Dear sir, please remove the concept of HUF(hindu undivided family). I am working in a bank and I found that most of the people are misutilizing it. This is also resulting in tax loss for the govt.@narendramodi @nsitharaman @KTRoffice

The ‘Greed of Government Job’ has done immense damage to this country and its youth.

Great gesture 👏 An annual tradition at Real Betis - a Spanish Club where fans throw thousands of toys onto the pitch for underprivileged children for Christmas 🎄🧸

Some of my fav tweets by @VRtrendfollower. he specializes in breakout stocks. Thanks, Bhai for the awesome content.

Thank you all for patiently listening for 3 and half hour and for Generous Ratings. @elearnmarkets

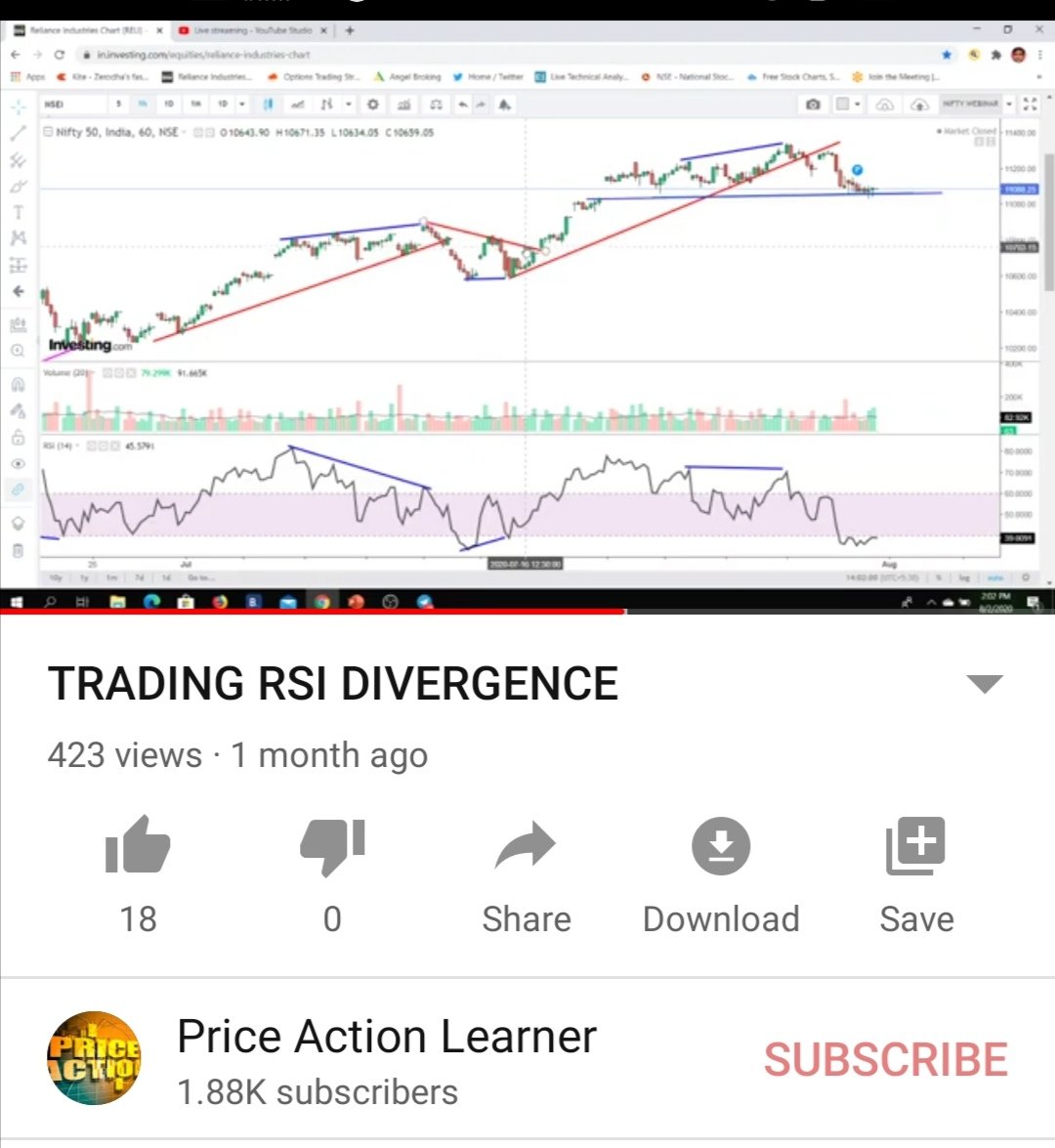

There is no Value of Free stuffs - I will prove today - My 1St Webinar - Nifty Option selling conducted before 2 month's watched by 6400 people's - YT- followers only 1.8 K. My 2nd webinar on RSI divergence - watched by only 600. No likes, no comments, no retweets.

First step to learning option adjustments: Option strategy names are so confusing right? [iron fly/ iron condor/ bull call spread etc] Do you agree? many strategies are combination of other strategies or can say extension of other strategies? wait, will give example: (1/3)

Weekend learning :- Sharing How to trade RSI Divergence . Tagging it for wide reach and learning purpose . If any observations please comment and Retweet . @sanstocktrader @ST_PYI @Stockengg @Pathik_Trader @jitendrajain

Let us understand the basic concept of Option Greeks. Option Greeks are classified into 5 components:

For option sellers following r d outcome Theta with u but Delta + Vega against u = Loss trade. Theta + Vega with u but delta goes against = small profit Theta + Delta with u but Vega goes against u = small profit Theta + Delta + Vega with u then is super duper profit trade

For the options sellers ATM and ITM options are like fire ball - If u comes near to these you will be sureshot burnt yourself. The more the distance your away from this fireball u will be safe and secure. #PALearner

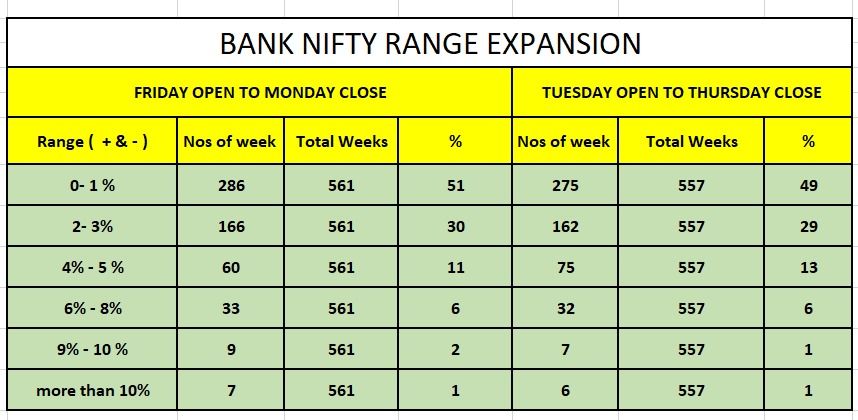

Bank Nifty first 2 days Range = Last 3 days range. Check data.

Many of friends confused about break-even point on Iron condor strategy . Here I am starting to explain in details with my original July month trade . Here we go -

Starting with Nifty Monthly data - see below pic - Data collected for past 153 months . focus on light blue area . As per data 90% of the time Nifty closed within +-10% range from spot . Also 90% of the time it has not crossed 10% from spot .

Regulator should monitor the Ad spends of the banks. Offlate seeing lot of weak banks with Increasing NPA spend a lot on unnecessary events in the media. Should RBI regulate ad spends of banks?

0 票 · 最終結果

May be RBI should cap the savings interest at 4%. save depositers

United States 趨勢

- 1. Good Monday 46.3K posts

- 2. #MondayMotivation 8,558 posts

- 3. #GoldenGlobes 21.6K posts

- 4. Harada 10.9K posts

- 5. Tekken 26.1K posts

- 6. Victory Monday N/A

- 7. #JungkookxRollingStone 65.1K posts

- 8. #MYNZ_CRCRevolution N/A

- 9. #OrmxHausNowhereBKK 706K posts

- 10. ORM HAUS NOWHERE GOP 686K posts

- 11. Mainz Biomed N.V. N/A

- 12. Orm Kornnaphat 37.3K posts

- 13. MAGICAL WITH WILLIAMEST 302K posts

- 14. Chiefs 125K posts

- 15. Emily Blunt 1,581 posts

- 16. Mahomes 46K posts

- 17. John Lennon 10.8K posts

- 18. Proverbs 6,228 posts

- 19. Kelce 27.3K posts

- 20. Zara 11.9K posts

Something went wrong.

Something went wrong.