krishna c m

@krishnacm2012

Dear sir, please remove the concept of HUF(hindu undivided family). I am working in a bank and I found that most of the people are misutilizing it. This is also resulting in tax loss for the govt.@narendramodi @nsitharaman @KTRoffice

The ‘Greed of Government Job’ has done immense damage to this country and its youth.

Great gesture 👏 An annual tradition at Real Betis - a Spanish Club where fans throw thousands of toys onto the pitch for underprivileged children for Christmas 🎄🧸

Some of my fav tweets by @VRtrendfollower. he specializes in breakout stocks. Thanks, Bhai for the awesome content.

Thank you all for patiently listening for 3 and half hour and for Generous Ratings. @elearnmarkets

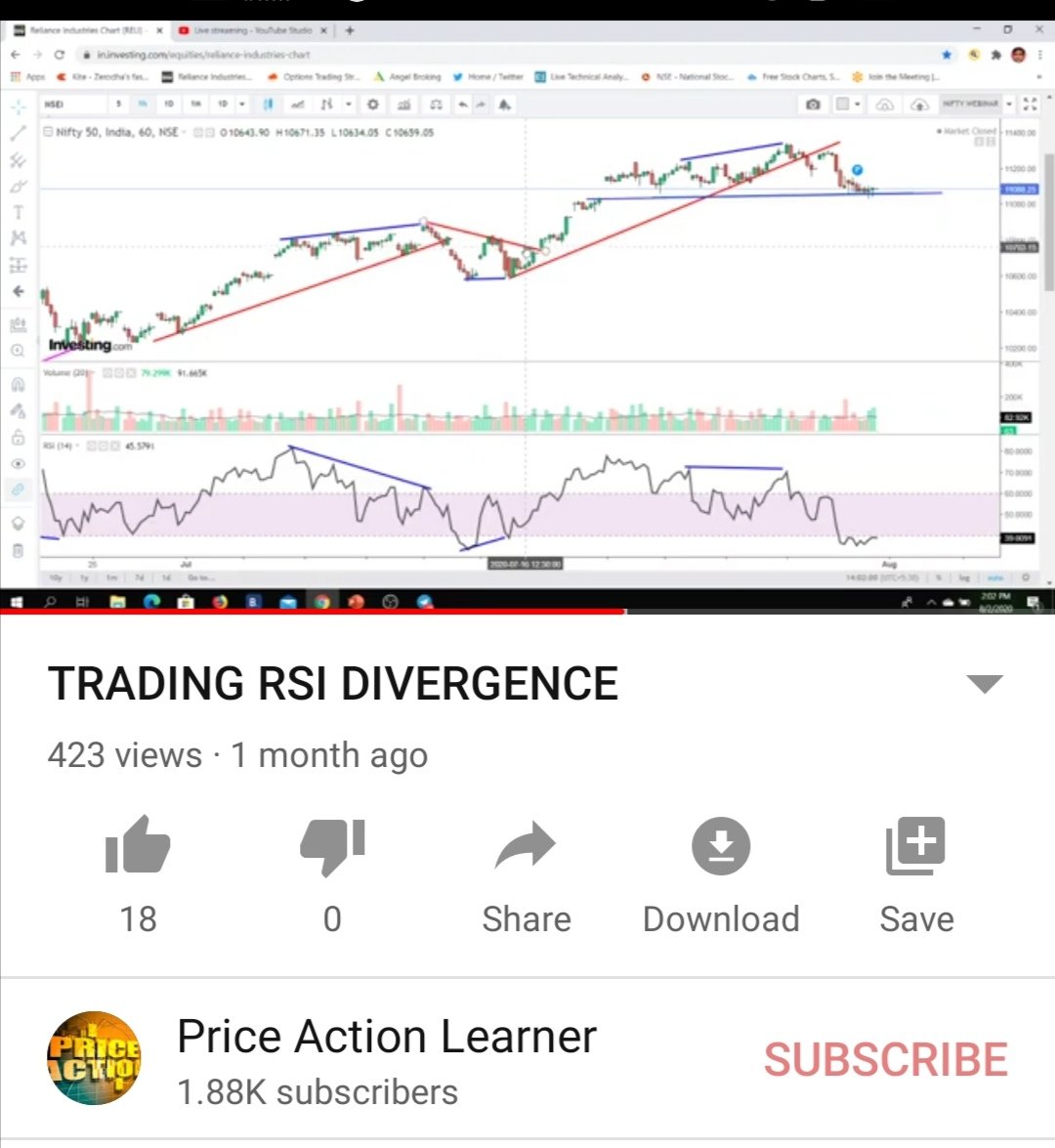

There is no Value of Free stuffs - I will prove today - My 1St Webinar - Nifty Option selling conducted before 2 month's watched by 6400 people's - YT- followers only 1.8 K. My 2nd webinar on RSI divergence - watched by only 600. No likes, no comments, no retweets.

First step to learning option adjustments: Option strategy names are so confusing right? [iron fly/ iron condor/ bull call spread etc] Do you agree? many strategies are combination of other strategies or can say extension of other strategies? wait, will give example: (1/3)

Weekend learning :- Sharing How to trade RSI Divergence . Tagging it for wide reach and learning purpose . If any observations please comment and Retweet . @sanstocktrader @ST_PYI @Stockengg @Pathik_Trader @jitendrajain

Let us understand the basic concept of Option Greeks. Option Greeks are classified into 5 components:

For option sellers following r d outcome Theta with u but Delta + Vega against u = Loss trade. Theta + Vega with u but delta goes against = small profit Theta + Delta with u but Vega goes against u = small profit Theta + Delta + Vega with u then is super duper profit trade

For the options sellers ATM and ITM options are like fire ball - If u comes near to these you will be sureshot burnt yourself. The more the distance your away from this fireball u will be safe and secure. #PALearner

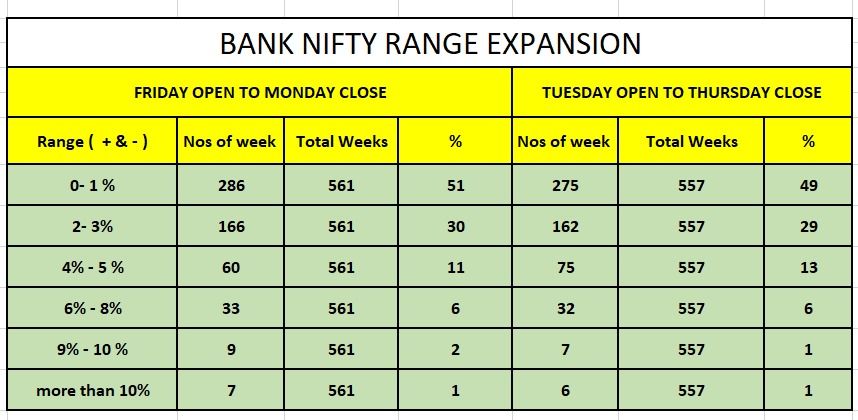

Bank Nifty first 2 days Range = Last 3 days range. Check data.

Many of friends confused about break-even point on Iron condor strategy . Here I am starting to explain in details with my original July month trade . Here we go -

Starting with Nifty Monthly data - see below pic - Data collected for past 153 months . focus on light blue area . As per data 90% of the time Nifty closed within +-10% range from spot . Also 90% of the time it has not crossed 10% from spot .

Regulator should monitor the Ad spends of the banks. Offlate seeing lot of weak banks with Increasing NPA spend a lot on unnecessary events in the media. Should RBI regulate ad spends of banks?

صوت 0 · النتائج النهائية

May be RBI should cap the savings interest at 4%. save depositers

United States الاتجاهات

- 1. StandX 4,981 posts

- 2. #NationalCatDay 1,966 posts

- 3. Aidan Hutchinson 3,053 posts

- 4. Huda 20.4K posts

- 5. South Korea 143K posts

- 6. FOMC 35.5K posts

- 7. #SpaceMarine2 N/A

- 8. #wednesdaymotivation 4,603 posts

- 9. Hump Day 19.2K posts

- 10. Good Wednesday 33.5K posts

- 11. Jay Z 8,570 posts

- 12. $XHLD $0.27 N/A

- 13. NBA Street N/A

- 14. Happy Hump 11.8K posts

- 15. Marcedes Lewis 1,056 posts

- 16. #Wednesdayvibe 2,333 posts

- 17. #MAYATVAWARDS2025 1.73M posts

- 18. Mandy 16K posts

- 19. Brad Holmes N/A

- 20. $NVDA 106K posts

Something went wrong.

Something went wrong.