Smart people don’t wanna tell anyone what’s going on in their career or personal life, ever.

On ADP data, the most crucial explanation of the decline: ""The most recent release of the QCEW contained a higher-than-normal number of missing or redacted values for establishment size by NAICS sector and geography subgroups. This required the benchmark to be calculated at a…

ADP payrolls for September: -32k Largest decline since March 2023

ADP Private Payrolls-32K, Exp. 51K, Last 54K

US jobless claims hit 263K last week — the highest since October 2021. 📈 All eyes are on today's release. Dig into the numbers on the Bloomberg Terminal with ECAN <GO>.

📍 One team, one home: Bloomberg Dublin. Our newly redesigned Dublin office unites employees from two locations across the city into a single hub. Rooted in natural elements, Bloomberg Dublin combines warm woods and lush greenery with colors and textures inspired by Dublin’s…

Recall what happened in 1936 to France then dragged into deflation by a gold anchor. A firm Euro is a sign of future weakness not current economic strength!

Time To Protect: Market At Risk Of A Quant Quake With $SPX tagging $6,666 - even though I can still see a meltup into year-end as I've posted for several months - I now see a good bit of evidence that it is time to protect into end of month. JOIN us live to see when/where/why

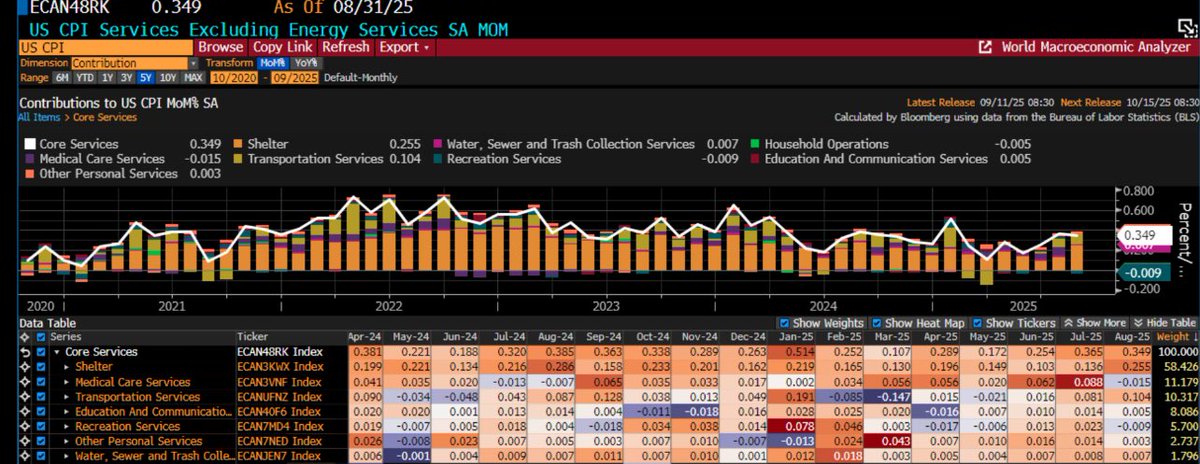

Inflation is moving in the wrong direction. Headline CPI increased to 2.9% and core increased to 3.1%.

The claims data look highly suspicious. Luckily we will know the truth RIGHT AFTER the next Fed meeting

With the US CPI numbers matching the consensus forecasts, the main market mover this morning is jobless claims, which came in far higher than expected (please see tables below). The overall signal from this week’s data is clear—and one I’ve stressed for some time, now…

CPI all Shelter.. No sign of Tariffs in Goods inflation.

CPI’s categories in both m/m and y/y terms

Core CPI 3m annualized change in August up to +3.65%

BREAKING: August CPI inflation rises to 2.9%, in-line with expectations of 2.9%. Core CPI inflation rises to 3.1%, in-line expectations of 3.1%. CPI inflation is now at its highest level since January 2025. We continue to see a 25 bps rate cut next week.

*US JOBLESS CLAIMS 263,000 IN SEPT. 6 WEEK; EST. 235K --- 4-year high and dominating bond trading over CPI. I labeled (red) this with the major holidays for 2025. Claims have jumped around every holiday this year, with Labor Day the biggest of these jumps. The BLS has long…

Has anyone considered the possibility that the UK is headed for societal and financial collapse?

Are Twitch notifications broken for just me? Never get any notifications

Odds of Sept rate cut jump to 98% after JOLTS

The only sam we like.

ADP payrolls for September: -32k Largest decline since March 2023

The UK faces the doom loop of rising borrowing costs, growing deficits and a government facing a lot of bad choices to raise revenues. Yields on 30-year gilts have reached their highest levels since 1998. (1 of 3)

United States Тренды

- 1. Happy Birthday Charlie 33.9K posts

- 2. Good Tuesday 26.6K posts

- 3. #tuesdayvibe 2,744 posts

- 4. #Worlds2025 37.5K posts

- 5. #T1WIN 16.4K posts

- 6. Janet Mills 1,220 posts

- 7. Pentagon 70.7K posts

- 8. #Wordle1578 N/A

- 9. Martin Sheen 5,999 posts

- 10. Romans 10.7K posts

- 11. Dissidia 5,282 posts

- 12. Blinken 24.8K posts

- 13. No American 63.8K posts

- 14. Time Magazine 15.5K posts

- 15. Benin 98.8K posts

- 16. JPMorgan 11.9K posts

- 17. Jake Moody 14.8K posts

- 18. #srchafreen 287K posts

- 19. Trump's Gaza 137K posts

- 20. Snell 26K posts

Something went wrong.

Something went wrong.