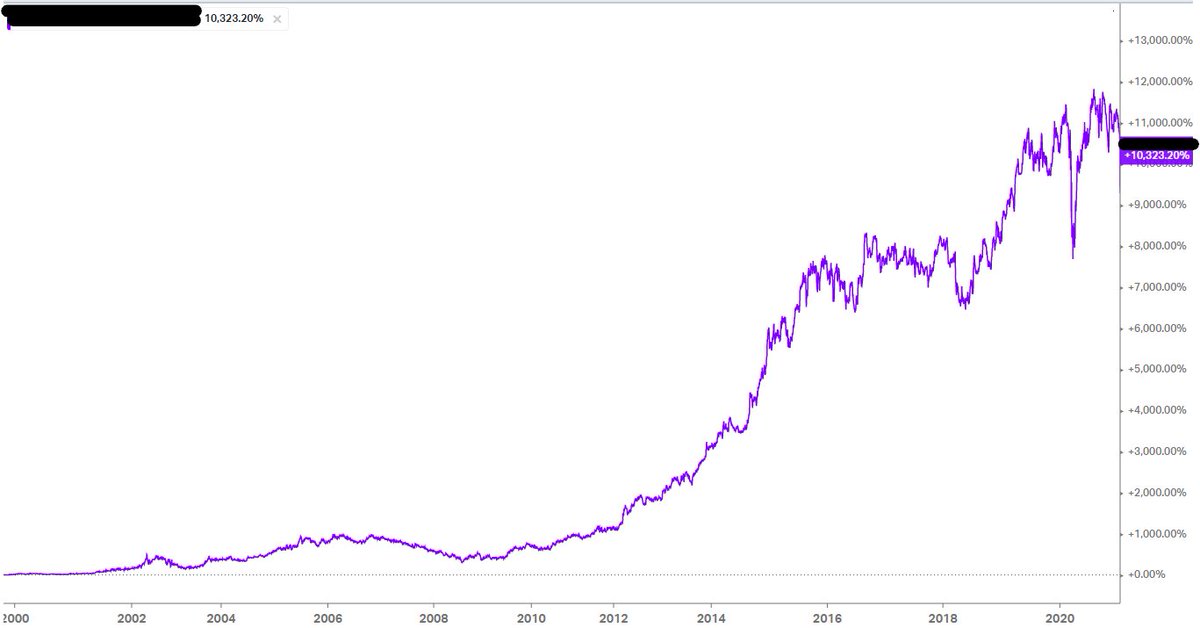

Let's play "name this 100x bagger" 📈

I've never looked at $Y before. Wanted to understand its business operation and the valuation. Looks like Alleghany has a very similar structure to $BRK. - Re/insurance - Public Investments - Whole Owned Businesses

Tomorrow 👀 $CSU

Tomorrow: $CSU.TO / $CNSWF Earlier deep dives: Uber, Etsy, Lululemon, Angi, Ansys, Autodesk, Copart, Shopify, Otis, CrowdStrike, Roku, Boeing, Square, Trupanion, RH, Spotify, Pinterest, and Twilio Subscribe: mbi-deepdives.com/plans/subscrib…

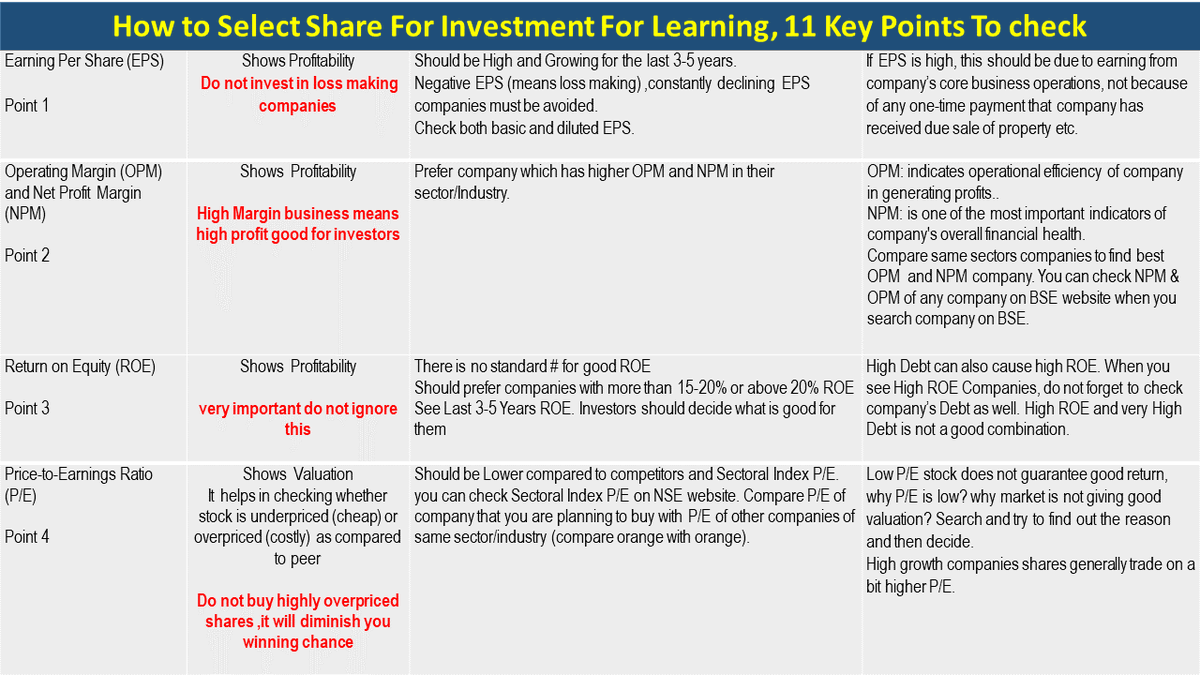

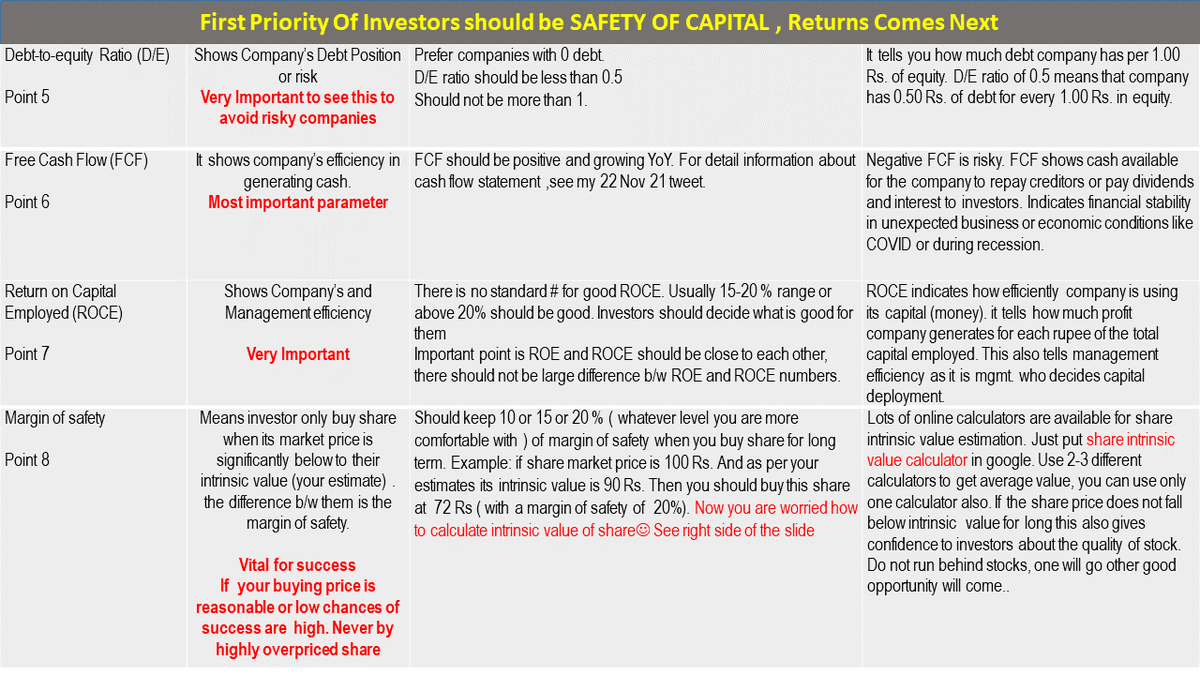

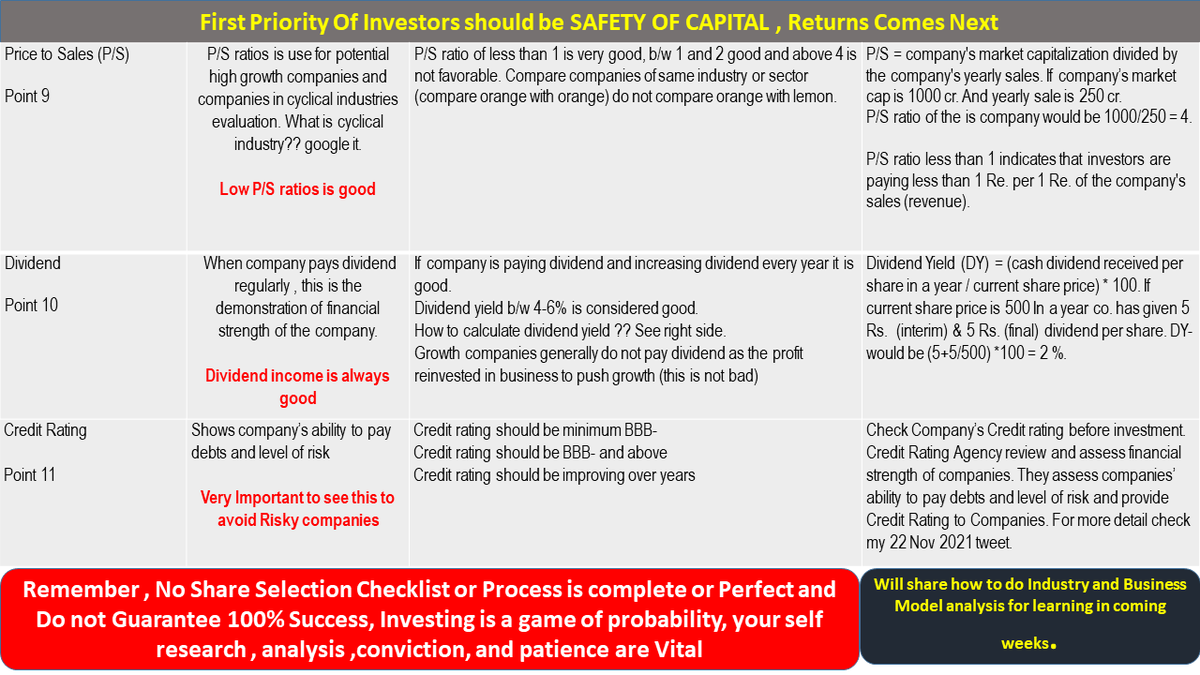

Sharing- 11 Points Stock Fundamental Analysis Checklist. I have tried to use simple language while creating this. Investors can refer this for educational purpose. Might help in learning.👇👇👇

$FVRR just reported excellent earnings, driven by strong subscription order growth, which now make up over 20% of all order volume. The two key drivers of $FVRR's business are: 1. Growth in subscriptions, which increases average order count/customer

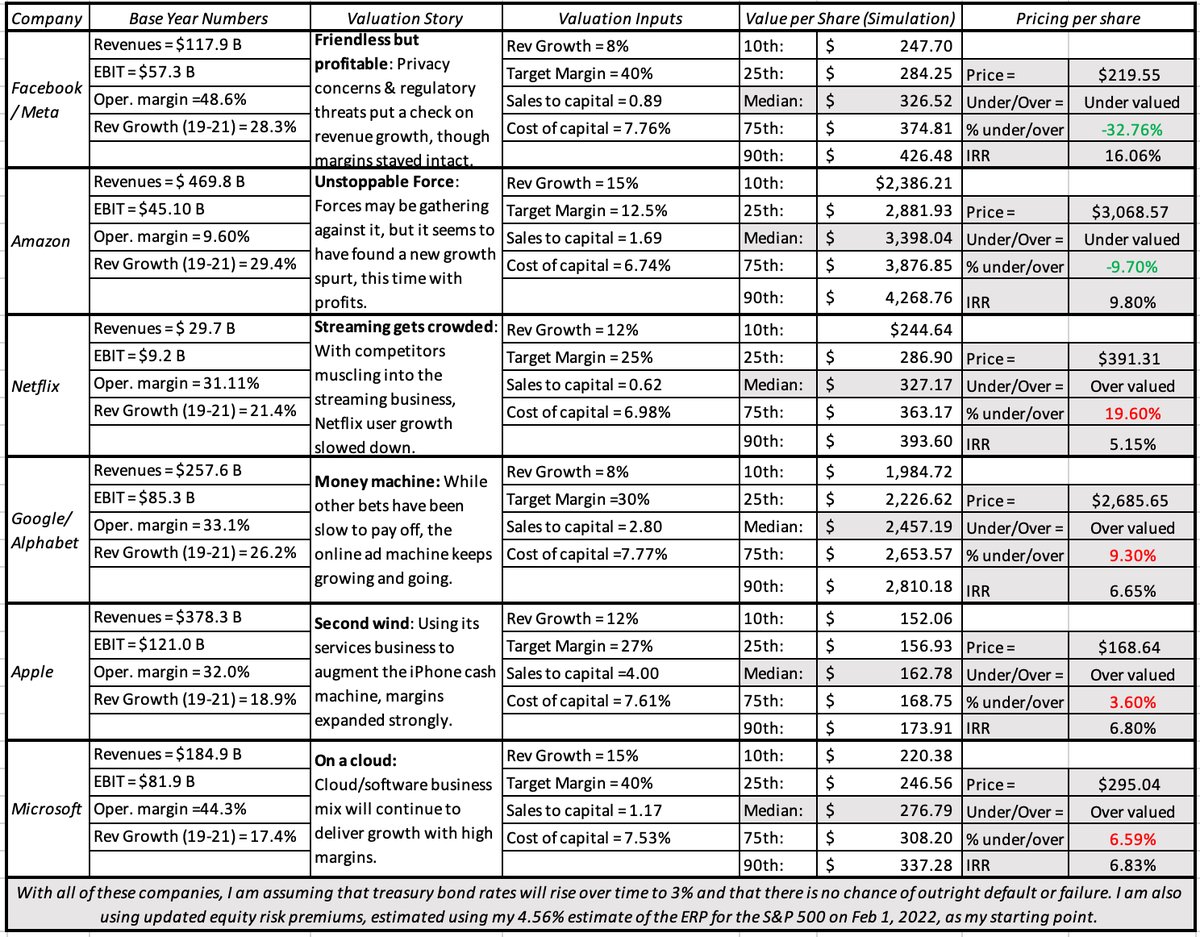

Wow timely updates from Prof @AswathDamodaran himself. Comparing notes. Wondering why $GOOGL is expected to grow only at 8%. $FB $AMZN $AAPL $MSFT seem inline with what I have.

Those updated stories play out as fresh valuations for the companies, with Facebook emerging as most under valued, but with a broken story, and Netflix as most overvalued, in spite of the mark down after its last earnings report. bit.ly/3sG2WW5

With the recent bloodbath, more ppl are saying “valuations do matter”. What if you do the homework, don’t want to overpay, realize that just looking at EV/S won’t cut it, but really don’t want to bring out that DCF spreadsheet? Well, let me help. 🧵

United States Trends

- 1. Chargers 74,7 B posts

- 2. Herbert 51,8 B posts

- 3. #GoldenGlobes 1,46 Mn posts

- 4. Greg Roman 7.984 posts

- 5. Drake Maye 23 B posts

- 6. Eagles 268 B posts

- 7. Pats 23,3 B posts

- 8. Powell 126 B posts

- 9. 49ers 135 B posts

- 10. AJ Brown 38,1 B posts

- 11. Milton Williams 2.531 posts

- 12. Sinners 72,3 B posts

- 13. Jalen 43,4 B posts

- 14. Jim Harbaugh 2.798 posts

- 15. Niners 29,8 B posts

- 16. Hamnet 10,8 B posts

- 17. #LACvsNE 3.640 posts

- 18. New England 12,6 B posts

- 19. Sirianni 34 B posts

- 20. Collinsworth 2.551 posts

You might like

Something went wrong.

Something went wrong.