pennyether

@penny_ether

Public BTC Miner analysis, like no one else. Won't take refuge in the false security of consensus (except BTC). Critical thinker, happily accept corrections.

You might like

Hashrate / ASICs: A collection of recent writing in case you want to be informed on hashrate, ASICs, and ASIC production (aka the arms dealers of BTC Miners) The Hashrate Almanac: Why hashrate always goes up, the hashcurve, forecasts, etc x.com/penny_ether/st… A study of…

Halfway through adjustment period, hashrate on trend for 1,080 EH/s @ $39.76 hashprice. Last time hashprice was here was a little over a year ago (~650 EH/s).. implying 50-60% CAGR for hashrate growth since then.

Instead of this, $BTDR today announced a delay on key next-gen ASIC, no concrete update on AI lease potential, and the CEO didn't join even join the call 👎 Stock -20% $BTDR

A smart media strategy would include meaningful announcements/updates from BTDR those days, alongside media appearances from Jihan to reinforce any progress made. I recommend a pre-announce @JihanWu @JeffLaberge4

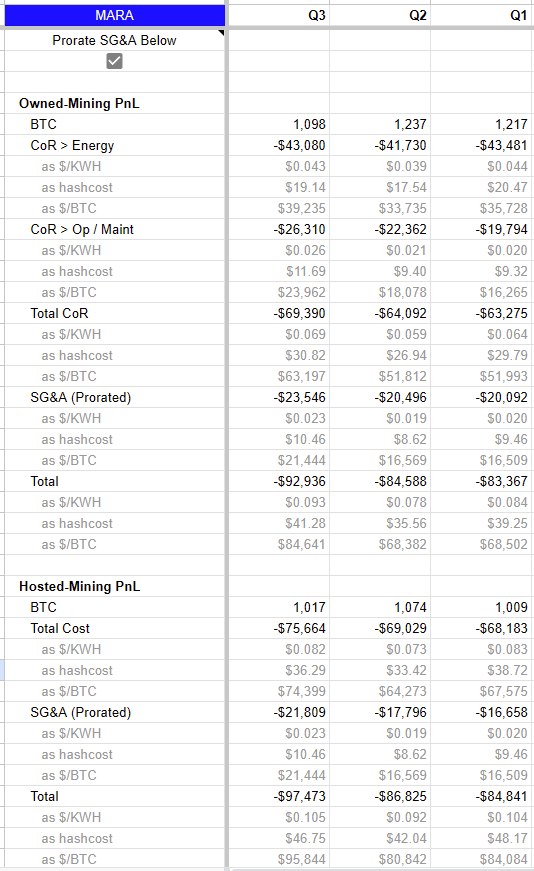

$MARA's O&O hashcost is barely any cheaper than what they pay for hosting.. even if you attribute 50% of SG&A towards "hosting". (And this doesn't count the costs of initially acquiring those MWs.) Additionally, YTD, the amount of O&O hashrate has barely budged... despite SG&A…

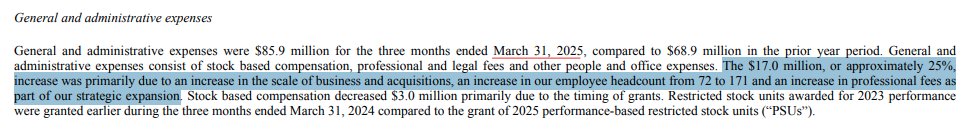

Let's go through this one by one. - $45m is indeed what I used for SG&A. See attached screenshot which assets $MARA shareholders in reading a table. - The increase in SG&A is from increased O&O MWs, used for mining. They are pivoting from paying $X/KWH for hosting, to $Y/KWH…

An example of ongoing semi fab tech, fueled by the investment (and production) of chips for AI: youtube.com/watch?v=vkx2zI… Along with other advancements, this will inevitably result in lower J/TH ASICs (as has always been the case). Long network hashrate.

youtube.com

YouTube

TSMC's Incredible 2nm Curvy Masks

Wasn't too far off

This whole saga would be relatively easy to sweep under the rug. Sure, mgmt might prefer the immediate payout... but if/when that's no longer an option, their next best thing is to resume a focus on maximizing shareholder value. Eg: we value our shareholders opinion, and in…

ChatGPT's product retention curves is a product manager's wet dream. Their 1 month retention has skyrocketed from <60% 2yrs ago to an unprecedented ~90%! Youtube was best-in-class with ~85%. 6mo retention is trending to ~80%. Rapidly rising smile curve. Generational product.

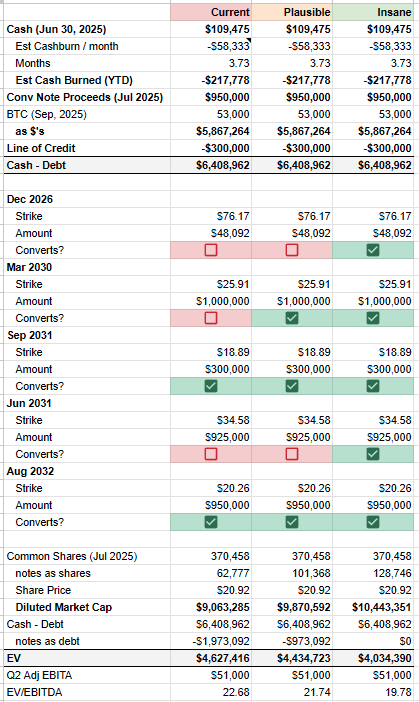

$MARA - Without HPC, they seem quite overvalued. Some quick stats. Enterprise (ex-BTC) valued at ~$4.4b. What do you get when you buy this? - Produced $51m in Q2. In Q2, hashprice was $51.15, hashcost was $38.19 ($41.20 if you include R&D and other). Hashprice is now $46 and on…

$MSTR - Update. Currently at 1.434x mNAV, via ATM, they need to sell 21,405 BTC ($2.3b*) of stock to generate 1% BTC Yield. They need to sell 521,283 BTC ($57.0b*) of stock to generate 19.75% BTC Yield (mid-way point), or 1.5m BTC ($160.4b*) of stock to generate 43.40% BTC…

United States Trends

- 1. James Comey 14.8K posts

- 2. Thanksgiving 150K posts

- 3. #GEAT_NEWS 1,454 posts

- 4. Jimmy Cliff 27K posts

- 5. #IDontWantToOverreactBUT 1,412 posts

- 6. #WooSoxWishList 4,141 posts

- 7. #NutramentHolidayPromotion N/A

- 8. Comey and James 9,537 posts

- 9. The Department of War 9,226 posts

- 10. #MondayMotivation 14.1K posts

- 11. DOGE 237K posts

- 12. Sen. Mark Kelly 14.7K posts

- 13. Monad 182K posts

- 14. Victory Monday 4,937 posts

- 15. Feast Week 2,246 posts

- 16. TOP CALL 5,006 posts

- 17. Justin Tucker N/A

- 18. Zach Bryan N/A

- 19. Towson N/A

- 20. $ENLV 20.1K posts

You might like

-

Sir Jack

Sir Jack

@SIR_JACK_A_LOT -

Jay Arlington

Jay Arlington

@JayArlington -

Longview Economics

Longview Economics

@Lvieweconomics -

Maleeha Bengali

Maleeha Bengali

@MaleehaMBCC -

Value Investor's Edge

Value Investor's Edge

@Shipping_VIE -

repos39

repos39

@Repos_39 -

Warren Buffett 📈 $SPY 👑

Warren Buffett 📈 $SPY 👑

@OptionsBuffett -

Dylan Grice

Dylan Grice

@dylangrice -

mr jhones

mr jhones

@MrMorphy007 -

Anp🅰️nman

Anp🅰️nman

@spacanpanman -

efficientenzyme

efficientenzyme

@efficientenzyme -

Jeremy McCrea, CFA

Jeremy McCrea, CFA

@JeremyMcCreaCFA -

Yonezu Investing

Yonezu Investing

@SteveYonezu -

belangem

belangem

@belangem1 -

brian

brian

@everynewdaysk

Something went wrong.

Something went wrong.