liam graham

@liam016

Investor, Ironman, Wind chaser

You might like

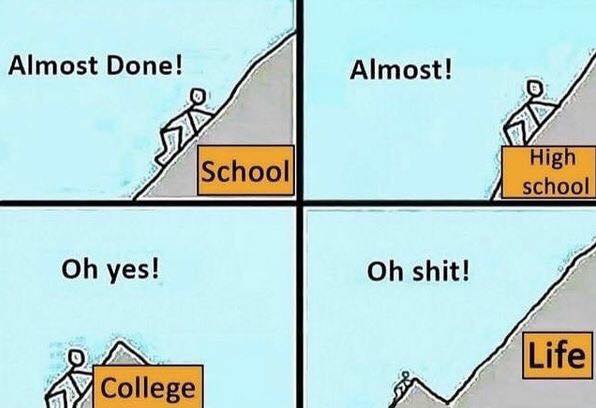

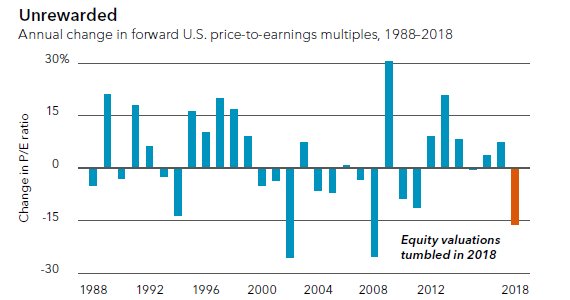

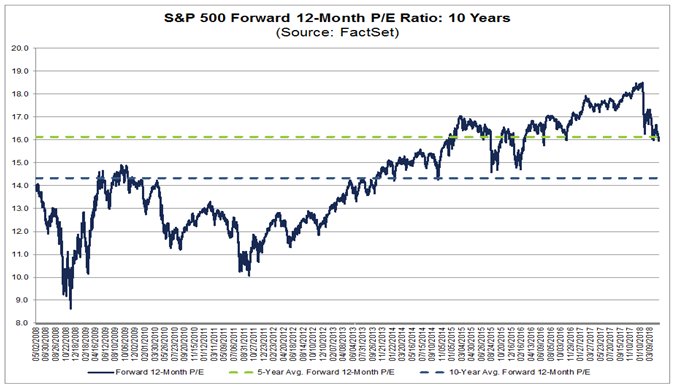

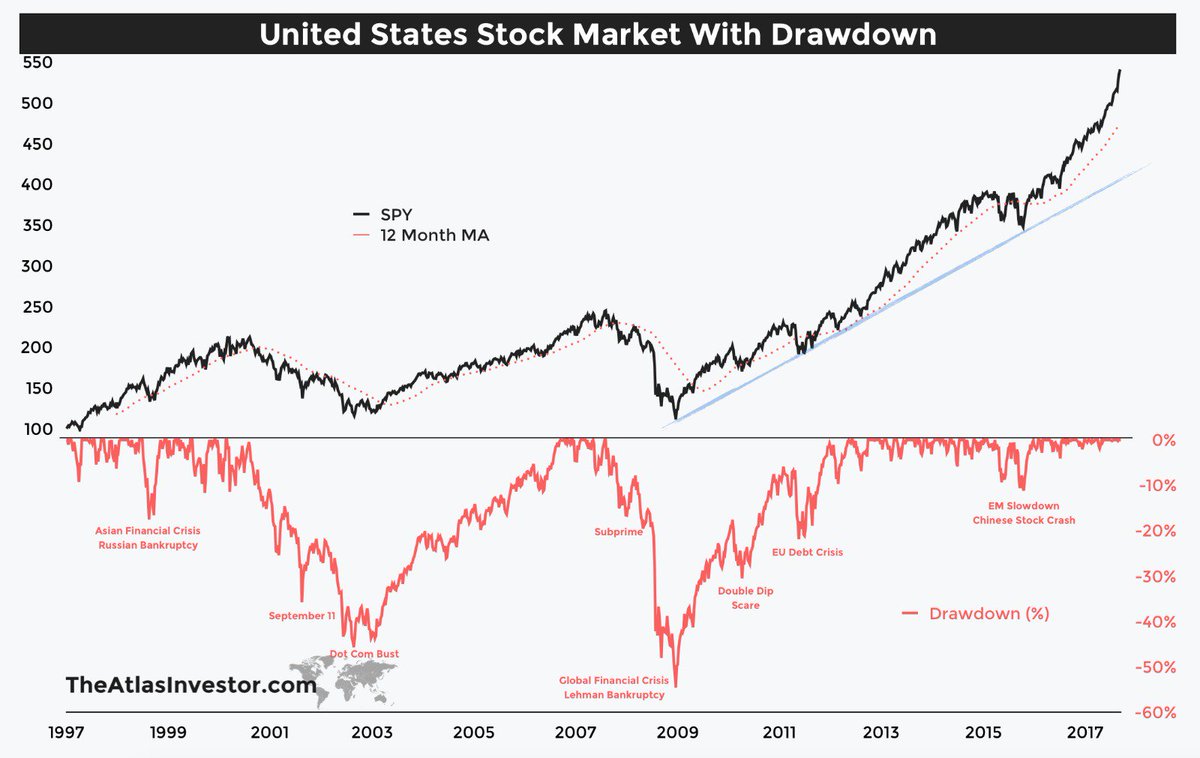

Some perspective on the re-rating that has occurred this year

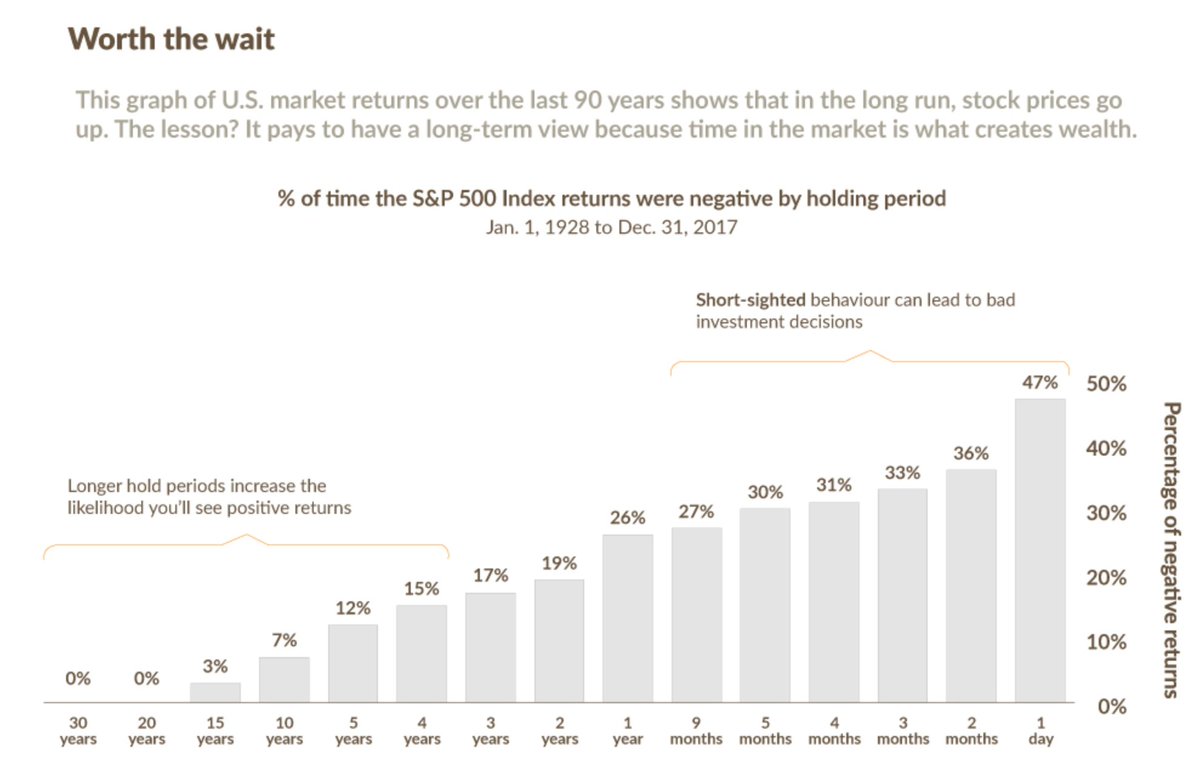

Good visual of "Short term = voting machine. Long term = weighing machine."

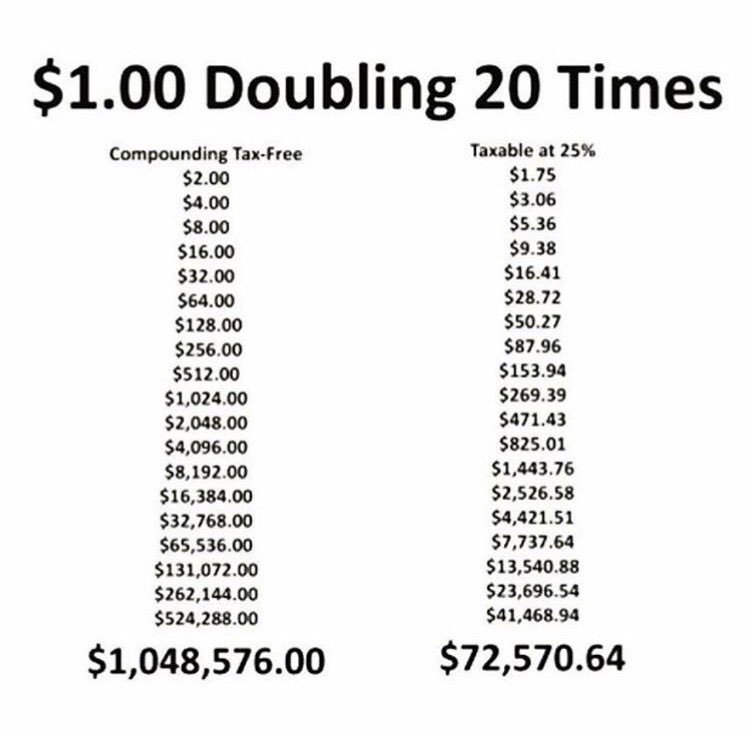

The greatest superpower you can have is a long-term focus

Start every ride from our historical villa @cancampolier. From luxury accommodation to personal guided rides and mechanics. We can build your perfect cycling holiday getaway. Email [email protected]

We forget Ramaphosa has been president for only 3 months. So much already achieved: * New Eskom Board & implicated execs out * New Transnet Board * New Denel Board & CEO out * New PRASA Board * SARS Tom Monyane out * SSA Arthur Fraser out * Supra’s NW Province taken over ....

Meet the team! Our man Willie Coetzee has been with us for a number of years now. He is our 2IC and care deeply about bikes and giving the best possible client service. He has also recently become a super dad to triplets. Thanks Willie for your commitment. #MeetTheTeam

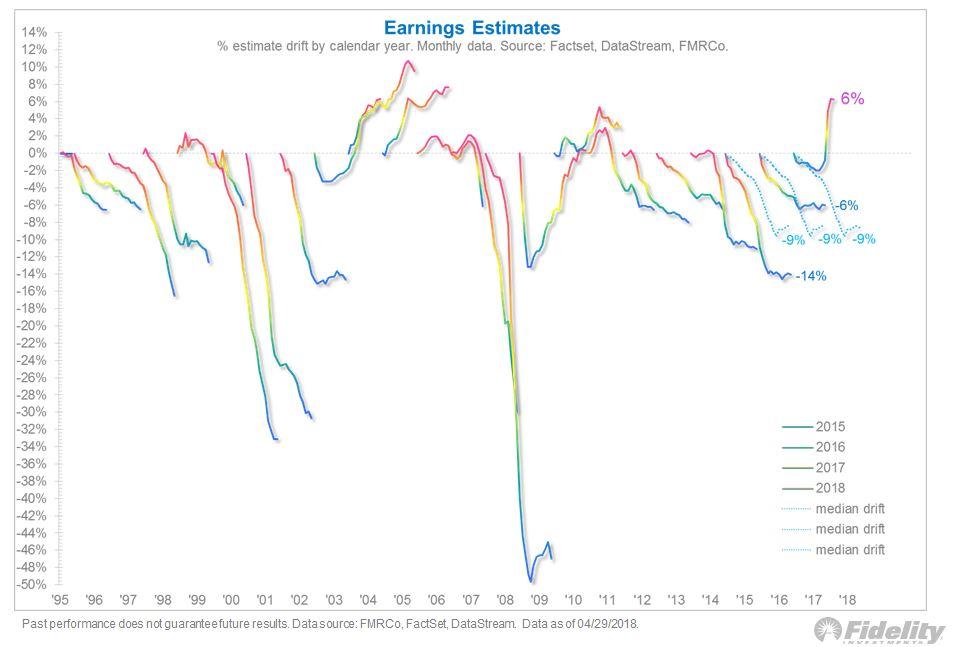

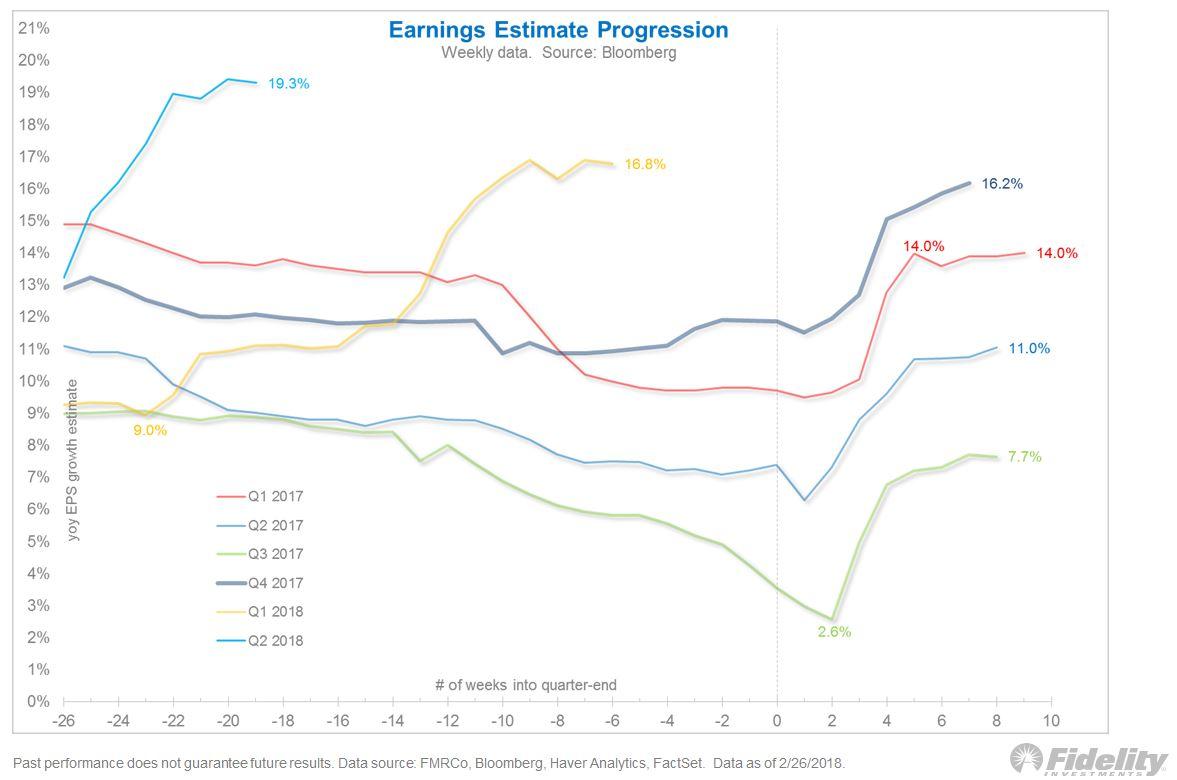

A colorful look at the typical #earnings estimate drift by calendar year, 1995-2018, after initial estimates come out. The Q1 earnings season: boom, no bust. #dataviz #data

The forward 12-month P/E ratio for $SPX is 16.0, which is above the 10-year average of 14.3. insight.factset.com/sp-500-earning…

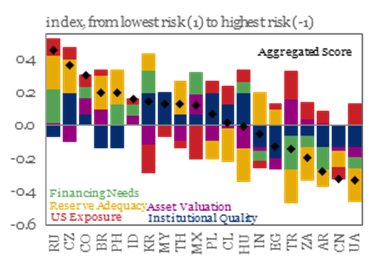

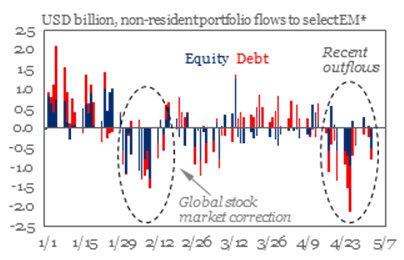

Our latest #EM scorecard puts relative risks in perspective. We find that #Ukraine, #China, #Argentina, #SouthAfrica, and #Turkey look more exposed to changes in risk appetite.

#EM portfolio flows hit another pothole, with particularly big outflows on the debt side.

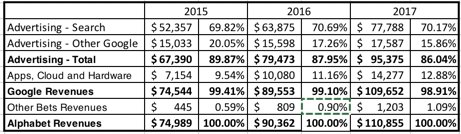

Google is Alphabet’s “alpha”, delivering 99% of its revenues and all its profits, but the “bets” are out-of-the-money options to be in big, albeit uncertain, businesses, I value the ad business at close to market cap, but the bets are icing on the cake. bit.ly/2vvqeU1

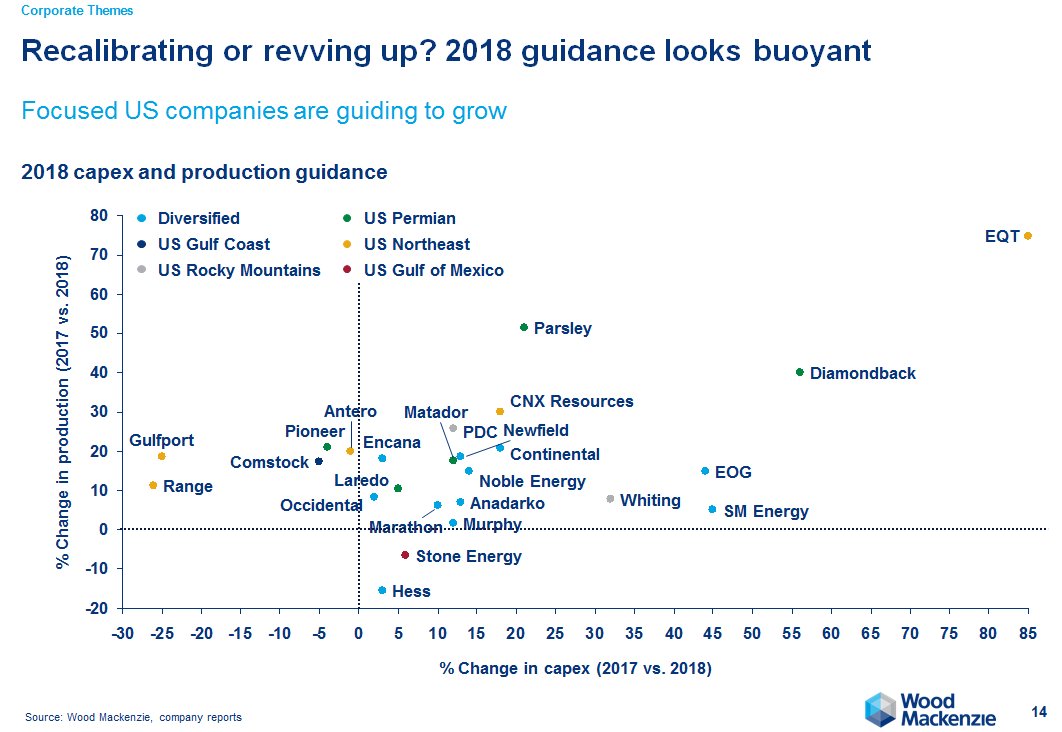

2018 guidance for Lower 48 focused companies is on the up @WoodMackenzie

Noteworthy: Solid #earnings growth of 21% is expected this year followed by 10% in 2019. This is important because it may make it easier for valuations to come down without triggering a bear market.

A scary week for markets can make you lose perspective. My attempt to regain investment serenity in four steps. bit.ly/2BPAw3V, with a tool to value the S&P 500: bit.ly/2ETze6u

Rising Bond Yields Rattle Equity Markets: Here's Why - seeitmarket.com/rising-bond-yi… research by @ConnectedWealth $SPY $TNX $VIX

seeitmarket.com

Rising Bond Yields Rattle Equity Markets: Here's Why

Rising bond yields may be the root cause of recent stock market volatility in February. Analysts at Connected Wealth note that everything except rising bond yields would argue for a healthy market in...

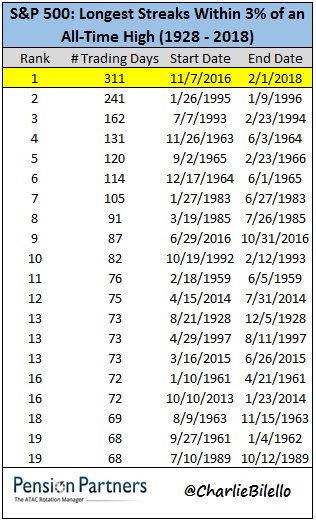

S&P 500: the longest streak in history without a 3% pullback has ended, 311 trading days.$SPX

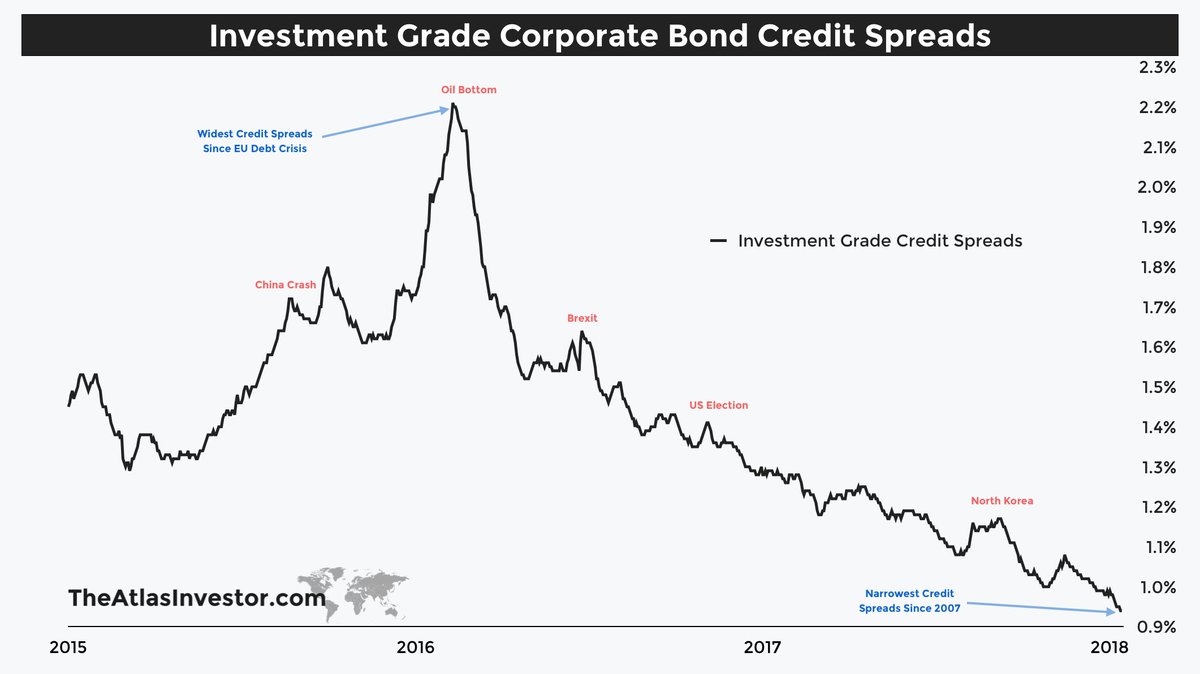

Blackrocks Survey shows clear asset allocation trend towards illiquid asset and private deals, at the time when: • equity prices are going vertical • equity valuations are extremely expensive • government bond yields historically low • credit spreads are very narrow

United States Trends

- 1. Dodgers N/A

- 2. #TNAiMPACT N/A

- 3. Mets N/A

- 4. #TheTraitorsUS N/A

- 5. Colton N/A

- 6. Baseball N/A

- 7. World Series N/A

- 8. Yankees N/A

- 9. #TNAonAMC N/A

- 10. Bellinger N/A

- 11. Skubal N/A

- 12. Nobel Peace Prize N/A

- 13. Cohen N/A

- 14. Lockout N/A

- 15. #thepitt N/A

- 16. Ohtani N/A

- 17. The MLB N/A

- 18. Tiffany N/A

- 19. Dixie Carter N/A

- 20. Soto N/A

Something went wrong.

Something went wrong.