macroption

@macroption

Random observations from non-random markets. Mainly equity indices, options & volatility. Petr Houstecky.

You might like

The two most important parts of market crashes: - In hindsight they always go too far. - They always rebound well before the real economy.

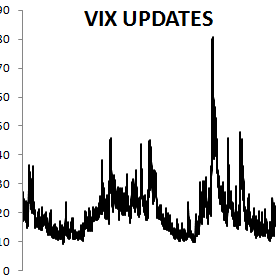

Updated the $VIX all-time high stats page with some comparison of current spike vs. 2008 vs. 1987 macroption.com/vix-all-time-h…

Today $VIX in context: #4 all-time highest close (75.47), #9 all-time highest intraday (76.83), #1 all-time biggest close-to-close increase (+21.57). We've reached 2008 panic levels, but not quite 1987 levels. Full stats here: macroption.com/vix-all-time-h…

Spot $VIX at record low but futures from December exp onwards are above the 20-23 Oct lows; long end & $VIXM strong last 2 days

OVX ( $USO $VIX ) on track to close highest since June 2012 (now 38.63)

Fourth year in a row that the S&P 500 has been down on the 1st trading day of December. Index was up remainder of month in '11, '12, '13.

First day of month unusually bearish in 2014: 9/12 negative, mean = -0.40%. Also 4/12 within +- 0.1%. Only 1 Apr + 1 Jul were > +0.1%. $SPX

$SPX most negative day since 22 Oct. Only second day since mid Oct low with d/d < -0.3%

$VIX futures contango settled at 5.94%. This is high for early in the expiration cycle. It is expensive to hold $VXX and $UVXY long term

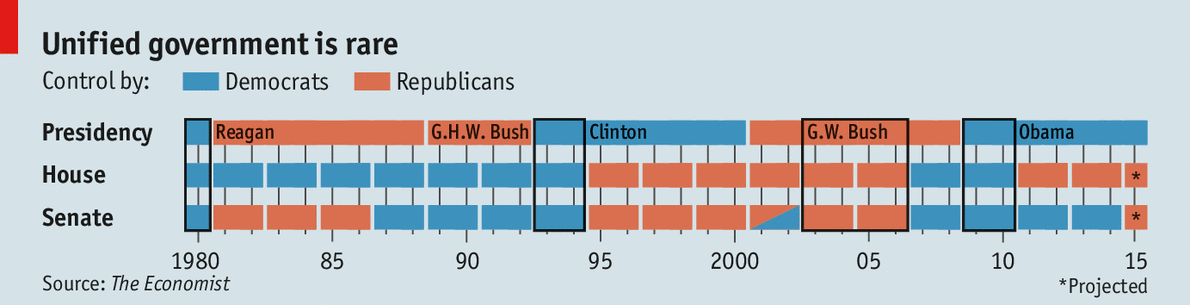

The last four American presidents have all had an opposition-controlled Congress at some point econ.st/1tZLCYn

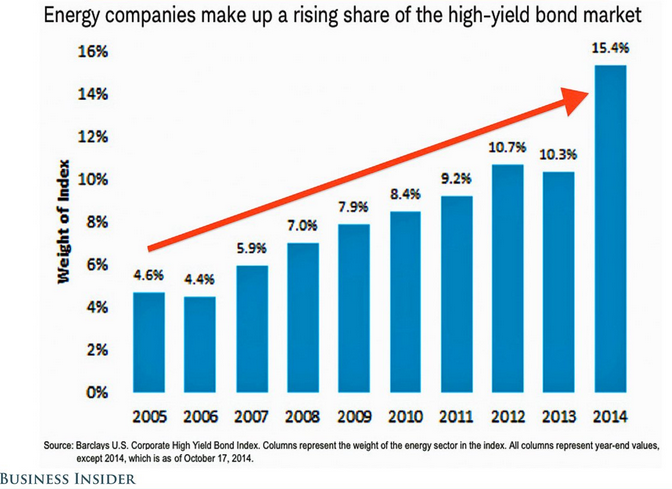

Crashing oil prices and rising interest rates make this a scary chart buff.ly/1rTJAnh

When $SPX + $INDU made all time highs on 18-19 Sept, $VIX was 12. The recent selloff has left some scars (currently priced at 2+ VIX points)

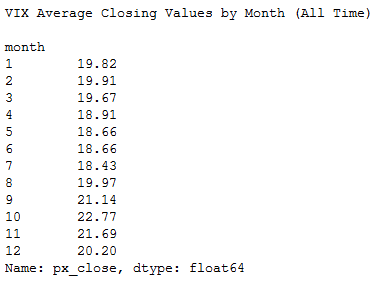

For comparison, on $VIX December has the 4th (all time) / 5th (2011-2013) highest average closing value.

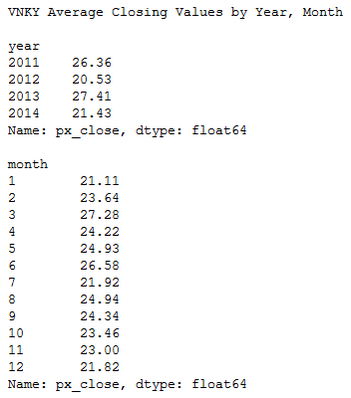

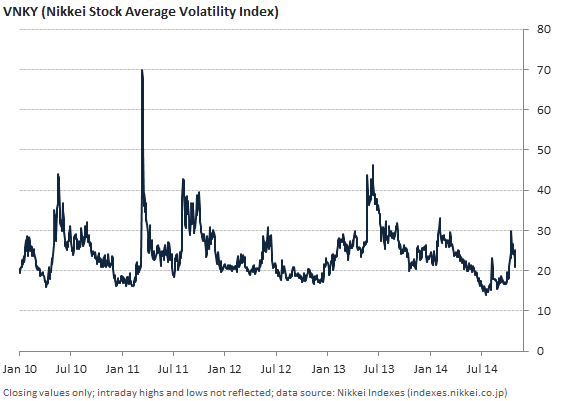

So far, the year end low vol pattern worked in all 4 years of VNKY data history. Dec+Jan have lowest avg close.

VNKY up 4.23 to 25.22 on BOJ news. It hasn't closed above 30 since 6 Feb.

The 5 stocks with the biggest weightings in the DJIA aren't even in the top 20 for weightings in the S&P 500. $V $GS $IBM $MMM $BA

Survey Shows an Urgency to Automate the Back Office ow.ly/DywZ0 via @wallstreettech

United States Trends

- 1. #911onABC N/A

- 2. Fanone N/A

- 3. harry styles N/A

- 4. Jack Smith N/A

- 5. #Aperture N/A

- 6. #BTS_WORLDTOUR N/A

- 7. #YIAYhouse N/A

- 8. Minter N/A

- 9. Fable N/A

- 10. Oliver Moore N/A

- 11. WE BELONG TOGETHER N/A

- 12. Massie N/A

- 13. Lady Vols N/A

- 14. Sinners N/A

- 15. Kelly Oubre N/A

- 16. Happy Anniversary N/A

- 17. Maki N/A

- 18. jungkook N/A

- 19. Hanoi Jane N/A

- 20. Mia Pauldo N/A

You might like

-

Kevin Van Trump

Kevin Van Trump

@KevinVanTrump -

Marcos López de Prado

Marcos López de Prado

@lopezdeprado -

Jill Malandrino

Jill Malandrino

@JillMalandrino -

Chess

Chess

@chessNwine -

Andreas Clenow

Andreas Clenow

@clenow -

WXRISK GRAIN WEATHER

WXRISK GRAIN WEATHER

@WxRiskGrains -

Darren Miller

Darren Miller

@djmphd -

Derek Hernquist

Derek Hernquist

@derekhernquist -

Options Trader (Hugh)

Options Trader (Hugh)

@ClassyHu -

justine underhill

justine underhill

@jj_under -

Emini Volume Trader

Emini Volume Trader

@RamosTrader -

Mr. X

Mr. X

@tradewithmrx -

Todd Salamone

Todd Salamone

@toddsalamone -

CatGPT 🐈

CatGPT 🐈

@loggyrhythm -

Matthew Jessup

Matthew Jessup

@matthewcjessup

Something went wrong.

Something went wrong.