Musing_m

@musing_m

Investing. Notes to self. kindle book deals.

You might like

10 WAYS TO AVOID BEING FOOLED In 10 tweets I’ll explain 10 heuristics that will make you smarter. Thread:

A Refresh: NSE Market Cap and Factor Indices - Risk vs Reward chart Thoughts...? Everything benefits with a lowvol blend I guess. Excellent risk reduction. Ex: n100lowvol30tr - dominate all mcaps - Large Caps, Midcaps, Small Caps. Also note: midcaps dominate smallcaps.

Price Drop: 30% off on amazon.in/Asset-Manageme… (Usually, 2070/~, today at 1445/~ - This is the lowest price in the last 5 yrs)

amazon.in

Asset Management: A Systematic Approach to Factor Investing (Financial Management Association...

In , Professor Andrew Ang presents a comprehensive, new approach to the age-old problem of where to put your money. Years of experience as a finance professor and a consultant have led him to see...

Another book deal: ~70% off (Usually ~4300/- today at ~1350/-, lowest price in 5 years) amazon.in/Trend-Trading-…

Great Deal, if you've ever wanted to know the imaginary number i : Price Drop: 80% off (Usually ~770/- today @ ~160/-) amazon.in/Imaginary-Tale…

Price Drop: 80% off (Usually ~300/-, today @ 60/-) amazon.in/Money-Trap-For…

Picked up this book to browse; it had come to the office perhaps from publisher. Racy, full of anecdotes. You would be glued to this page-turner. Surprisingly good writing by an investment banker. Hope there’s more to come @alok_sama

And the joke: pi says to i: get real i says to pi : be rational e says to both: Join me and we’ll be - one. youtu.be/IUTGFQpKaPU

youtube.com

YouTube

The Most Beautiful Equation in Math

this equation is sheer poetry. had come across this in a 3blue1brown video to understand the intuition. still blows my mind

Book deal: ~46% off on amazon.in/Everything-Pre…

Review: Everything is Predictable - @TomChivers ***** I can't remember when I last enjoyed a maths book as much as this celebration of Bayesian statistics, and how scientific studies would benefit from using them. Great! popsciencebooks.blogspot.com/2024/05/everyt… #bookreview #popularscience #bayes

Book deal: 45% off on amazon.in/Missing-Billio… This one was recommended by quiet a few. One of the authors, Victor was a partner at LTCM. x.com/manishgvalani/…

amazon.in

The Missing Billionaires: A Guide to Better Financial Decisions

The Missing Billionaires: A Guide to Better Financial Decisions

Reading this now .. on recommendation in one of @safiranand tweets .. I’m hooked on from the line where they state that it’s not “what to buy” that’s matters as much as “how much to buy” .. most of my mistakes were also position sizing on bets that went wrong and costed me…

Price Drop: ~75% off, usually 324/- today at 94 amazon.in/Concepts-Physi…

8) Concepts Of Physics (HC Verma) It is a totally different attempt to teach physics. The exposition of each concept is extremely lucid. In carefully formatted chapters, besides problems and short questions, a number of objective questions have also been included.

Book deal: 40% off amazon.in/Option-futures…

Want to learn about Derivatives? Buy this book and read through it first - amazon.in/Options-Future…

Fully disagree with this line of reasoning. Expectation matters only when you get to play those odds many times. If it’s just a one time thing, that expectation is a mirage. Optimize for most likely outcome. Problem is getting those odds correctly! So agree with stay inv part.

This may be slightly off topic, but conceptually it's mathematically intelligent to remain invested even if one has a negative outlook. For instance, suppose someone believes there is an 80% chance that the market will decline, and a 20% chance it will go up. I’m simplifying this…

Most DIY Practitioners run their momentum strategies using popular indices as their universe. How about an alternative based on liquidity? Would that be any worse or better? New Post: abacuswisdom.wordpress.com/2024/12/24/mom…

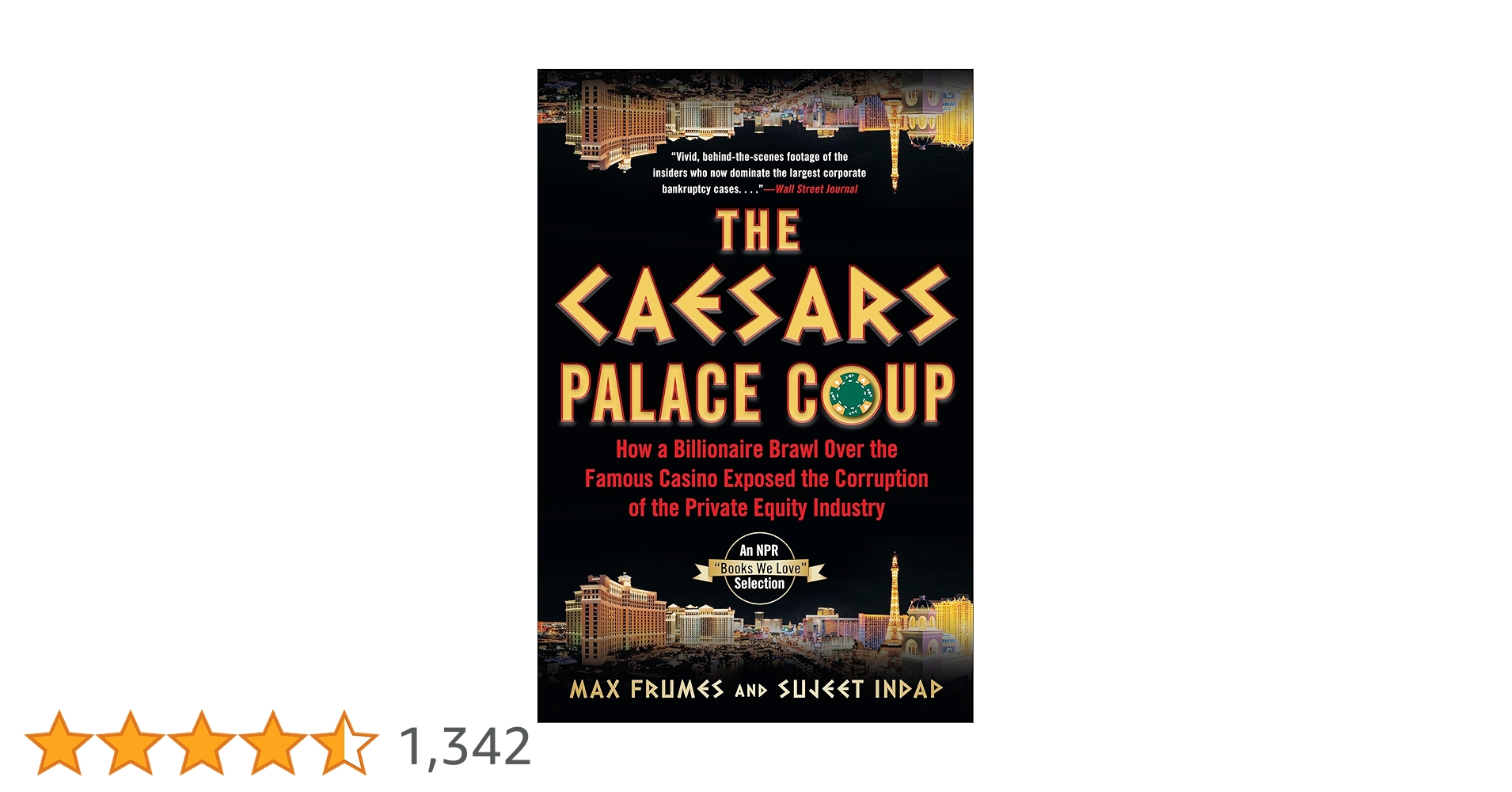

Price Drop Alert: ~60% off, usually 1160/- today @ ~498/- amazon.in/Caesars-Palace…

If their dumbness is not enough and you want to learn about greed and complete lack of ethics of major PE funds read: "The Caesars Palace Coup". Book is not for everyone for it very very detailed but absolutely fascinating for those who like such stuff.

United States Trends

- 1. LeBron 76K posts

- 2. #DWTS 52.5K posts

- 3. #LakeShow 3,693 posts

- 4. Whitney 15.7K posts

- 5. Keyonte George 1,811 posts

- 6. Reaves 7,772 posts

- 7. Peggy 17.6K posts

- 8. Grayson 6,909 posts

- 9. Celebrini 4,522 posts

- 10. Elaine 17.4K posts

- 11. Orioles 6,784 posts

- 12. Jazz 26.6K posts

- 13. #TheFutureIsTeal 1,486 posts

- 14. Taylor Ward 3,442 posts

- 15. Dylan 24.8K posts

- 16. Tatum 15.7K posts

- 17. #WWENXT 16.8K posts

- 18. Winthrop 2,476 posts

- 19. #Lakers 1,580 posts

- 20. Angels 31.7K posts

You might like

-

Anoop

Anoop

@CalmInvestor -

AmeyaD

AmeyaD

@ameyanifty -

VivekTaru

VivekTaru

@kendheswapnil -

Rajan Raju

Rajan Raju

@rajanraju26 -

Sandeep Rao - SEBI Reg. RA🖖

Sandeep Rao - SEBI Reg. RA🖖

@mysandz -

Nishant Batra CWM® 🇮🇳

Nishant Batra CWM® 🇮🇳

@stepbystep888 -

Anish Teli

Anish Teli

@anishteli -

Prabhakar Kudva

Prabhakar Kudva

@prabhakarkudva -

Kunal Bajaj

Kunal Bajaj

@Kuna1Bajaj -

Harish Krishnan,CFA

Harish Krishnan,CFA

@hktg13 -

vijaimantri

vijaimantri

@vijaimantrimf -

Anish Moonka

Anish Moonka

@AnishA_Moonka -

Sri Sri Rural Development Programme Trust

Sri Sri Rural Development Programme Trust

@SriSriRDP -

SIP Investor

SIP Investor

@SIP_INVEST0R -

Pawan Kumar Rai

Pawan Kumar Rai

@prai2303

Something went wrong.

Something went wrong.