Plasma war room 🧵 We dedicated our morning today to trading the $XPL TGE, so I thought I’d share some of my notes Maybe this might help you in pricing such events in the future, or maybe you are better than us at this and can add some more nuances in a comment

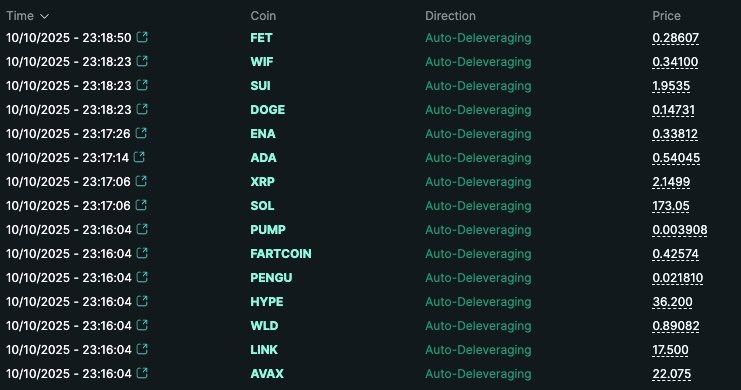

1/ Since a lot of people are waking up to see their perps positions closed and wondering what the hell “Auto-Deleveraging” means, here’s a quick and dirty primer. What is ADL? How does it work? And why does it exist?

Lot of crypto folks asking me "What happened?"... It's probably time to dust off the Taleb book 'Antifragile'. The amount of Open Interest that has been taken off in one day is unreal. 15B -> 6B on hyperliquid alone, the real total number must be insane! People always want a…

Managing a Portfolio at Drastically Different Sizes I've led the DeFi Dojo community for nearly half a decade now. We have family offices, hedge funds, trade shops, founders, and VCs in there. We also have real estate investors, software engineers, and investment managers in…

The top secret rules of my first production trend following system Take the top 30 /BTC pairs on binance ETH/BTC, LTC/BTC, SOLBTC etc On Monday go long the top 5, equal weighted Next Monday sell anything that dropped out of the top 5 to buy the new top 5, equal weighted

A thread on being a trading slut and expressing your trading ideas in the dirtiest way 1/

A thread on trading slutty carry trades on shitty perp dexes /1

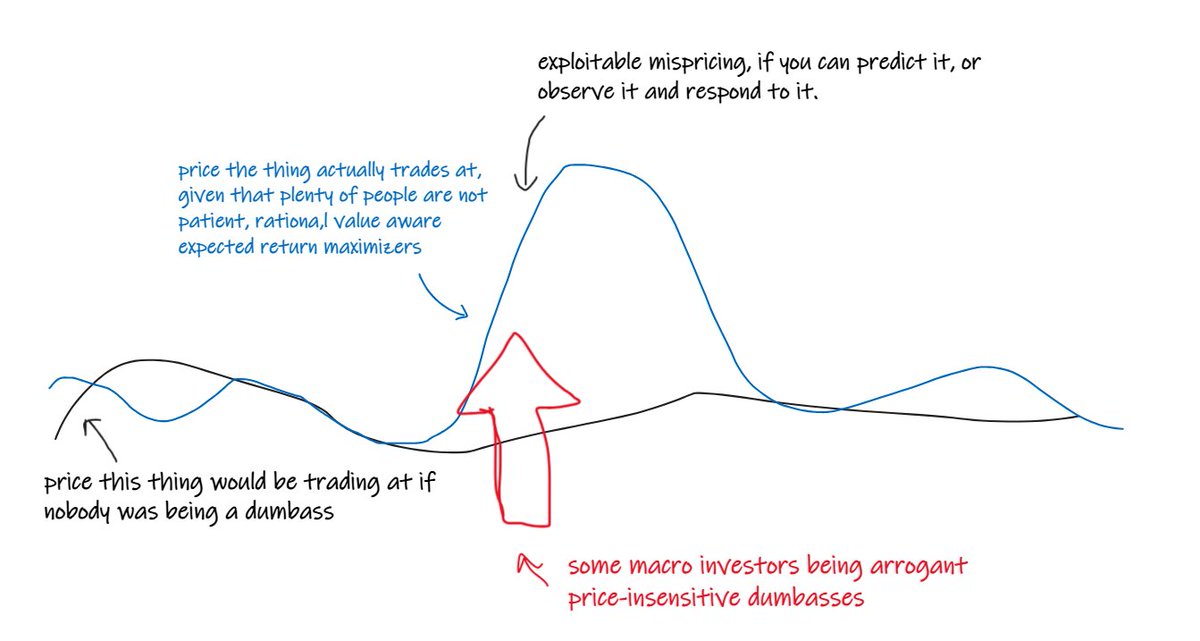

nearly everything that is a good repeatable trading idea looks like: "under <some circumstances> this thing is likely to be too cheap/rich because <some people> are being forced or greedy or stupid... so the thing is more likely to go up/down in the future"

Let me tell you how to build a high frequency trading system using all the best practices. If you don't like this then clearly your practices aren't the best. First split everything up into microservices that talk through IPC, that way profiling and debugging is really annoying

Official documentation for projects is the single best way to learn, followed closely by curating a good feed. Some smart frens: @ekrii3 @Grantblocmates (A+ research) @GryptoGoon @IDrawCharts @larpcapitalwc @pedma7 @ScottPh77711570 @skyquake_1 @therobotjames

Starting from 0, I would begin with PoW vs PoS, how gas works and tx are ordered on different chains. Technical foundation is overlooked by so many ppl. Next, reading CEX/DEX documentation will get you accustomed to how TradFi things work in crypto. Uniswap docs are a great…

Starting from 0, I would begin with PoW vs PoS, how gas works and tx are ordered on different chains. Technical foundation is overlooked by so many ppl. Next, reading CEX/DEX documentation will get you accustomed to how TradFi things work in crypto. Uniswap docs are a great…

How do you find edge? In crypto markets, it often lies in data others ignore. If you aren’t digging into numbers, you’re probably just punting trades on a whim. This thread aims to give non-technical ppl a starting point for how to pull/analyze data to test your theories. 1/10

The scam works because spot markets in small coins can be easy to push around DWF finds projects about to go broke and “invests” in them, buying a large % of supply at deep discount 1/

The basics are two things 1. Trading edges are noisy. Trade more shit 2. Trading systems work sometimes and then stop See this paper ideas.repec.org/a/bla/jfinan/v… /20

A thread on building better algorithmic trading systems for crypto from first principles 1/

Currently talking a lot with people about pairs trading and stat arb. Did I make the green bit in this slide too big?

Good post, though I'd add one thing In crypto it is axiomatic that you run TOWARDS crimes in progress Why? Edge comes downstream of price insensitive traders Criminals don't care much about good fills Their victims hoping to catch the next hyperliquid also don't care about…

Perp DEXes, volume vs OI. Big spread here, most obvious regressor is pre-TGE vs post-TGE. To compare with CEXes: Binance is 92%, OKX 80%, Bybit 184% according to @coinglass_com.

This article by @blockbandit_ is *excellent* Beginner kwants want to build the perfect system Expert kwants just get stuck in as quick as humanly possible At the end of every good trade you always wish you got stuck in sooner, with crappier infra blockbandit.xyz/adventures-in-…

1/10 New Article: “Trading Without Edge? That’s Expensive Gambling” Many people, including me (especially early on) start with techniques - backtests, machine learning, kalman filters, before knowing the effect they’re trying to model. That order is backwards, and costly. The…

United States Trends

- 1. Auburn 18.4K posts

- 2. #UFCRio 39.3K posts

- 3. Penn State 25K posts

- 4. Indiana 46.1K posts

- 5. James Franklin 12.8K posts

- 6. Oregon 68.8K posts

- 7. Hugh Freeze N/A

- 8. Diane Keaton 204K posts

- 9. Andrew Vaughn 1,161 posts

- 10. Charles 92.4K posts

- 11. Nuss 4,269 posts

- 12. Do Bronx 5,501 posts

- 13. Mateer 12.8K posts

- 14. King Miller N/A

- 15. Michigan 53.7K posts

- 16. #iufb 7,927 posts

- 17. Makai Lemon 1,218 posts

- 18. Drew Allar 6,003 posts

- 19. #AEWCollision 7,023 posts

- 20. Northwestern 9,698 posts

Something went wrong.

Something went wrong.