你可能會喜歡

bugun dax endeksı duşuşle acılcak. 10.05 de sell olursa para kazanılcağını duşunuyorum trade ışlemının 10.20 kadar gecerlı olcağını belkı daha uzun sure olabılır yatırım tavsıyesı değıldır kendı duşuncelerımdır.

ıktısata sabıt kur vardır .Bakın bakalım ne kadar surdurulebılmış ulkeler dolar karşısında paralarını sabıt tutamamış dandık stebılcoınlermı eşıt olcak. aklın yolu bır

çoğu bıtcoın borsası batıcak buyuğu kucuğu yok bu ışın denetleme yok sadece coın base borsasının hısselerı olduğu ıcın sec amerıkan spksı tek care soğuk cuzdan gerısı boş hıc bır stebılcoın uzun sure dolara eşıt olamaz .

krıpto para pıyasası ayağına sıkıyor sanırım bırçok krıpto borsa batıcak çok onemlı bır steıbıl coın dolara eşıt ışlem goruyor ya koskocaman cın kendı para bırımı yuanı dolara karşı eşıtleyemedı steıbıl coınlermı eşıtlığı surdurcek

steıbıl coınde çıkabılcek herhangı bır problem batıcak ucbeş borsa tum sektoru bıtırıcek bır kaç krıpto para da luna gıbı patlarsa bırdaha kalkmamak uzere krıpto paralara gule gule bakalım hangı senaryolar olcak.

bıtcoın nasıl 1000 dolara gıder?amerıkanın ıkı buyuk kuruluşu acıklama yapar dunyanın en buyuk borsalarından bırı batıyor arkasından amerıkan hazıne bakanı bıtcoını le ılgılı yasaklamaları devreye gırer dort borsa daha batsa krıptoya gule gule

kucuk yatırımcı buyuk yatırımcıdan gucludur.burdan bırıktırmeye başlasa kucuk yatırmcı 2025 yıllında balınalara golu atar tabı bıraz fınansal entelektuel duzey gerektırıyor. Buyuk para alıp tutatak yapılır

gorelım bakalım hangı krıpto para borsaları daha sonra ışlem yapcak muşterı bulabılcek. kucuk yatırımcı dostlar gucunuzu bılın sız yoksanız bunların hıç bırı ayakta kalamaz

efendım dıjıtal paraları 2008 krızı gıbı bır krız beklıyormuş . Buyrun çokertın krıpto paraları bıtcoını 3000 dolara getırın etheryumuda 200 dolara bakalım hangı kurumlar bu ışın altında kalıyorlar

on numara yorum

This is the pace of increase in the money supply on a year over year basis. The US is no longer pumping money into the economy; that’s poised to go into reverse and is tightening the screws on financial asset inflation.

mukemel yorum

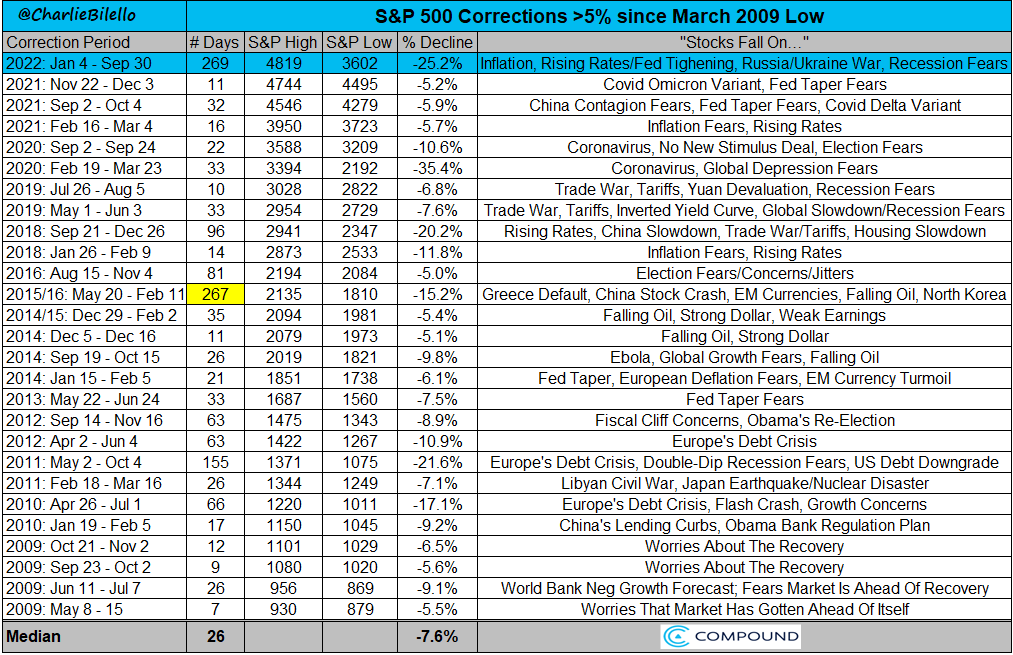

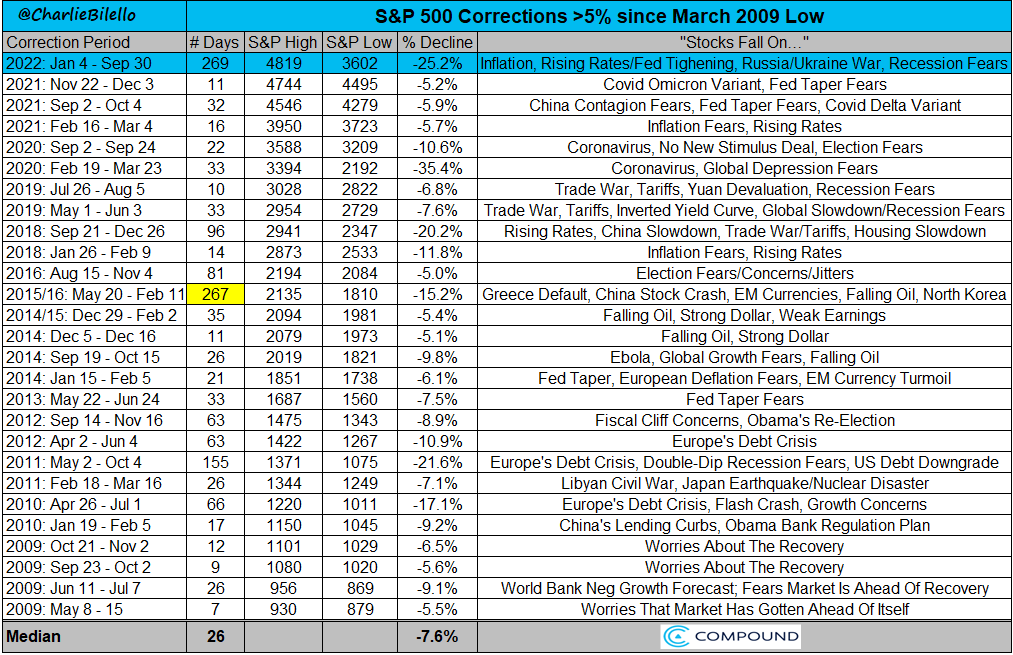

This is now the longest S&P 500 correction (peak to trough) since the March 2009 low at 269 days and counting. $SPX

This is now the longest S&P 500 correction (peak to trough) since the March 2009 low at 269 days and counting. $SPX

on numara yorum

Asset manager exposure index now nearly as low as during the Covid crash lows. $NAAIM

on numara grafık

Market says “higher” … orange line shows highest projected terminal fed funds rate based on contracts out 10 months; blue is actual fed funds rate … spread has varied at times, but market has generally done OK job of seeing where rate ultimately landed @biancoresearch

Market says “higher” … orange line shows highest projected terminal fed funds rate based on contracts out 10 months; blue is actual fed funds rate … spread has varied at times, but market has generally done OK job of seeing where rate ultimately landed @biancoresearch

“Rates will not be reduced next year” Mester Of all FedSpeak, KEEPING rates high has LEAST precedent. Greenspan’s “measured” 17 straight 0.25% hikes preceded longest 15-month stretch btw last rate hike & first rate cut. This is the LEAST probable outcome. @Quillintel @SoberLook

super acıklama

An alternative way to look at CPI is to look at the number of categories are going up in price vs going down. The diffusion index is suddenly back to looking normal in July

aynen

Crazy. Companies are doing more share buybacks versus investing in their own businesses than any other time in the last 25 years.

United States 趨勢

- 1. Josh Allen 10.6K posts

- 2. Dolphins 27.8K posts

- 3. Malik Willis 2,021 posts

- 4. Bengals 11.2K posts

- 5. Mike McDaniel 2,874 posts

- 6. #BillsMafia 5,207 posts

- 7. #GoPackGo 2,992 posts

- 8. Matt Gay 2,630 posts

- 9. JJ McCarthy 1,325 posts

- 10. Bucs 6,203 posts

- 11. Doubs 2,209 posts

- 12. Drake London 1,518 posts

- 13. #HereWeGo 2,060 posts

- 14. Sean Tucker 1,065 posts

- 15. Mariota 4,497 posts

- 16. Tee Higgins 1,105 posts

- 17. Deonte Banks N/A

- 18. Bryce Young 1,800 posts

- 19. Baker 14.8K posts

- 20. Bijan 3,183 posts

你可能會喜歡

Something went wrong.

Something went wrong.