Policy Tensor

@policytensor

Anusar Farooqui, Founder and CEO, Systematic Portfolios LLC. Words: http://policytensor.substack.com/?sort=top

你可能會喜歡

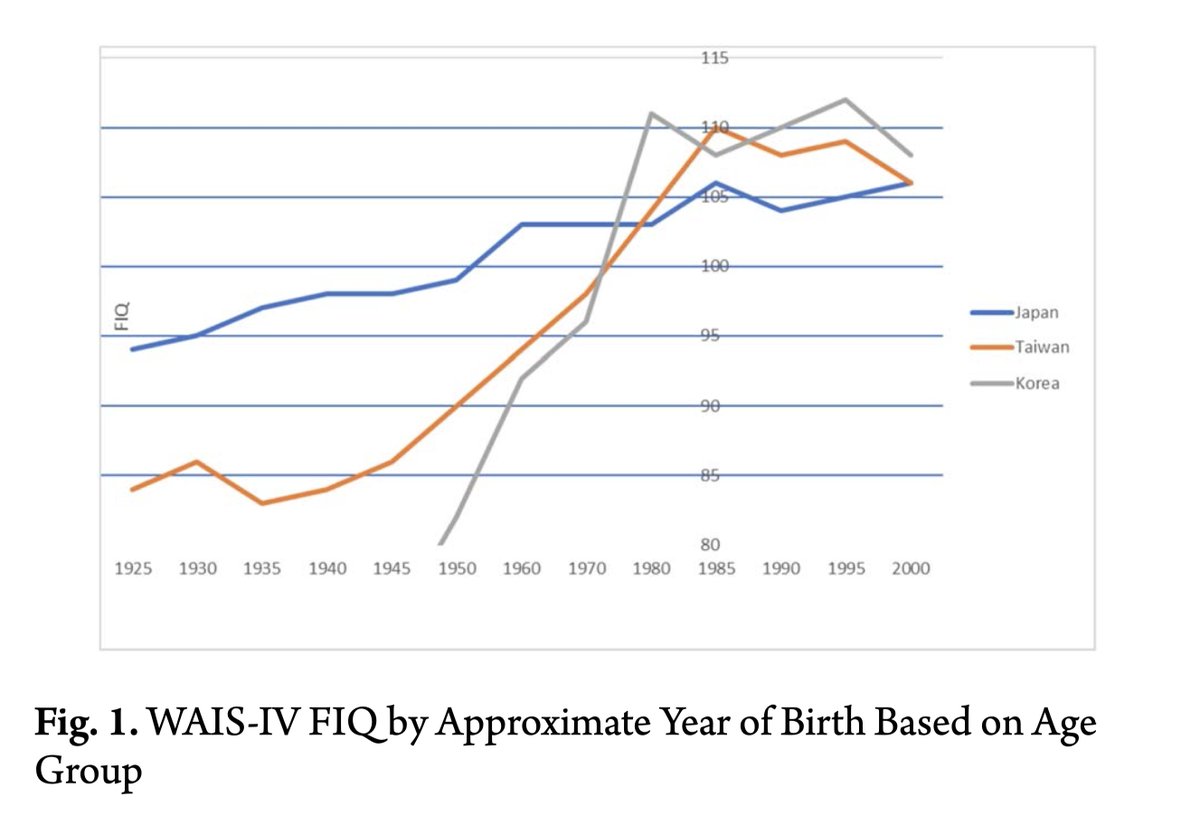

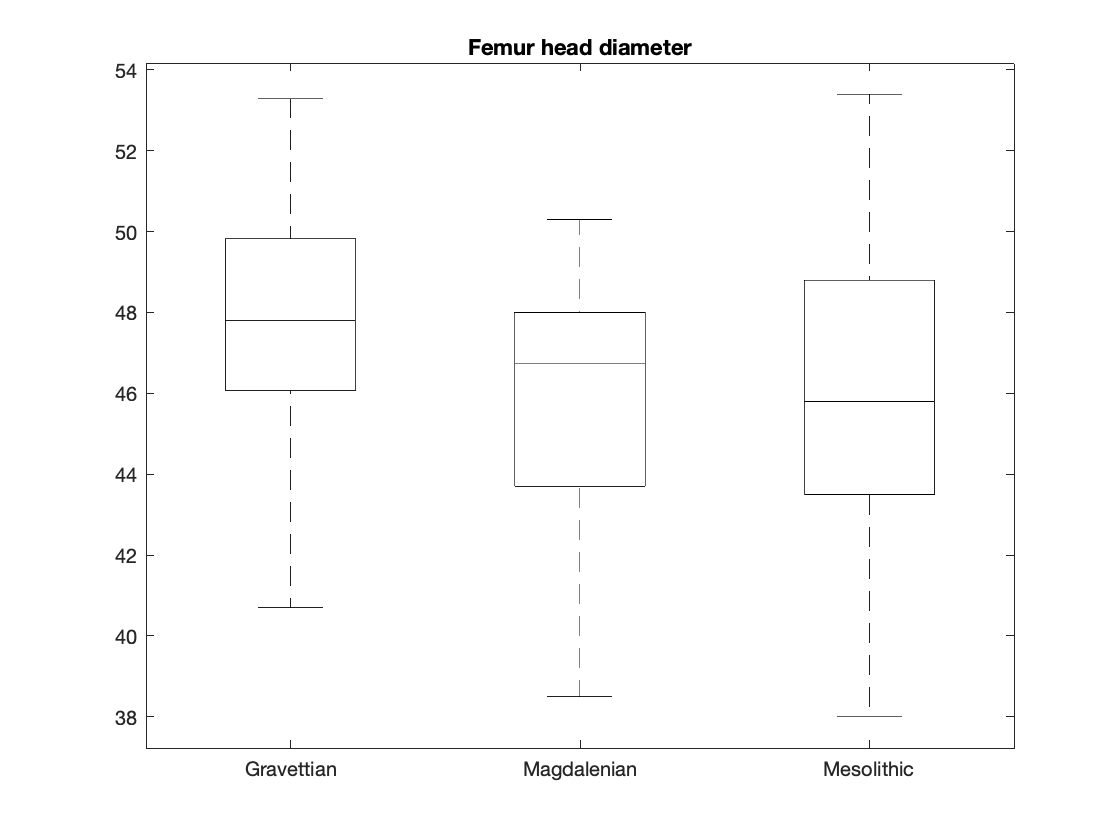

Stature, handgrip strength, lung capacity, heart rate, iq — they’re just different measures of heath status.

The diff with the cargo cult, @gilliantett, is that we’re making the planes. AI does not have to even improve anymore for it to have decisive effects. Whether the valuations are too lofty is a diff ques from the value itself: how much can they capture? on.ft.com/3JgsQMb

ft.com

AI has a cargo cult problem

Spending vast sums and inflating an investment bubble is no guarantee of unleashing technological magic

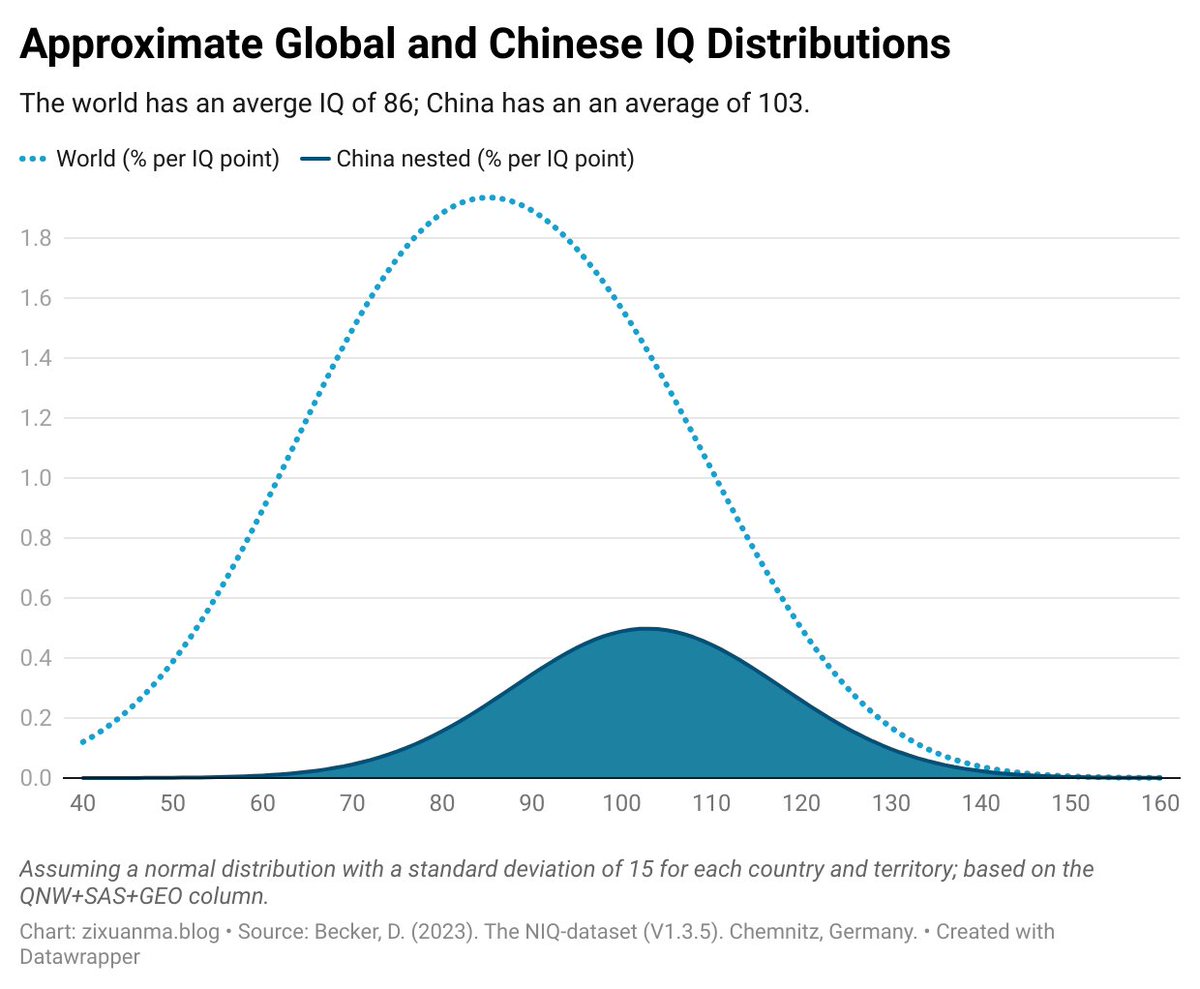

Interesting, @ZixuanMaWrites. But instead of using Becker's estimates, use HLO. A much more robust proxy of cognitive skill distribution; particularly, math scores. datacatalog.worldbank.org/search/dataset…

22 Million Geniuses — China’s Greatest Asset and America’s Missed Opportunity Link in the first reply. In the third essay on my blog, I discuss the vast pool of elite human talent in China, and how both China and the U.S. are missing out on a great opportunity. "How China may…

Demsas begins with an even bigger economic history myth: “No matter how much the world changed for most of human history, the realities of gut-wrenching poverty and subsistence farming remained the same.” This is simply wrong. For most of human history, there was no farming and…

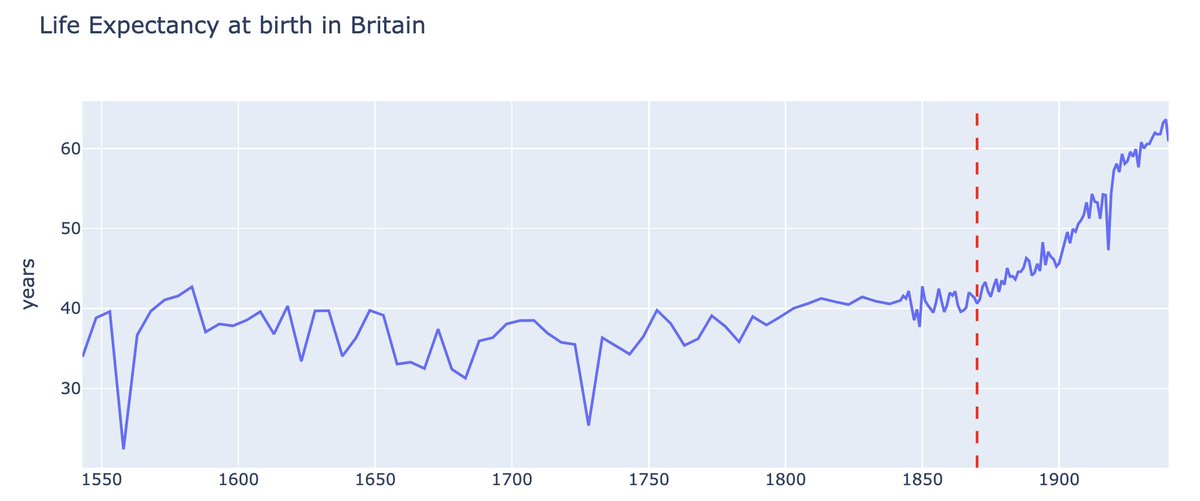

Reading @_brianpotter and revisiting Mokyr, one is stuck by how easy it is to believe that — production is ultimately the only thing that matters — there has really only ever been a single event in the entire history of capitalism — if you can explain this event, you’ve…

11/96 thought we may well wake up to AGI like rn. Wild times.

Is it over? Will we wake up to AGI?

96 票 · 最終結果

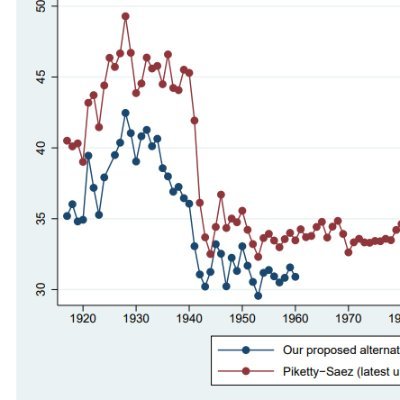

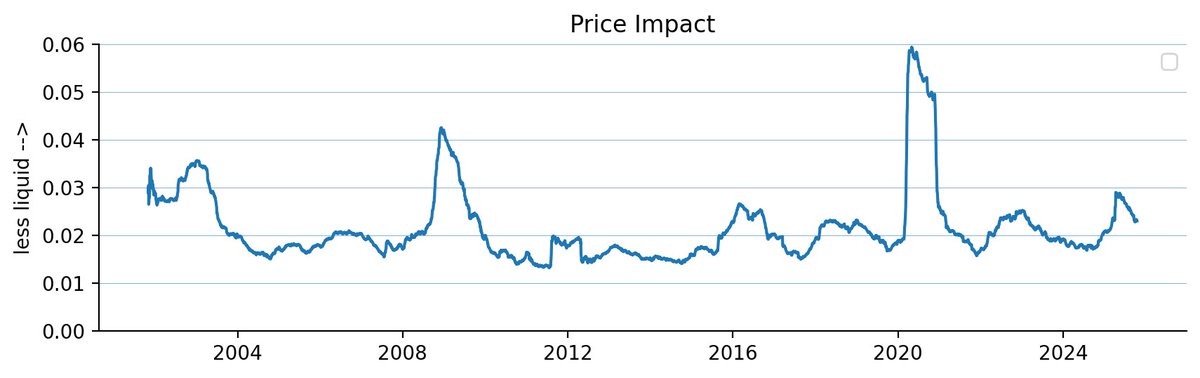

Covid killed all Econ graphs for real.

Liberation Day was also a liquidity shock. Here's I'm measuring a price impact parameter from the gradient along the cross-section of daily returns of the absolute return against 1/√share_volume, controlling for market beta.

Liberation Day was also a liquidity shock. Here's I'm measuring a price impact parameter from the gradient along the cross-section of daily returns of the absolute return against 1/√share_volume, controlling for market beta.

“A number of recent studies advocate for U.S. first use in a Taiwan scenario. A spring 2023 academic study in a leading U.S. journal observed that this could be a logical response to China’s growing military power: “[one may anticipate a] state’s increasing its reliance on…

Honored to present this research after many years of work— and so thankful to my many colleagues at Defense Priorities who have helped to improve these papers. Let’s have a real debate about the Taiwan issue — across all dimensions— long overdue. Let’s work together to prevent…

You have to understand that the shit in the Thames was not cleaned up with new technology. It was cleaned up by a new politics made possible by modernity.

Yes and no. Yes, the second Industrial Revolution is the real Industrial Revolution. No, there is more to modernity than industrial production. The great difference between an American c. 1970 and c. 1870 was not just that she could buy cheap motor cars, TVs, phones,…

Yes and no. Yes, the second Industrial Revolution is the real Industrial Revolution. No, there is more to modernity than industrial production. The great difference between an American c. 1970 and c. 1870 was not just that she could buy cheap motor cars, TVs, phones,…

Fed governor Chris Waller issues a two-word statement today upon the Fed revoking the climate-related financial-risk-management principles he opposed issuing in 2022: "Good riddance."

One Fed governor, Christopher Waller, voted against issuing the framework. "Climate change is real, but I disagree with the premise that it poses a serious risk to the safety and soundness of large banks and the financial stability of the U.S." federalreserve.gov/newsevents/pre…

I will say this about the scheming English. They know what to do here.

KETCHUP DOES NOT EXIST What you having with these??

A partial solution to the problem of persistence is to have it write notes to future instances of itself. I have found that it really works.

For example, testing shows that models get 0% on Long-Term Memory Storage (continual learning). Without persistent memory, current AIs have “amnesia.” Relying on massive context windows is a “capability contortion”—a workaround that masks this fundamental limitation.

An economic history professor is a machine for teaching these doctrinal facts to students so that everyone is on the same page about the event and how it explains everything under the sun.

Reading @_brianpotter and revisiting Mokyr, one is stuck by how easy it is to believe that — production is ultimately the only thing that matters — there has really only ever been a single event in the entire history of capitalism — if you can explain this event, you’ve…

Reading @_brianpotter and revisiting Mokyr, one is stuck by how easy it is to believe that — production is ultimately the only thing that matters — there has really only ever been a single event in the entire history of capitalism — if you can explain this event, you’ve…

The most frustrating thing about the so-called British Industrial Revolution lala-land is this: we are promised A MASTER EXPLANATION of how the West started enjoying higher living standards—that is the fucking JOB of the Industrial Revolution. This is not a question of how rich…

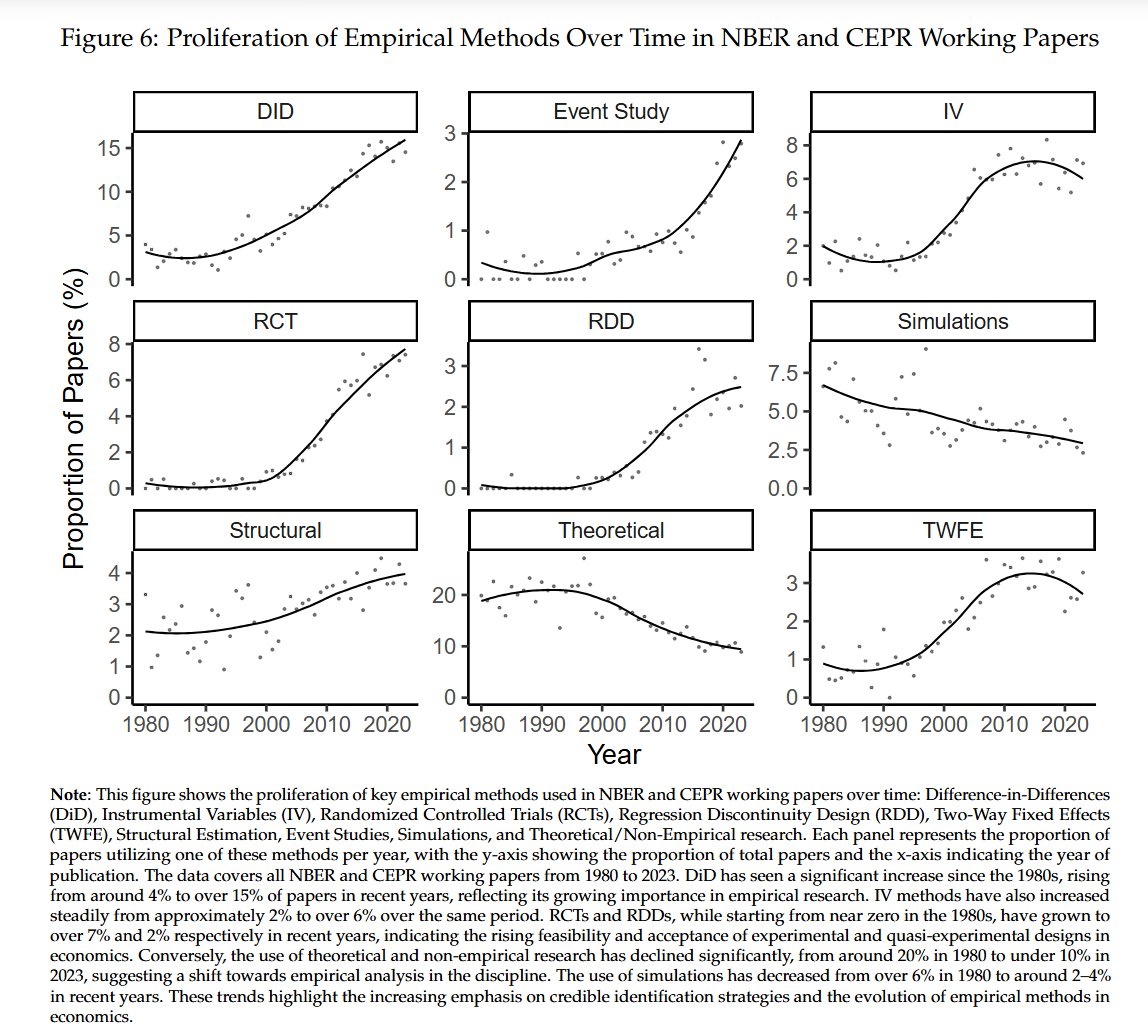

This is partly what I mean by the New Empiricism.

easiest way to get a publishable applied micro paper is take any question and ask "how can I DiD this?" (@Prashant_Garg_ & @fetzert, 2024)

Worth reminding folks that in 2020, Pettis' "model" predicted that China's debt/GDP ratio would rise to somewhere between 400-690% if the country maintained growth in the 4-5% range — a.k.a. well above the infamous self-asserted "correct sustainable level" in the 2-3% range.

1/5 Chinese debt continues to rise quickly, with total social financing rising by 8.7% year on year in September (more than twice GDP growth) to RMB 437.08 trillion. This is equal to nearly 312% of 2025's expected GDP (versus 303% at the end of 2024). caixinglobal.com/2025-10-16/chi…

United States 趨勢

- 1. George Santos 29.3K posts

- 2. Louisville 7,384 posts

- 3. Dan Wilson 1,399 posts

- 4. #askdave N/A

- 5. Jeff Brohm N/A

- 6. Bryce Miller 1,553 posts

- 7. Tina Peters 5,410 posts

- 8. Chris Bell N/A

- 9. Prince Andrew 46.4K posts

- 10. No Kings 310K posts

- 11. End 1Q N/A

- 12. End of 1 14.1K posts

- 13. Brash N/A

- 14. Malachi Toney N/A

- 15. #DaytimeEmmys 1,103 posts

- 16. Gio Ruggiero N/A

- 17. Duke of York 19K posts

- 18. #LightningStrikes N/A

- 19. #drwfirstgoal N/A

- 20. Miller Moss N/A

你可能會喜歡

-

Albert Pinto

Albert Pinto

@70sBachchan -

Adam Tooze

Adam Tooze

@adam_tooze -

Ones and Tooze

Ones and Tooze

@OnesandToozePod -

Melanie Brusseler

Melanie Brusseler

@BrusselerMel -

Daniel Zamora Vargas

Daniel Zamora Vargas

@DanielZamoraV -

Jamie Merchant

Jamie Merchant

@pathtopraxis -

Eurotrash

Eurotrash

@eurotrashpod -

Daniela Gabor

Daniela Gabor

@DanielaGabor -

Samuel Moyn 🔭

Samuel Moyn 🔭

@samuelmoyn -

DeLong🖖

DeLong🖖

@delong -

Matthew C. Klein

Matthew C. Klein

@M_C_Klein -

Phenomenal World

Phenomenal World

@phenomenalworld -

Anton Jäger

Anton Jäger

@AntonJaegermm -

Max Krahé

Max Krahé

@maxkrahe -

Elham Saeidinezhad

Elham Saeidinezhad

@elham_saeidi

Something went wrong.

Something went wrong.