pennyether

@pennyetherr

Public BTC Miner analysis, like no one else. Won't take refuge in the false security of consensus (except BTC). Critical thinker, happily accept corrections.

$CORZ at the price it was before 120MWs of HPC announced (Oct 22, 8:00am), worth about $124m/yr in profits across 12 years. Earnings are after market close on Wednesday, and I expect them to be monumental in terms of future guidance. They've now secured 500MWs of long-term HPC…

$IREN is buying 1,080 GPUs for $43.9m (all-in cost, includes cabling, racks, labor, etc). Here's how the math breaks down: This totals only 1.35MW of capacity. They're estimating around $2.00 to $2.50 / GPUh in revenue, which at 1.25KW/GPU is around $1.80/KWH. With costs at…

$CORZ / $SQ - A quick and dirty description of the upcoming new paradigm of ASICs... I believe the industry term is "c'mon, just the chip". Currently, the way baby bitcoin are currently made begins when miners dump a ton of the shares in the open market and collect the cash.…

$CORZ just sold $400m of convertible notes. Money in the bank. Terms are 3.00% interest, with another $60m possible within 13 days. Maturing on Sep 1, 2029. This is upsized from yesterday's proposed $350m + $52.5m. Net proceeds will be $386.4m, meaning it cost $13.6m in various…

$MIGI 20MW + 144MW deal implies an absolute insanity of an undervaluation, so I bought a lot of them. They are so under covered, hell I don't cover them, that it took all day for them to ramp up in price despite a ludicrous value proposition. I might be missing something and…

$RIOT - Rather interesting move here. They had $278m of their previous ATM left, but they opted to terminate and open a brand new $750m ATM.. while their stock is at 52w lows and it costs ~50% more $RIOT shares to buy $BITF shares than it did in May. If they continue to buy…

$CLSK - Not a good report, IMHO. The real story here are cash SG&A expenses ballooning, and CoR's coming in higher than last quarter (on a $/KWH basis). They barely improved all-in cash hashcost, moving it from $44.44 to $43.85, despite installing ~$75m in new miners. First,…

$CLSK coming up today. They're a pureplay miner and, true to the name, have a pretty clean 10Q. Can they defeat $CORZ's mining operations? My guesses: - Revenue: $104m - CoR: ($41.2m) - Prof fees: ($2m) - Payroll: ($18m) - G&A: ($8m) - Loss on disposal of assets: ($2m) - Change…

$CLSK coming up today. They're a pureplay miner and, true to the name, have a pretty clean 10Q. Can they defeat $CORZ's mining operations? My guesses: - Revenue: $104m - CoR: ($41.2m) - Prof fees: ($2m) - Payroll: ($18m) - G&A: ($8m) - Loss on disposal of assets: ($2m) - Change…

Cash costs by company, by line item -- in $/BTC, hashcost, and $/KWH. It takes a ton of work and attention to detail to come up with this, and I'm fairly certain it's more accurate than anything else out there. $RIOT and $MARA are Q2, the rest are Q1. $/BTC is a garbage metric…

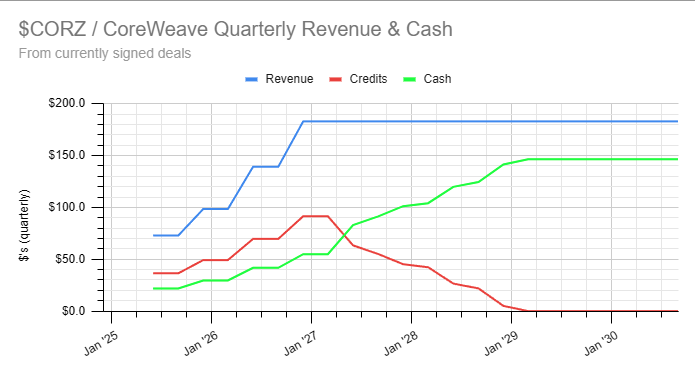

Bought even more $CORZ today. $DLR: EV/EBITDA = 19x $EQIX: EV/EBITDA = 26x $CORZ: EV/EBITDA (just from CoreWeave) = ~12x This is assuming a fully diluted Core Scientific (410m shares), and only the EBITDA of the CoreWeave deal (~$280m/yr). This excludes: - possibility of…

I think the days of single-digit $CORZ are gone for good.

For anyone buying other miners, and not $CORZ, what's your reason for passing on $CORZ? Not saying you should buy it, but if you've ruled it out for one reason or another, would love to hear why!

Tomorrow looking good so far.

$MARA seems to be hitting its stride, with respect to hashrate. Very likely they're at a new ATH. With 90% confidence intervals: - 7d: ~33 EH/s ± 5EH/s - 3d: ~42 EH/s ± 10 EH/s Disclaimer: These are just facts, and not a comment about the stock, or anything else.

$IREN you guys will love this: GPUs pull in ~$4/KWH. If $IREN sold AI Cloud services, they'd pull in about $35m/yr per 1MW. They'll have 2,000 MWs or whatever, so that's $70b/yr in revenue. Then we just assign a 10x P/S, and that's a $700b company. Their market cap is currently…

Numbers for HPC are so insane that I'm feeling like $CORZ actually got a raw deal, even including the capex required to upgrade their DCs. Let's look at CW's unit costs. I'm going by HPC KWH: Datacenter & Utility: To $CORZ, CW is paying $3.5b/12 years = $291m/yr. Plus for the…

I've never felt so excited about owning something fundamentally free from the grasp of politicians, probably because it never existed before. #Bitcoin

$CORZ Christmas came early. Another 70MW of HPC, appears to be same exact terms as the first 200MW. That'll put yearly cashflow from HPC at around $280m. For reference, at $48 hashprice and $40 hashcost (better than any big miner in Q1), that's around 95 EH/s of hashrate in…

$CORZ - Last two sessions. What a difference having a monster HPC contract makes. $208m/yr in cashflow is more than 35 EH/s would make in an entire year at present mining conditions.

One wonders if the market is going to care about Q2 cash flows, or if there will be perpetual FOMO of a BTC rally and AI/HPC deals. Literally, I'm the only one.

United States الاتجاهات

- 1. Knicks 12.4K posts

- 2. Landry Shamet 1,189 posts

- 3. #AEWDynamite 20.7K posts

- 4. Philon 1,732 posts

- 5. Brandon Williams N/A

- 6. #Survivor49 3,690 posts

- 7. #CMAawards 5,280 posts

- 8. #AEWCollision 8,306 posts

- 9. Vucevic 4,913 posts

- 10. Vooch 1,022 posts

- 11. Blazers 3,983 posts

- 12. Derik Queen 3,410 posts

- 13. #mnwild N/A

- 14. Simon Walker N/A

- 15. Wallstedt N/A

- 16. Dubon 3,655 posts

- 17. Donovan Mitchell 3,910 posts

- 18. Bristow 1,087 posts

- 19. Jackson Blake N/A

- 20. Coby White N/A

Something went wrong.

Something went wrong.