MUX Protocol

@muxprotocol

Leading Perps Aggregator http://linktr.ee/muxprotocol 🤑 Low Cost 🐂 100X+ Leverage 0️⃣ 0% Spread on ETH & BTC 💧 Aggregated Liquidity 🔥 80+ markets

You might like

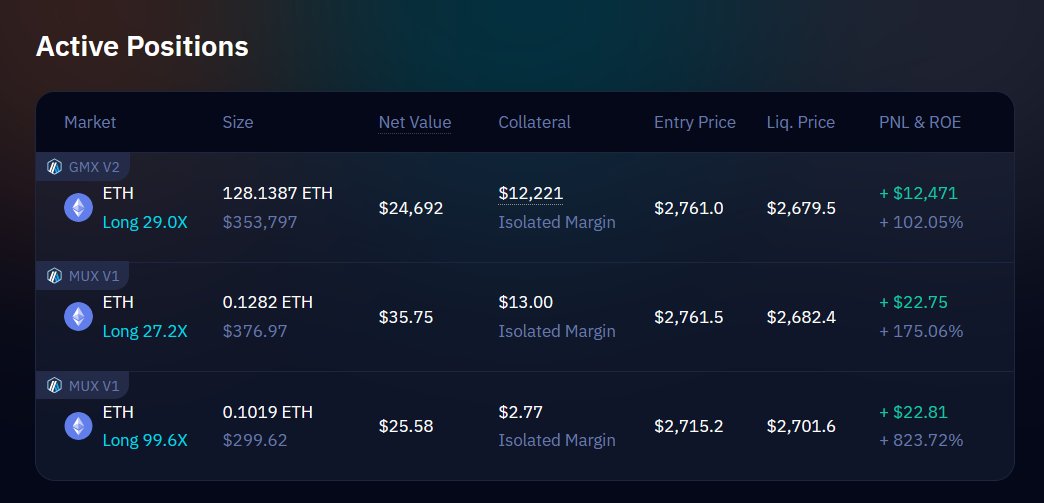

Trading across perp platforms shouldn’t require juggling tabs. One MUX chad routed $353k in $ETH through GMX v2 while managing two MUX v1 $ETH longs from the same window. Unified view. Siloed risk. Pure efficiency.

$BTC, $ETH, $SPY, $XAU all ripped on New York Open! Crypto, stocks, gold back in sync. MUX lets you: • Trade $BTC + its TradFi beta via aggregated positions • Get the lowest fees across GMX, Gains Network + MUX • Stay fully on-chain with one-click UX We're (so so) back.

Calm before another storm? Price impact often costs more than open/close fees when you size up. Size where 0.1% price impact hits on other perps: • $BTC → $500k–$2M • $ETH → $200k–$1M MUX removes that for BTC & ETH, so every extra dollar of size actually works for you.

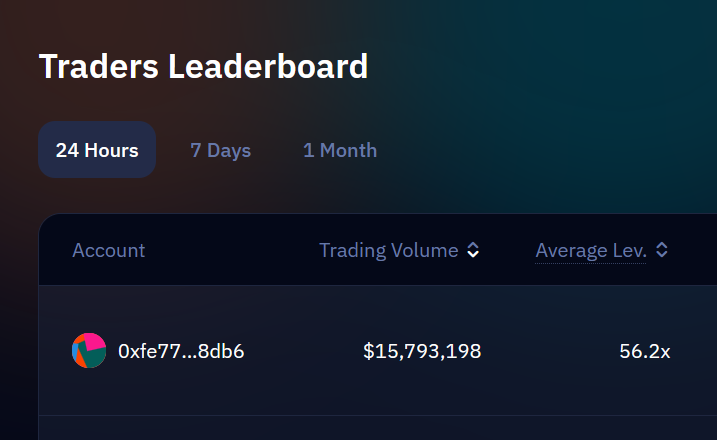

When a whale wants to move $15M+ in $BTC volume in one day, they pick a place that can handle it: • 0% spread + 0% price impact $BTC + $ETH • Aggregated routing for best fees • One UX, multiple platforms • Deep, cross-protocol liquidity When size matters, execution wins.

BTC nuked 7.19% today. Most 25x swing longs vanished. But MUX routing kept positions alive through the full move. • Same leverage • Same entry • Different platform One platform keeps you in the trade while others take you out. Breakdown coming soon.

BTC fell 4.5% today. 📉 A 25x long from $94.2k would usually get clipped instantly. But MUX’s liquidation optimization adds extra margin behind the scenes, lifting your maintenance buffer. Your long survives deeper moves to avoid forced sells other platforms trigger.

Extra Margin Boost = Higher Liquidation Price Open a $50k $BTC short, get routed across multiple perps, and MUX adds extra margin behind the scenes. Your liq price moves further away, even at the same leverage. Less risk. Same position. More trades to take in volatile markets.

Brrrypto taxation headlines are hitting the tape, and $BTC tagged $91.3k! Peak crypto timing. MUX stays predictable: fixed position fees, 0% price impact + spread on $BTC + $ETH. When news gets chaotic, your trade execution shouldn’t be. Fills = quotes on MUX.

We've been blessed with volatility chads: ⬇️ Fridays dump. ⬆️ Sundays pump. ⬇️ Mondays dump. On MUX you can pre-plan both sides with 0% spread + 0% price impact on $BTC + $ETH and transparent, fixed position fees. Take Saturday for R/R. Perfect time to map out next week.

Market sentiment is mixed. Trading conditions are great. > $BTC used to move 0.3% a day. > Now 3% days are normal! If you're using leverage for that, invisible fees erode your edge. Spread and price impact hit your PnL by surprise. Fixed trading costs don’t.

Reminder for this market: • Spot investors: only win if price grinds up. • Perp traders: win when price moves - up or down. Trading lets you monetize any direction. Get the best fills and lowest costs across multiple perp protocols. Route your orders through one UX, on MUX.

Not too long ago, a daily 3% BTC move meant "market crash". Today, it’s just Wednesday. $BTC daily swings of 2-4% are the new normal. That makes BTC the trade: volatility, liquidity, direction. MUX is the best place to trade it. No spread. No price impact. No excuses.

Sidelined? BTC just woke up. 4% intraday swings are back. Those used to show up only every few months! Make your $BTC trades count on MUX with 0% spread and 0% price impact. No hidden costs. Your fill = your quote. Best asset to trade. Best place to trade it. 👌

PerpDEXs with “zero fees”? Acktually... They remove the fee line item, but tax you via higher spreads + slippage. You pay on entry and exit. But trading $BTC and $ETH on MUX? 0% price impact. 0% spread. Your fill = your quote. The larger your size, the more you save on fees.

There’s always a market to trade. The real edge isn’t being early enough - it’s learning transferable skills: • Trade psychology • Risk management • Setup + execution Master those and they carry across assets, asset classes, and instruments. Yes, MUX has a built-in trading…

Hardest part early on: figuring out if you’re actually early or if no one cares. When there’s barely any info, no social signals, and the market’s lazy. You have to know whether it’s quiet because it’s early, or quiet because no one really cares (and won’t).

Trading TradFi markets on-chain change everything. Q4 Performance: - $BTC (-8%) - $GOOGL (+14.5%) - $AMZN (+10%) - $AAPL (+6%) Short what's weak. Long what's strong. Always trade the trend. There's always a bull market somewhere. MUX keeps you in it. 🤝

This is actually insane 🤯 @muxprotocol didn’t just open the gates. It merged the worlds. 277 pairs. Forex. Stocks. Commodities. Indices. You can get TradFI exposure through @GainsNetwork_io What they’ve built is genuinely next-level. Before, I had to jump between…

Three BTC long ideas? Run all three. Most perps merge same-asset trades into “one big position.” MUX doesn’t. You can open several same-asset, same-direction trades (diff params, diff leverage) while MUX aggregates them across platforms. One pane to manage them all.

United States Trends

- 1. Ferran 16.3K posts

- 2. Sonny Gray 7,799 posts

- 3. Rush Hour 4 11.9K posts

- 4. Chelsea 339K posts

- 5. Godzilla 21.3K posts

- 6. Red Sox 7,523 posts

- 7. Raising Arizona 1,075 posts

- 8. Happy Thanksgiving 21.7K posts

- 9. Dick Fitts N/A

- 10. Barca 121K posts

- 11. National Treasure 5,789 posts

- 12. 50 Cent 5,125 posts

- 13. Gone in 60 2,140 posts

- 14. Giolito N/A

- 15. Muriel Bowser N/A

- 16. Brett Ratner 3,555 posts

- 17. Clarke 6,516 posts

- 18. Man in the Mirror 1,401 posts

- 19. Ghost Rider 2,552 posts

- 20. Lord of War 1,509 posts

You might like

-

Lens

Lens

@LC -

Balmy

Balmy

@balmy_xyz -

GMX 🫐

GMX 🫐

@GMX_IO -

Velora (formerly ParaSwap)

Velora (formerly ParaSwap)

@VeloraDEX -

WENWIN.FUN

WENWIN.FUN

@WenWinFun -

Zapper ⚡️

Zapper ⚡️

@zapper_fi -

Everclear

Everclear

@EverclearOrg -

Kyan

Kyan

@KyanExchange -

Bounce Brand

Bounce Brand

@bounce_finance -

dForce

dForce

@dForcenet -

Pendle

Pendle

@pendle_fi -

ZigZag Labs

ZigZag Labs

@zigzagxc -

dYdX

dYdX

@dYdX -

TokenPocket

TokenPocket

@TokenPocket_TP -

HPX Official

HPX Official

@Hpx_Official

Something went wrong.

Something went wrong.